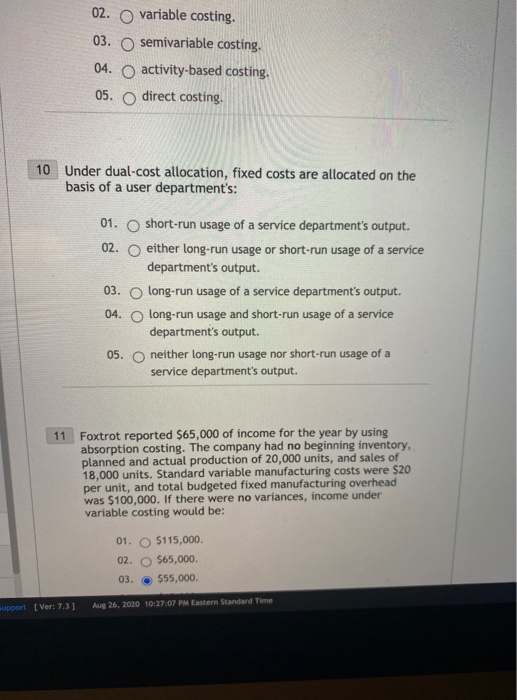

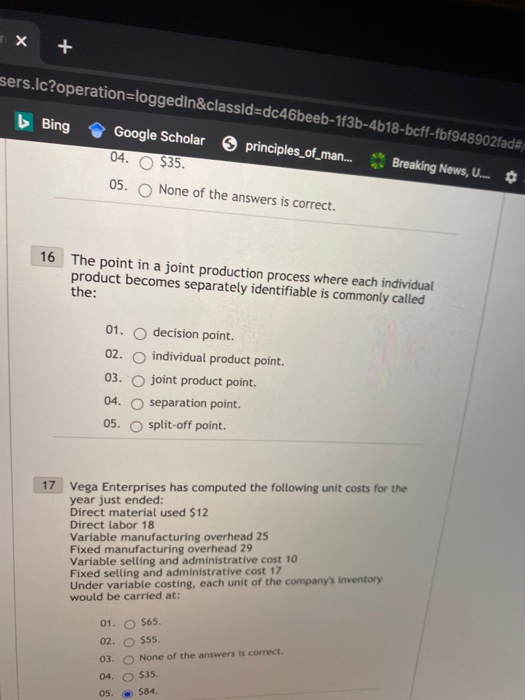

02. O variable costing. 03. O semivariable costing. 04. O activity-based costing. 05. O direct costing. 10 Under dual-cost allocation, fixed costs are allocated on the basis of a user department's: 03 01. short-run usage of a service department's output. 02. either long-run usage or short-run usage of a service department's output long-run usage of a service department's output. 04. O long-run usage and short-run usage of a service department's output. 05. O neither long-run usage nor short-run usage of a service department's output. 11 Foxtrot reported $65,000 of income for the year by using absorption costing. The company had no beginning inventory, planned and actual production of 20,000 units, and sales of 18,000 units. Standard variable manufacturing costs were $20 per unit, and total budgeted fixed manufacturing overhead was $100,000. If there were no variances, income under variable costing would be: 01. O $115,000. 02. $65,000 03. $55,000 Gupport [Ver: 7.3] Aug 26, 2020 10:27:07 PM Eastern Standard Time + ssers.lc?operation=loggedIn&classid=dc46beeb-1f3b-4b18-bcff-fbf948902fade; Bing Google Scholar principles_of_man... Breaking News, U. $35. 05. None of the answers is correct. 04. 16 The point in a joint production process where each individual product becomes separately identifiable is commonly called the: 01. O decision point. 02. individual product point. 03. O joint product point. 04. separation point. 05. split-off point. 17 Vega Enterprises has computed the following unit costs for the year just ended: Direct material used $12 Direct labor 18 Variable manufacturing overhead 25 Fixed manufacturing overhead 29 Variable selling and administrative cost 10 Fixed selling and administrative cost 17 Under variable costing, each unit of the company's inventory would be carried at: 01. $65. 02. O $55. 03. None of the answers is correct. 04. $35. 05 584 02. O variable costing. 03. O semivariable costing. 04. O activity-based costing. 05. O direct costing. 10 Under dual-cost allocation, fixed costs are allocated on the basis of a user department's: 03 01. short-run usage of a service department's output. 02. either long-run usage or short-run usage of a service department's output long-run usage of a service department's output. 04. O long-run usage and short-run usage of a service department's output. 05. O neither long-run usage nor short-run usage of a service department's output. 11 Foxtrot reported $65,000 of income for the year by using absorption costing. The company had no beginning inventory, planned and actual production of 20,000 units, and sales of 18,000 units. Standard variable manufacturing costs were $20 per unit, and total budgeted fixed manufacturing overhead was $100,000. If there were no variances, income under variable costing would be: 01. O $115,000. 02. $65,000 03. $55,000 Gupport [Ver: 7.3] Aug 26, 2020 10:27:07 PM Eastern Standard Time + ssers.lc?operation=loggedIn&classid=dc46beeb-1f3b-4b18-bcff-fbf948902fade; Bing Google Scholar principles_of_man... Breaking News, U. $35. 05. None of the answers is correct. 04. 16 The point in a joint production process where each individual product becomes separately identifiable is commonly called the: 01. O decision point. 02. individual product point. 03. O joint product point. 04. separation point. 05. split-off point. 17 Vega Enterprises has computed the following unit costs for the year just ended: Direct material used $12 Direct labor 18 Variable manufacturing overhead 25 Fixed manufacturing overhead 29 Variable selling and administrative cost 10 Fixed selling and administrative cost 17 Under variable costing, each unit of the company's inventory would be carried at: 01. $65. 02. O $55. 03. None of the answers is correct. 04. $35. 05 584