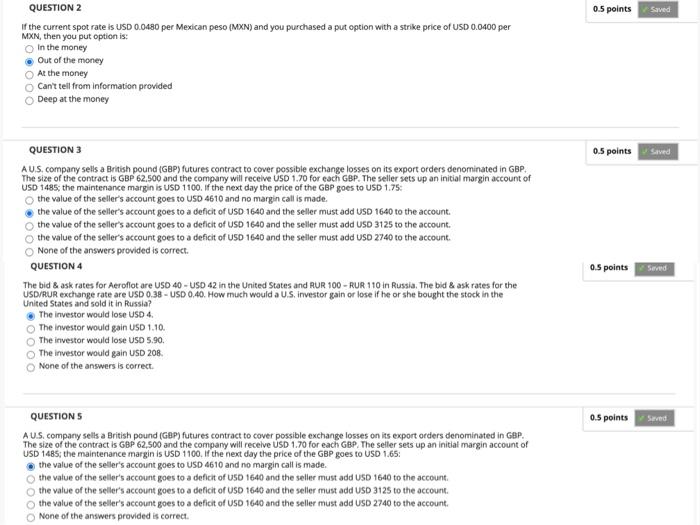

0.5 points Saved QUESTION 2 if the current spot rate is USD 0.0480 per Mexican peso (MXN) and you purchased a put option with a strike price of USD 0.0400 per MXN, then you put option is: In the money Out of the money At the money Can't tell from information provided Deep at the money QUESTION 3 0.5 points Saved AU.S. company sells a British pound (GBP) futures contract to cover possible exchange losses on its export orders denominated in GBP The size of the contract is GBP 62.500 and the company will receive USD 1.70 for each GBP. The seller sets up an initial margin account of USD 1485; the maintenance margin is USD 1100. if the next day the price of the GBP goes to USD 1.75: the value of the seller's account goes to USD 4610 and no margin call is made. the value of the seller's account goes to a deficit of USD 1640 and the seller must add USD 1640 to the account. the value of the seller's account goes to a deficit of USD 1640 and the seller must add USD 3125 to the account. the value of the seller's account goes to a deficit of USD 1640 and the seller must add USD 2740 to the account None of the answers provided is correct. QUESTION 4 The bid & ask rates for Aeroflot are USD 40 - USD 42 in the United States and RUR 100 - RUR 110 in Russia. The bid & ask rates for the USD/RUR exchange rate are USD 0.38 - USD 0.40. How much would a U.S. investor gain or lose if he or she bought the stock in the United States and sold it in Russia? The investor would lose USD 4. The investor would gain USD 1.10. The investor would lose USD 5,90 The investor would gain USD 208 None of the answers is correct. 0.5 points Seved 0.5 points Seved QUESTIONS A U.S. company sells a British Pound (GBP) futures contract to cover possible exchange losses on its export orders denominated in GBP. The size of the contract is GBP 62,500 and the company will receive USD 1.70 for each GBP. The seller sets up an initial margin account of USD 1485; the maintenance margin is USD 1100. If the next day the price of the GBP goes to USD 1.65: the value of the seller's account goes to USD 4610 and no margin call is made. the value of the seller's account goes to a deficit of USD 1640 and the seller must add USD 1640 to the account the value of the seller's account goes to a deficit of USD 1640 and the seller must add USD 3125 to the account. the value of the seller's account goes to a deficit of USD 1640 and the seller must add USD 2740 to the account None of the answers provided is correct