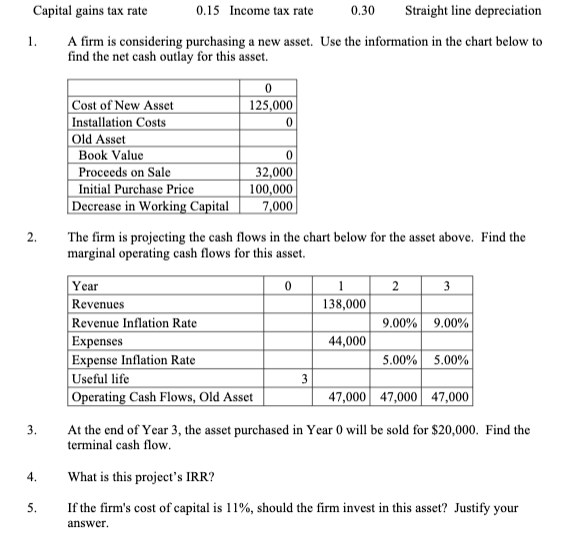

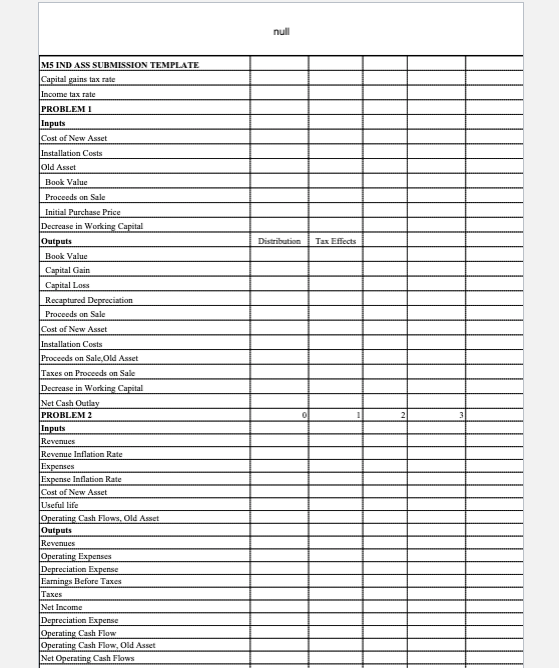

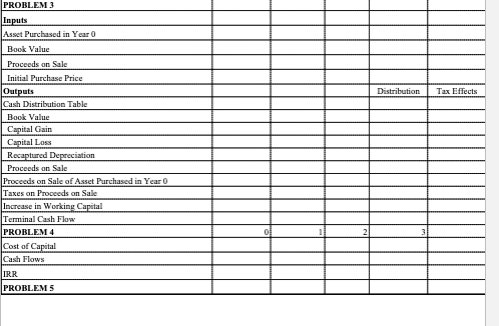

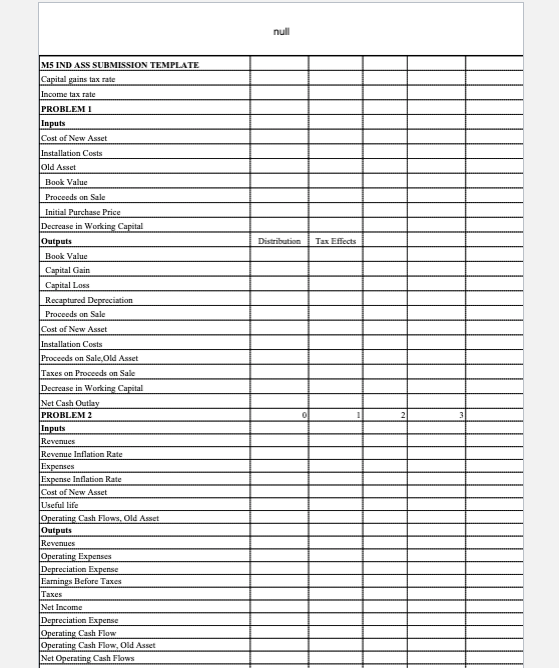

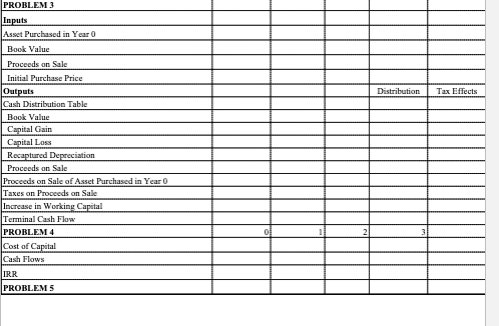

0.30 Capital gains tax rate 0.15 Income tax rate Straight line depreciation 1. A firm is considering purchasing a new asset. Use the information in the chart below to find the net cash outlay for this asset. 2. 0 Cost of New Asset 125,000 Installation Costs 0 Old Asset Book Value 0 Proceeds on Sale 32,000 Initial Purchase Price 100,000 Decrease in Working Capital 7,000 The firm is projecting the cash flows in the chart below for the asset above. Find the marginal operating cash flows for this asset. Year 0 1 2 3 Revenues 138,000 Revenue Inflation Rate 9.00% 9.00% Expenses 44,000 Expense Inflation Rate 5.00% 5.00% Useful life 3 Operating Cash Flows, Old Asset 47,000 47,000 47,000 At the end of Year 3, the asset purchased in Year 0 will be sold for $20,000. Find the terminal cash flow. 3. 4. What is this project's IRR? If the firm's cost of capital is 11%, should the firm invest in this asset? Justify your answer. 5. nul Distribution Tax Effects MS IND ASS SUBMISSION TEMPLATE Capital gains tax rate Income tax rate PROBLEMI Inputs Cost of New Asset Installation Costs Old Asset Book Value Proceeds on Sale Initial Purchase Price Decrease in Working Capital Outputs Book Value Capital Gain Capital Loss Recaptured Depreciation Proceeds on Sale Cost of New Asset Installation Costs Proceeds on Sale Old Asset Taxes on Proceeds on Sale Decrease in Working Capital Net Cash Outlay PROBLEM 2 Inputs Revenues Revenue Inflation Rate Expenses Expense Inflation Rate Cost of New Asset Useful life Operating Cash Flow, Old Asset Outputs Revenues Operating Expenses Depreciation Expense Earnings Before Taxes Taxes Net Income Depreciation Expense Operating Cash Flow Operating Cash Flow, Old Asset Net Operating Cash Flows Distribution Tax Effects PROBLEM 3 Inputs Asset Purchased in Year O Book Value Proceeds on Sale Initial Purchase Price Outputs Cash Distribution Table Book Value Capital Gain Capital Loss Recaptured Depreciation Proceeds on Sale Proceeds on Sale of Asset Purchased in Year 0 Taxes on Proceeds on Sale Increase in Working Capital Terminal Cash Flow PROBLEM 4 Cost of Capital Cash Flows IRR PROBLEMS