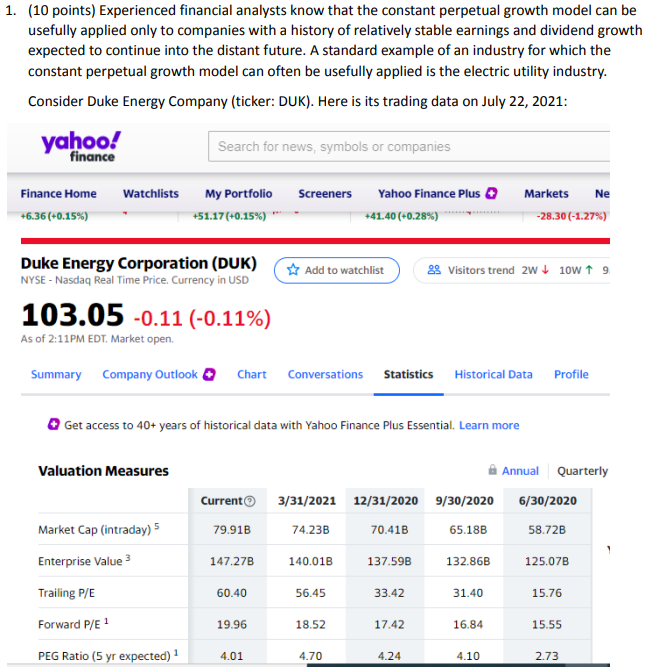

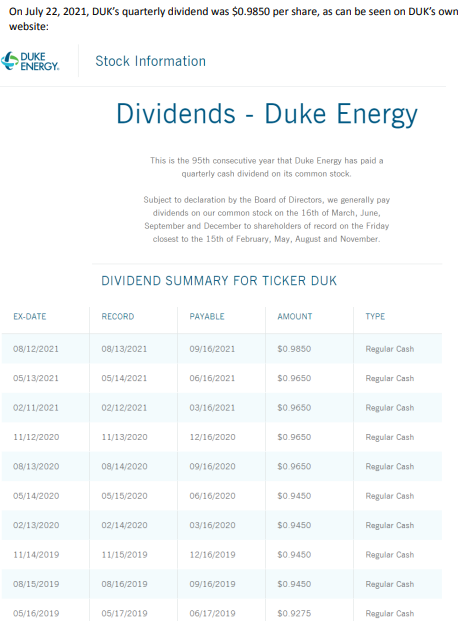

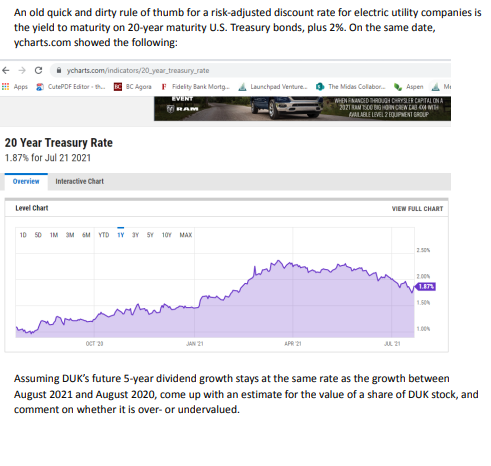

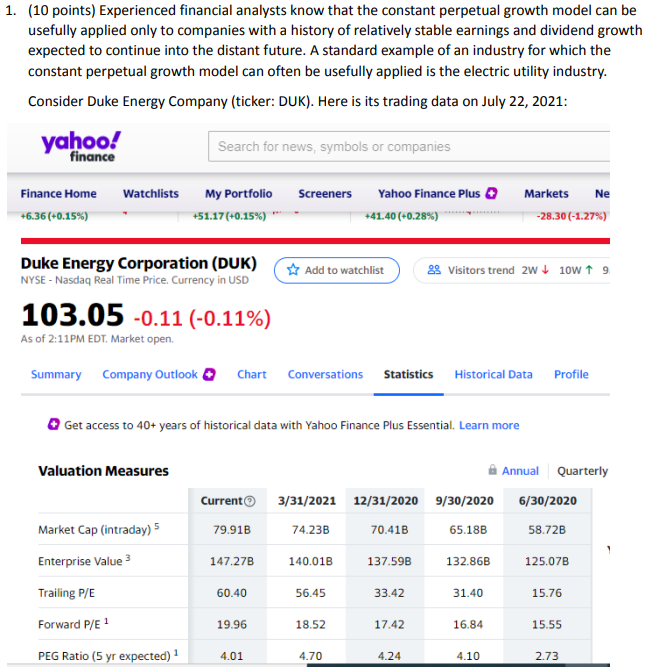

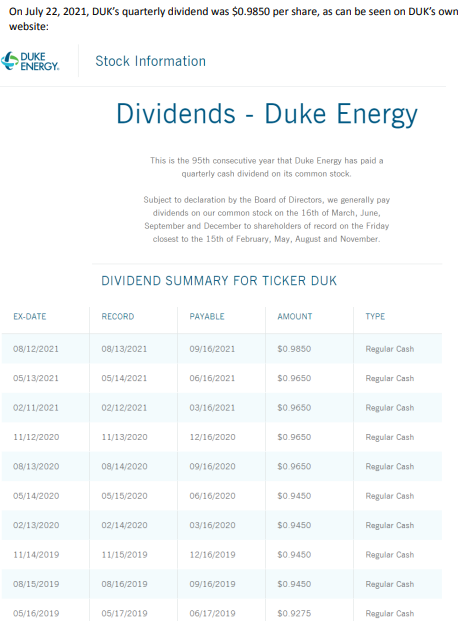

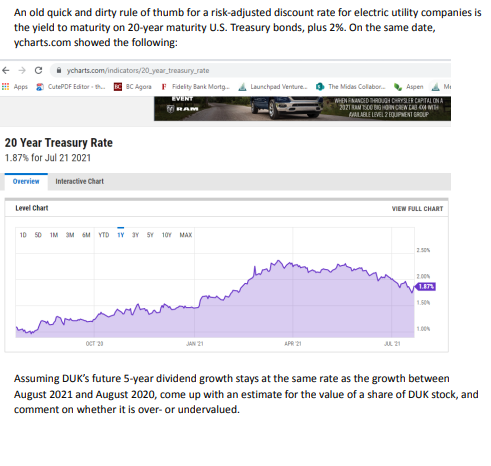

1. (10 points) Experienced financial analysts know that the constant perpetual growth model can be usefully applied only to companies with a history of relatively stable earnings and dividend growth expected to continue into the distant future. A standard example of an industry for which the constant perpetual growth model can often be usefully applied is the electric utility industry. Consider Duke Energy Company (ticker: DUK). Here is its trading data on July 22, 2021: yahoo! finance Search for news, symbols or companies Watchlists Screeners Markets Ne Finance Home +6.36 (+0.15%) My Portfolio +51.17(+0.15%) Yahoo Finance Plus +41.40 (+0.28%) -28.30 (-1.27%) Duke Energy Corporation (DUK) Add to watchlist 2. Visitors trend zw+ 10w 9 NYSE - Nasdaq Real Time Price. Currency in USD 103.05 -0.11 (-0.11%) As of 2:11PM EDT. Market open. Summary Company Outlook Chart Conversations Statistics Historical Data Profile Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn more Valuation Measures Annual Quarterly Current 3/31/2021 12/31/2020 9/30/2020 6/30/2020 79.91B 74.23B 70.41B 65.18B 58.72B Market Cap (intraday) Enterprise Value Trailing P/E 147.27B 140.01B 137.59B 132.86B 125.07B 60.40 56.45 33.42 31.40 15.76 19.96 18.52 17.42 16.84 15.55 Forward P/E 1 PEG Ratio (5 yr expected) 4.01 4.70 4.24 4.10 2.73 On July 22, 2021, DUK's quarterly dividend was $0.9850 per share, as can be seen on DUK's own website: DUKE ENERGY Stock Information Dividends - Duke Energy This is the 95th consecutive year that Duke Energy has paid a quarterly cash dividend on its common stock Subject to declaration by the Board of Directors, we generally pay dividends on our common stock on the 16th of March, June, September and December to shareholders of record on the Friday closest to the 15th of February, May, August and November DIVIDEND SUMMARY FOR TICKER DUK EX-DATE RECORD PAYABLE AMOUNT TYPE 08/12/2021 08/13/2021 09/16/2021 $0.9850 Regular Cash 05/13/2021 05/14/2021 06/16/2021 $0.9650 Regular Cash 02/11/2021 02/12/2021 03/16/2021 $0.9650 Regular Cash 11/12/2020 11/13/2020 12/16/2020 S0.9650 Regular Cash 08/13/2020 08/14/2020 09/16/2020 $0.9650 Regular Cash 05/14/2020 05/15/2020 06/16/2020 $0.9450 Regular Cash 02/13/2020 02/14/2020 03/16/2020 $0.9450 Regular Cash 11/14/2019 11/15/2019 12/16/2019 $0.9450 Regular Cash 08/15/2019 08/16/2019 09/16/2019 $0.9450 Regular Cash 05/16/2019 05/17/2019 06/17/2019 SO 9275 Regular Cash An old quick and dirty rule of thumb for a risk-adjusted discount rate for electric utility companies is the yield to maturity on 20-year maturity U.S. Treasury bonds, plus 2%. On the same date, ycharts.com showed the following: > Cycharts.com/indicators/20_year_treasury_sate Apps CutePDF Edito. Agora F Fidelity Bank Mortg. EVENT Launchpad Venture The Midas Collabor.Apen Mi WHERFRANDED THROUGH DYSLER CAPITAL ONA 212T RATIO BIGHON CENTRE CAM AZALAELE LEVEL 2 EQUIPMENT GROUP 20 Year Treasury Rate 1.87% for Jul 21 2021 Overview Interactive Chart Level Chart VIEW FULL CHART 1D SOM SM 6M YTD 1YYSY 10 MAX 2001 APR 21 Assuming DUK's future 5-year dividend growth stays at the same rate as the growth between August 2021 and August 2020, come up with an estimate for the value of a share of DUK stock, and comment on whether it is over- or undervalued