Answered step by step

Verified Expert Solution

Question

1 Approved Answer

07 v Desde Wur QUESTION ONE (30 MARKS Ona Smile Spieler 2018 Deseneye ihmiselt regrounded on the best responde were parte un sentimental se bom

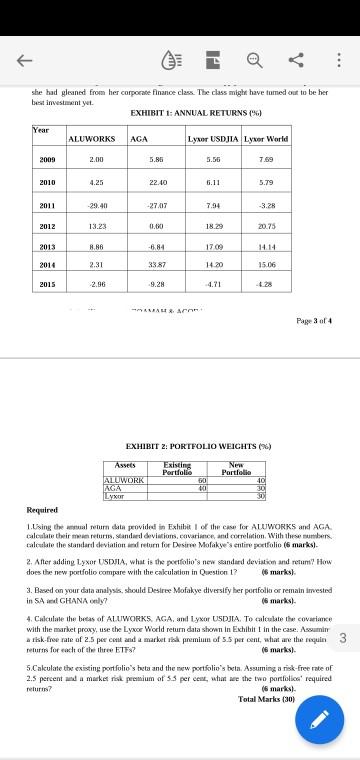

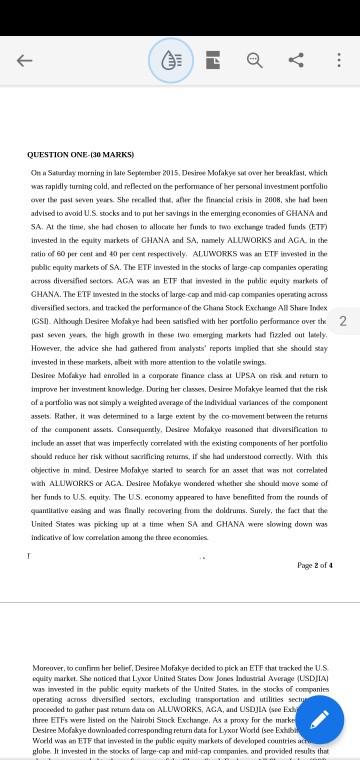

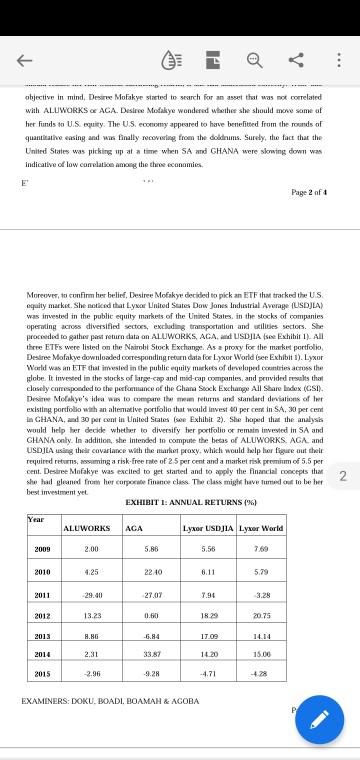

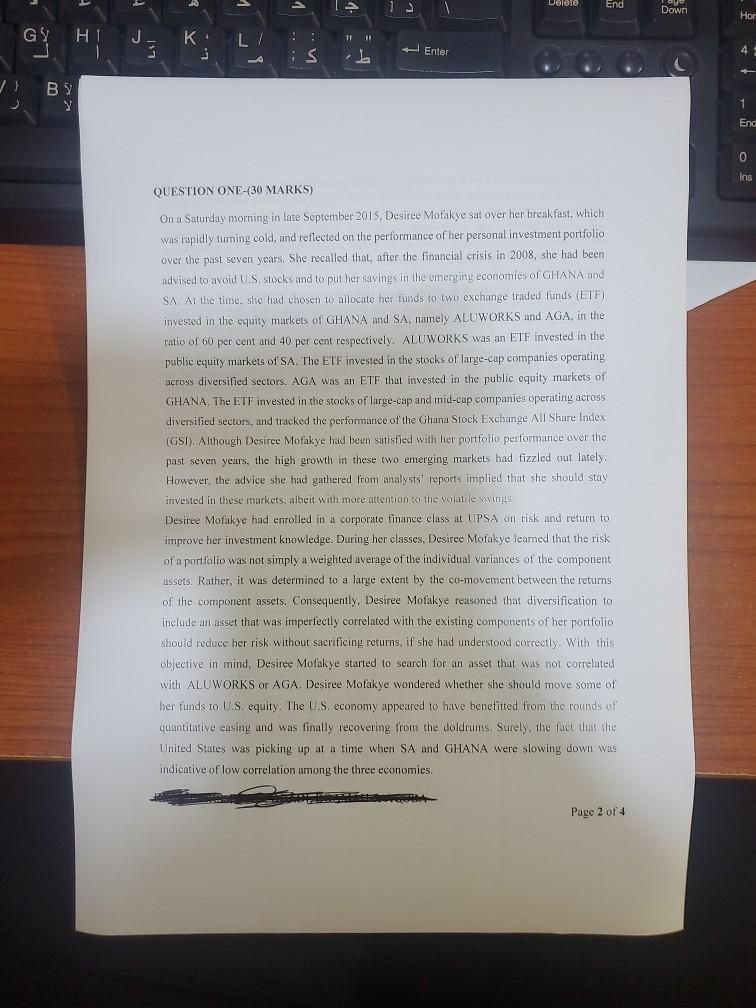

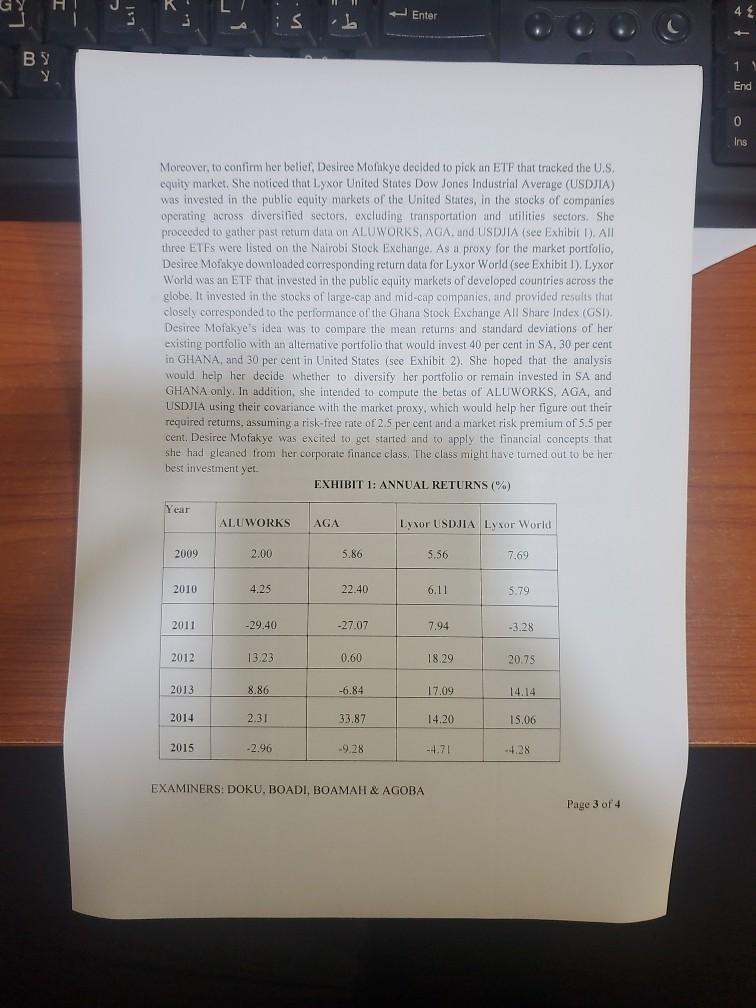

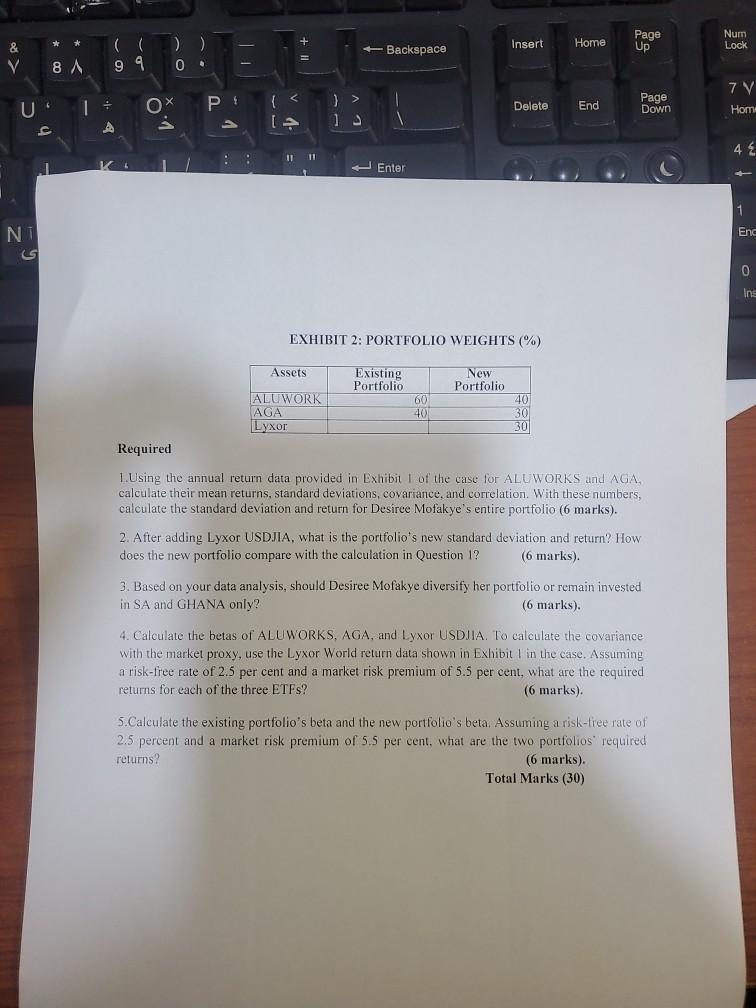

07 v Desde Wur QUESTION ONE (30 MARKS Ona Smile Spieler 2018 Deseneye ihmiselt regrounded on the best responde were parte un sentimental se bom indow Sistema GHANA SA. Al these se la chante aceleifunds to tradem Indies CHANA! SA ALLWORKS and AGA to set as dy ALLWORKS ETT We jelena The dvered NGAWETF dhe pulleys of CHANA The ETF is the leading afbedecided to purse de CharStack Excha All Star Index SILA Wade where the - the high pranath in these tree mariets aunt firathae aati latity: Hm, te te gledala pots lapidi de meestelewi Desire Mulchehalisema UPSA gerekmektig. Den har en Desire Melideye mw the of prospettive of the taber. It was reduce by the team of open Comedy Mulky medicina |star rr the streetirtyartril with the aiaing pamils w belegt. I dette w Wien dhe ne te. Dere se stein for en tales of with ALUWORKSMA. Dar viewsbred white show har et US mitt. The US Embase from the ash of und well introdom. Sunt the latte de pat we SA HANA Wowing down ladicha cambiare 24 Never, som har blid, Dule decided to pick attacked the US. quyniot Shot Lyour US Down USDA) was in the publicate din beton verschwisse perceeded a steam. AWRKS, AGA SAI The True Bund therapie 2 2 hardcore the work to and dad de GHARACS 4 ptSA. 30 percent wa vylepude SA GHANA hy he del cape the ALS MER USD via de mult proxy wahabi wale wat representeresanti penafs5 De Milky wasted and the capital we had glased from her pared. The can raightawad at the EXHIBITI: ANNUAL RETURNS Yew ALUWORKS AGA Lyour USDJA Lymer Wwe 20 2.00 68 5.98 7 2000 21 11 1.9 2001 2240 27.01 TSH 28 2012 18 2003 654 IT. 11 she had gleaned from her corporate Finance class. The class might have turned out to be her best investoint yet. EXHIBIT 1: ANNUAL RETURNS (%) Year ALUWORKS AGA Lyxor USDJIA Lyxor World 2009 2.00 5.86 7.69 2010 4.25 22.10 6.11 5.79 2011 -29.40 -27.17 7.94 -3.2R 2012 13.23 03.60 20.75 2013 8.86 -6.84 1709 1414 2014 2.31 33.87 14.20 15.06 2015 2.96 9.29 4.71 + -RAUTAL ACOR Page 3 of 4 EXHIBIT 2: PORTFOLIO WEIGHTS (96) Assets Existing New Portfolio Portfolio ALUWORK AGA 40 Lyr Required 1. Using the turn data provided in Exhibit of the case for ALUWORKS and AGA calculate their mature, standard deviations, covariance, and correlation. With thesember calculate the standard deviation of return for Desiree Mofskye's entire portfolio (6 marks). 2. After adding Lyxor USDJA, what is the portfolio's new standard deviation and retum? How does the new portfolio compare with the calculation in Question 1? (6 marks) 3. Based on your data analysis should Desiree Mofakye diversify her portfolio or remain invested in SA GHANA only! (6 marks) 4. Calculate the breas of ALUWORKS. AGA, and Lyxor USDJA. To calculate the covariance with the market proxy, use the Lyxor World return data shown in Exhibit in the case. Assumir a tisk-free rate of 2.5 per cent and market is premiun of 5.5 percent, what are the requin 3 return for each of the three ETFs? (6 marks). 5.Cakulate the existing portfolio's bets and the new portfolio's bela Assuming a risk-free rate of 2.5 percentual a market risk premium of 33 per cent, what we the two portfolios required (6 marks) Total Marks (30) w P 2. QUESTION ONE-630 MARKS) On Saturday morning in bale September 2015. Desiree Mofakye safewer tur breakfast, which was rapidly turning cold, and reflected on the performance of her personal investment portfolio over the past seven years. She recalled th, afer the financial crisis in 2008, she had been advised to avold US stocks and to put her savings in the emerging economies of GHANA and SA. At the time she had chosen to allocate her funds to two excurge traded funds (ET) Invested in the equity markets of GHANA and SA, namely ALUWORKS and AGA. In the ratin of 60 per cent and 40 percent respectively. ALUWORKS was an ETF invested in the public equity markets of SA. The ETF invested in the stocks of large cap companies operating acros diversified sectors. AGA was in ETF that invested in the public equity markets of GHANA. The ETF invested in the stocks of large cap and mid cap companies operating across diversified sectors, and tracked the performance of the Chan Stock Exchange All ShareTex ICSI). Although Desiree Molakye had been satisfied with her portfolio performance over the puest seen years, the high growth in the woning markets hul fizzled out lately However, the advice she had gathered from analysts' reports implied that she should stay invested in the markets, albeit with more attention to the volatile swings Desiree Mofukye had enrolled in a corporate finance class at UPSA on risk and retain to improve her investment knowledge. During her classes. Desiree Mofakye learned that the risk of a portfolio was so simply a weighted average of the Individual variances of the component assets. Rather. It was determined to a large extent by the co-movement between the returns of the component assets. Consequently, Desiree Mofakye reasoned that diversification to include an asset that was imperfectly correlated with the existing components of her portfolio should reduce her risk without sacrificing returns, if she had understood correctly. With this objective in mind. Desiree Mofakye started to search for an asset that was not correlated with ALUWORKS AGA Desiree Mofakye wandered whether she should move some of her funds to U.S. equity. The US economy appeared to have benefitted from the mounds of quantitative casing and was finally recovering from the doldrums. Surely, the fact that the United States was picking up at a time when SA and GHANA were slowing down was indicative of low coration among the the economies 1 Page 2 of 4 Moreover, to confirm her belief, Desiree Mufakye decided to pick an ETF that tracked the US quity market. She noticed that Lyxor United States Dow Jones Industrial Average (USDJIA was invested in the public equity markets of the United States in the stocks of companies operating across diversified sectors, excluding transportation and utilities sect proceeded to gather past rotum dalam ALUWORKS, AGA, and USDJLA (Exch three ETFs were listed on the Nairobi Stock Exchange. As a proxy for the marke Desiree Mofakye downloaded corresponding return data for Lyxor World (see Exhibit Worlil was an ETF that invested in the public equily markets of developed countries globe. It invested in the stocks of large-cap and mid-cap companies and provided results that objective in mind, Desire MoFakye stated to search for an asset that was not correlated with ALUWORKS AGA. Desiree Moakye wondered whether she should move some of her funds to US Equity. The US. economy appeared to have benefitted from the rounds of quantitate ensing and was finally recovering from the doldrums. Surely, the fact that the United States was picking up at a time when SA and GHANA were swing down was indicative of low comelatice among the three conamies Page 2 of 4 Moreover, to confirm her belief, Desiree Mofaky decided to pick an ETF that tracked the US equity market. She noticed that Lyxor United States Dow Jones Industrial Average (USDJLA) was invested in the public equity markets of the United States, in the stocks of companies operating across diversified sectors, excluding transportation and stilles sectors. She proceeded to gather past return data on ALUWORKS, AGA and USDJIA se Exhibit 1). All the ETFs were listed on the Nairobt Stock Exchange. As a proxy for the market portfolio, Desiree Mofakye downloaded corresponding return data for Lyxor World (see Exhibit 1). Lyxor World was an ETF chat imested in the public equily markets of developed countries across the globe. It invested in the stocks of large-cap and mid-cap companies, and provided results that closely corresponded to the performance of the Ghana Stock Exchange All Share Index (CSI). Deine Molekye's idea was to compare the man returns and standard de atices of Ir existing portfolio with an alternative portfolio that would invest 90 per cent in SA. 30 per cent in CHANA, and 30 per cent in United States see Exhibit 2). She hoped that the analysis would help her decide whether to diversify her portfolio of remain invested in SA and GHANA only. In addition, she intended to compute the beas of ALUWORKS. AGA and USDJLA using their covariance with the market proxy, which would help her figure out the required returns, assuming a risk-free rate of 25 per cent and a market risk premium of 5.5 per cent. Desiree Mofakye was excited to get started and to apply the financial concepts that she had gleaned from her corporate finance class. The class might have med out to be her best investment yet EXHIBIT 1: ANNUAL RETURNS (N.) 2 Year ALUWORKS AGA Lyxor USDJIA Lyxer World 2009 2.00 5.86 5.56 7.69 2010 4.25 22:40 6.11 5.79 2011 29.90 27.07 7.94 3.28 2012 13.23 050 18-29 20.75 2013 H.BG 17.0 14.14 2014 2.31 14.20 15.00 2015 -2.96 -9.28 -4.71 EXAMINERS: OKU. BOADI. BOAMAH & AGOBA P Delete End Down Hor GY HI J K.LT TI I! is Enter 1) BY 1 End 0 Ins QUESTION ONE-(30 MARKS) On a Saturday morning in late September 2015. Desiree Mofakye sat over her breakfast, which was rapidly tuming cold, and reflected on the performance of her personal investment portfolio over the past seven years. She recalled that, after the financial crisis in 2008, she had been advised to avoid U.S. Stocks and to put her savings in the emerging economies of GHANA and SA At the time she had chosen to allocate her funds to two exchange traded funds (ETF) invested in the equity markets of GHANA and SA, namely ALUWORKS and AGA, in the ratio of 60 per cent and 40 per cent respectively. ALUWORKS was an ETF invested in the public equity markets of SA. The ETF invested in the stocks of large-cap companies operating across diversified sectors. AGA was an ETF that invested in the public equity markets of GHANA. The ETF invested in the stocks of large-cap and mid-cap companies operating across diversified sectors, and tracked the performance of the Ghana Stock Exchange All Share Index (GSI). Although Desiree Mofakye had been satisfied with her portfolio performance over the past seven years, the high growth in these two emerging markets had fizzled out lately. However, the advice she had gathered from analysts' reports implied that she should stay invested in these markets, albeit with more attention to the volatile swings Desiree Mofakye had enrolled in a corporate finance class at UPSA on risk and return to improve her investment knowledge. During her classes, Desiree Mofakye learned that the risk of a portfolio was not simply a weighted average of the individual variances of the component assets. Rather, it was determined to a large extent by the co-movement between the returns of the component assets. Consequently, Desiree Mofakye reasoned that diversification to include an asset that was imperfectly correlated with the existing components of her portfolio should reduce her risk without sacrificing returns, if she had understood correctly. With this objective in mind, Desiree Mofakye started to search for an asset that was not correlated with ALUWORKS or AGA. Desiree Mofakye wondered whether she should move some of her funds to US equity. The U.S. economy appeared to have benefitted from the rounds of quantitative easing and was finally recovering from the doldrums. Surely, the fact that the United States was picking up at a time when SA and GHANA were slowing down was indicative of low correlation among the three economies. Page 2 of 4 Enter 42 Y 1 End 0 Ins Moreover, to confirm her belief, Desiree Mofukye decided to pick an ETF that tracked the U.S. equity market. She noticed that Lyxor United States Dow Jones Industrial Average (USDJIA) was invested in the public equity markets of the United States, in the stocks of companies operating across diversified sectors, excluding transportation and utilities sectors. She proceeded to gather past retum data on ALUWORKS, AGA and USDHIA (see Exhibit ). All three ETFs were listed on the the Nairobi Stock Exchange. As a a proxy for the market portfolio World was an ETF that invested in the public equity markets of developed countries across the Desiree Morakye downloaded corresponding return data for Lyxor World (see Exhibit 1). Lyxor globe. It invested in the stocks of large-cap and mid-cap companies and provided results that closely corresponded to the performance of the Ghana Stock Exchange All Share Index (Gs). Desiree Mofakye's iden was to compare the mean returns and standard deviations of her existing portfolio with an alternative portfolio that would invest 40 per cent in SA, 30 per cent in GHANA, and 30 per cent in United States (see Exhibit 2). She hoped that the analysis would help her decide whether to diversify her portfolio or remain invested in SA and GHANA only. In addition, she intended to compute the betas of ALUWORKS, AGA, and USDJIA using their covariance with the market proxy, which would help her figure out their required returns, assuming a risk-free rate of 2.5 per cent and a market risk premium of 5.5 per cent. Desiree Mofakye was excited to get started and to apply the financial concepts that She had gleaned from her corporate finance class. The class might have turned out to be her best investment yet EXHIBIT 1: ANNUAL RETURNS () Year ALUWORKS AGA Lyxor USDJIA Lyxor World 2009 2.00 5.86 5.56 7.69 2010 4.25 22.40 6.11 5.79 2011 -29.40 -27.07 7.94 -3.28 2012 13.23 0.60 18.29 20.75 2013 8.86 -6.84 17.09 14.14 2014 2.31 33.87 14.20 15.06 2015 -2.96 -9.28 -4.71 -4.28 EXAMINERS: DOKU, BOADI, BOAMAH & AGOBA Page 3 of 4 * + Home Page Up Num Lock Insert & V ( 99 +Backspace 8 0. U. 7 V Hom Delete Page Down End A S ] 1 4 & 1111 1 4 Enter 1 NI Enc 0 Ins EXHIBIT 2: PORTFOLIO WEIGHTS (%) Assets Existing New Portfolio Portfolio ALUWORK 60 40 AGA 40 30 Lyxor Required 1. Using the annual return data provided in Exhibit 1 of the case for ALL WORKS and AGA calculate their mean returns, standard deviations, covariance, and correlation. With these numbers, calculate the standard deviation and return for Desiree Mofakye's entire portfolio (6 marks). 2. After adding Lyxor USDJIA. what is the portfolio's new standard deviation and return? How does the new portfolio compare with the calculation in Question 1? (6 marks). 3. Based on your data analysis, should Desiree Mofakye diversify her portfolio or remain invested in SA and GHANA only? (6 marks). 4. Calculate the betas of ALUWORKS, AGA, and Lyxor USDIA. To calculate the covariance with the market proxy, use the Lyxor World return data shown in Exhibit I in the case. Assuming a risk-free rate of 2.5 per cent and a market risk premium of 5.5 per cent, what are the required returns for each of the three ETFs? (6 marks). 5.Calculate the existing portfolio's beta and the new portfolio's beta. Assuming a risk-free rate of 2.5 percent and a market risk premium of 5.5 per cent, what are the two portfolios required returns? (6 marks). Total Marks (30) 07 v Desde Wur QUESTION ONE (30 MARKS Ona Smile Spieler 2018 Deseneye ihmiselt regrounded on the best responde were parte un sentimental se bom indow Sistema GHANA SA. Al these se la chante aceleifunds to tradem Indies CHANA! SA ALLWORKS and AGA to set as dy ALLWORKS ETT We jelena The dvered NGAWETF dhe pulleys of CHANA The ETF is the leading afbedecided to purse de CharStack Excha All Star Index SILA Wade where the - the high pranath in these tree mariets aunt firathae aati latity: Hm, te te gledala pots lapidi de meestelewi Desire Mulchehalisema UPSA gerekmektig. Den har en Desire Melideye mw the of prospettive of the taber. It was reduce by the team of open Comedy Mulky medicina |star rr the streetirtyartril with the aiaing pamils w belegt. I dette w Wien dhe ne te. Dere se stein for en tales of with ALUWORKSMA. Dar viewsbred white show har et US mitt. The US Embase from the ash of und well introdom. Sunt the latte de pat we SA HANA Wowing down ladicha cambiare 24 Never, som har blid, Dule decided to pick attacked the US. quyniot Shot Lyour US Down USDA) was in the publicate din beton verschwisse perceeded a steam. AWRKS, AGA SAI The True Bund therapie 2 2 hardcore the work to and dad de GHARACS 4 ptSA. 30 percent wa vylepude SA GHANA hy he del cape the ALS MER USD via de mult proxy wahabi wale wat representeresanti penafs5 De Milky wasted and the capital we had glased from her pared. The can raightawad at the EXHIBITI: ANNUAL RETURNS Yew ALUWORKS AGA Lyour USDJA Lymer Wwe 20 2.00 68 5.98 7 2000 21 11 1.9 2001 2240 27.01 TSH 28 2012 18 2003 654 IT. 11 she had gleaned from her corporate Finance class. The class might have turned out to be her best investoint yet. EXHIBIT 1: ANNUAL RETURNS (%) Year ALUWORKS AGA Lyxor USDJIA Lyxor World 2009 2.00 5.86 7.69 2010 4.25 22.10 6.11 5.79 2011 -29.40 -27.17 7.94 -3.2R 2012 13.23 03.60 20.75 2013 8.86 -6.84 1709 1414 2014 2.31 33.87 14.20 15.06 2015 2.96 9.29 4.71 + -RAUTAL ACOR Page 3 of 4 EXHIBIT 2: PORTFOLIO WEIGHTS (96) Assets Existing New Portfolio Portfolio ALUWORK AGA 40 Lyr Required 1. Using the turn data provided in Exhibit of the case for ALUWORKS and AGA calculate their mature, standard deviations, covariance, and correlation. With thesember calculate the standard deviation of return for Desiree Mofskye's entire portfolio (6 marks). 2. After adding Lyxor USDJA, what is the portfolio's new standard deviation and retum? How does the new portfolio compare with the calculation in Question 1? (6 marks) 3. Based on your data analysis should Desiree Mofakye diversify her portfolio or remain invested in SA GHANA only! (6 marks) 4. Calculate the breas of ALUWORKS. AGA, and Lyxor USDJA. To calculate the covariance with the market proxy, use the Lyxor World return data shown in Exhibit in the case. Assumir a tisk-free rate of 2.5 per cent and market is premiun of 5.5 percent, what are the requin 3 return for each of the three ETFs? (6 marks). 5.Cakulate the existing portfolio's bets and the new portfolio's bela Assuming a risk-free rate of 2.5 percentual a market risk premium of 33 per cent, what we the two portfolios required (6 marks) Total Marks (30) w P 2. QUESTION ONE-630 MARKS) On Saturday morning in bale September 2015. Desiree Mofakye safewer tur breakfast, which was rapidly turning cold, and reflected on the performance of her personal investment portfolio over the past seven years. She recalled th, afer the financial crisis in 2008, she had been advised to avold US stocks and to put her savings in the emerging economies of GHANA and SA. At the time she had chosen to allocate her funds to two excurge traded funds (ET) Invested in the equity markets of GHANA and SA, namely ALUWORKS and AGA. In the ratin of 60 per cent and 40 percent respectively. ALUWORKS was an ETF invested in the public equity markets of SA. The ETF invested in the stocks of large cap companies operating acros diversified sectors. AGA was in ETF that invested in the public equity markets of GHANA. The ETF invested in the stocks of large cap and mid cap companies operating across diversified sectors, and tracked the performance of the Chan Stock Exchange All ShareTex ICSI). Although Desiree Molakye had been satisfied with her portfolio performance over the puest seen years, the high growth in the woning markets hul fizzled out lately However, the advice she had gathered from analysts' reports implied that she should stay invested in the markets, albeit with more attention to the volatile swings Desiree Mofukye had enrolled in a corporate finance class at UPSA on risk and retain to improve her investment knowledge. During her classes. Desiree Mofakye learned that the risk of a portfolio was so simply a weighted average of the Individual variances of the component assets. Rather. It was determined to a large extent by the co-movement between the returns of the component assets. Consequently, Desiree Mofakye reasoned that diversification to include an asset that was imperfectly correlated with the existing components of her portfolio should reduce her risk without sacrificing returns, if she had understood correctly. With this objective in mind. Desiree Mofakye started to search for an asset that was not correlated with ALUWORKS AGA Desiree Mofakye wandered whether she should move some of her funds to U.S. equity. The US economy appeared to have benefitted from the mounds of quantitative casing and was finally recovering from the doldrums. Surely, the fact that the United States was picking up at a time when SA and GHANA were slowing down was indicative of low coration among the the economies 1 Page 2 of 4 Moreover, to confirm her belief, Desiree Mufakye decided to pick an ETF that tracked the US quity market. She noticed that Lyxor United States Dow Jones Industrial Average (USDJIA was invested in the public equity markets of the United States in the stocks of companies operating across diversified sectors, excluding transportation and utilities sect proceeded to gather past rotum dalam ALUWORKS, AGA, and USDJLA (Exch three ETFs were listed on the Nairobi Stock Exchange. As a proxy for the marke Desiree Mofakye downloaded corresponding return data for Lyxor World (see Exhibit Worlil was an ETF that invested in the public equily markets of developed countries globe. It invested in the stocks of large-cap and mid-cap companies and provided results that objective in mind, Desire MoFakye stated to search for an asset that was not correlated with ALUWORKS AGA. Desiree Moakye wondered whether she should move some of her funds to US Equity. The US. economy appeared to have benefitted from the rounds of quantitate ensing and was finally recovering from the doldrums. Surely, the fact that the United States was picking up at a time when SA and GHANA were swing down was indicative of low comelatice among the three conamies Page 2 of 4 Moreover, to confirm her belief, Desiree Mofaky decided to pick an ETF that tracked the US equity market. She noticed that Lyxor United States Dow Jones Industrial Average (USDJLA) was invested in the public equity markets of the United States, in the stocks of companies operating across diversified sectors, excluding transportation and stilles sectors. She proceeded to gather past return data on ALUWORKS, AGA and USDJIA se Exhibit 1). All the ETFs were listed on the Nairobt Stock Exchange. As a proxy for the market portfolio, Desiree Mofakye downloaded corresponding return data for Lyxor World (see Exhibit 1). Lyxor World was an ETF chat imested in the public equily markets of developed countries across the globe. It invested in the stocks of large-cap and mid-cap companies, and provided results that closely corresponded to the performance of the Ghana Stock Exchange All Share Index (CSI). Deine Molekye's idea was to compare the man returns and standard de atices of Ir existing portfolio with an alternative portfolio that would invest 90 per cent in SA. 30 per cent in CHANA, and 30 per cent in United States see Exhibit 2). She hoped that the analysis would help her decide whether to diversify her portfolio of remain invested in SA and GHANA only. In addition, she intended to compute the beas of ALUWORKS. AGA and USDJLA using their covariance with the market proxy, which would help her figure out the required returns, assuming a risk-free rate of 25 per cent and a market risk premium of 5.5 per cent. Desiree Mofakye was excited to get started and to apply the financial concepts that she had gleaned from her corporate finance class. The class might have med out to be her best investment yet EXHIBIT 1: ANNUAL RETURNS (N.) 2 Year ALUWORKS AGA Lyxor USDJIA Lyxer World 2009 2.00 5.86 5.56 7.69 2010 4.25 22:40 6.11 5.79 2011 29.90 27.07 7.94 3.28 2012 13.23 050 18-29 20.75 2013 H.BG 17.0 14.14 2014 2.31 14.20 15.00 2015 -2.96 -9.28 -4.71 EXAMINERS: OKU. BOADI. BOAMAH & AGOBA P Delete End Down Hor GY HI J K.LT TI I! is Enter 1) BY 1 End 0 Ins QUESTION ONE-(30 MARKS) On a Saturday morning in late September 2015. Desiree Mofakye sat over her breakfast, which was rapidly tuming cold, and reflected on the performance of her personal investment portfolio over the past seven years. She recalled that, after the financial crisis in 2008, she had been advised to avoid U.S. Stocks and to put her savings in the emerging economies of GHANA and SA At the time she had chosen to allocate her funds to two exchange traded funds (ETF) invested in the equity markets of GHANA and SA, namely ALUWORKS and AGA, in the ratio of 60 per cent and 40 per cent respectively. ALUWORKS was an ETF invested in the public equity markets of SA. The ETF invested in the stocks of large-cap companies operating across diversified sectors. AGA was an ETF that invested in the public equity markets of GHANA. The ETF invested in the stocks of large-cap and mid-cap companies operating across diversified sectors, and tracked the performance of the Ghana Stock Exchange All Share Index (GSI). Although Desiree Mofakye had been satisfied with her portfolio performance over the past seven years, the high growth in these two emerging markets had fizzled out lately. However, the advice she had gathered from analysts' reports implied that she should stay invested in these markets, albeit with more attention to the volatile swings Desiree Mofakye had enrolled in a corporate finance class at UPSA on risk and return to improve her investment knowledge. During her classes, Desiree Mofakye learned that the risk of a portfolio was not simply a weighted average of the individual variances of the component assets. Rather, it was determined to a large extent by the co-movement between the returns of the component assets. Consequently, Desiree Mofakye reasoned that diversification to include an asset that was imperfectly correlated with the existing components of her portfolio should reduce her risk without sacrificing returns, if she had understood correctly. With this objective in mind, Desiree Mofakye started to search for an asset that was not correlated with ALUWORKS or AGA. Desiree Mofakye wondered whether she should move some of her funds to US equity. The U.S. economy appeared to have benefitted from the rounds of quantitative easing and was finally recovering from the doldrums. Surely, the fact that the United States was picking up at a time when SA and GHANA were slowing down was indicative of low correlation among the three economies. Page 2 of 4 Enter 42 Y 1 End 0 Ins Moreover, to confirm her belief, Desiree Mofukye decided to pick an ETF that tracked the U.S. equity market. She noticed that Lyxor United States Dow Jones Industrial Average (USDJIA) was invested in the public equity markets of the United States, in the stocks of companies operating across diversified sectors, excluding transportation and utilities sectors. She proceeded to gather past retum data on ALUWORKS, AGA and USDHIA (see Exhibit ). All three ETFs were listed on the the Nairobi Stock Exchange. As a a proxy for the market portfolio World was an ETF that invested in the public equity markets of developed countries across the Desiree Morakye downloaded corresponding return data for Lyxor World (see Exhibit 1). Lyxor globe. It invested in the stocks of large-cap and mid-cap companies and provided results that closely corresponded to the performance of the Ghana Stock Exchange All Share Index (Gs). Desiree Mofakye's iden was to compare the mean returns and standard deviations of her existing portfolio with an alternative portfolio that would invest 40 per cent in SA, 30 per cent in GHANA, and 30 per cent in United States (see Exhibit 2). She hoped that the analysis would help her decide whether to diversify her portfolio or remain invested in SA and GHANA only. In addition, she intended to compute the betas of ALUWORKS, AGA, and USDJIA using their covariance with the market proxy, which would help her figure out their required returns, assuming a risk-free rate of 2.5 per cent and a market risk premium of 5.5 per cent. Desiree Mofakye was excited to get started and to apply the financial concepts that She had gleaned from her corporate finance class. The class might have turned out to be her best investment yet EXHIBIT 1: ANNUAL RETURNS () Year ALUWORKS AGA Lyxor USDJIA Lyxor World 2009 2.00 5.86 5.56 7.69 2010 4.25 22.40 6.11 5.79 2011 -29.40 -27.07 7.94 -3.28 2012 13.23 0.60 18.29 20.75 2013 8.86 -6.84 17.09 14.14 2014 2.31 33.87 14.20 15.06 2015 -2.96 -9.28 -4.71 -4.28 EXAMINERS: DOKU, BOADI, BOAMAH & AGOBA Page 3 of 4 * + Home Page Up Num Lock Insert & V ( 99 +Backspace 8 0. U. 7 V Hom Delete Page Down End A S ] 1 4 & 1111 1 4 Enter 1 NI Enc 0 Ins EXHIBIT 2: PORTFOLIO WEIGHTS (%) Assets Existing New Portfolio Portfolio ALUWORK 60 40 AGA 40 30 Lyxor Required 1. Using the annual return data provided in Exhibit 1 of the case for ALL WORKS and AGA calculate their mean returns, standard deviations, covariance, and correlation. With these numbers, calculate the standard deviation and return for Desiree Mofakye's entire portfolio (6 marks). 2. After adding Lyxor USDJIA. what is the portfolio's new standard deviation and return? How does the new portfolio compare with the calculation in Question 1? (6 marks). 3. Based on your data analysis, should Desiree Mofakye diversify her portfolio or remain invested in SA and GHANA only? (6 marks). 4. Calculate the betas of ALUWORKS, AGA, and Lyxor USDIA. To calculate the covariance with the market proxy, use the Lyxor World return data shown in Exhibit I in the case. Assuming a risk-free rate of 2.5 per cent and a market risk premium of 5.5 per cent, what are the required returns for each of the three ETFs? (6 marks). 5.Calculate the existing portfolio's beta and the new portfolio's beta. Assuming a risk-free rate of 2.5 percent and a market risk premium of 5.5 per cent, what are the two portfolios required returns? (6 marks). Total Marks (30)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started