Answered step by step

Verified Expert Solution

Question

1 Approved Answer

07:03 1213 < 88 0 Revisions (L8... AF5115 review... 22% 0 final assignment 5115_Final Re... Untitled (Draft) final assig... To The Hong Kong Polytechnic

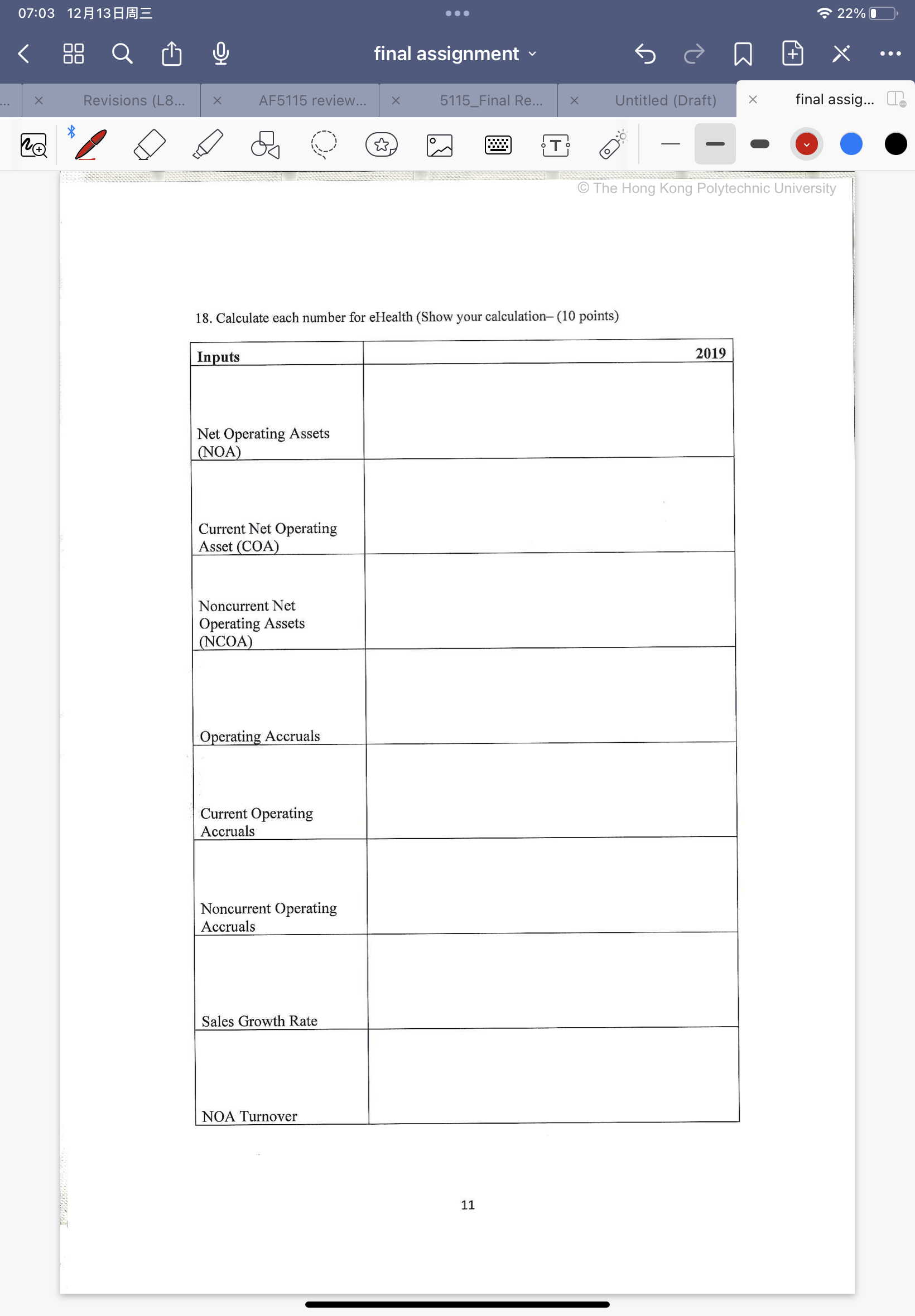

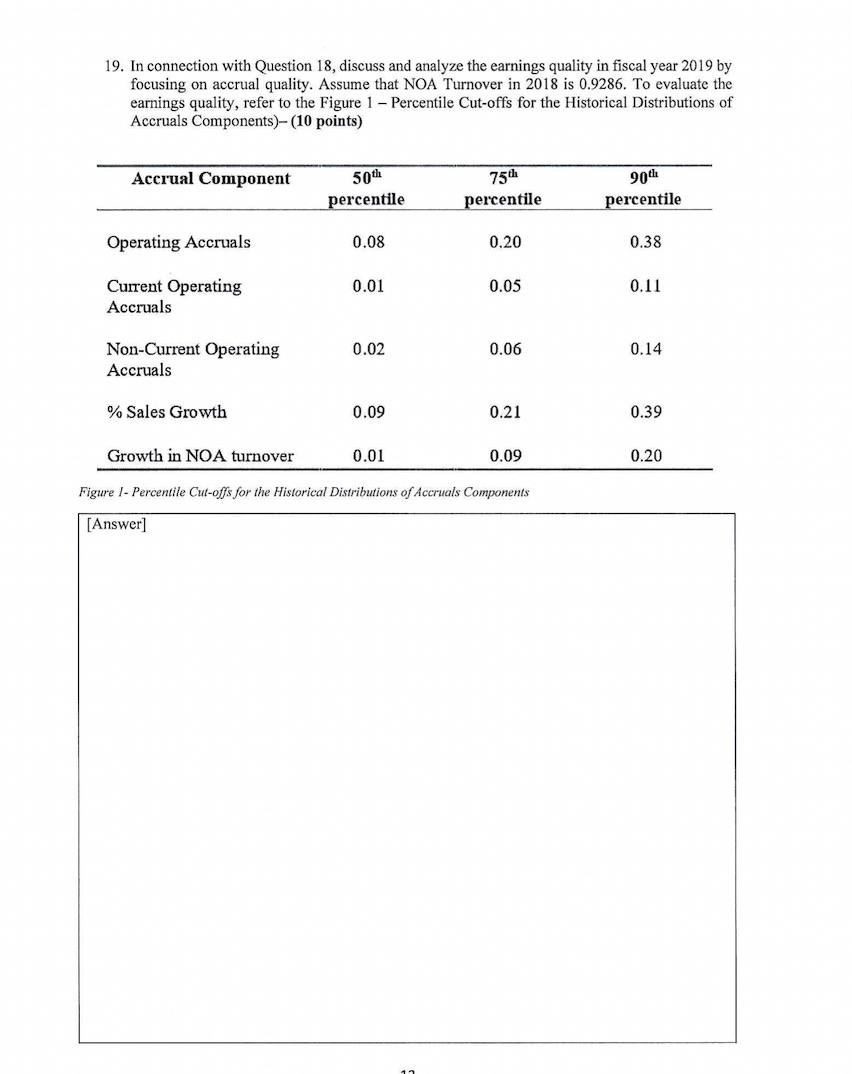

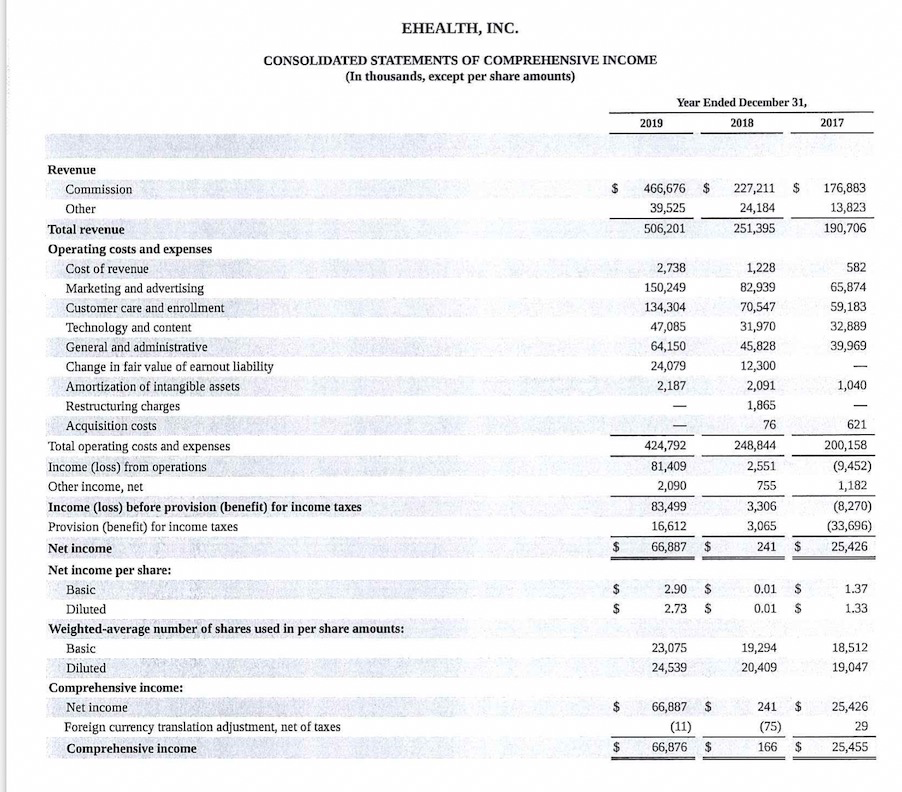

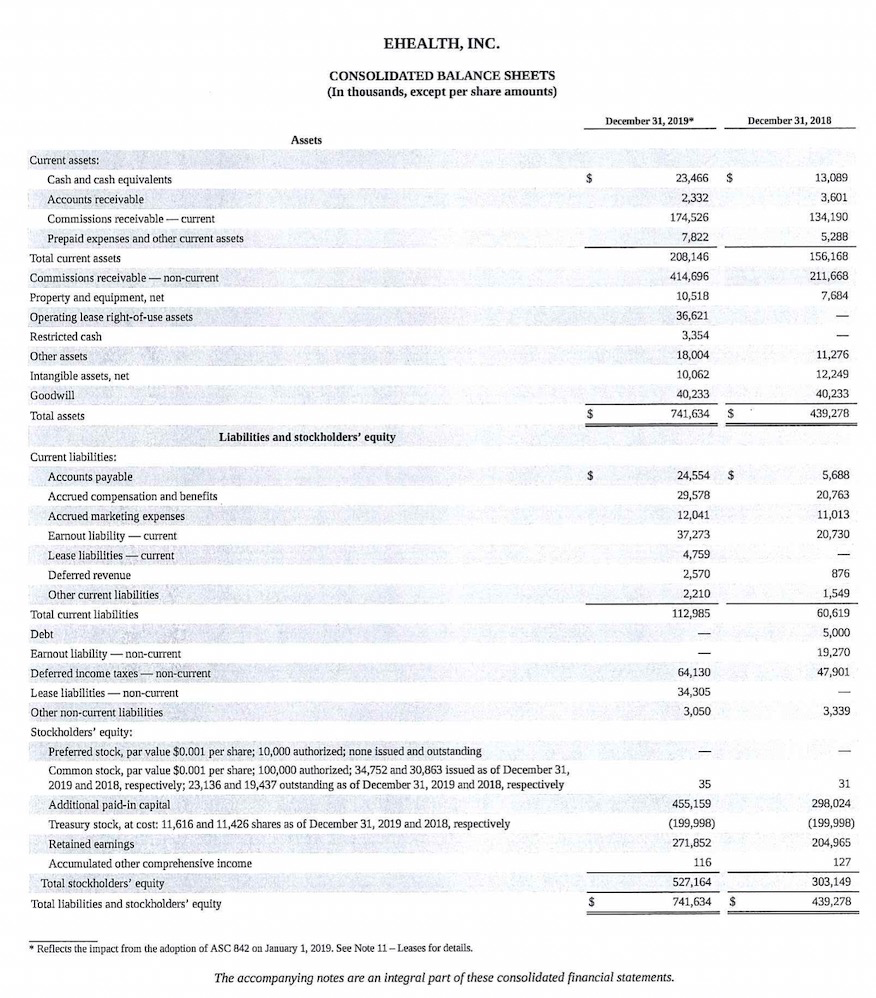

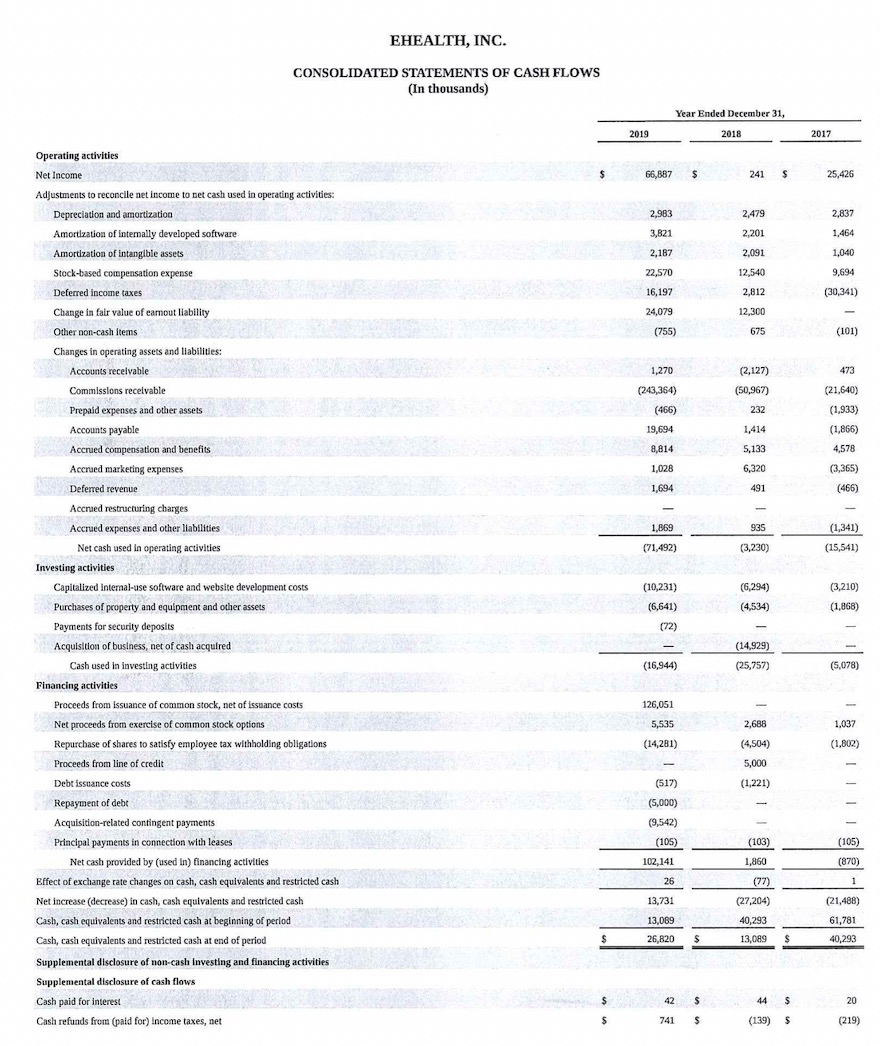

07:03 1213 < 88 0 Revisions (L8... AF5115 review... 22% 0 final assignment 5115_Final Re... Untitled (Draft) final assig... To The Hong Kong Polytechnic University 18. Calculate each number for eHealth (Show your calculation- (10 points) Inputs Net Operating Assets (NOA) Current Net Operating Asset (COA) Noncurrent Net Operating Assets (NCOA) Operating Accruals Current Operating Accruals Noncurrent Operating Accruals Sales Growth Rate NOA Turnover 11 2019 19. In connection with Question 18, discuss and analyze the earnings quality in fiscal year 2019 by focusing on accrual quality. Assume that NOA Turnover in 2018 is 0.9286. To evaluate the earnings quality, refer to the Figure 1 - Percentile Cut-offs for the Historical Distributions of Accruals Components)- (10 points) Accrual Component 50th percentile 75th percentile 90th percentile Operating Accruals 0.08 0.20 0.38 Current Operating 0.01 0.05 0.11 Accruals Non-Current Operating 0.02 0.06 0.14 Accruals % Sales Growth 0.09 0.21 0.39 Growth in NOA turnover 0.01 0.09 0.20 Figure 1-Percentile Cut-offs for the Historical Distributions of Accruals Components [Answer] EHEALTH, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In thousands, except per share amounts) Year Ended December 31, 2019 2018 2017 Revenue Commission Other Total revenue Operating costs and expenses Cost of revenue Marketing and advertising Customer care and enrollment Technology and content General and administrative Change in fair value of earnout liability Amortization of intangible assets 466,676 $ 227,211 176,883 39,525 24,184 13,823 506,201 251,395 190,706 2,738 1,228 582 150,249 82,939 65,874 134,304 70,547 59,183 47,085 31,970 32,889 64,150 45,828 39,969 24,079 12,300 - 2,187 2,091 1,040 Restructuring charges 1,865 - Acquisition costs 76 621 Total operating costs and expenses 424,792 248,844 200,158 Income (loss) from operations 81,409 2,551 (9,452) Other income, net 2,090 755 1,182 Income (loss) before provision (benefit) for income taxes 83,499 3,306 (8,270) Provision (benefit) for income taxes 16,612 3,065 (33,696) Net income 66,887 $ 241 $ 25,426 Net income per share: Basic Diluted Weighted-average number of shares used in per share amounts: 2.90 $ 0.01 $ 1.37 2.73 0.01 $ 1.33 Basic Diluted Comprehensive income: Net income Foreign currency translation adjustment, net of taxes Comprehensive income 23,075 19,294 24,539 20,409 18,512 19,047 66,887 241 $ 25,426 (11) (75) 29 $ 66,876 $ 166 $ 25,455 Current assets: Cash and cash equivalents Accounts receivable Commissions receivable-current Prepaid expenses and other current assets Total current assets Commissions receivable-non-current Property and equipment, net Operating lease right-of-use assets Restricted cash Other assets Intangible assets, net Goodwill Total assets Assets EHEALTH, INC. CONSOLIDATED BALANCE SHEETS (In thousands, except per share amounts) December 31, 2019" December 31, 2018 23,466 $ 13,089 2,332 174,526 3,601 134,190 7,822 5,288 208,146 156,168 414,696 211,668 10,518 7,684 36,621 3,354 18,004 11,276 10,062 12,249 40,233 40,233 $ 741,634 $ 439,278 Liabilities and stockholders' equity Current liabilities: Accounts payable Accrued compensation and benefits Accrued marketing expenses Earnout liability-current Lease liabilities-current Deferred revenue Other current liabilities. Total current liabilities Debt Earnout liability non-current Deferred income taxes--non-current Lease liabilities-non-current Other non-current liabilities Stockholders' equity: Preferred stock, par value $0.001 per share; 10,000 authorized; none issued and outstanding Common stock, par value $0.001 per share; 100,000 authorized; 34,752 and 30,863 issued as of December 31, 2019 and 2018, respectively; 23,136 and 19,437 outstanding as of December 31, 2019 and 2018, respectively Additional paid-in capital Treasury stock, at cost: 11,616 and 11,426 shares as of December 31, 2019 and 2018, respectively Retained earnings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity 24,554 5,688 29,578 20,763 12,041 11,013 37,273 20,730 4,759 - 2,570 876 2,210 1,549 112,985 60,619 5,000 19,270 64,130 47,901 34,305 3,050 3,339 - 35 31 298,024 (199,998) 455,159 (199,998) 271,852 116 204,965 127 527,164 303,149 $ 741,634 $ 439,278 Reflects the impact from the adoption of ASC 842 on January 1, 2019. See Note 11 - Leases for details. The accompanying notes are an integral part of these consolidated financial statements. EHEALTH, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS Operating activities Net Income Adjustments to reconcile net income to net cash used in operating activities: Depreciation and amortization Amortization of internally developed software Amortization of intangible assets Stock-based compensation expense Deferred income taxes Change in fair value of earnout liability Other non-cash items Changes in operating assets and liabilities: Accounts receivable Commissions receivable Prepaid expenses and other assets Accounts payable Accrued compensation and benefits Accrued marketing expenses Deferred revenue Accrued restructuring charges (In thousands) 2019 66,887 Year Ended December 31, 2018 2017 241 $ 25,426 2,983 2,479 2,837 3,821 2,201 1,464 2,187 2,091 1,040 22,570 12,540 9,694 16,197 2,812 (30,341) 24,079 12,300 - (755) 675 (101) 1,270 (2,127) 473 (243,364) (50,967) (21,640) (466) 232 (1,933) 19,694 1,414 (1,866) 8,814 5,133 4,578 1,028 6,320 (3,365) 1,694 491 (466) Accrued expenses and other liabilities 1,869 935 (1,341) Net cash used in operating activities (71,492) (3,230) (15,541) Investing activities Capitalized internal-use software and website development costs (10,231) (6,294) (3,210) Purchases of property and equipment and other assets (6,641) (4,534) (1,868) Payments for security deposits (72) Acquisition of business, net of cash acquired - (14,929) Cash used in investing activities (16,944) (25,757) (5,078) Financing activities Proceeds from issuance of common stock, net of issuance costs 126,051 Net proceeds from exercise of common stock options 5,535 2,688 1,037 Repurchase of shares to satisfy employee tax withholding obligations (14,281) (4,504) (1,802) Proceeds from line of credit 5,000 Debt issuance costs (517) (1,221) (5,000) Acquisition-related contingent payments (9,542) Repayment of debt Principal payments in connection with leases Net cash provided by (used in) financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of period Cash, cash equivalents and restricted cash at end of period Supplemental disclosure of non-cash investing and financing activities Supplemental disclosure of cash flows Cash paid for interest Cash refunds from (paid for) income taxes, net (105) (103) 102,141 26 13,731 13,069 1,860 (77) (27,204) 40,293 $ 26,820 $ 13,089 (21,488) 61,781 40,293 42 44 $ 20 741 $ (139) $ (219)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started