Answered step by step

Verified Expert Solution

Question

1 Approved Answer

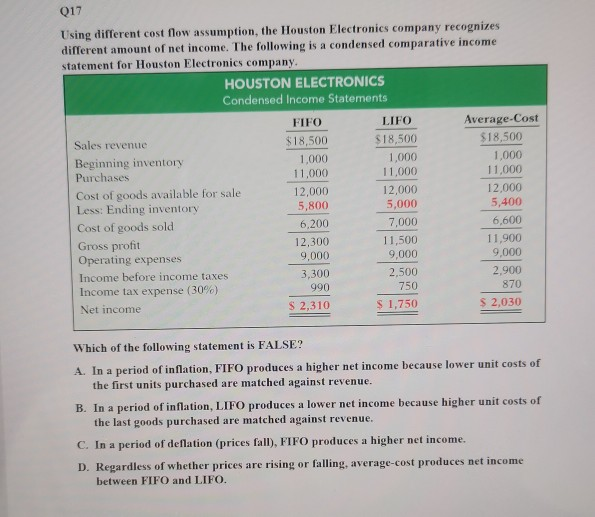

017 Using different cost flow assumption, the Houston Electronics company recognizes different amount of net income. The following is a condensed comparative income statement for

017 Using different cost flow assumption, the Houston Electronics company recognizes different amount of net income. The following is a condensed comparative income statement for Houston Electronics company. HOUSTON ELECTRONICS Condensed Income Statements FIFO $18,500 1,000 11,000 12.000 5,800 6,200 12,300 9,000 3,300 990 Sales revenue Beginning inventory Purchases Cost of goods available for sale Less: Ending inventory Cost of goods sold Gross profit Operating expenses Income before income taxes Income tax expense (30%) Net income Average-Cost $18,500 1,000 11,000 12.000 5,400 LIFO $18,500 1,000 11,000 12.000 5,000 7,000 11,500 9,000 2,500 750 6.600 11,900 9,000 2.900 870 S 2,030 S 2,310 $ 1,750 Which of the following statement is FALSE? A. In a period of inflation, FIFO produces a higher net income because lower unit costs of the first units purchased are matched against revenue. B. In a period of inflation, LIFO produces a lower net income because higher unit costs of the last goods purchased are matched against revenue. C. In a period of deflation (prices fall), FIFO produces a higher net income. D. Regardless of whether prices are rising or falling, average-cost produces net income between FIFO and LIFO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started