Answered step by step

Verified Expert Solution

Question

1 Approved Answer

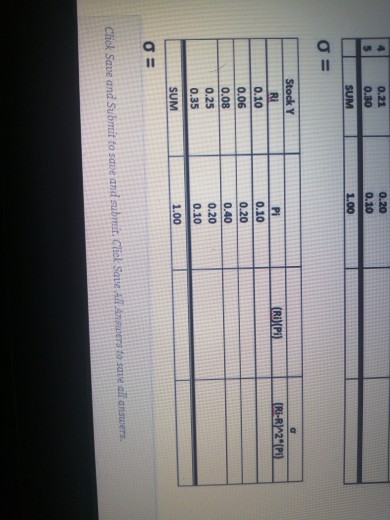

0.21 0.30 5 0.20 0.10 1.00 SUM o = (RO) (Pi) (RI- R2 (PU) Stock Y Ri 0.10 0.06 0.08 0.25 0.35 Pi 0.10 0.20

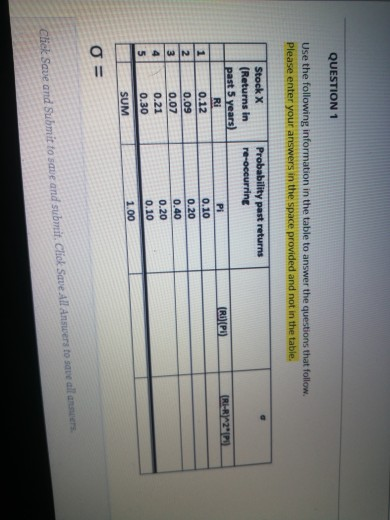

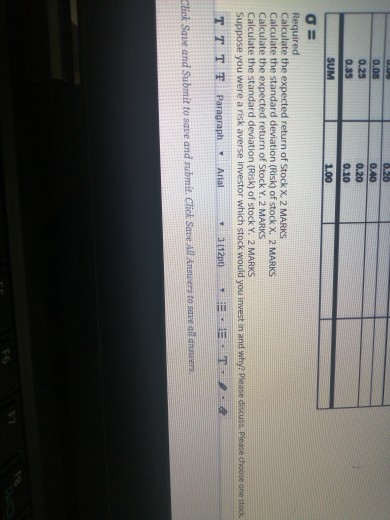

0.21 0.30 5 0.20 0.10 1.00 SUM o = (RO) (Pi) (RI- R2 (PU) Stock Y Ri 0.10 0.06 0.08 0.25 0.35 Pi 0.10 0.20 0.40 0.20 0.10 SUM 1.00 0= Click Save and Submit to save and submit. Click Save All Answers to save all answers. QUESTION 1 Use the following information in the table to answer the questions that follow. Please enter your answers in the space provided and not in the table. Probability past returns re-occurring (CRI) (PU) (RI-R)*2*120 INN Stock X (Returns in past 5 years) Ri 0.12 0.09 0.07 0.21 0.30 Pi 0.10 0.20 0.40 0.20 0.10 3 4 5 100 SUM = Click Save and Submit to save and submit. Click Save All answers to save alla UU 20 0.08 0.40 0.25 0.20 0.35 0.10 SUM 1.00 = Required Calculate the expected return of Stock X. 2 MARKS Calculate the standard deviation (Risk) of stock X. 2 MARKS Calculate the expected return of Stock Y. 2 MARKS Calculate the standard deviation (Risk) of stock Y. 2 MARKS Suppose you were a risk averse investor which stock would you invest in and why? Please discuss. Please choose one stock TTTT Paragraph Arial 3:112pt) TERET. Click Save and Submit to save and submit. Click Save All Answers to see all answers E6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started