Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (1 point) Brandon earns $37,200 per year, and he's paid monthly. His employer offers a 401(k) plan with 75% matching up to 8% of

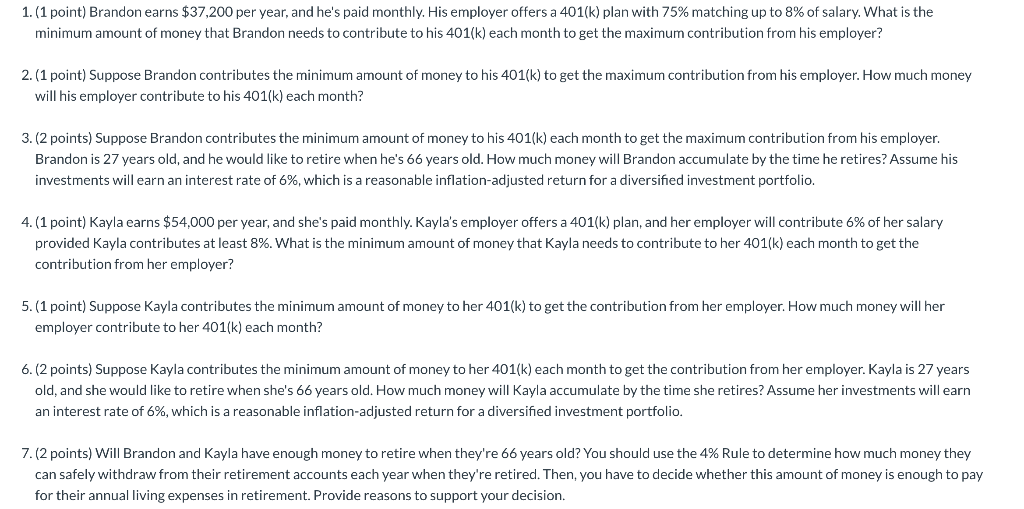

1. (1 point) Brandon earns $37,200 per year, and he's paid monthly. His employer offers a 401(k) plan with 75% matching up to 8% of salary. What is the minimum amount of money that Brandon needs to contribute to his 401(k) each month to get the maximum contribution from his employer? 2.(1 point) Suppose Brandon contributes the minimum amount of money to his 401(k) to get the maximum contribution from his employer. How much money will his employer contribute to his 401(k) each month? 3.(2 points) Suppose Brandon contributes the minimum amount of money to his 401(k) each month to get the maximum contribution from his employer. Brandon is 27 years old, and he would like to retire when he's 66 years old. How much money will Brandon accumulate by the time he retires? Assume his investments will earn an interest rate of 6%, which is a reasonable inflation-adjusted return for a diversified investment portfolio. 4.(1 point) Kayla earns $54,000 per year, and she's paid monthly. Kayla's employer offers a 401(k) plan, and her employer will contribute 6% of her salary provided Kayla contributes at least 8%. What is the minimum amount of money that Kayla needs to contribute to her 401(k) each month to get the contribution from her employer? 5.(1 point) Suppose Kayla contributes the minimum amount of money to her 401(k) to get the contribution from her employer. How much money will her employer contribute to her 401(k) each month? 6.(2 points) Suppose Kayla contributes the minimum amount of money to her 401(k) each month to get the contribution from her employer. Kayla is 27 years old, and she would like to retire when she's 66 years old. How much money will Kayla accumulate by the time she retires? Assume her investments will earn an interest rate of 6%, which is a reasonable inflation-adjusted return for a diversified investment portfolio. 7.(2 points) Will Brandon and Kayla have enough money to retire when they're 66 years old? You should use the 4% Rule to determine how much money they can safely withdraw from their retirement accounts each year when they're retired. Then, you have to decide whether this amount of money is enough to pay for their annual living expenses in retirement. Provide reasons to support your decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started