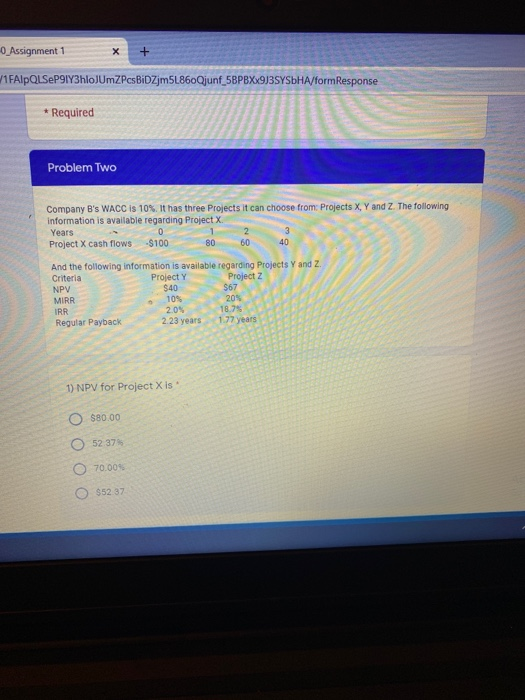

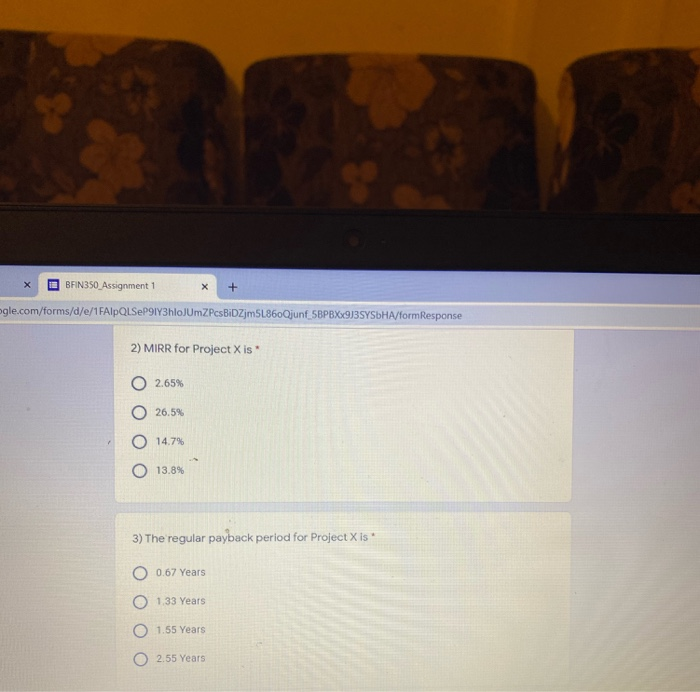

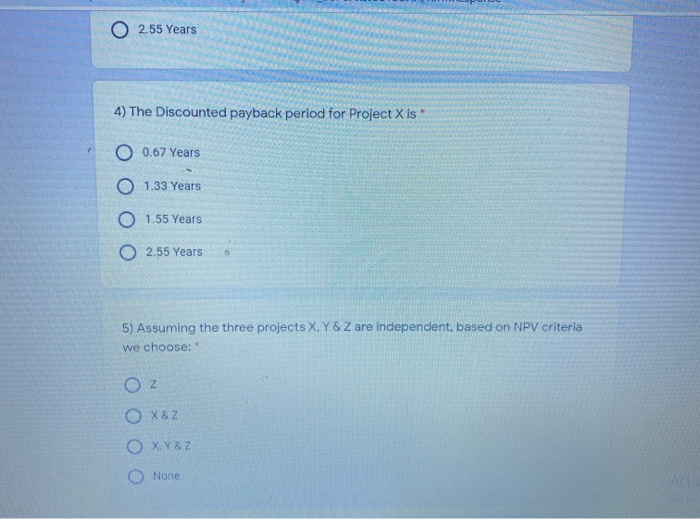

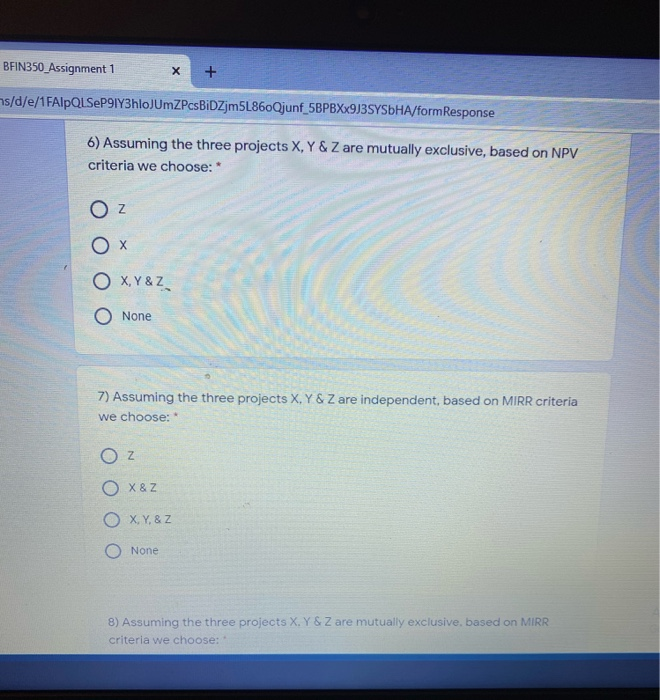

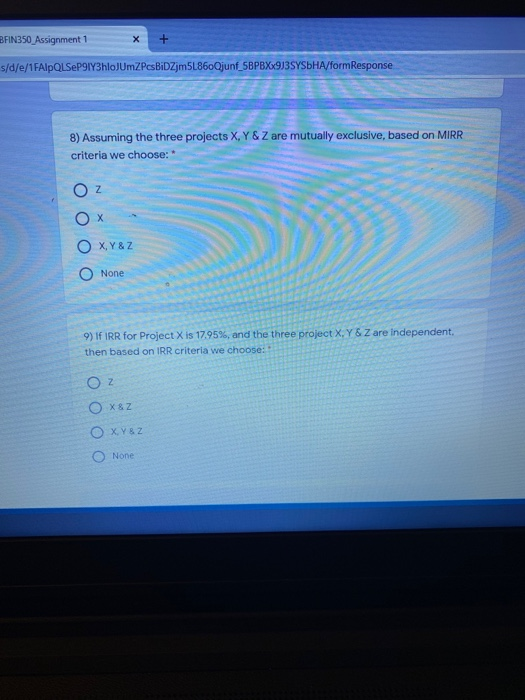

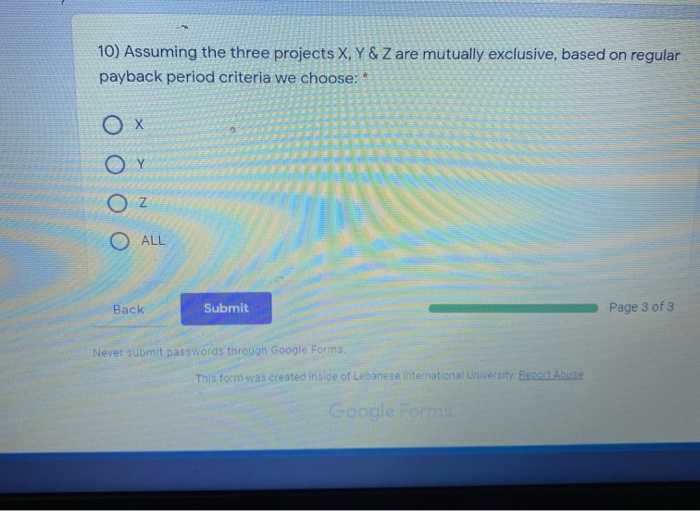

0_Assignment 1 x 1FAIpQLSeP91Y3hloJUMZPcsBIDZjm5L860Qjunf_58PBXx9J3SYSHA/formResponse * Required Problem Two Company B's WACC is 10%. It has three Projects it can choose from: Projects X, Y and Z. The following information is available regarding Project X. Years 0 1 2 Project X cash flows $100 80 60 $40 $67 And the following information is available regarding Projects Y and Z. Criteria Project Y Project Z NPV MIRR 10% 20% IRR 20% 18.75 Regular Payback 2.23 years 1.77 years 1) NPV for Project X is O $80.00 52 374 70.00% $5237 O BFIN350_Assignment 1 X + ogle.com/forms/d/e/1FAIpQLSeP91Y3hloJumZPcsBIDZjm5L860Qjunf_5BPBX233SYSHA/formResponse 2) MIRR for Project X is" OOO O 2.65% 26.5% 14,7% O 13.8% 3) The regular payback period for Project X is O 0.67 Years 1.33 Years 0 1.55 Years 0 2.55 Years 2.55 Years 4) The Discounted payback period for Project X is O 0.67 Years O 1.33 Years O 1.55 Years O 2.55 Years 5) Assuming the three projects X. Y&Z are independent, based on NPV criteria we choose: 02 O X & Z OXY&Z O None BFIN350_Assignment 1 ms/d/e/1FAIpQLSeP91Y3hloJUMZPcsBiDZjm5L860Qjunf 5BPBXx9J3SYSHA/formResponse 6) Assuming the three projects X,Y & Z are mutually exclusive, based on NPV criteria we choose: * OZ ooo O X,Y&Z O None 7) Assuming the three projects X,Y & Z are independent, based on MIRR criteria we choose: Oz O x&Z O X,Y,& Z O None 8) Assuming the three projects X. Y&Z are mutually exclusive, based on MIRR criteria we choose: BFIN350_Assignment 1 s/d/e/1FAIpQLSeP91Y3hloJmZPcsBiDZjm5L860Qjunf_SBPBXx9J3SYSHA/formResponse 8) Assuming the three projects X,Y & Z are mutually exclusive, based on MIRR criteria we choose: * oz OXY&Z O None 9) FIRR for Project X is 17.95%, and the three project X,Y & Z are independent, then based on IRR criteria we choose: Oz O x &Z O X, Y&Z None 10) Assuming the three projects X, Y & Z are mutually exclusive, based on regular payback period criteria we choose: or Oz O ALL Back Submit Page 3 of 3 Never submit passwords through Google Forms. This form was created inside of Lebanese International University Report Abuse Google Forms 0_Assignment 1 x 1FAIpQLSeP91Y3hloJUMZPcsBIDZjm5L860Qjunf_58PBXx9J3SYSHA/formResponse * Required Problem Two Company B's WACC is 10%. It has three Projects it can choose from: Projects X, Y and Z. The following information is available regarding Project X. Years 0 1 2 Project X cash flows $100 80 60 $40 $67 And the following information is available regarding Projects Y and Z. Criteria Project Y Project Z NPV MIRR 10% 20% IRR 20% 18.75 Regular Payback 2.23 years 1.77 years 1) NPV for Project X is O $80.00 52 374 70.00% $5237 O BFIN350_Assignment 1 X + ogle.com/forms/d/e/1FAIpQLSeP91Y3hloJumZPcsBIDZjm5L860Qjunf_5BPBX233SYSHA/formResponse 2) MIRR for Project X is" OOO O 2.65% 26.5% 14,7% O 13.8% 3) The regular payback period for Project X is O 0.67 Years 1.33 Years 0 1.55 Years 0 2.55 Years 2.55 Years 4) The Discounted payback period for Project X is O 0.67 Years O 1.33 Years O 1.55 Years O 2.55 Years 5) Assuming the three projects X. Y&Z are independent, based on NPV criteria we choose: 02 O X & Z OXY&Z O None BFIN350_Assignment 1 ms/d/e/1FAIpQLSeP91Y3hloJUMZPcsBiDZjm5L860Qjunf 5BPBXx9J3SYSHA/formResponse 6) Assuming the three projects X,Y & Z are mutually exclusive, based on NPV criteria we choose: * OZ ooo O X,Y&Z O None 7) Assuming the three projects X,Y & Z are independent, based on MIRR criteria we choose: Oz O x&Z O X,Y,& Z O None 8) Assuming the three projects X. Y&Z are mutually exclusive, based on MIRR criteria we choose: BFIN350_Assignment 1 s/d/e/1FAIpQLSeP91Y3hloJmZPcsBiDZjm5L860Qjunf_SBPBXx9J3SYSHA/formResponse 8) Assuming the three projects X,Y & Z are mutually exclusive, based on MIRR criteria we choose: * oz OXY&Z O None 9) FIRR for Project X is 17.95%, and the three project X,Y & Z are independent, then based on IRR criteria we choose: Oz O x &Z O X, Y&Z None 10) Assuming the three projects X, Y & Z are mutually exclusive, based on regular payback period criteria we choose: or Oz O ALL Back Submit Page 3 of 3 Never submit passwords through Google Forms. This form was created inside of Lebanese International University Report Abuse Google Forms