Answered step by step

Verified Expert Solution

Question

1 Approved Answer

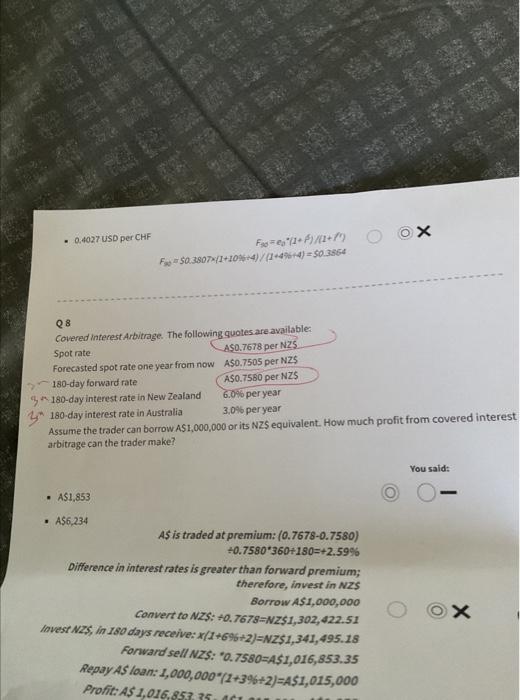

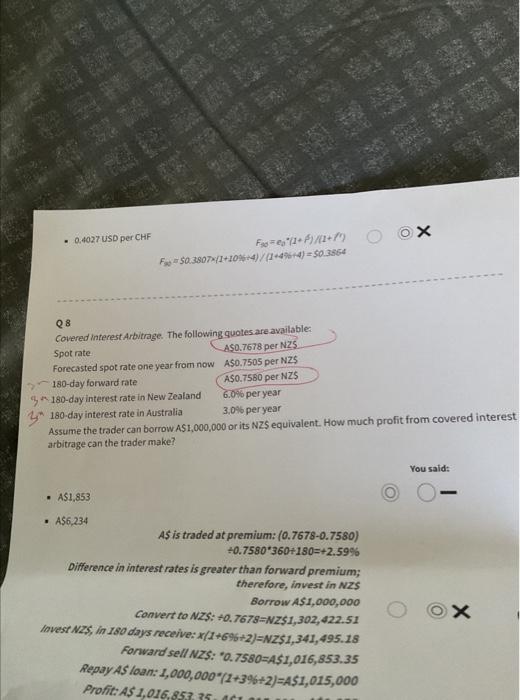

- 0.4027 USD per CHF F50=e0(1+)/(1+17) F50=50.3807(1+105+4)/(1+496+4)=50.3564 Q8 Covered interest Arbitrage. The following quotes are avallable: Spot rate AS0.7678 per N2S Forecasted spot rate one

- 0.4027 USD per CHF F50=e0(1+)/(1+17) F50=50.3807(1+105+4)/(1+496+4)=50.3564 Q8 Covered interest Arbitrage. The following quotes are avallable: Spot rate AS0.7678 per N2S Forecasted spot rate one year from now AS0.7505 per NZS 180-day forward rate AS0.7580 per NZS 5. 180-day interest rate in New Zealand 6.0%6 peryear 180-day interest rate in Australia 3.04 peryear Assume the trader can borrow AS1,000,000 or its NZS equivalent. How much profit from covered intere arbitrage can the trader make? You said: - AS1,853 - AS6, 234 ASistradedatpremium:(0.76780.7580)+0.7580360+180=+2.59% Difference in interest rates is greater than forward premium; therefore, invest in NZS Borrow AS1,000,000 Convert to NZS: +0.7678=NZ$1,302,422.51 lovest NZS, in 150 days receive: x(1+6%+2)=NZS1,341,495.18 Forward sell NZS: "0.7580=451,016,853.35 Repay AS laan: 1,000,000(1+39+2)=AS1,015,000

- 0.4027 USD per CHF F50=e0(1+)/(1+17) F50=50.3807(1+105+4)/(1+496+4)=50.3564 Q8 Covered interest Arbitrage. The following quotes are avallable: Spot rate AS0.7678 per N2S Forecasted spot rate one year from now AS0.7505 per NZS 180-day forward rate AS0.7580 per NZS 5. 180-day interest rate in New Zealand 6.0%6 peryear 180-day interest rate in Australia 3.04 peryear Assume the trader can borrow AS1,000,000 or its NZS equivalent. How much profit from covered intere arbitrage can the trader make? You said: - AS1,853 - AS6, 234 ASistradedatpremium:(0.76780.7580)+0.7580360+180=+2.59% Difference in interest rates is greater than forward premium; therefore, invest in NZS Borrow AS1,000,000 Convert to NZS: +0.7678=NZ$1,302,422.51 lovest NZS, in 150 days receive: x(1+6%+2)=NZS1,341,495.18 Forward sell NZS: "0.7580=451,016,853.35 Repay AS laan: 1,000,000(1+39+2)=AS1,015,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started