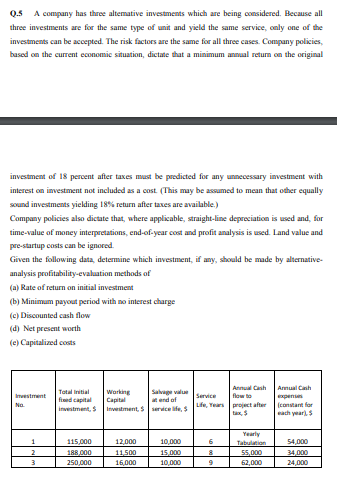

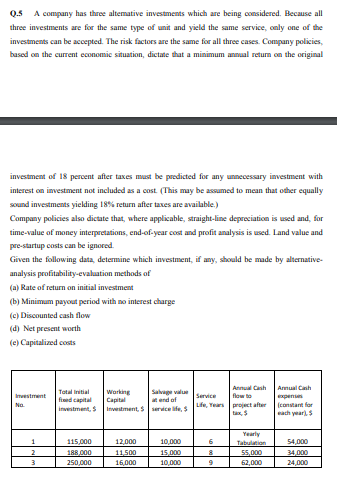

0.5 A company has three alterative investments which are being considered. Because all three investments are for the same type of unit and yield the same service, only one of the investments can be accepted. The risk factors are the same for all three cases. Company policies, based on the current economic situation, dictate that a minimum annual return on the original investment of 18 percent after taxes must be predicted for any unnecessary investment with interest on investment not included as a cost. (This may be assumed to mean that other equally sound investments yielding 18% return after taxes are available.) Company policies also dictate that, where applicable, straight-line depreciation is used and for time-value of money interpretations, end-of-year cost and profit analysis is used. Land value and pre-startup costs can be ignored Given the following data, determine which investment, if any, should be made by alternative analysis profitability evaluation methods of (a) Rate of return on initial investment (b) Minimum payout period with no interest charge (c) Discounted cash flow (d) Net present worth (e) Capitalized costs Annual Cash Investment Na Total al fred capital investment, Working Salve value Annual Cash Capital endol Service flow to Investment, celife, Life, es project after constant for each years 1 115.000 6 12.000 11,500 16,000 188,000 250,000 Yearly Tab 55,000 62,000 10,000 15.000 10,000 8 9 54 000 34 DOO 24,000 3 0.5 A company has three alterative investments which are being considered. Because all three investments are for the same type of unit and yield the same service, only one of the investments can be accepted. The risk factors are the same for all three cases. Company policies, based on the current economic situation, dictate that a minimum annual return on the original investment of 18 percent after taxes must be predicted for any unnecessary investment with interest on investment not included as a cost. (This may be assumed to mean that other equally sound investments yielding 18% return after taxes are available.) Company policies also dictate that, where applicable, straight-line depreciation is used and for time-value of money interpretations, end-of-year cost and profit analysis is used. Land value and pre-startup costs can be ignored Given the following data, determine which investment, if any, should be made by alternative analysis profitability evaluation methods of (a) Rate of return on initial investment (b) Minimum payout period with no interest charge (c) Discounted cash flow (d) Net present worth (e) Capitalized costs Annual Cash Investment Na Total al fred capital investment, Working Salve value Annual Cash Capital endol Service flow to Investment, celife, Life, es project after constant for each years 1 115.000 6 12.000 11,500 16,000 188,000 250,000 Yearly Tab 55,000 62,000 10,000 15.000 10,000 8 9 54 000 34 DOO 24,000 3