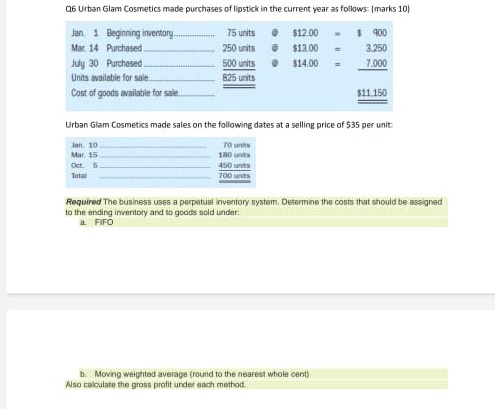

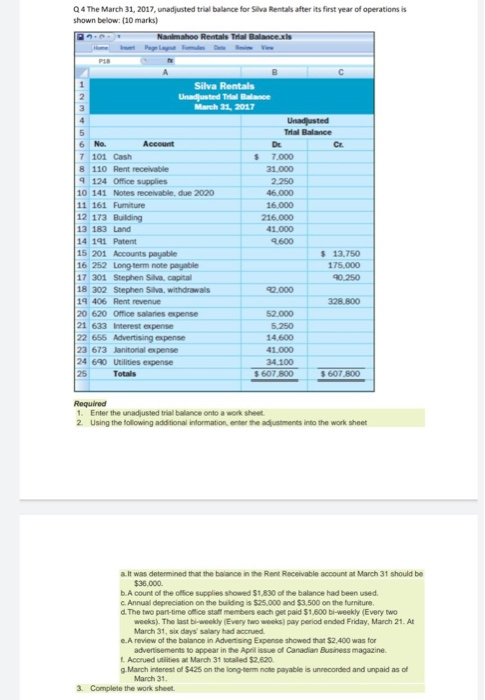

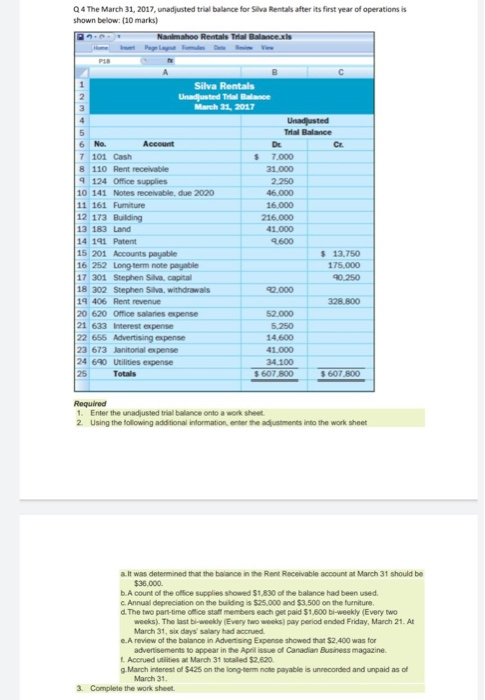

06 Urban Glam Cosmetics made purchases of lipstick in the current year as follows: (marks 101 $ Jan. 1 Beginning inventory Mar 14 Purchased July 30 Purchased Units available for sale Cost of goods available for sale 75 units 250 units 500 units 825 units $12.00 $13.00 $14.00 - - 900 3.250 7.000 511150 Urban Glam Cosmetics made sales on the following dates at a selling price of $35 per unit: 10 M15 Oet Total 18 40 700 Required The business uses a perpetual inventory system. Determine the costs that should be assigned to the ending inventory and to goods sold undert a FIFO Moving weighted average round to the nearest whole cent) Also calculate the gross profit under each method Q4 The March 31, 2017, unadjusted trial balance for SihaRentals after its first year of operations is shown below. (10 marks) Namahoo Real The Silva Rentals Lindsted Trial Balance March 2017 Unted Hace $ 7000 31.000 2.250 46.000 16 000 216 000 41 000 9600 $ 6 No. Accu 7 101 Cash 8 110 Rent recevable 9 124 Office Supplies 10 141 Notes receivable due 2020 11 161 Fumiture 12 173 Building 13 183 Land 14 191 Patent 15 201 Accounts payable 16 252 Long term note payable 17 301 Stephen Silva, capital 18 302 Stephen Silva, withdrawals 19 406 Rent revenue 20 620 Omice salaries expense 21 633 interest expense 22 655 Advertising expense 23 673 Janitorial expense 24 640 Utilities expense Totals 12.750 175.000 0250 0.000 328.800 52 000 5.250 14 600 41.000 34 100 $ 607 800 Required 1. Enter the unadjusted tra n ce on worksheet 2. Using the following additional information on the auments into the worksheet at was determined at the balance in the Rat Race Un March 31 should be 0000 Acount of the chce s h owed $1830 of the balance had been used Anual depreciation on the buildings 5.000 and $3.500 on the furniture d. The two pre o b ers each get paid $1.600 wody Every two The last b y Every Day period ended Friday, March 21. At March 31, Sixdays say had acced A review of the balance in Advertising Expense showed that $2.400 was for advertisements to appear in the Aprilie of Canadian Business magazine L Accued March 31 de $2.520 March interest of $425 on the long-term not payable is unrecorded and unpaid as of March 31 3. Complete the worksheet