Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[ 1 0 0 MARKS ] FORMATTVE ASSESSMENT 1 Rosd the case study and anawer the questions that follow COUATONC LTD: THE DEVERAGE GIANT Colatonic

MARKS

FORMATTVE ASSESSMENT

Rosd the case study and anawer the questions that follow

COUATONC LTD: THE DEVERAGE GIANT

Colatonic Lid is a madeter of a range of ronaloholc bevernges. commenoed operators a few years ago wh an autorized share captal of ondinary shares and by eighty peroent h of the thanes has been loseed. ls product mix includes sot driks, juloss, onergy diriss and Eivoured wabler. Therse products are matuted under varous brinds. The company has distrbution oufets in at the poovinoes in Sout Rhick, wth the headquarten in Pretarte if negobated with as suppliers for all puchages to be made on Colatonic Les experimoed a grot dela of succids in the moent years becacse of its exicelent sales strategy and the dever ube of socily media. However the entry of chevp anergy dirks and flacored water into the South Rhoan beverage manes foon China and ofer couteles led to a downtum in the financlal performanoe in The company did, howev, pay an intirm divend of RET to the shareholders during A final diviend was also dedured at the end of zoess. The market price of each share of Colatonic Las was R on December ets.

This folowing awe the finandial statements for the past tro years:

tableCOLATONIC LTDtableSTATEMENT OF COMPRENENSNE NCOME FOR THE YEAR ENDED H DECEMBER:RSalesCoot of saves,

QUESTION

MARKS

REQUIRED

Use the relevant information provided in the case study to answer the following questions with ratios expressed to two decimal places in respect of

Note: Use the formulas provided in the formula sheot only that appear atter QUESTION

Comment on the liquidity of the company. Calculate TWO appropriste ratios to support your answer.

marks

Comment on the efficiency of the company regarding the colloctions from credit sales. Motvate your answer by using a suitable ratio.

marks

Did the company make good use of the credif period allowed by the suppliers? Motivale your answer with a relevant ratio and offer a recommendation, if necessary.

marks

Comment on the retum that the company made on its own and borrowod capital. Support your answer with the use of a relevant ratio.

marks

Calculate the price eamings rato.

marks

Was any provision made by the company to fund its future growth? Motivate your answer

by using an appropriate ratio.

marks

QUESTION

MARKS

REQUIRED

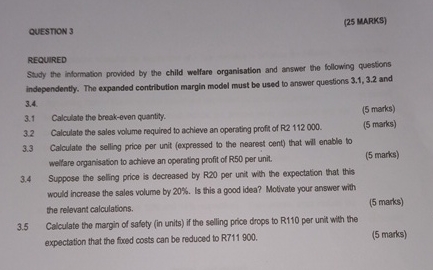

Study the information provided by the child welfare organisation and answer the following questions independently. The expanded contribution margin model must be used to answer questions and

Calculate the breakeven quantity.

marks

Calculate the sales volume required to achieve an operating profif of R

marks

Calculate the selling price per unit expressed to the nearest cent that will enable to wellare organisation to achieve an operating profit of R per unit.

marks

Suppose the seling price is decreased by R per unit with the expectation that this would increase the sales volume by Is this a good idea? Motivate your answer with the relevant calculations.

marks

Calculate the margin of safety in units if the selling price drops to R per unit with the expectation that the fixed costs can be reduced to R

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started