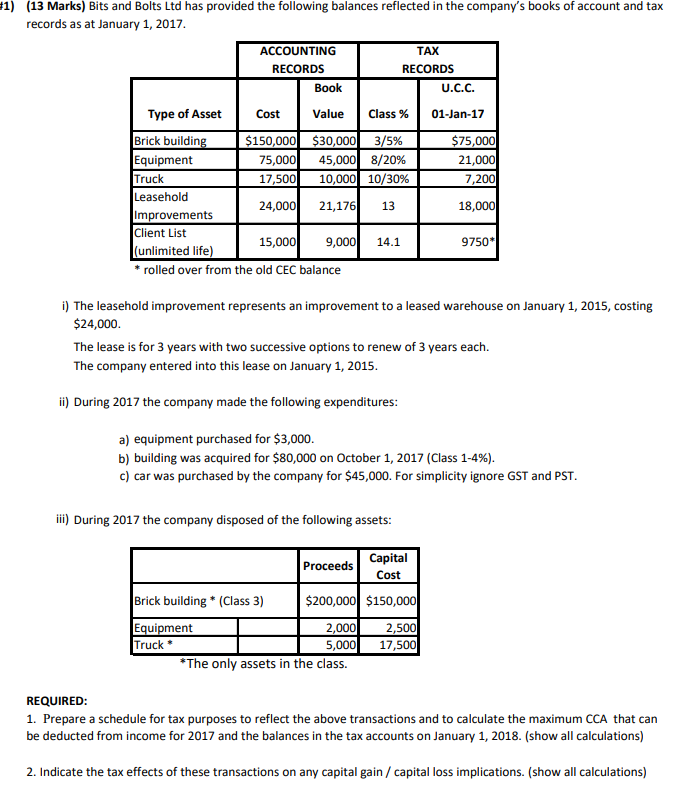

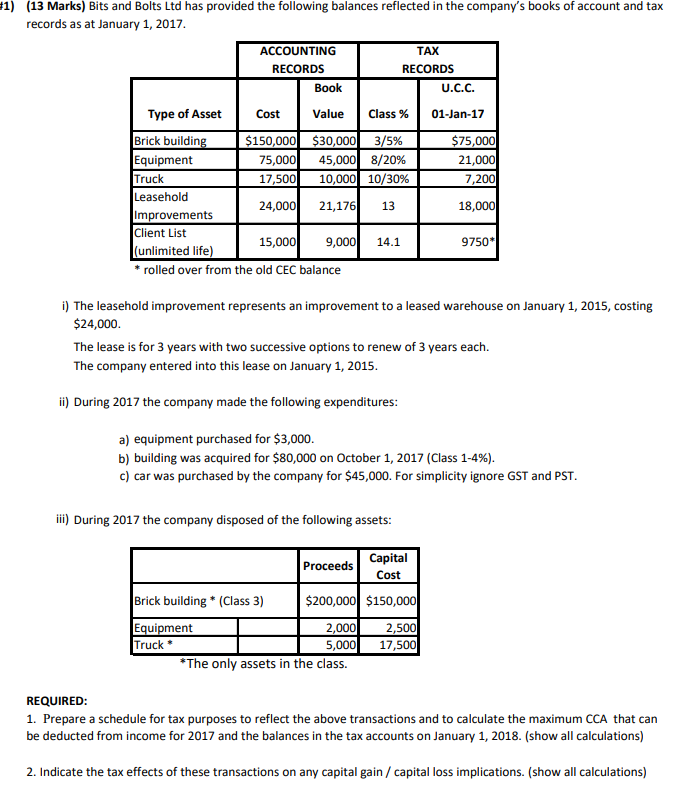

1) (13 Marks) Bits and Bolts Ltd has provided the following balances reflected in the company's books of account and tax records as at January 1, 2017. ACCOUNTING TAX RECORDS RECORDS Book U.C.C. Type of Asset Cost Value Class % 01-Jan-17 Brick building $150,000 $30,000 3/5% $75,000 Equipment 75,000 45,000 8/20% 21,000 Truck 17,500 10,000 10/30% 7,200 Leasehold 24,000 21,176 18,000 Improvements Client List 15,000 9,000 14.1 9750* (unlimited life) * rolled over from the old CEC balance 13 i) The leasehold improvement represents an improvement to a leased warehouse on January 1, 2015, costing $24,000. The lease is for 3 years with two successive options to renew of 3 years each. The company entered into this lease on January 1, 2015. ii) During 2017 the company made the following expenditures: a) equipment purchased for $3,000. b) building was acquired for $80,000 on October 1, 2017 (Class 1-4%). c) car was purchased by the company for $45,000. For simplicity ignore GST and PST. iii) During 2017 the company disposed of the following assets: Capital Proceeds Cost Brick building * (Class 3) $200,000 $150,000 Equipment 2,000 2,500 Truck 5,000 17,500 *The only assets in the class. REQUIRED: 1. Prepare a schedule for tax purposes to reflect the above transactions and to calculate the maximum CCA that can be deducted from income for 2017 and the balances in the tax accounts on January 1, 2018. (show all calculations) 2. Indicate the tax effects of these transactions on any capital gain / capital loss implications. (show all calculations) 1) (13 Marks) Bits and Bolts Ltd has provided the following balances reflected in the company's books of account and tax records as at January 1, 2017. ACCOUNTING TAX RECORDS RECORDS Book U.C.C. Type of Asset Cost Value Class % 01-Jan-17 Brick building $150,000 $30,000 3/5% $75,000 Equipment 75,000 45,000 8/20% 21,000 Truck 17,500 10,000 10/30% 7,200 Leasehold 24,000 21,176 18,000 Improvements Client List 15,000 9,000 14.1 9750* (unlimited life) * rolled over from the old CEC balance 13 i) The leasehold improvement represents an improvement to a leased warehouse on January 1, 2015, costing $24,000. The lease is for 3 years with two successive options to renew of 3 years each. The company entered into this lease on January 1, 2015. ii) During 2017 the company made the following expenditures: a) equipment purchased for $3,000. b) building was acquired for $80,000 on October 1, 2017 (Class 1-4%). c) car was purchased by the company for $45,000. For simplicity ignore GST and PST. iii) During 2017 the company disposed of the following assets: Capital Proceeds Cost Brick building * (Class 3) $200,000 $150,000 Equipment 2,000 2,500 Truck 5,000 17,500 *The only assets in the class. REQUIRED: 1. Prepare a schedule for tax purposes to reflect the above transactions and to calculate the maximum CCA that can be deducted from income for 2017 and the balances in the tax accounts on January 1, 2018. (show all calculations) 2. Indicate the tax effects of these transactions on any capital gain / capital loss implications. (show all calculations)