Question

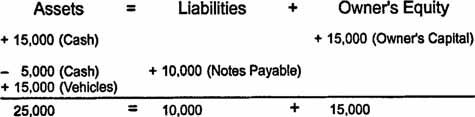

Assume Mr. J. Green invests $15,000 to start a landscape business. This transaction increases the company's assets, specifically cash, by $15,000 and increases owner's equity

Assume Mr. J. Green invests $15,000 to start a landscape business. This transaction increases the company's assets, specifically cash, by $15,000 and increases owner's equity by $15,000. Notice that the accounting equation remains in balance.

![]()

Mr. Green uses $5,000 of the company's cash to place a down‐payment on a used truck that costs $15,000, and he signs a note payable that requires him to pay the remaining $10,000 in eighteen months. This transaction decreases one type of asset (cash) by $5,000, increases another type of asset (vehicles) by $15,000, and increases a liability (notes payable) by $10,000. The accounting equation remains in balance, and Mr. Green now has two types of assets ($10,000 in cash and a vehicle worth $15,000), a liability (a $10,000 note payable), and owner's equity of $15,000.

Given the large number of transactions that companies usually have, accountants need a more sophisticated system for recording transactions than the one shown on the previous page. Accountants use the double‐entry bookkeeping system to keep the accounting equation in balance and to double‐check the numerical accuracy of transaction entries. Under this system, each transaction is recorded using at least two accounts. An account is a record of all transactions involving a particular item.

Companies maintain separate accounts for each type of asset (cash, accounts receivable, inventory, etc.), each type of liability (accounts payable, wages payable, notes payable, etc.), owner investments (usually referred to as the owner's capital account in a sole proprietorship), owner drawings (withdrawals made by the owner), each type of revenue (sales revenue, service revenue, etc.), and each type of expense (rent expense, wages expense, etc.). All accounts taken together make up the general ledger. For organizational purposes, each account in the general ledger is assigned a number, and companies maintain a chart of accounts, which lists the accounts and account numbers.

Account numbers vary significantly from one company to the next, depending on the company's size and complexity. A sole proprietorship may have few accounts, but a multinational corporation may have thousands of accounts and use ten‐ or even twenty‐digit numbers to track accounts by location, department, project code, and other categories. Most companies numerically separate asset, liability, owner's equity, revenue, and expense accounts. A typical small business might use the numbers 100–199 for asset accounts, 200–299 for liability accounts, 300–399 for owner's equity accounts, 400–499 for revenue accounts, and 500–599 for expense accounts.

Assets +15,000 (Cash) Liabilities Owner's Equity + 15,000 (Owner's Capital)

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided here are the key points 1 Mr J Green invests 15000 to start a land...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started