Question

Based on these exhibits, please make an Excel template for analysis of the Redhook Ale Brewery loan application . Specifically, what do you think of

Based on these exhibits, please make an Excel template for analysis of the Redhook Ale Brewery loan application. Specifically, what do you think of David Mickelson's projections? Hint: consider the forecasts, collateral, strategy, and past performance. In other words, how can I analyze these financial statements to determine if the company should get a loan? What should I consider?

As Harding, would you make this loan? If yes, when would you set the loan's maturity date? What covenants would you request? What (if any) covenants would you demand? What yield would you demand?

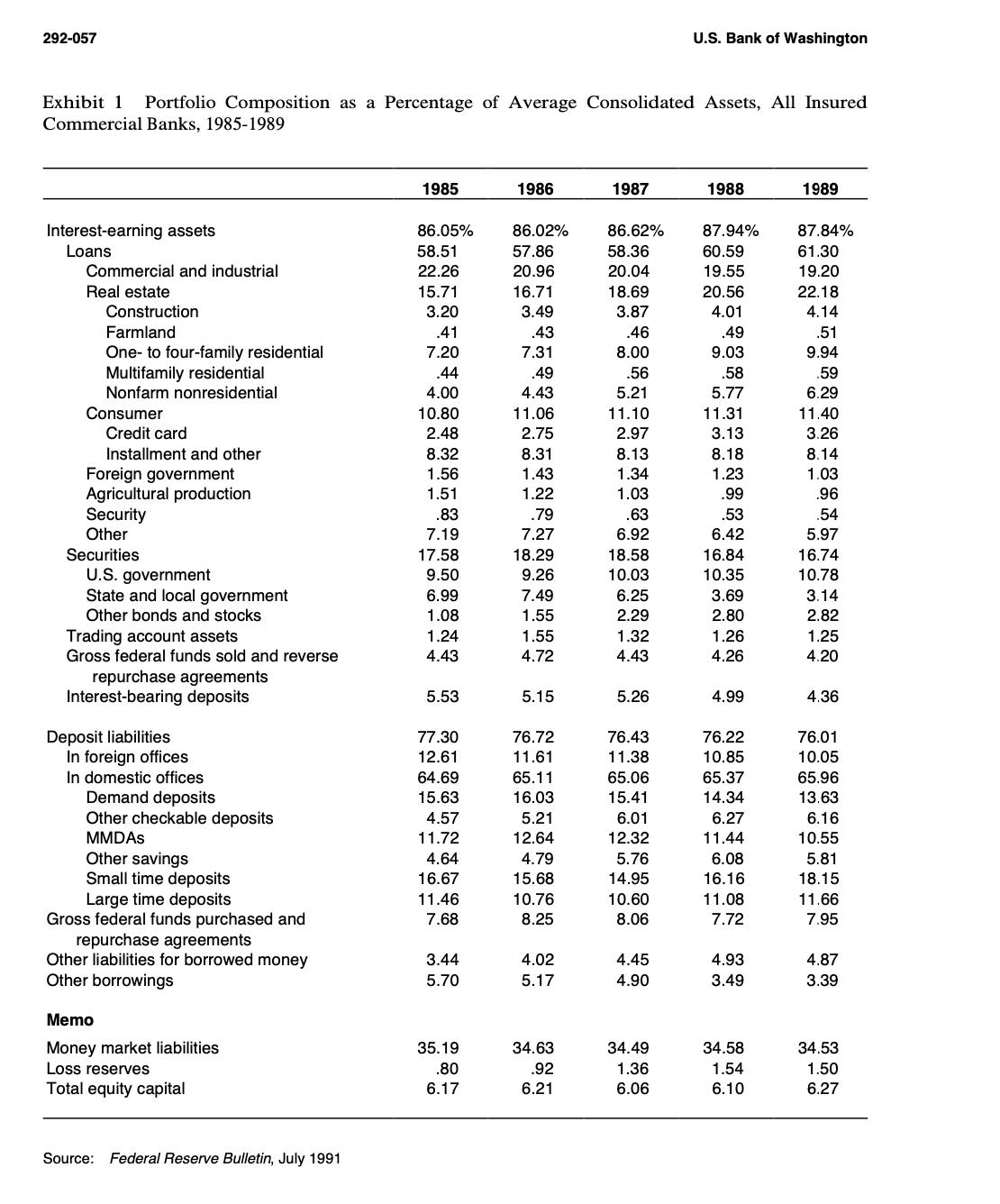

292-057 Exhibit 1 Portfolio Composition as a Percentage of Average Consolidated Assets, All Insured Commercial Banks, 1985-1989 Interest-earning assets Loans Commercial and industrial Real estate Construction Farmland One-to four-family residential Multifamily residential Nonfarm nonresidential Consumer Credit card Installment and other Foreign government Agricultural production Security Other Securities U.S. government State and local government Other bonds and stocks Trading account assets Gross federal funds sold and reverse repurchase agreements Interest-bearing deposits Deposit liabilities In foreign offices In domestic offices Demand deposits Other checkable deposits MMDAS Other savings Small time deposits Large time deposits Gross federal funds purchased and repurchase agreements Other liabilities for borrowed money Other borrowings Memo Money market liabilities Loss reserves Total equity capital Source: Federal Reserve Bulletin, July 1991 1985 86.05% 58.51 22.26 15.71 3.20 .41 7.20 .44 4.00 10.80 2.48 8.32 1.56 1.51 .83 7.19 17.58 9.50 6.99 1.08 1.24 4.43 5.53 77.30 12.61 64.69 15.63 4.57 11.72 4.64 16.67 11.46 7.68 3.44 5.70 35.19 .80 6.17 1986 86.02% 57.86 20.96 16.71 3.49 .43 7.31 .49 4.43 11.06 2.75 8.31 1.43 1.22 .79 7.27 18.29 9.26 7.49 1.55 1.55 4.72 5.15 76.72 11.61 65.11 16.03 5.21 12.64 4.79 15.68 10.76 8.25 4.02 5.17 34.63 .92 6.21 1987 86.62% 58.36 20.04 18.69 3.87 .46 8.00 .56 5.21 11.10 2.97 8.13 1.34 1.03 .63 6.92 18.58 10.03 6.25 2.29 1.32 4.43 5.26 76.43 11.38 65.06 15.41 6.01 12.32 5.76 14.95 10.60 8.06 4.45 4.90 U.S. Bank of Washington 34.49 1.36 6.06 1988 87.94% 60.59 19.55 20.56 4.01 .49 9.03 .58 5.77 11.31 3.13 8.18 1.23 .99 .53 6.42 16.84 10.35 3.69 2.80 1.26 4.26 4.99 76.22 10.85 65.37 14.34 6.27 11.44 6.08 16.16 11.08 7.72 4.93 3.49 34.58 1.54 6.10 1989 87.84% 61.30 19.20 22.18 4.14 .51 9.94 .59 6.29 11.40 3.26 8.14 1.03 .96 .54 5.97 16.74 10.78 3.14 2.82 1.25 4.20 4.36 76.01 10.05 65.96 13.63 6.16 10.55 5.81 18.15 11.66 7.95 4.87 3.39 34.53 1.50 6.27

Step by Step Solution

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the Redhook Ale Brewery loan application and evaluate David Mickelsons projections we need to consider several factors including forecasts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started