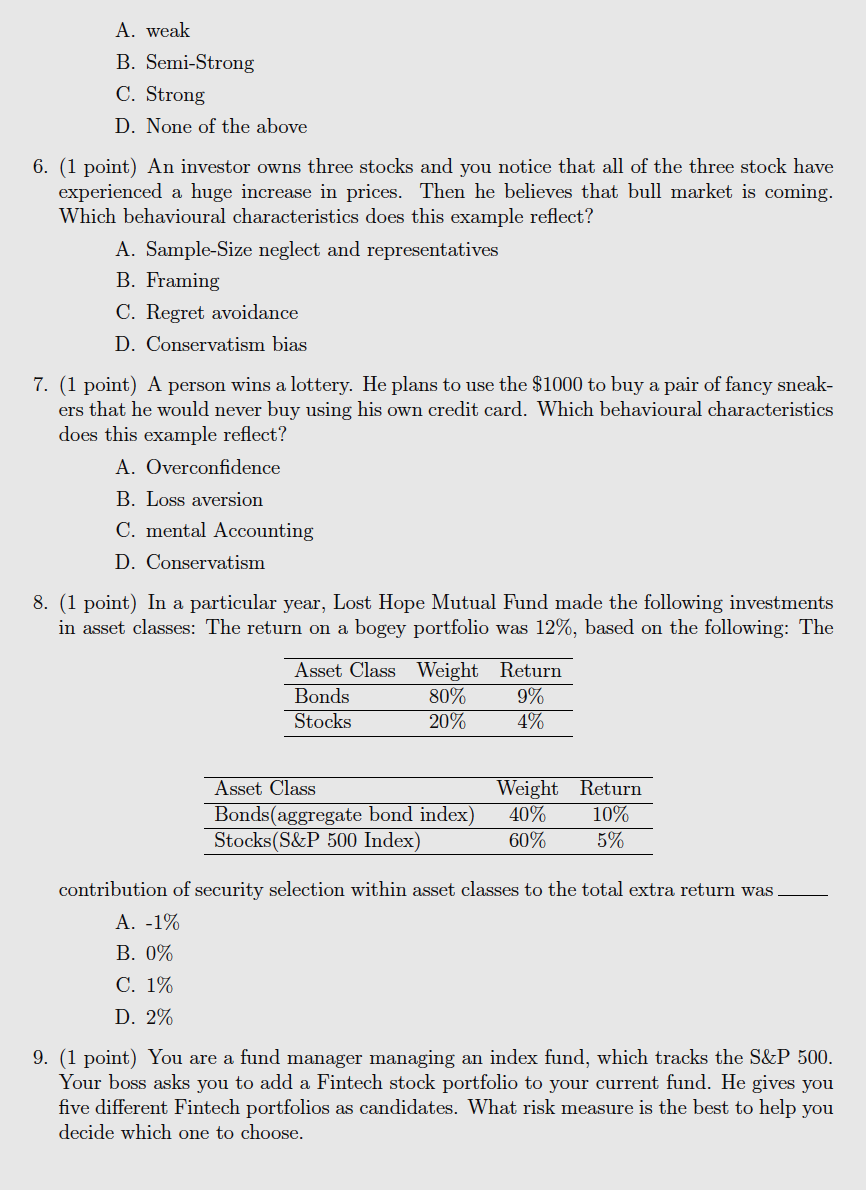

1. (1 point) According to the semi-strong form of the efficient markets hypothesis A. stock prices do not rapidly adjust to new information B. future changes in stock prices cannot be predicted from any information that is publicly available C. corporate insiders should have no better investment performance than other investors even if allowed to trade freely D. arbitrage between futures and cash markets should not produce extraordinary profits 2. (1 point) Flanders, Inc., has expected earnings of $4 per share for next year. The firm's ROE is 8%, and its earnings retention ratio is 40%. If the firm's market capitalization rate is 15%, what is the present value of its growth opportunities (PVGO)? A. -$6.33 B. $0 C. $20.34 D. $26.67 3. (1 point) Gator Airline is expected to pay a dividend of $3 in the upcoming year. Div- idends are expected to grow at the rate of 10% per year. The risk-free rate of return is 4%, and the expected return on the market portfolio is 13%. The stock of Interior Airline has a beta of 4. Using the constant-growth DDM, the intrinsic value of the stock A. $10 B. $22.73 C. $27.78 D. $41.67 4. (1 point) BabyGator, Inc., paid a $4 dividend per share last year and is expected to continue to pay out 60% of its earnings as dividends for the foreseeable future. If the firm is expected to generate a 13% return on equity in the future, and if you require a 15% return on the stock, the value of the stock is : A. $26.67 B. $35.19 C. $42.94 D. $59.89 5. (1 point) "Investors can profit from choosing stocks by searching for predictable patterns based on historical evidences in stock prices" this violates form EMH. A. weak B. Semi-Strong C. Strong D. None of the above 6. (1 point) An investor owns three stocks and you notice that all of the three stock have experienced a huge increase in prices. Then he believes that bull market is coming. Which behavioural characteristics does this example reflect? A. Sample-Size neglect and representatives B. Framing C. Regret avoidance D. Conservatism bias 7. (1 point) A person wins a lottery. He plans to use the $1000 to buy a pair of fancy sneak- ers that he would never buy using his own credit card. Which behavioural characteristics does this example reflect? A. Overconfidence B. Loss aversion C. mental Accounting D. Conservatism 8. (1 point) In a particular year, Lost Hope Mutual Fund made the following investments in asset classes: The return on a bogey portfolio was 12%, based on the following: The Asset Class Weight Return Bonds 80% 9% Stocks 20% 4% Asset Class Bonds(aggregate bond index) Stocks(S&P 500 Index) Weight Return 40% 10% 60% 5% contribution of security selection within asset classes to the total extra return was A. -1% B. 0% C. 1% D. 2% 9. (1 point) You are a fund manager managing an index fund, which tracks the S&P 500. Your boss asks you to add a Fintech stock portfolio to your current fund. He gives you five different Fintech portfolios as candidates. What risk measure is the best to help you decide which one to choose. A. Sharp Ratio B. Treynor Ratio C. Jensen Measure D. Information Ratio 10. (1 point) ABC Corporation produces a good that is very mature in the firm's product life cycles. This corporation is expected to pay a dividend in year 1 of $3, a dividend in year 2 of $2, and a dividend in year 3 of $1. After year 3, dividends are expected to decline at the rate of 2% per year. An appropriate required return for the stock is 8%. Using the multistage DDM, the stock should be worth today. A. $13.07 B. $13.58 C. $18.25 D. $18.78 11. (2 points) A firm has a stock price of $54.75 per share. The firm's earnings are expected to be $75 million, and the firm has 20 million shares outstanding. The firm has an ROE of 15% and a plowback of 65%. What is the firm's PEG ratio? A. 1.5 B. 1.25 C. 1.1 D. 1