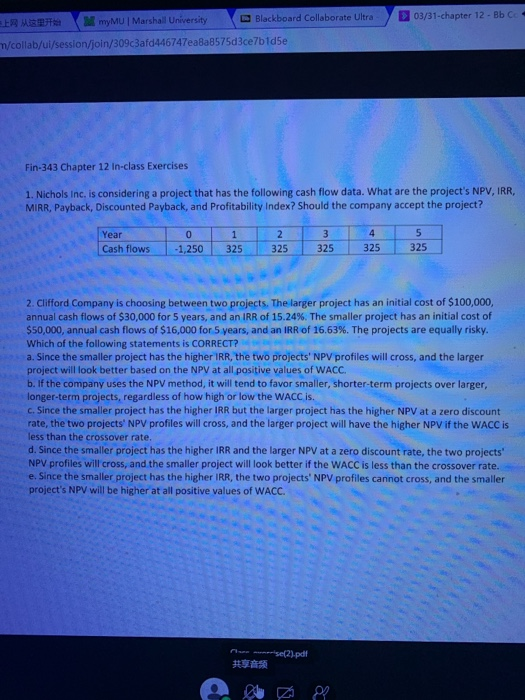

03/31-chapter 12 - Bb C EER M M MyMU | Marshall University Blackboard Collaborate Ultra m/collab/ui/session/join/309c3afd446747ea8a8575d3ce7b1d5e Fin-343 Chapter 12 In-class Exercises 1. Nichols Inc, is considering a project that has the following cash flow data. What are the project's NPV, IRR MIRR, Payback, Discounted Payback, and Profitability Index? Should the company accept the project? Year Cash flows 0 -1,250 1 325 325 325 325 2. Clifford Company is choosing between two projects. The larger project has an initial cost of $100,000, annual cash flows of $30,000 for 5 years, and an IRR of 15.24%. The smaller project has an initial cost of $50,000, annual cash flows of $16,000 for 5 years, and an IRR of 16.63%. The projects are equally risky. Which of the following statements is CORRECT? a. Since the smaller project has the higher IRR, the two projects' NPV profiles will cross, and the larger project will look better based on the NPV at all positive values of WACC. b. If the company uses the NPV method, it will tend to favor smaller, shorter-term projects over larger, longer-term projects, regardless of how high or low the WACC is. c. Since the smaller project has the higher IRR but the larger project has the higher NPV at a zero discount rate, the two projects' NPV profiles will cross, and the larger project will have the higher NPV if the WACC is less than the crossover rate. d. Since the smaller project has the higher IRR and the larger NPV at a zero discount rate, the two projects' NPV profiles will cross, and the smaller project will look better if the WACC is less than the crossover rate. e. Since the smaller project has the higher IRR, the two projects' NPV profiles cannot cross, and the smaller project's NPV will be higher at all positive values of WACC. se(2).pdf O 03/31-chapter 12 - Bb C EER M M MyMU | Marshall University Blackboard Collaborate Ultra m/collab/ui/session/join/309c3afd446747ea8a8575d3ce7b1d5e Fin-343 Chapter 12 In-class Exercises 1. Nichols Inc, is considering a project that has the following cash flow data. What are the project's NPV, IRR MIRR, Payback, Discounted Payback, and Profitability Index? Should the company accept the project? Year Cash flows 0 -1,250 1 325 325 325 325 2. Clifford Company is choosing between two projects. The larger project has an initial cost of $100,000, annual cash flows of $30,000 for 5 years, and an IRR of 15.24%. The smaller project has an initial cost of $50,000, annual cash flows of $16,000 for 5 years, and an IRR of 16.63%. The projects are equally risky. Which of the following statements is CORRECT? a. Since the smaller project has the higher IRR, the two projects' NPV profiles will cross, and the larger project will look better based on the NPV at all positive values of WACC. b. If the company uses the NPV method, it will tend to favor smaller, shorter-term projects over larger, longer-term projects, regardless of how high or low the WACC is. c. Since the smaller project has the higher IRR but the larger project has the higher NPV at a zero discount rate, the two projects' NPV profiles will cross, and the larger project will have the higher NPV if the WACC is less than the crossover rate. d. Since the smaller project has the higher IRR and the larger NPV at a zero discount rate, the two projects' NPV profiles will cross, and the smaller project will look better if the WACC is less than the crossover rate. e. Since the smaller project has the higher IRR, the two projects' NPV profiles cannot cross, and the smaller project's NPV will be higher at all positive values of WACC. se(2).pdf O