Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1/ 18 QUESTION 2 Frank established a Roth IRA at age 30 and contributed a total of $140,000 to it over 31 years. The account

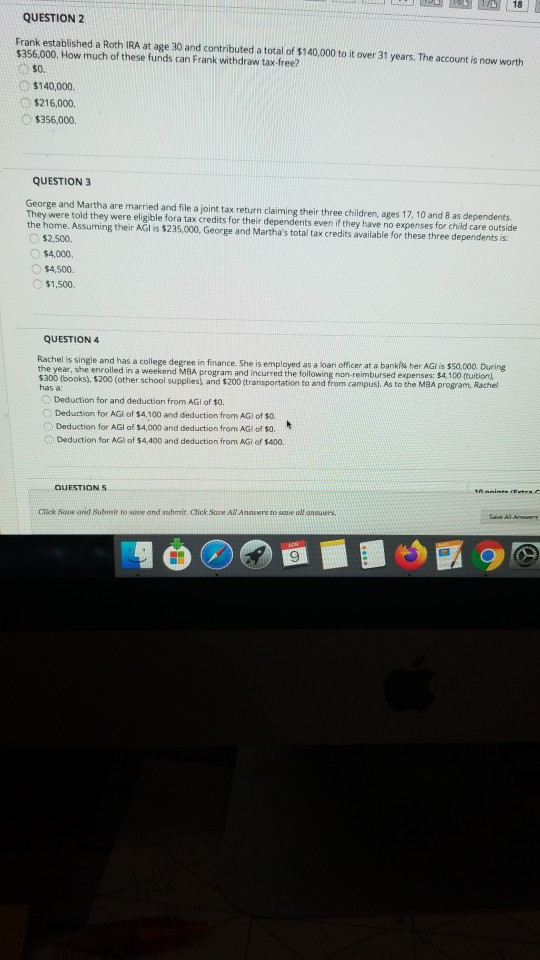

1/ 18 QUESTION 2 Frank established a Roth IRA at age 30 and contributed a total of $140,000 to it over 31 years. The account is now worth $356,000. How much of these funds can Frank withdraw tax-free? $0. $140,000 $216,000 $356,000 QUESTION 3 George and Martha are married and file a joint tax return claiming their three children, ages 17.10 and 8 as dependents. They were told they were eligible fora tax credits for their dependents even if they have no expenses for child care outside the home. Assuming their AGI is $235,000, George and Martha's total tax credits available for these three dependents is: $2,500. $4,000 $4,500 $1,500 QUESTION 4 Rachel is single and has a college degree in finance. She is employed as a loan officer at a bank her AG is $50.000. During the year, she enrolled in a weekend MBA program and incurred the following non reimbursed expenses: $4100 tuition), $300 (books). $200 (other school supplies, and $200 (transportation to and from campus). As to the MBA program Rachel has a Deduction for and deduction from AGI of $0. Deduction for AG of $4,100 and deduction from AGI of $0. Deduction for AGI of $4,000 and deduction from AG of so. Deduction for AGI of $4,400 and deduction from AG of $400. QUESTIONS Click Save and submit to save and submit. Click Save All Answers to see all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started