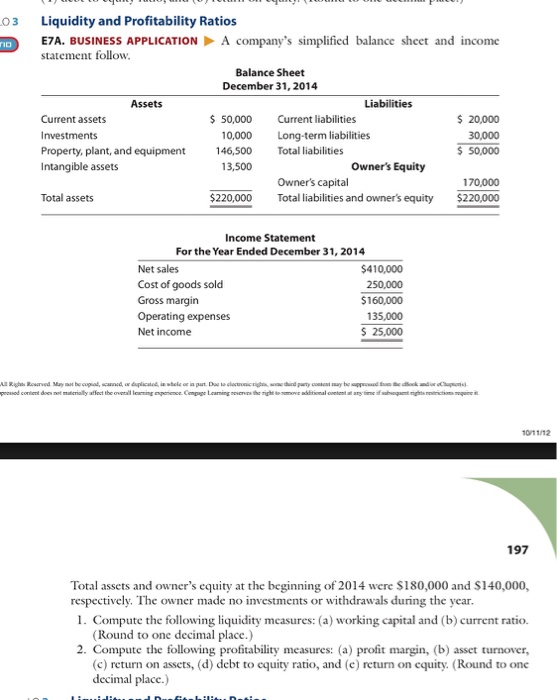

03 Liquidity and Profitability Ratios TI E7A. BUSINESS APPLICATIONA company's simplified balance sheet and income statement follow Balance Sheet December 31, 2014 Assets Liabilities 20,000 30,000 50,000 Current assets $50,000 Crrent liabilities 10,000 Long-term liabilities Total liabilities Property, plant, and equipment Intangible assets 146,500 13,500 Owner's Equity Owner's capital 170,000 $220,000 abilities and owners equity $220,000 Total assets Income Statement For the Year Ended December 31, 2014 Net sales Cost of goods sold Gross margin Operating expenses Net income $410,000 250,000 $160,000 135,000 25,000 10/11/12 197 Total assets and owner's equity at the begini of 2014 were S180,000 and $140,000, I. Compute the following liquidity measures: (a) working capital and (b) current ratio. 2. Compute the following profitability measures: (a) profit margin, (b) asset turnover, respectively. The owner made no investments or withdrawals during the year. (Round to one decimal place.) (c) return on assets, (d) debt to equity ratio, and (c) return on equity. (Round to one decimal place.) 03 Liquidity and Profitability Ratios TI E7A. BUSINESS APPLICATIONA company's simplified balance sheet and income statement follow Balance Sheet December 31, 2014 Assets Liabilities 20,000 30,000 50,000 Current assets $50,000 Crrent liabilities 10,000 Long-term liabilities Total liabilities Property, plant, and equipment Intangible assets 146,500 13,500 Owner's Equity Owner's capital 170,000 $220,000 abilities and owners equity $220,000 Total assets Income Statement For the Year Ended December 31, 2014 Net sales Cost of goods sold Gross margin Operating expenses Net income $410,000 250,000 $160,000 135,000 25,000 10/11/12 197 Total assets and owner's equity at the begini of 2014 were S180,000 and $140,000, I. Compute the following liquidity measures: (a) working capital and (b) current ratio. 2. Compute the following profitability measures: (a) profit margin, (b) asset turnover, respectively. The owner made no investments or withdrawals during the year. (Round to one decimal place.) (c) return on assets, (d) debt to equity ratio, and (c) return on equity. (Round to one decimal place.)