Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 2 3 4 5 6 7 8 9 10 11 12 Please show your work Crystal Corporation produces a single product. The company's variable

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10

11

12

Please show your work

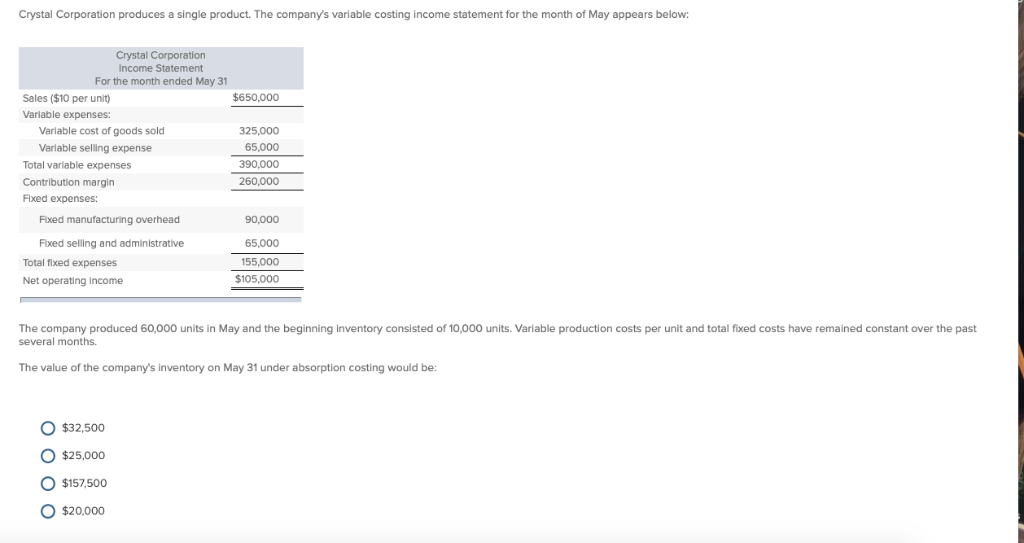

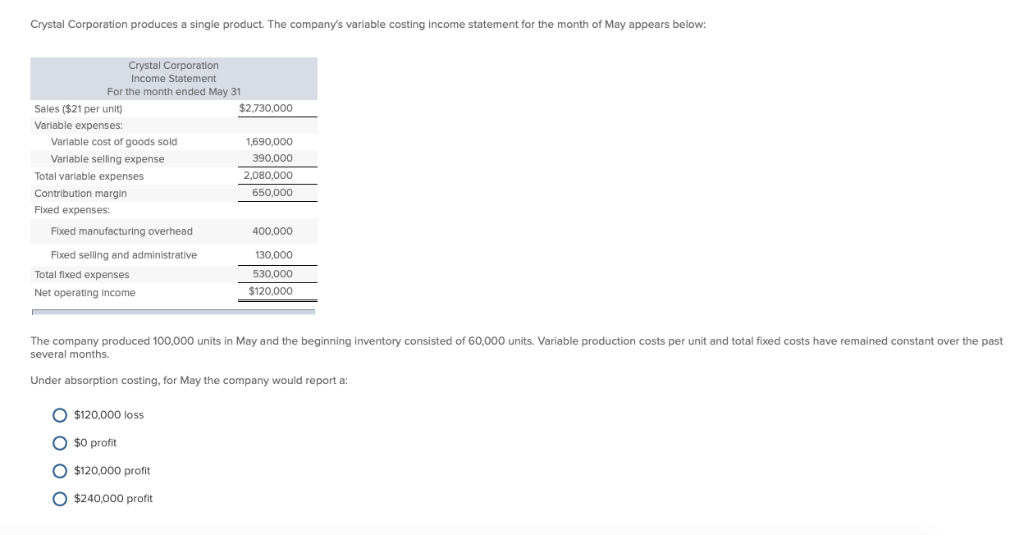

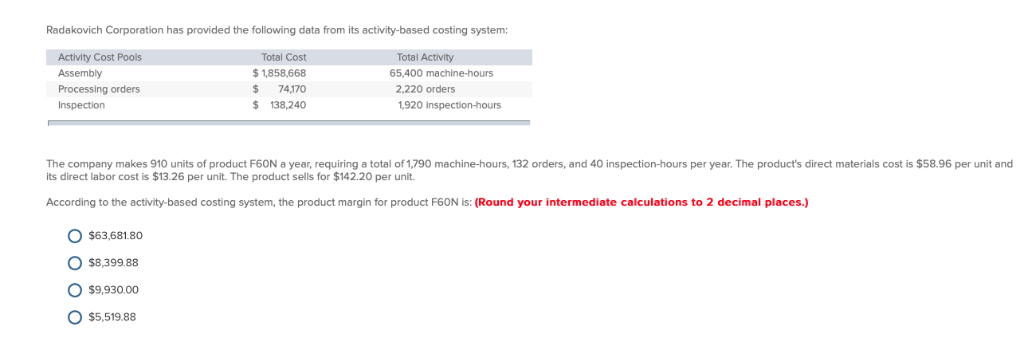

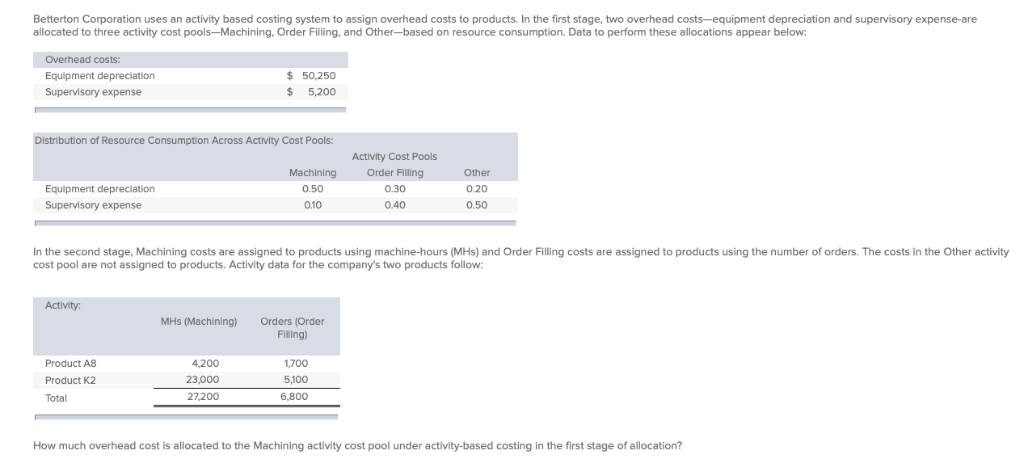

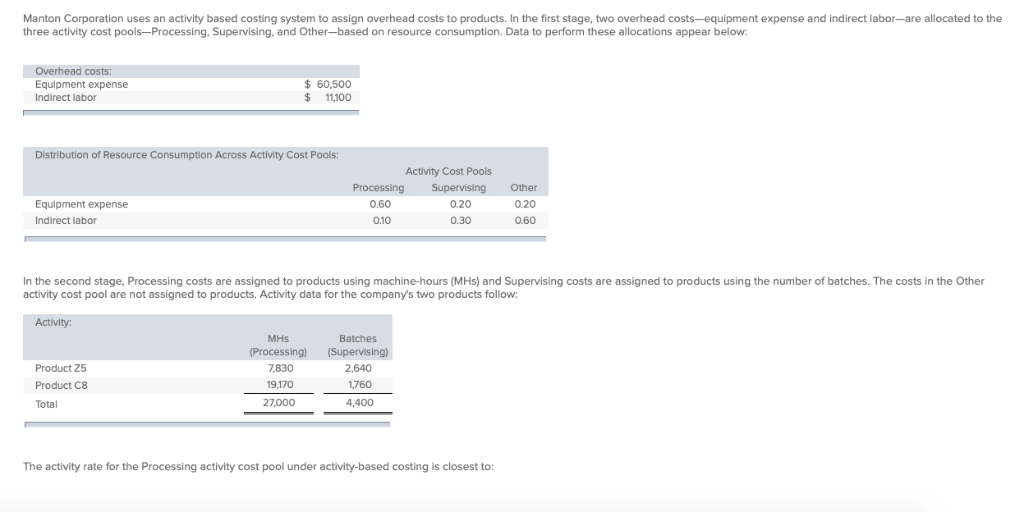

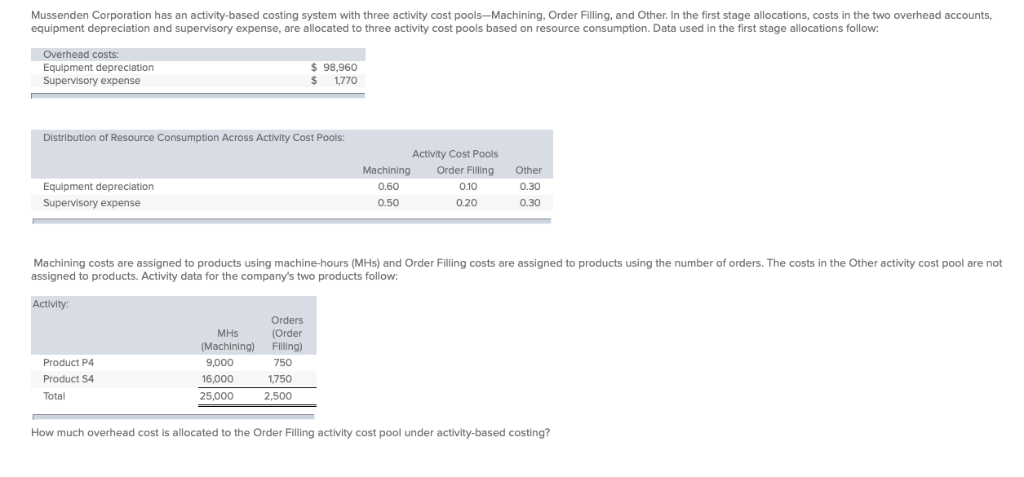

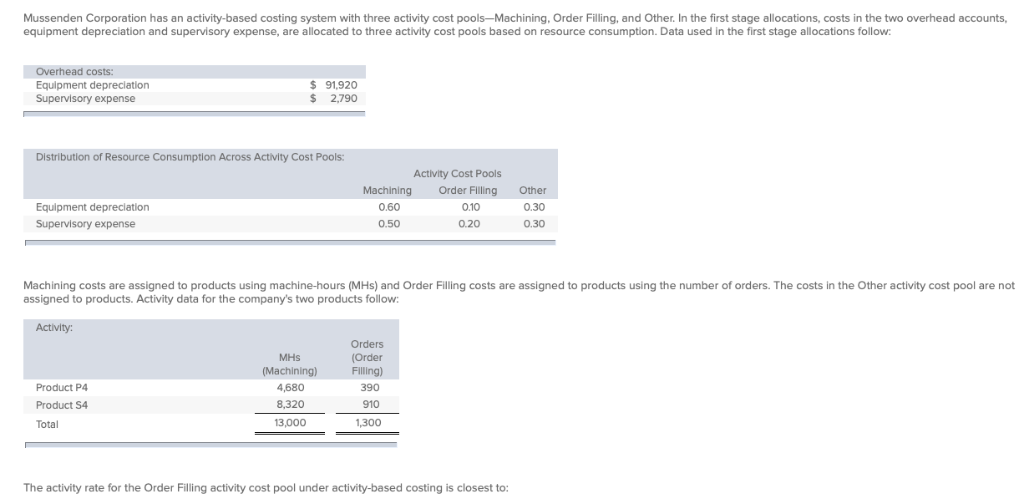

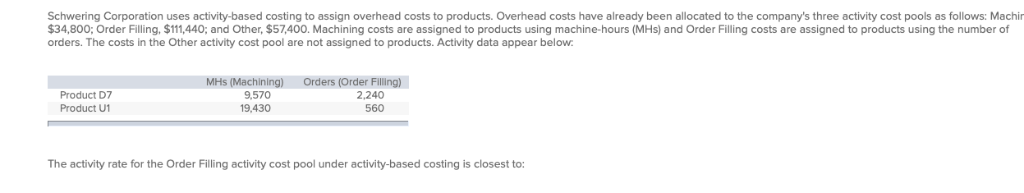

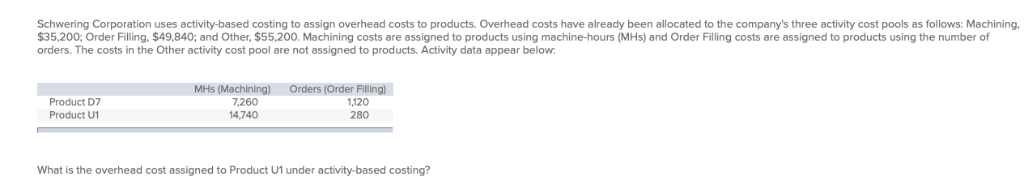

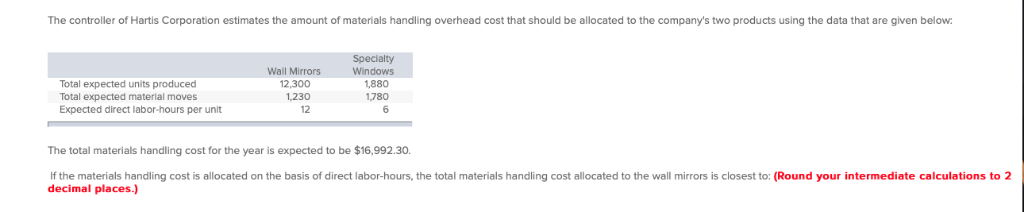

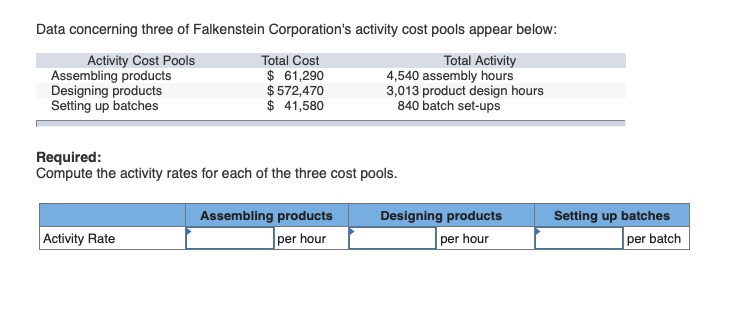

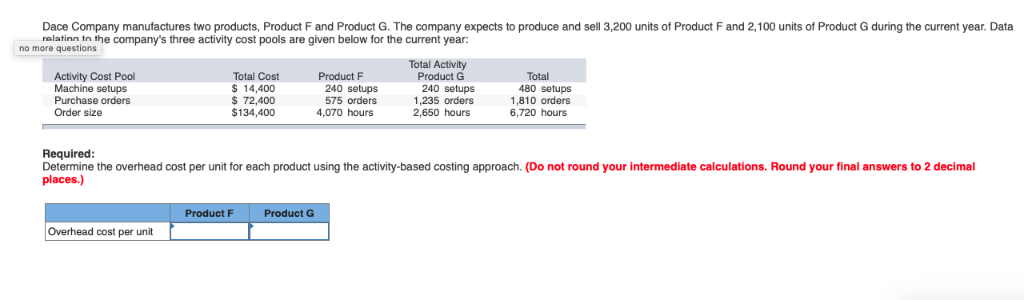

Crystal Corporation produces a single product. The company's variable costing income statement for the month of May appears below: Crystal Corporation Income Statement For the month ended May 31 Sales ($21 per unit) $2,730,000 Variable expenses: Variable cost of goods sold 1,690,000 Variable selling expense 390,000 Total variable expenses 2,080,000 Contribution margin 650,000 Fixed expenses: Fixed manufacturing overhead 400,000 130,000 Fixed selling and administrative Total fixed expenses Net operating income 530.000 $120,000 The company produced 100,000 units in May and the beginning inventory consisted of 60,000 units. Variable production costs per unit and total fixed costs have remained constant over the past several months. Under absorption costing, for May the company would report a: $120,000 loss $0 profit $120,000 profit $240,000 profit Radakovich Corporation has provided the following data from its activity-based costing system: Activity Cost Pools Assembly Processing orders Inspection Total Cost $ 1,858,668 $ 74,170 $ 138,240 Total Activity 65,400 machine-hours 2,220 orders 1,920 Inspection-hours The company makes 910 units of product F60N a year, requiring a total of 1,790 machine-hours, 132 orders, and 40 inspection-hours per year. The product's direct materials cost is $58.96 per unit and its direct labor cost is $13.26 per unit. The product sells for $142.20 per unit. According to the activity-based costing system, the product margin for product F60N is: (Round your intermediate calculations to 2 decimal places.) O $63,681.80 $8,399.88 $9,930.00 $5,519.88 Betterton Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below: Overhead costs: Equipment depreciation Supervisory expense $ 50,250 $ 5,200 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Order Filling 0.30 0.40 Machining 0.50 0.10 Equipment depreciation Supervisory expense Other 0.20 0.50 In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: MHS (Machining) Orders (Order Filling) Product AS Product K2 Total 4,200 23,000 27,200 1,700 5,100 ,800 6 How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation? Manton Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below: Overhead costs: Equipment expense Indirect labor $ 60,500 $ 11,100 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Processing Supervising 0.60 0.20 0.10 0.30 Equipment expense Indirect labor Other 0.20 0.60 In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: Product 25 Product C8 Total MHS (Processing) 7,830 19,170 27,000 (Supervising) 2,640 1,760 4,400 The activity rate for the Processing activity cost pool under activity-based costing is closest to: Mussenden Corporation has an activity-based costing system with three activity cost pools-Machining. Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Equipment depreciation Supervisory expense $ 98,960 $ 1.770 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Machining Order Filling 0.60 0. 100 0.50 0.20 Equipment depreciation Supervisory expense Other .30 0.30 Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: Product P4 Product S4 Total MHS (Machining) 9,000 16,000 25,000 Orders (Order Filling) 750 1,750 2,500 How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing? Mussenden Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Equipment depreciation Supervisory expense $ 91,920 $ 2,790 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Machining Order Filling 0.60 0.10 0.50 0.20 Equipment depreciation Supervisory expense Other 0.30 0.30 Machining costs are assigned to products using machine-hours (MHS) and Order Filling costs are assigned to products using the number of orders. The costs in the other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: Product P4 Product S4 Total MHS (Machining) 4,680 8,320 13,000 Orders (Order Filling) 390 910 1,300 The activity rate for the Order Filling activity cost pool under activity-based costing is closest to: Schwering Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Machin $34,800; Order Filling, $111,440; and Other, $57,400. Machining costs are assigned to products using machine-hours (MHS) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below. Product D7 Product U1 MHS (Machining 9,570 19,430 Orders (Order Filling) 2,240 560 The activity rate for the Order Filling activity cost pool under activity-based costing is closest to: Schwering Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $35,200; Order Filling, $49,840; and Other $55,200. Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Product D7 Product U1 MHS (Machining 7,260 14,740 Orders (Order Filling) 1.120 280 What is the overhead cost assigned to Product U1 under activity-based costing? The controller of Hartis Corporation estimates the amount of materials handling overhead cost that should be allocated to the company's two products using the data that are given below: Specialty Windows 1880 1,780 Wall Mirrors 12,300 1,230 Total expected units produced Total expected material moves Expected direct labor-hours per unit The total materials handling cost for the year is expected to be $16,992.30. If the materials handling cost is allocated on the basis of direct labor-hours, the total materials handling cost allocated to the wall mirrors is closest to: (Round your intermediate calculations to 2 decimal places.) Data concerning three of Falkenstein Corporation's activity cost pools appear below: Activity Cost Pools Assembling products Designing products Setting up batches Total Cost $ 61,290 $572,470 $ 41,580 Total Activity 4,540 assembly hours 3,013 product design hours 840 batch set-ups Required: Compute the activity rates for each of the three cost pools. Assembling products per hour Designing products per hour Setting up batches per batch Activity Rate Dace Company manufactures two products, Product F and Product G. The company expects to produce and sell 3,200 units of Product F and 2,100 units of Product G during the current year. Data relating to the company's three activity cost pools are given below for the current year: no more questions Activity Cost Pool Machine setups Purchase orders Order size Total Cost $ 14,400 $ 72,400 $134,400 Product F 240 setups 575 orders 4,070 hours Total Activity Product G 240 setups 1,235 orders 2,650 hours Total 480 setups 1.810 orders 6,720 hours Required: Determine the overhead cost per unit for each product using the activity-based costing approach. (Do not round your intermediate calculations. Round your final answers to 2 decimal places.) Product F Product G Overhead cost per unitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started