Answered step by step

Verified Expert Solution

Question

1 Approved Answer

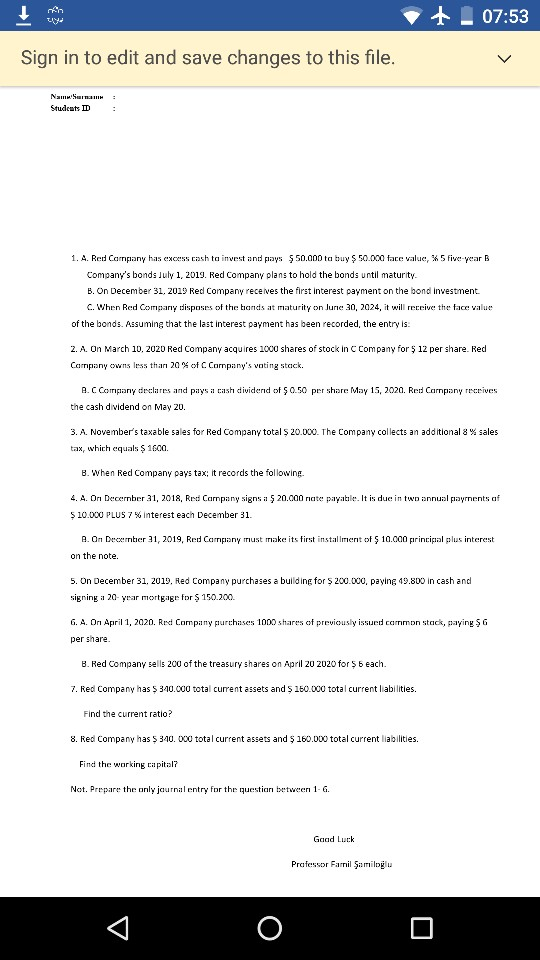

+07:53 Sign in to edit and save changes to this file. Namuna Students ID 1. A. Red Campany has excess cash to invest and pays

+07:53 Sign in to edit and save changes to this file. Namuna Students ID 1. A. Red Campany has excess cash to invest and pays $50.000 ta buy $ 50.000 face value, X5 five-year B Company's bonds July 1, 2019. Red Company plans to hold the bonds until maturity B. On December 31, 2019 Red Company receives the first interest payment on the bond Investment C. When Red Company disposes of the brands at maturity on June 30, 2024, it will receive the face value of the bonds. Assuming that the last interest payment has been recorded the entry is. 2. A. On March 10, 2020 Red Company acquires 1000 shares of stock in C Company for $ 12 per share. Red Company owns less than 20 % of Company's voting stack. A. c Company declares and pays a cash diividend of $0.50 per share May 15, 2020. Red Company receives the cash dividend on May 20. 3. A. November's taxable sales for Red Company total $ 20.000. The Company collects an additional 8% sales tax, which equals $ 1600 B. When Red Company pays tax; it records the following 4. A. Or December 31, 2018, Red Company signs a $20.000 nate payabile. It is due in two annual payments af $ 10.000 PLUS 7 % interest each December 31. 2. On December 31, 2019, Red Company must make its first installment of $ 10.000 principal plus interest on the note 5. On December 31, 2019. Red Company purchases a building for $ 200.000, paying 19.800 in cash and signing a 20-year mortgage for $ 150.200. 6. A. On April 1, 2020. Red Company purchases 1000 shares of previously issued common stack, paying $6 per share B. Red Company sells 200 of the treasury shares on April 20 2020 for $6 each. 7. Red Company has $ 340.000 total current assets and $ 150.000 total current liabilities. Find the current ratio? 8. Red Company has $ 300.000 total current assets and $ 160.000 total current liabilities. Find the working capital? Not. Prepare the only journal entry for the question between 1-6. Gaad Luck Professor Famil Samiloglu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started