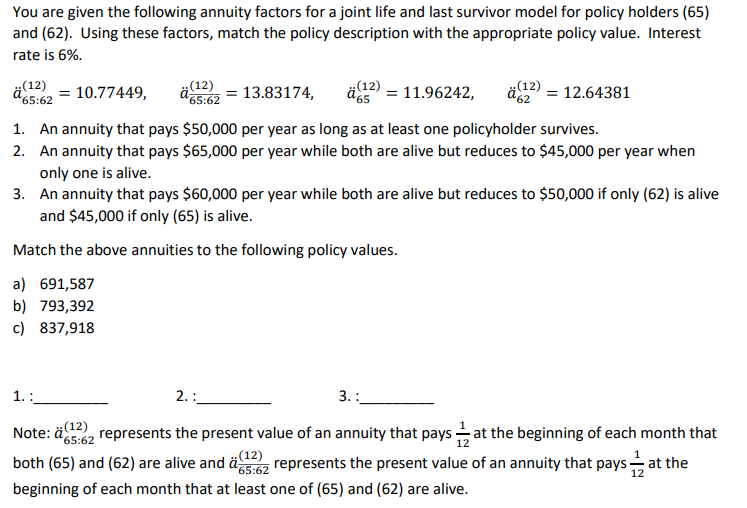

065:62 (12) = 12.64381 You are given the following annuity factors for a joint life and last survivor model for policy holders (65) and (62). Using these factors, match the policy description with the appropriate policy value. Interest rate is 6%. (12) = 10.77449, ;(12) 465:62 = 13.83174 (12) 52 = 11.96242, 1. An annuity that pays $50,000 per year as long as at least one policyholder survives. 2. An annuity that pays $65,000 per year while both are alive but reduces to $45,000 per year when only one is alive. 3. An annuity that pays $60,000 per year while both are alive but reduces to $50,000 if only (62) is alive and $45,000 if only (65) is alive. Match the above annuities to the following policy values. a) 691,587 b) 793,392 c) 837,918 1. : 2. 3. : Note: 65?62 represents the present value of an annuity that pays at the beginning of each month that both (65) and (62) are alive and l272 represents the present value of an annuity that pays at the ;(12) beginning of each month that at least one of (65) and (62) are alive. 12 065:62 (12) = 12.64381 You are given the following annuity factors for a joint life and last survivor model for policy holders (65) and (62). Using these factors, match the policy description with the appropriate policy value. Interest rate is 6%. (12) = 10.77449, ;(12) 465:62 = 13.83174 (12) 52 = 11.96242, 1. An annuity that pays $50,000 per year as long as at least one policyholder survives. 2. An annuity that pays $65,000 per year while both are alive but reduces to $45,000 per year when only one is alive. 3. An annuity that pays $60,000 per year while both are alive but reduces to $50,000 if only (62) is alive and $45,000 if only (65) is alive. Match the above annuities to the following policy values. a) 691,587 b) 793,392 c) 837,918 1. : 2. 3. : Note: 65?62 represents the present value of an annuity that pays at the beginning of each month that both (65) and (62) are alive and l272 represents the present value of an annuity that pays at the ;(12) beginning of each month that at least one of (65) and (62) are alive. 12