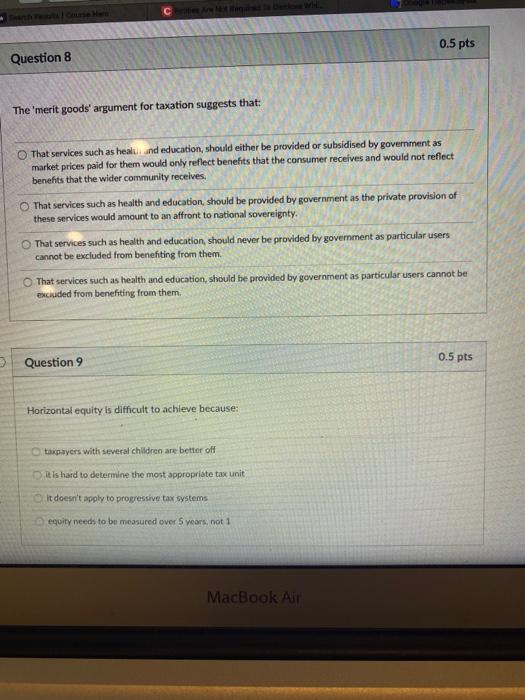

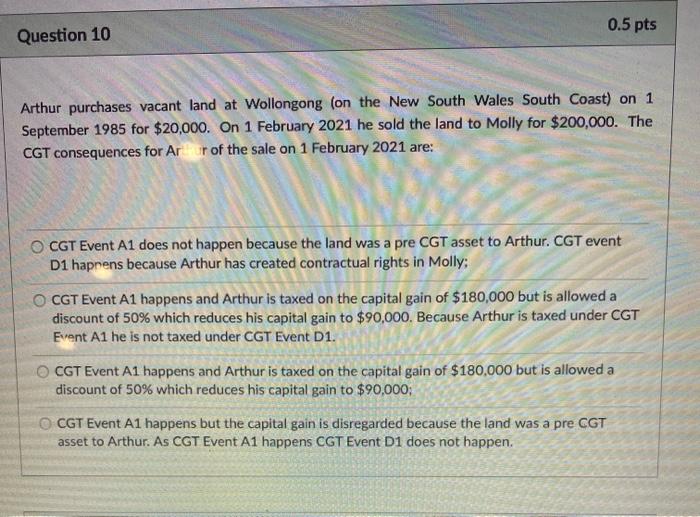

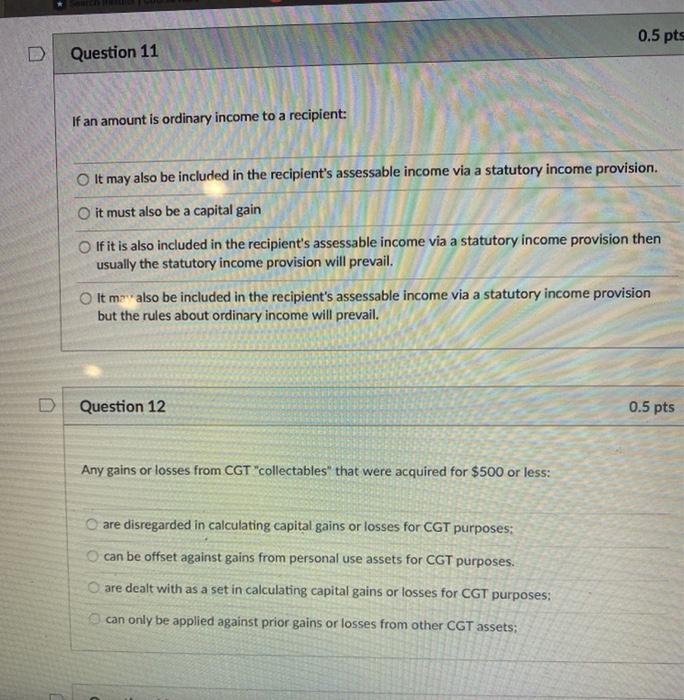

0.5 pts Question 8 The 'merit goods' argument for taxation suggests that: That services such as healind education, should either be provided or subsidised by government as market prices paid for them would only reflect benefits that the consumer receives and would not reflect benefits that the wider community receives That services such as health and education, should be provided by government as the private provision of these services would amount to an affront to national sovereignty. That services such as health and education, should never be provided by government as particular users cannot be excluded from benefiting from them. That services such as health and education, should be provided by government as particular users cannot be excluded from benefiting from them. Question 9 0.5 pts Horizontal equity is difficult to achieve because: O taxpayers with several children are better off It is hard to determine the most appropriate tax unit It doesn't apply to progressive tax wystems equity needs to be measured over 5 years, not 1 MacBook Air 0.5 pts Question 10 Arthur purchases vacant land at Wollongong (on the New South Wales South Coast) on 1 September 1985 for $20,000. On 1 February 2021 he sold the land to Molly for $200,000. The CGT consequences for Ar ur of the sale on 1 February 2021 are: OCGT Event A1 does not happen because the land was a pre CGT asset to Arthur. CGT event D1 happens because Arthur has created contractual rights in Molly: OCGT Event A1 happens and Arthur is taxed on the capital gain of $180,000 but is allowed a discount of 50% which reduces his capital gain to $90,000. Because Arthur is taxed under CGT Event A1 he is not taxed under CGT Event D1. CGT Event A1 happens and Arthur is taxed on the capital gain of $180,000 but is allowed a discount of 50% which reduces his capital gain to $90,000; OCGT Event A1 happens but the capital gain is disregarded because the land was a pre CGT asset to Arthur. As CGT Event A1 happens CGT Event D1 does not happen. 0.5 pts D Question 11 If an amount is ordinary income to a recipient: It may also be included in the recipient's assessable income via a statutory income provision. O it must also be a capital gain If it is also included in the recipient's assessable income via a statutory income provision then usually the statutory income provision will prevail. It may also be included in the recipient's assessable income via a statutory income provision but the rules about ordinary income will prevail. Question 12 0.5 pts Any gains or losses from CGT "collectables" that were acquired for $500 or less: are disregarded in calculating capital gains or losses for CGT purposes: can be offset against gains from personal use assets for CGT purposes. are dealt with as a set in calculating capital gains or losses for CGT purposes: can only be applied against prior gains or losses from other CGT assets