Question: 2 1 Complete client engagement acceptance form. Review correspondence files, prior year audit workpapers, permanent files, financial statements and NA auditor's reports. 3 Apollo

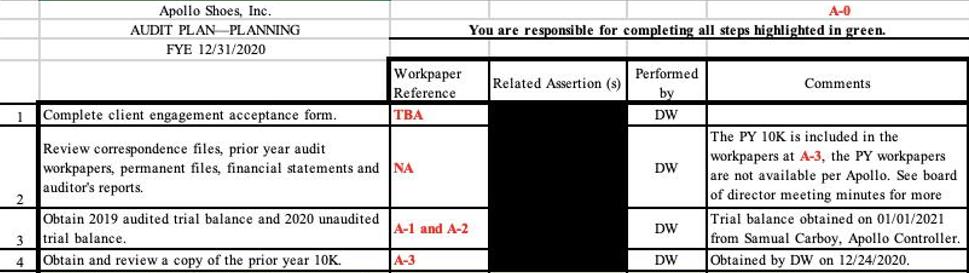

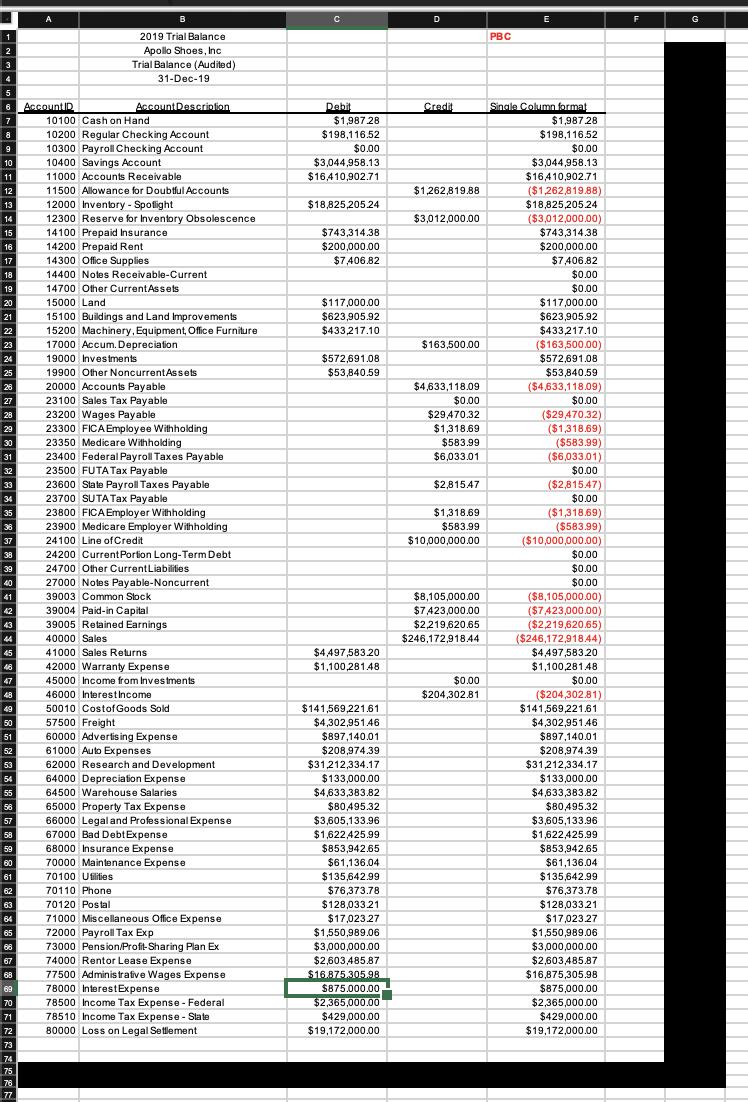

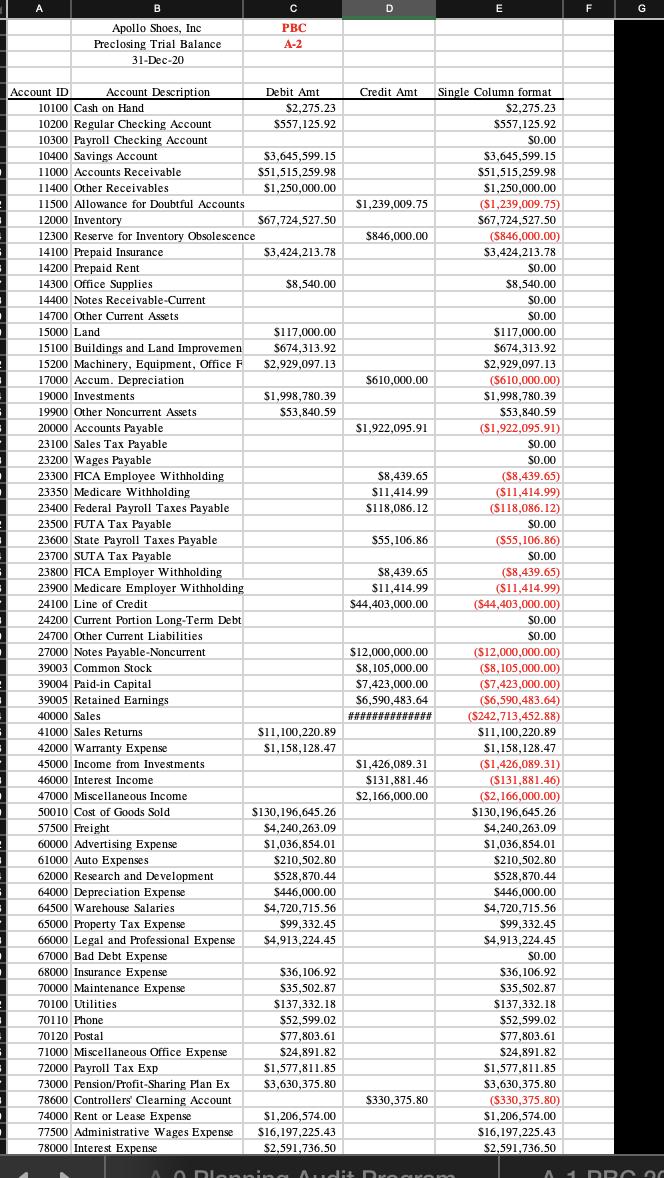

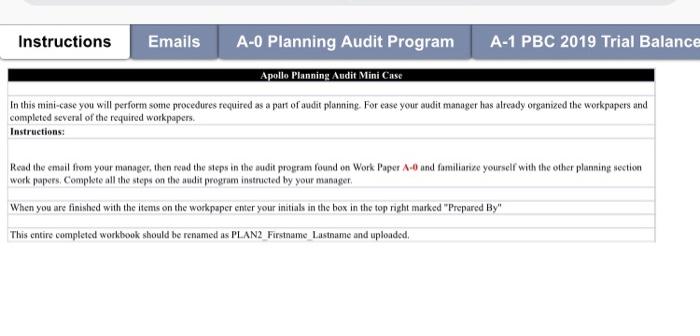

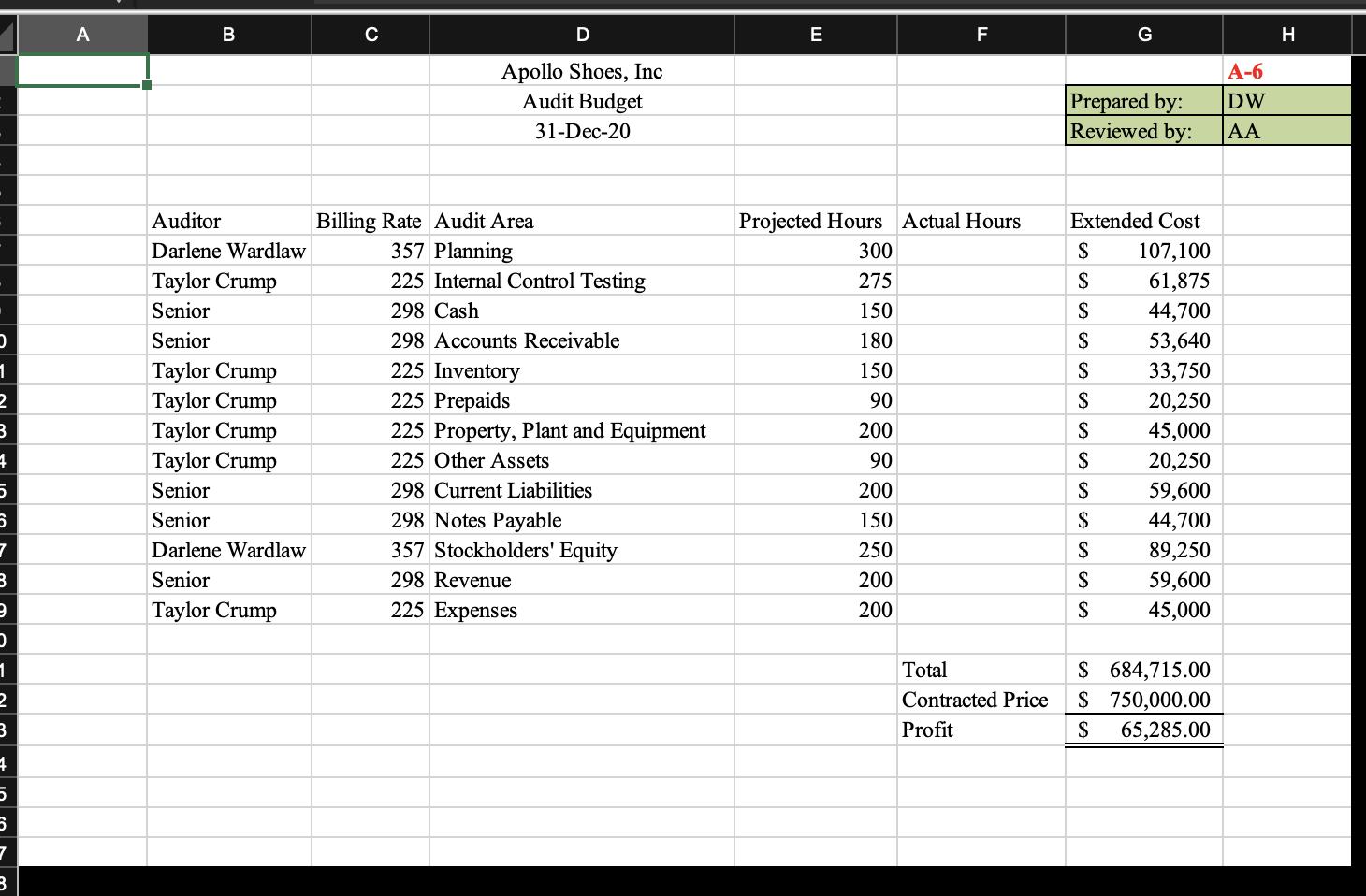

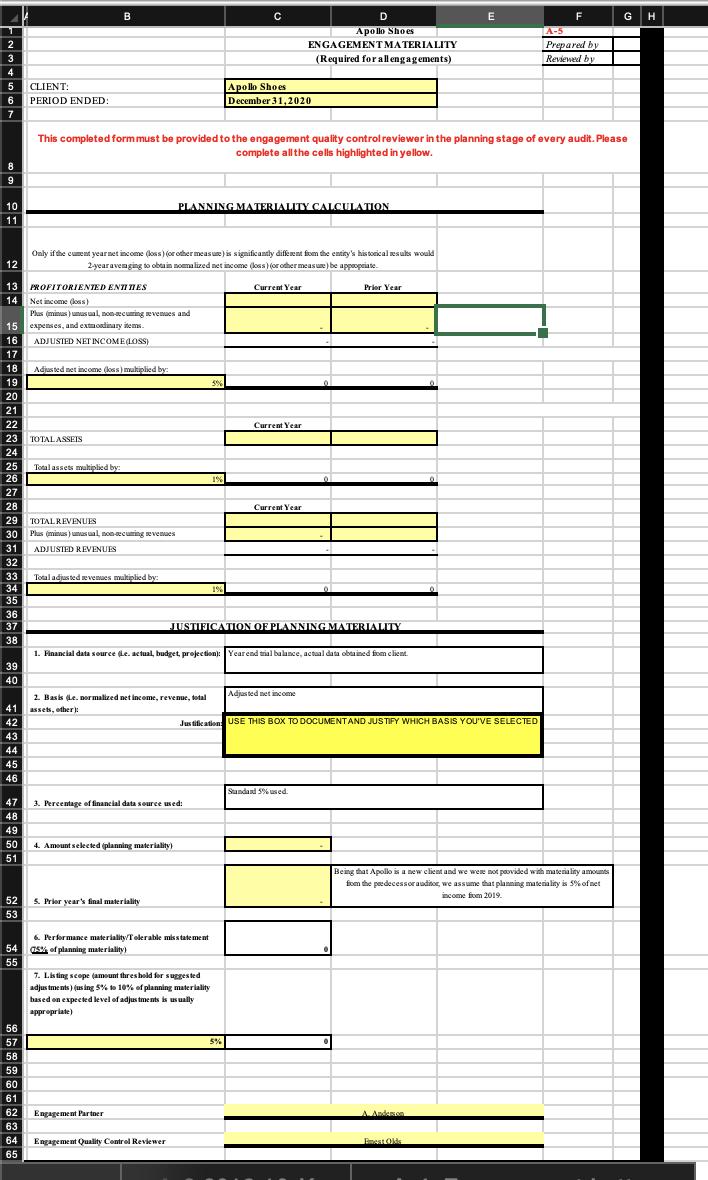

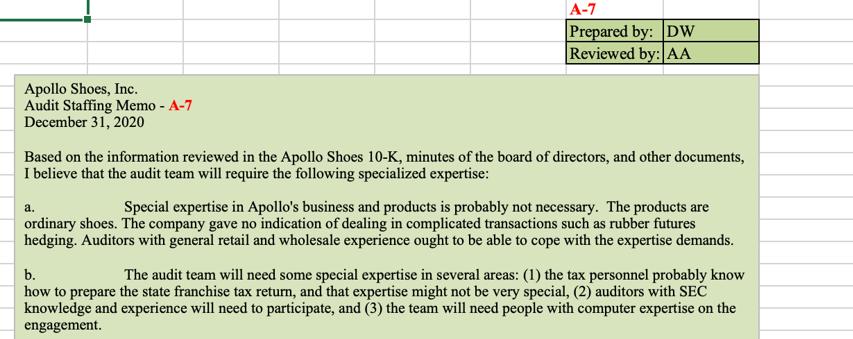

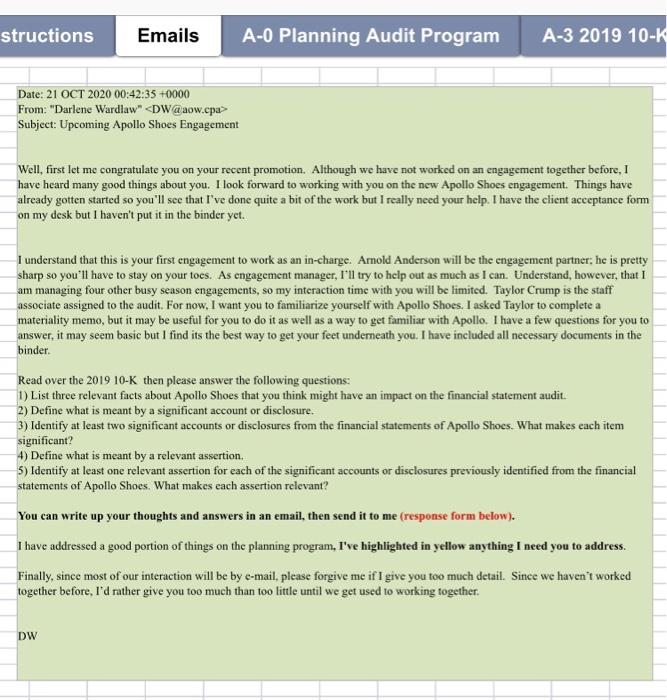

2 1 Complete client engagement acceptance form. Review correspondence files, prior year audit workpapers, permanent files, financial statements and NA auditor's reports. 3 Apollo Shoes, Inc. AUDIT PLAN PLANNING FYE 12/31/2020 4 Workpaper Reference TBA Obtain 2019 audited trial balance and 2020 unaudited trial balance. Obtain and review a copy of the prior year 10K. A-1 and A-2 A-3 A-0 You are responsible for completing all steps highlighted in green. Related Assertion (s) Performed by DW DW DW DW Comments The PY 10K is included in the workpapers at A-3, the PY workpapers are not available per Apollo. See board of director meeting minutes for more Trial balance obtained on 01/01/2021 from Samual Carboy, Apollo Controller. Obtained by DW on 12/24/2020. 1 2 3 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 A Account ID B 2019 Trial Balance Apollo Shoes, Inc. Trial Balance (Audited) 31-Dec-19 Account Description 10100 Cash on Hand. 10200 Regular Checking Account 10300 Payroll Checking Account 10400 Savings Account 11000 Accounts Receivable. 11500 Allowance for Doubtful Accounts 12000 Inventory - Spotlight 12300 Reserve for Inventory Obsolescence 14100 Prepaid Insurance 14200 Prepaid Rent 14300 Office Supplies 14400 Notes Receivable-Current 14700 Other Current Assets 15000 Land 15100 Buildings and Land Improvements. 15200 Machinery, Equipment, Office Furniture 17000 Accum. Depreciation 19000 Investments 19900 Other Noncurrent Assets 20000 Accounts Payable 23100 Sales Tax Payable 23200 Wages Payable 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 24100 Line of Credit 24200 Current Portion Long-Term Debt 24700 Other Current Liabilities 27000 Notes Payable-Noncurrent 39003 Common Stock 39004 Paid-in Capital 39005 Retained Earnings 40000 Sales 41000 Sales Returns 42000 Warranty Expense 45000 Income from Investments 46000 Interest Income 50010 Costof Goods Sold 57500 Freight 60000 Advertising Expense 61000 Auto Expenses 62000 Research and Development 64000 Depreciation Expense 64500 Warehouse Salaries 65000 Property Tax Expense 66000 Legal and Professional Expense 67000 Bad Debt Expense 68000 Insurance Expense 70000 Maintenance Expense 70100 Utilities 70110 Phone 70120 Postal 71000 Miscellaneous Office Expense 72000 Payroll Tax Exp 73000 Pension/Profit-Sharing Plan Ex 74000 Rentor Lease Expense 77500 Administrative Wages Expense 78000 Interest Expense 78500 Income Tax Expense - Federal 78510 Income Tax Expense - State 80000 Loss on Legal Settlement C Debit $1,987.28 $198.116.52 $0.00 $3,044,958.13 $16,410,902.71 $18,825,205.24 $743,314.38 $200,000.00 $7.406.82 $117,000.00 $623,905.92 $433,217.10 $572,691.08 $53,840.59 $4,497,583.20 $1,100,281.48 $141,569,221.61 $4,302,95146 $897,140.01 $208,974.39 $31,212,334.17 $133,000.00 $4,633,383.82 $80,495.32 $3,605,133.96 $1,622425.99 $853,942.65 $61,136.04 $135,642.99 $76,373.78 $128,033.21 $17,023.27 $1,550,989.06 $3,000,000.00 $2,603,485.87 $16.875.305.98 $875.000.00 $2,365,000.00 $429,000.00 $19,172,000.00 D Credit $1,262,819.88 $3,012,000.00 $163,500.00 $4,633,118.09 $0.00 $29,470.32 $1,318.69 $583.99 $6,033.01 $2,815.47 $1,318.69 $583.99 $10,000,000.00 $8,105,000.00 $7423,000.00 $2,219,620.65 $246,172,918.44 $0.00 $204,302.81 PBC E Single Column format $1,987.28 $198,116.52 $0.00 $3,044,958,13 $16,410,902.71 ($1,262,819.88) $18,825,205.24 ($3,012,000.00) $743,314.38 $200,000.00 $7,406.82 $0.00 $0.00 $117,000.00 $623,905.92 $433,217.10 ($163,500.00) $572,691.08 $53,840.59 ($4,633,118.09) $0.00 ($29,470.32) ($1,318.69) ($583.99) ($6,033.01) $0.00 ($2,815.47) $0.00 ($1,318.69) ($583.99) ($10,000,000.00) $0.00 $0.00 $0.00 ($8,105,000.00) ($7423,000.00) ($2,219,620.65) ($246,172,918.44) $4,497,583.20 $1,100,281.48 $0.00 ($204,302.81) $141,569,221.61 $4,302,951.46 $897,140.01 $208,974.39 $31,212,334.17 $133,000.00 $4,633,383.82 $80,495.32 $3,605,133.96 $1,622,425.99 $853,942.65 $61,136.04 $135,642.99 $76,373.78 $128,033.21 $17,023.27 $1,550,989.06 $3,000,000.00 $2,603,485.87 $16,875,305.98 $875,000.00 $2,365,000.00 $429,000.00 $19,172,000.00 F G 7 Account ID B Apollo Shoes, Inc Preclosing Trial Balance 31-Dec-20 Account Description 10100 Cash on Hand 10200 Regular Checking Account 10300 Payroll Checking Account 10400 Savings Account 11000 Accounts Receivable 11400 Other Receivables Atom 11500 Allowance for Doubtful Accounts. woman 12000 ce around Inventory 12300 Reserve for Inventory Obsolescence 14100 Prepaid Insurance Proproparg 14200 Prepaid Rent. Toxpan 14300 Office Supplies *** St 14400 Notes Receivable-Current www 14700 Other Current Assets *600* 15000 Land ********* 15100 Buildings and Land Improvemen 15200 Machinery, Equipment, Office F 1000 17000 Accum. Depreciation wwwwww 19000 Investments 19900 Other Noncurrent Assets * 20000 Accounts Payable. *** mater 23100 Sales Tax Payable 53000 23200 Wages Payable 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding 23900 Medicare Emplover Withholding 24100 Line of Credit 24200 Current Portion Long-Term Debt 24200 Current Portion 24700 Other Current Liabilities 27000 Notes Payable-Noncurrent 39003 Common Stock 39004 Paid-in Capital 35009 Retained Earnings 40000 Sales 41000 Sales Returns 71000 Sales 42000 Warranty Expense 45000 Income from Investments 46000 Interest Income 10000 47000 Miscellaneous Income 50010 Cost of Goods Sold 30010 COST OF 37500 Freight 57500 Freight 60000 Advertising Expense 61000 Auto Expenses 62000 Research and Development www 64000 Depreciation Expense 64500 Warehouse Salaries 65000 Property Tax Expense drops woning and Ad 66000 Legal and Professional Expense 67000 Bad Debt Expense CORPO 68000 Insurance Expense www. 70000 Maintenance Expense 70100 Utilities. www conte 70110 Phone 70120 Postal on 16 71000 Miscellaneous Office Expense R 72000 Payroll Tax Exp. www 73000 Pension/Profit-Sharing Plan Ex 78600 Controllers' Clearning Account 74000 Rent or Lease Expense 77500 Administrative Wages Expense 78000 Interest Expense PBC A-2 Debit Amt $2,275.23 $557,125.92 $3,645,599.15 $51,515,259.98 $1,250,000.00 $67,724,527.50 $3,424,213.78 $8,540.00 $117,000.00 $674,313.92 $2,929,097.13 $1,998,780.39 $53,840.59 $11,100,220.89 $1,158,128.47 $130,196,645.26 $4,240,263.09 $1,036,854.01 $210,502.80 $528,870.44 $446,000.00 $4,720,715.56 $99,332.45 $4,913,224.45 $36,106.92 $35,502.87 $137,332.18 $52,599.02 $77,803.61 $24,891.82 $1,577,811.85 $3,630,375.80 $1,206,574.00 $16,197.225.43 $2,591,736.50 D Credit Amt $1,239,009.75 $846,000.00 $610,000.00 $1,922,095.91 $8,439.65 $11,414.99 $118,086.12 $55,106.86 $8,439.65 $11,414.99 $44,403,000.00 $12,000,000.00 $8,105,000.00 $7,423,000.00 $6,590,483.64 ############## $1,426,089.31 $131,881.46 $2,166,000.00 $330,375.80 E Single Column format $2,275.23 $557,125.92 $0.00 O Planning Audit Drogrom $3,645,599.15 $51,515,259.98 $1,250,000.00 ($1,239,009.75) Compare $67,724,527.50 250.08 ($846,000.00) 2015 m $3,424,213.78 doku $0.00 www.ne $8,540.00 Bronne $0.00 www.ne $0.00 wwwwwww $117,000.00 $674,313.92 ***** $2,929,097.13 DAN AN ($610,000.00) $1,998,780.39 400 $53,840.59 FOTO-a ($1,922,095.91) 60.00 $0.00 $0.00 ($8,439.65) ($11,414.99) ($118,086.12) $0.00 ($55,100.001 $0.00 ($8,439.05 ($11,414.99) ($44,403,000.00) ,000.00) $0.00 $0.00 ($12,000,000.00) 1,000.00 ($8,105.000.00) ($7,423,000.00) ($6,590,483.64) ($242,713,452.88) $11,100,220.89 $1,158,128.47 ($1,426,089.31) ($131,881.46) ($2,166,000.00) $130,150,0.co $4,240,203.09 $1,036,854.01 $210.502.80 $210,502.80 $528,870.44 $446,000.00 wwwwwww $4,720,715.56 $99,332.45 $4,913,224.45 $0.00 626 106.08 $36,106.92 www. $35,502.87 ********** $137,332.18 FOR AN $52,599.02 www $77,803.61 CATHRI $24,891.82 $1,577,811.85 $3,630,375.80 ($330,375.80) $1,206,574.00 $16,197,225.43 $2,591,736.50 F G A1 DRC 30 Instructions Emails A-0 Planning Audit Program A-1 PBC 2019 Trial Balance Apollo Planning Audit Mini Case In this mini-case you will perform some procedures required as a part of audit planning. For ease your audit manager has already organized the workpapers and completed several of the required workpapers. Instructions: Read the email from your manager, then read the steps in the audit program found on Work Paper A-0 and familiarize yourself with the other planning section work papers. Complete all the steps on the audit program instructed by your manager. When you are finished with the items on the workpaper enter your initials in the box in the top right marked "Prepared By" This entire completed workbook should be renamed as PLAN2 Firstname Lastname and uploaded. 0 1 2 3 4 5 5 7 3 9 0 1 2 3 4 5 6 7 B A B Auditor Darlene Wardlaw Taylor Crump Senior Senior Taylor Crump Taylor Crump Crump Taylor Crump Senior Senior Darlene Wardlaw Senior Taylor Crump D Apollo Shoes, Inc Audit Budget 31-Dec-20 Billing Rate Audit Area 357 Planning 225 Internal Control Testing 298 Cash 298 Accounts Receivable 225 Inventory 225 Prepaids 225 Property, Plant and Equipment 225 Other Assets 298 Current Liabilities 298 Notes Payable 357 Stockholders' Equity 298 Revenue 225 Expenses E F Projected Hours Actual Hours 300 275 150 180 150 90 200 90 200 150 250 200 200 Total Contracted Price Profit Prepared by: Reviewed by: Extended Cost 107,100 61,875 44,700 53,640 33,750 20,250 $ $ $ $ $ $ $ $ $ $ $ $ $ 45,000 20,250 59,600 44,700 89,250 59,600 45,000 $ 684,715.00 $ 750,000.00 $ 65,285.00 A-6 DW AA H 1 MASON~ ~~~~*~*~*88588388588429494 +9985 5 10 11 12 21 54 55 56 57 58 13 PROFITORIENTED ENTITIES Net income (loss) Plus (minus) unusual, non-curring revenues and 15 expenses, and extraordinary items. ADJUSTED NET INCOME (LOSS) 59 60 CLIENT: PERIOD ENDED: 61 62 63 64 65 B Adjusted net income (loss) multiplied by: TOTAL ASSEIS Total assets multiplied by: Only if the curent year net income (loss) (or other measure) is significantly different from the entity's historical results would 2-year avenging to obtain normalized net income (loss) (or other measure) be appropriate. TOTAL REVENUES Plus (minus) unusual, non-recurring revenues ADJUSTED REVENUES This completed form must be provided to the engagement quality control reviewer in the planning stage of every audit. Please complete all the cells highlighted in yellow. Total adjusted revenues multiplied by: 52 5. Prior year's final materiality 53 2. Basis (Le. normalized net income, revenue, total assets, other): 4. Amount selected (planning materiality) PLANNING MATERIALITY CALCULATION 3. Percentage of financial data source used: Engagement Partner 6. Performance materiality/Tolerable misstatement 75% of planning materiality) Engagement Quality Control Reviewer 5% 7. Listing scope (amount threshold for suggested adjustments) (using 5% to 10% of planning materiality based on expected level of adjustments is usually appropriate) C 1% 1% Apollo Shoes December 31,2020 1. Financial data source (Le. actual, budget, projection): Year end trial balance, actual data obtained from client. Current Year JUSTIFICATION OF PLANNING MATERIALITY 5% D Apollo Shoes ENGAGEMENT MATERIALITY (Required for all engagements) Current Year Current Year Adjusted net income 0 Justification USE THIS BOX TO DOCUMENT AND JUSTIFY WHICH BASIS YOU'VE SELECTED Standard 5% used Prior Year E F A. Anderson A-5 Prepared by Reviewed by Being that Apollo is a new client and we were not provided with materiality amounts from the predecessor auditor, we assume that planning materiality is 5% of net income from 2019. G H Apollo Shoes, Inc. Audit Staffing Memo - A-7 December 31, 2020 A-7 Prepared by: DW Reviewed by: AA Based on the information reviewed in the Apollo Shoes 10-K, minutes of the board of directors, and other documents, I believe that the audit team will require the following specialized expertise: a. Special expertise in Apollo's business and products is probably not necessary. The products are ordinary shoes. The company gave no indication of dealing in complicated transactions such as rubber futures hedging. Auditors with general retail and wholesale experience ought to be able to cope with the expertise demands. b. The audit team will need some special expertise in several areas: (1) the tax personnel probably know how to prepare the state franchise tax return, and that expertise might not be very special, (2) auditors with SEC knowledge and experience will need to participate, and (3) the team will need people with computer expertise on the engagement. structions Emails Date: 21 OCT 2020 00:42:35 +0000 From: "Darlene Wardlaw" Subject: Upcoming Apollo Shoes Engagement A-0 Planning Audit Program A-3 2019 10-K Well, first let me congratulate you on your recent promotion. Although we have not worked on an engagement together before, I have heard many good things about you. I look forward to working with you on the new Apollo Shoes engagement. Things have already gotten started so you'll see that I've done quite a bit of the work but I really need your help. I have the client acceptance form on my desk but I haven't put it in the binder yet. DW I understand that this is your first engagement to work as an in-charge. Arnold Anderson will be the engagement partner; he is pretty sharp so you'll have to stay on your toes. As engagement manager, I'll try to help out as much as I can. Understand, however, that I am managing four other busy season engagements, so my interaction time with you will be limited. Taylor Crump is the staff associate assigned to the audit. For now, I want you to familiarize yourself with Apollo Shoes. I asked Taylor to complete a materiality memo, but it may be useful for you to do it as well as a way to get familiar with Apollo. I have a few questions for you to answer, it may seem basic but I find its the best way to get your feet underneath you. I have included all necessary documents in the binder. Read over the 2019 10-K then please answer the following questions: 1) List three relevant facts about Apollo Shoes that you think might have an impact on the financial statement audit. 2) Define what is meant by a significant account or disclosure. 3) Identify at least two significant accounts or disclosures from the financial statements of Apollo Shoes. What makes each item significant? 4) Define what is meant by a relevant assertion. 5) Identify at least one relevant assertion for each of the significant accounts or disclosures previously identified from the financial statements of Apollo Shoes. What makes each assertion relevant? You can write up your thoughts and answers in an email, then send it to me (response form below). I have addressed a good portion of things on the planning program, I've highlighted in yellow anything I need you to address. Finally, since most of our interaction will be by e-mail, please forgive me if I give you too much detail. Since we haven't worked together before, I'd rather give you too much than too little until we get used to working together.

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

SOLUTION It appears youve provided an email communication between Darlene Wardlaw DW and another team member regarding the upcoming Apollo Shoes engagement Darlene has outlined specific tasks for the ... View full answer

Get step-by-step solutions from verified subject matter experts