Question

1) 10% of sales are for cash, the balance is received the following month. The amount to be received in June for May?s sales is

1) 10% of sales are for cash, the balance is received the following month. The amount to be received in June for May?s sales is ?28,500

2) Wages are paid two months in arrears. Wages for April and May are ?14,500 and ?12,000 respectively.

3) Overheads for June, July, August and September include ?1,500 per month for depreciation. Overheads are settled in the month following. ?5,500 is to be paid in June for May?s overheads

4) Purchases of direct materials are paid for in the month purchased

5) The opening cash balance is ?14,750

6) A tax bill of ?24,000 pertaining to an earlier period, is to be paid in July

Required:

a) Calculate the amount of direct material purchases in each of the months for June, July, August and September.?

b) Prepare the monthly Cash Budget for June, July, August and September.?

c) Prepare the Budgeted Profit and Loss Statement for the period June to September. Ignore the tax bill in preparing your Profit and Loss Statement.?

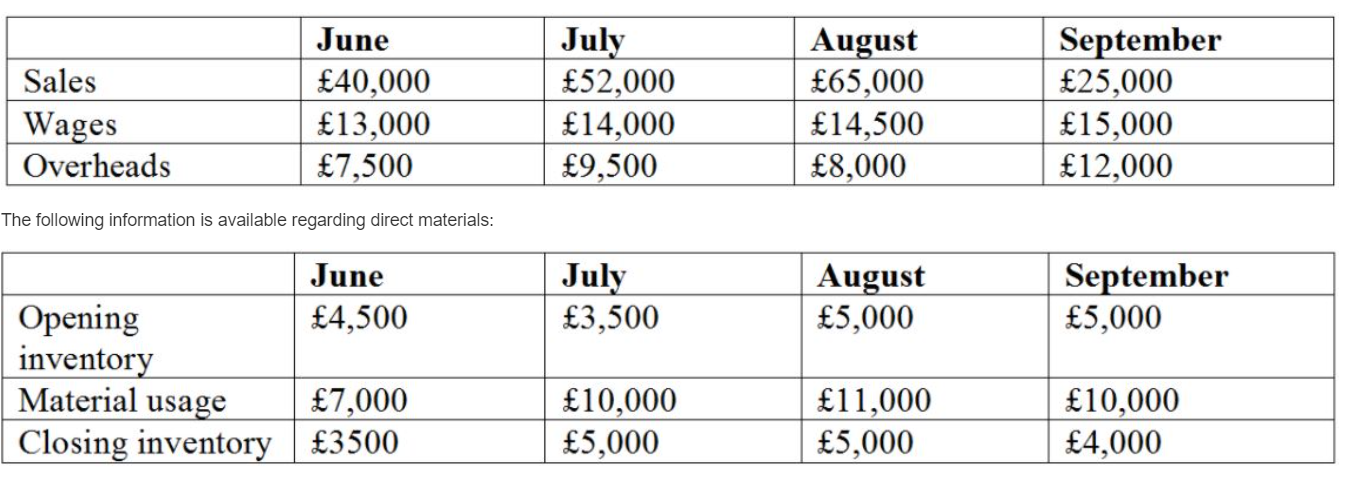

?Sales Wages Overheads June 40,000 13,000 7,500 The following information is available regarding direct materials: June 4,500 Opening inventory Material usage 7,000 Closing inventory 3500 July 52,000 14,000 9,500 July 3,500 10,000 5,000 August 65,000 14,500 8,000 August 5,000 11,000 5,000 September 25,000 15,000 12,000 September 5,000 10,000 4,000

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

aThe amount of direct material purchases in each of the months for June July August and September is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started