Answered step by step

Verified Expert Solution

Question

1 Approved Answer

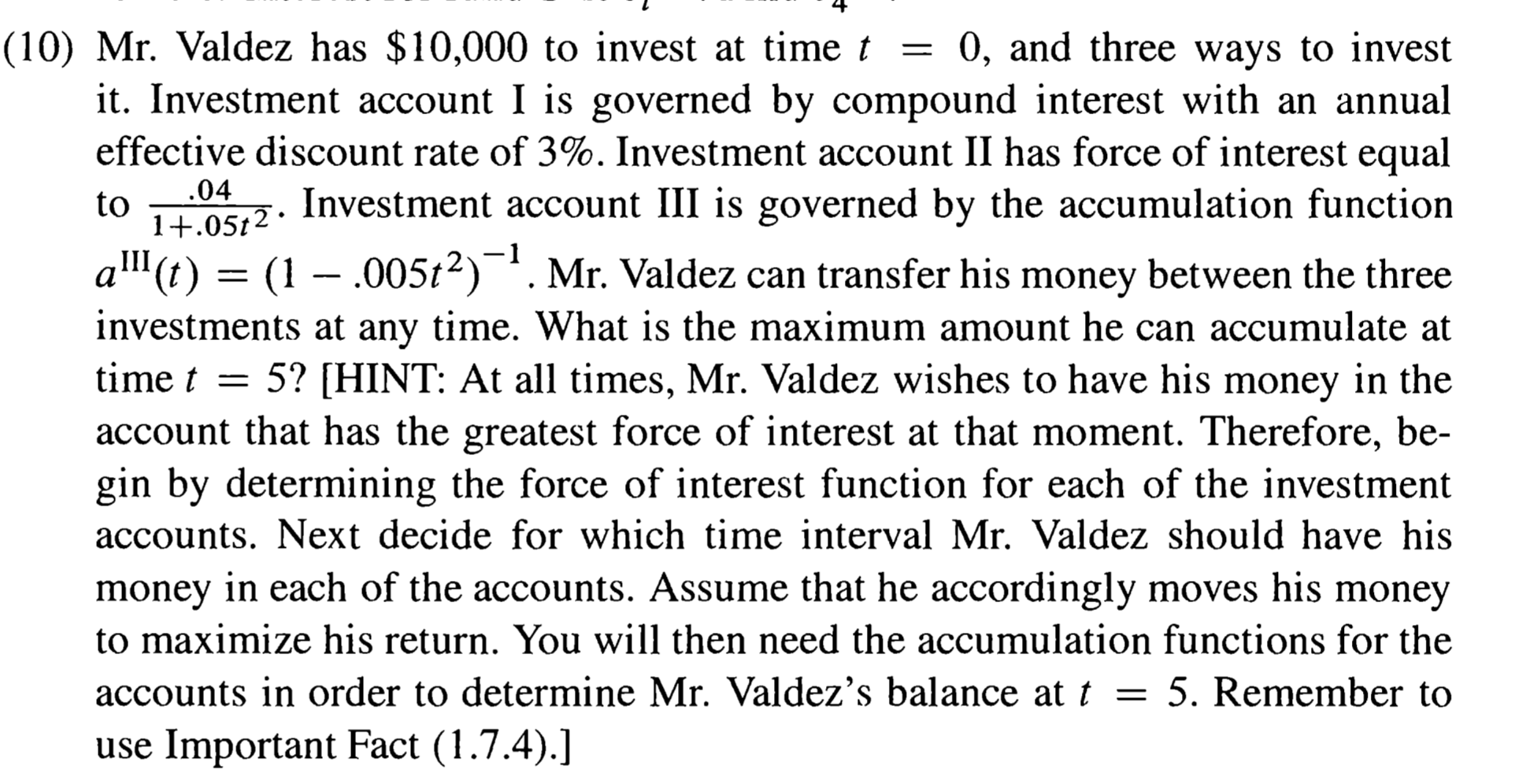

( 1 0 ) Mr . Valdez has $ 1 0 , 0 0 0 to invest at time t = 0 , and three

Mr Valdez has $ to invest at time and three ways to invest

it Investment account I is governed by compound interest with an annual

effective discount rate of Investment account II has force of interest equal

to Investment account III is governed by the accumulation function

Mr Valdez can transfer his money between the three

investments at any time. What is the maximum amount he can accumulate at

time HINT: At all times, Mr Valdez wishes to have his money in the

account that has the greatest force of interest at that moment. Therefore, be

gin by determining the force of interest function for each of the investment

accounts. Next decide for which time interval Mr Valdez should have his

money in each of the accounts. Assume that he accordingly moves his money

to maximize his return. You will then need the accumulation functions for the

accounts in order to determine Mr Valdez's balance at Remember to

use Important Fact Here is your writing assignment:

Fully explain your thought process for the above problem and clearly state your answers Please include one graph of deltat versus t for all investments as part of your justification and make sure you are answering ALL the questions asked in this problem to earn full credit.

Hint: Draw the graph of deltat versus t and then examine it carefully to determine the intervals where each curve prevails. Then use the corresponding at for that prevailing curve to accumulate in that time interval.

Ex if II is the highest curve from to t then the accumulated value at t is at We discuss this kind of situation in the notes Lecture B class notes page GH

Total points.

correct deltat for investment I

at for investment II correct deltat for investment III

the correct values of t

correct final answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started