Answered step by step

Verified Expert Solution

Question

1 Approved Answer

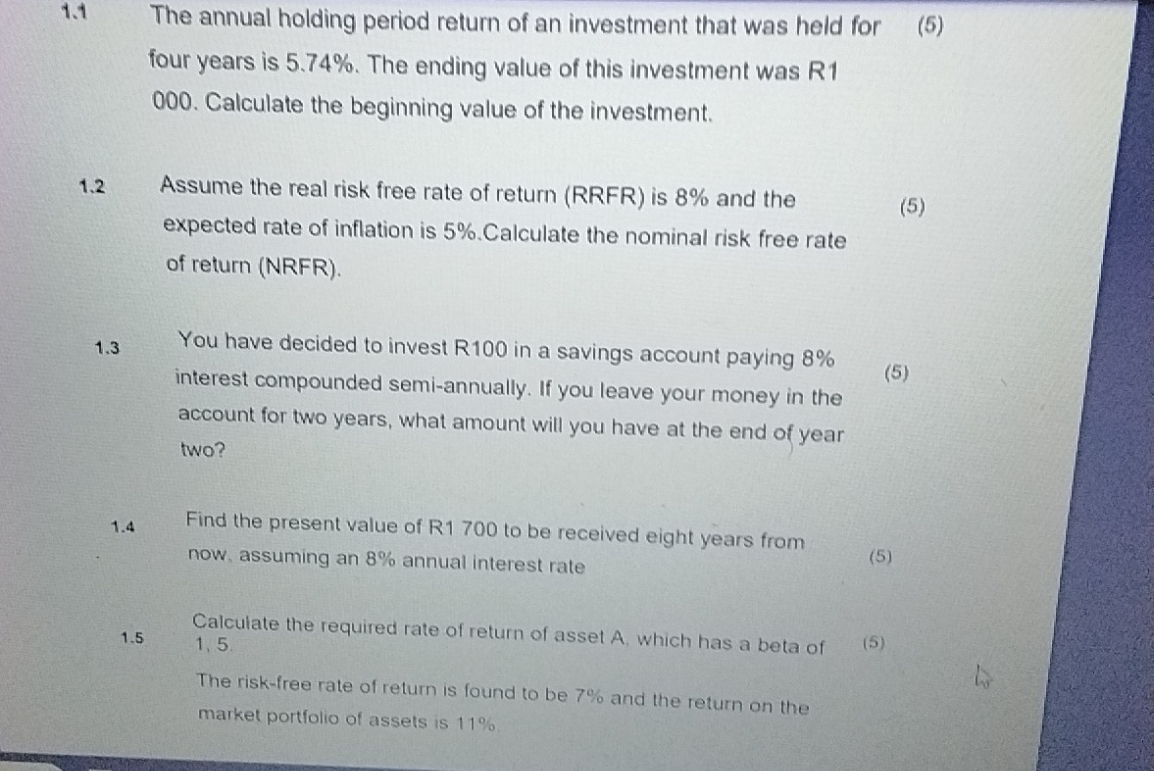

1 . 1 The annual holding period return of an investment that was held for ( 5 ) four years is 5 . 7 4

The annual holding period return of an investment that was held for

four years is The ending value of this investment was R Calculate the beginning value of the investment.

Assume the real risk free rate of return RRFR is and the expected rate of inflation is Calculate the nominal risk free rate of return NRFR

You have decided to invest R in a savings account paying interest compounded semiannually. If you leave your money in the account for two years, what amount will you have at the end of year two?

Find the present value of R to be received eight years from now, assuming an annual interest rate

Calculate the required rate of return of asset which has a beta of The riskfree rate of return is found to be and the return on the market portfolio of assets is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started