Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (10 points) Spongebob and his best friend Patrick Star have decided to open a bubble stand. Unfortunately, Spongebob and Patrick are short of capital

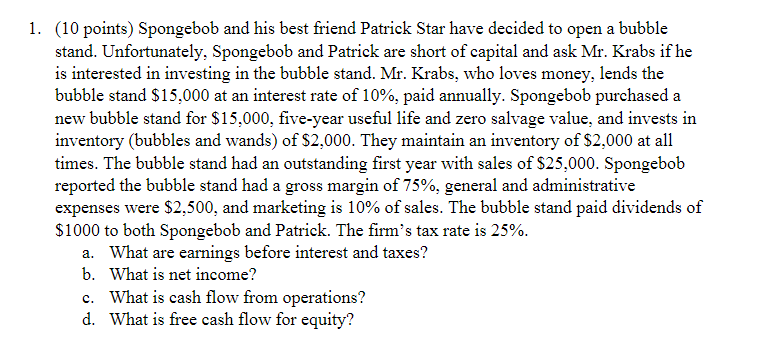

1. (10 points) Spongebob and his best friend Patrick Star have decided to open a bubble stand. Unfortunately, Spongebob and Patrick are short of capital and ask Mr. Krabs if he is interested in investing in the bubble stand. Mr. Krabs, who loves money, lends the bubble stand $15,000 at an interest rate of 10%, paid annually. Spongebob purchased a new bubble stand for $15,000, five-year useful life and zero salvage value, and invests in inventory (bubbles and wands) of $2,000. They maintain an inventory of $2,000 at all times. The bubble stand had an outstanding first year with sales of $25,000. Spongebob reported the bubble stand had a gross margin of 75%, general and administrative expenses were $2,500, and marketing is 10% of sales. The bubble stand paid dividends of $1000 to both Spongebob and Patrick. The firm's tax rate is 25%. a. What are earnings before interest and taxes? b. What is net income? c. What is cash flow from operations? d. What is free cash flow for equity

1. (10 points) Spongebob and his best friend Patrick Star have decided to open a bubble stand. Unfortunately, Spongebob and Patrick are short of capital and ask Mr. Krabs if he is interested in investing in the bubble stand. Mr. Krabs, who loves money, lends the bubble stand $15,000 at an interest rate of 10%, paid annually. Spongebob purchased a new bubble stand for $15,000, five-year useful life and zero salvage value, and invests in inventory (bubbles and wands) of $2,000. They maintain an inventory of $2,000 at all times. The bubble stand had an outstanding first year with sales of $25,000. Spongebob reported the bubble stand had a gross margin of 75%, general and administrative expenses were $2,500, and marketing is 10% of sales. The bubble stand paid dividends of $1000 to both Spongebob and Patrick. The firm's tax rate is 25%. a. What are earnings before interest and taxes? b. What is net income? c. What is cash flow from operations? d. What is free cash flow for equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started