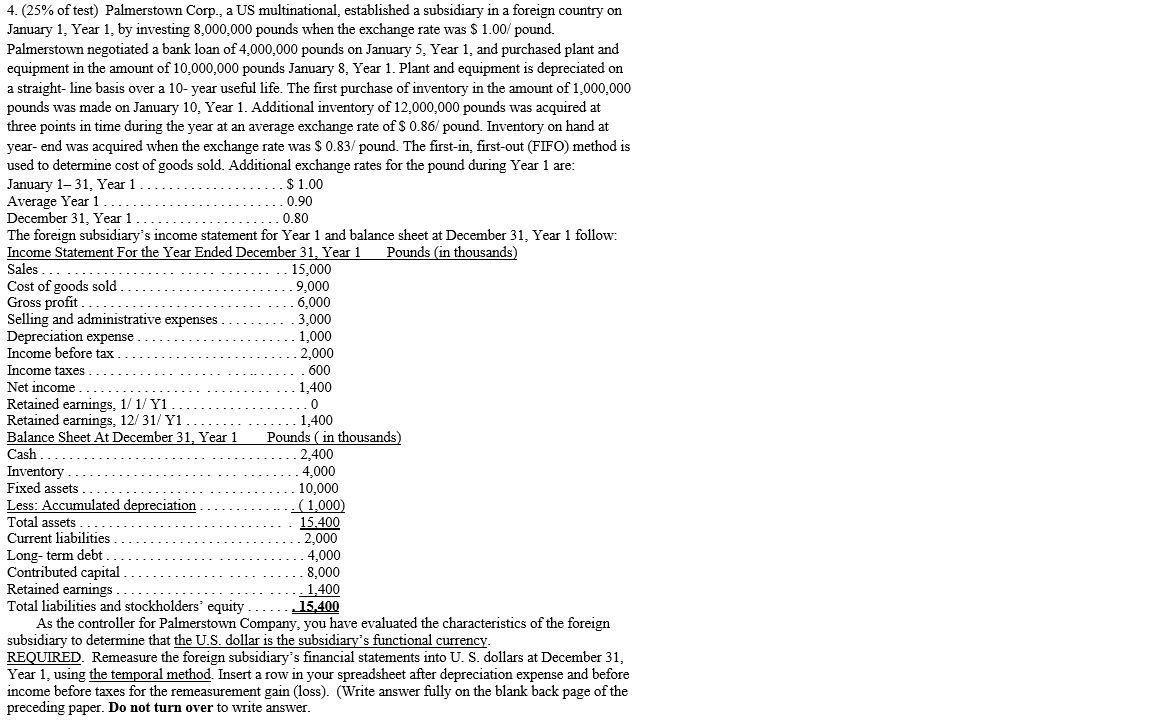

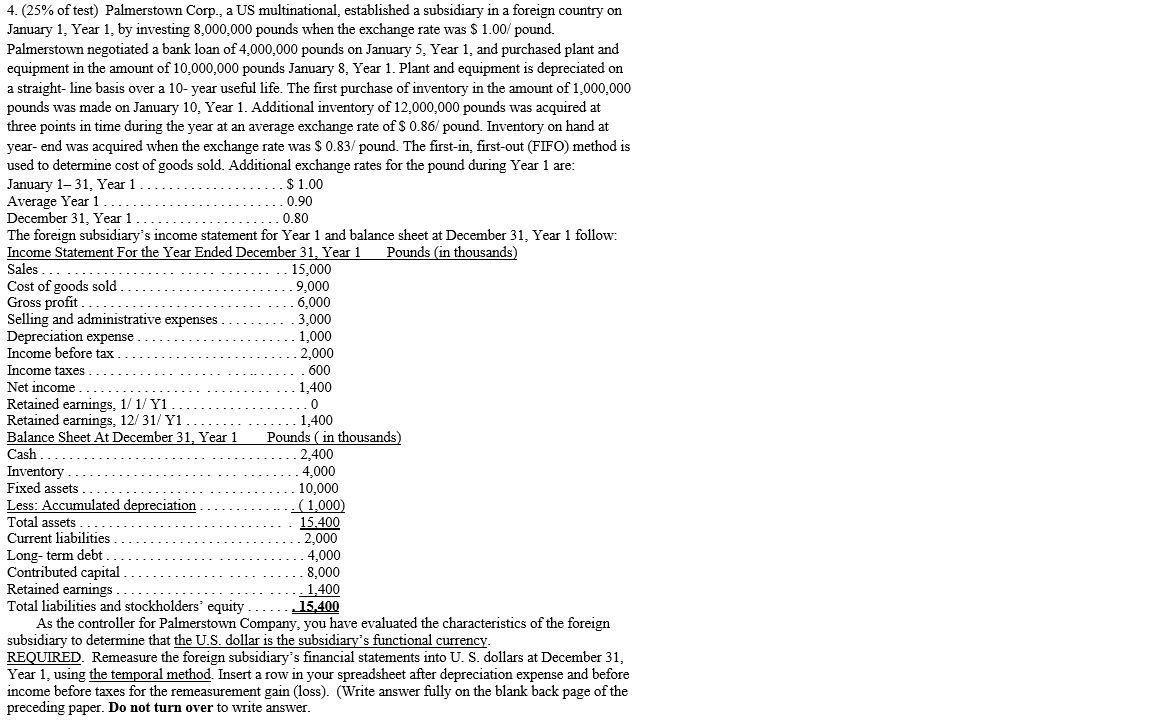

..........0.90 ........... 1.000 4. (25% of test) Palmerstown Corp., a US multinational, established a subsidiary in a foreign country on January 1, Year 1, by investing 8,000,000 pounds when the exchange rate was $ 1.00/pound. Palmerstown negotiated a bank loan of 4,000,000 pounds on January 5, Year 1, and purchased plant and equipment in the amount of 10,000,000 pounds January 8, Year 1. Plant and equipment is depreciated on a straight-line basis over a 10-year useful life. The first purchase of inventory in the amount of 1,000,000 pounds was made on January 10, Year 1. Additional inventory of 12,000,000 pounds was acquired at three points in time during the year at an average exchange rate of $ 0.86/pound. Inventory on hand at year-end was acquired when the exchange rate was $ 0.83/ pound. The first-in, first-out (FIFO) method is used to determine cost of goods sold. Additional exchange rates for the pound during Year 1 are: January 1-31, Year 1....................$ 1.00 Average Year 1 ..... December 31, Year 1 .......... .... 0.80 The foreign subsidiary's income statement for Year 1 and balance sheet at December 31, Year 1 follow: Income Statement For the Year Ended December 31, Year 1 Pounds (in thousands) Sales ................. ............ 15,000 Cost of goods sold.. Gross profit ............................. 6,000 Selling and administrative expenses..........3,000 Depreciation expense..... Income before tax.......... ..2,000 Income taxes ........... Net income ............ ... 1,400 Retained earnings, 1/1/ Y1....... Retained earnings, 12/31/ Y1.. Balance Sheet At December 31, Year 1 Pounds in thousands) Cash...... ........... 2.400 Inventory ................ . ...................4,000 Fixed assets ......................... . Less: Accumulated depreciation .... Total assets.. ............ 15.400 Current liabilities ........... ....... 2,000 Long-term debt ............. ........ 4,000 Contributed capital ........ 8,000 Retained earnings. ... 1,400 Total liabilities and stockholders' equity...... 15,400 As the controller for Palmerstown Company, you have evaluated the characteristics of the foreign subsidiary to determine that the U.S. dollar is the subsidiary's functional currency. REQUIRED. Remeasure the foreign subsidiary's financial statements into U.S. dollars at December 31, Year 1, using the temporal method. Insert a row in your spreadsheet after depreciation expense and before income before taxes for the remeasurement gain (loss). (Write answer fully on the blank back page of the preceding paper. Do not turn over to write answer. .......600 .... 0 ...... 1,400 ..........10.000