Answered step by step

Verified Expert Solution

Question

1 Approved Answer

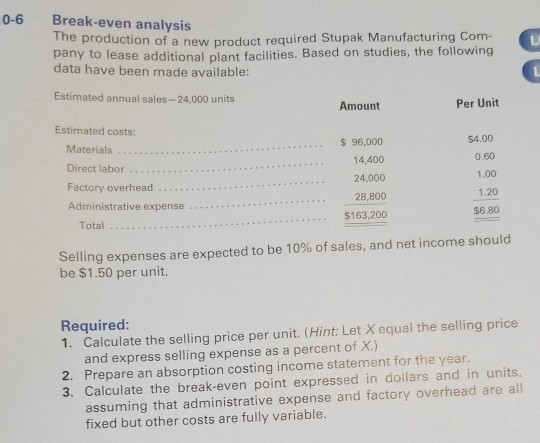

0-6 Break-even analysis The production of a new product required Stupak Manufacturing Com- pany to lease additional plant facilities. Based on studies, the following data

0-6 Break-even analysis The production of a new product required Stupak Manufacturing Com- pany to lease additional plant facilities. Based on studies, the following data have been made available: Estimated annual sales-24,000 units Amount Per Unit Estimated costs: s 96,000 14,400 24,000 28,800 $163,200 $4.00 Materials Direct labor .. Factory overhead... Administrative expense . 0.60 1.00 1.20 $6.80 Total Selling expenses are expected to be 10% of sales, and net income should be $1.50 per unit. Required: 1. Calculate the selling price per unit. (Hint: Let Xequal the selling price and express selling expense as a percent of X 2. Prepare an absorption costing income statement for the year. 3. Calculate the break-even point expressed in doilars and in units assuming that administrative expense and factory overhead are all fixed but other costs are fully variable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started