Answered step by step

Verified Expert Solution

Question

1 Approved Answer

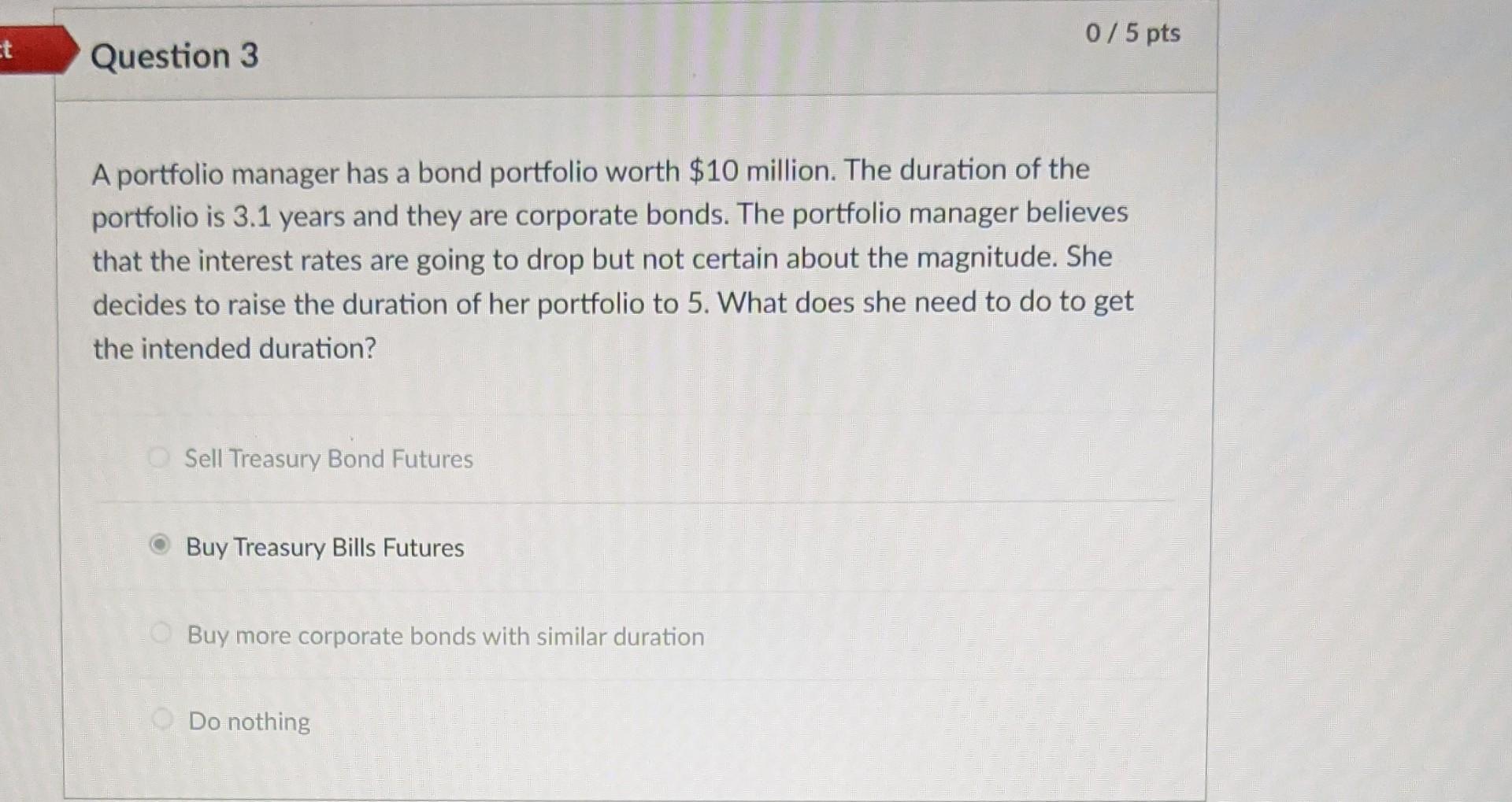

0/5 pts ct Question 3 A portfolio manager has a bond portfolio worth $10 million. The duration of the portfolio is 3.1 years and they

0/5 pts ct Question 3 A portfolio manager has a bond portfolio worth $10 million. The duration of the portfolio is 3.1 years and they are corporate bonds. The portfolio manager believes that the interest rates are going to drop but not certain about the magnitude. She decides to raise the duration of her portfolio to 5. What does she need to do to get the intended duration? Sell Treasury Bond Futures Buy Treasury Bills Futures Buy more corporate bonds with similar duration Do nothing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started