Answered step by step

Verified Expert Solution

Question

1 Approved Answer

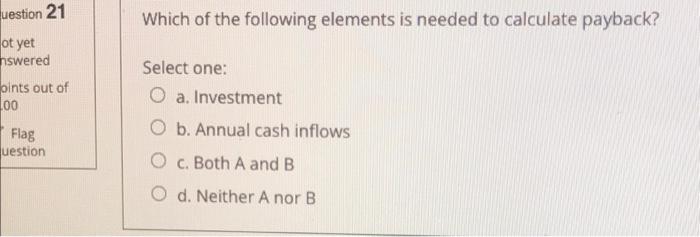

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Which of the following elements is needed to calculate payback? Select one: a. Investment b.

1.

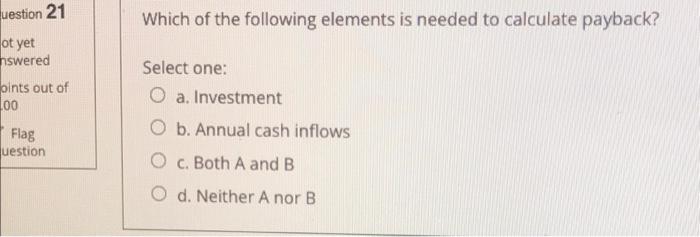

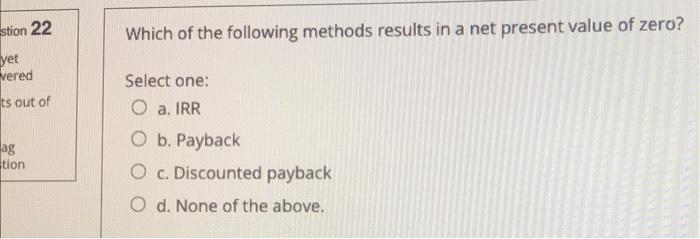

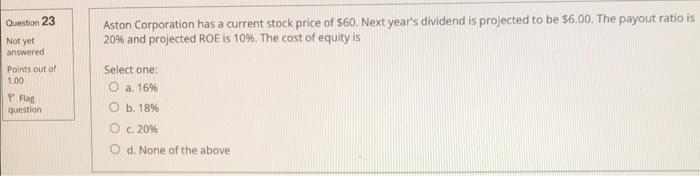

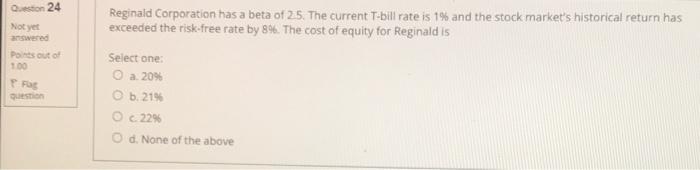

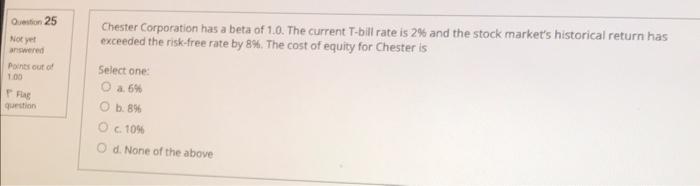

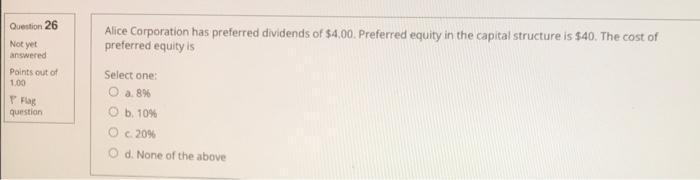

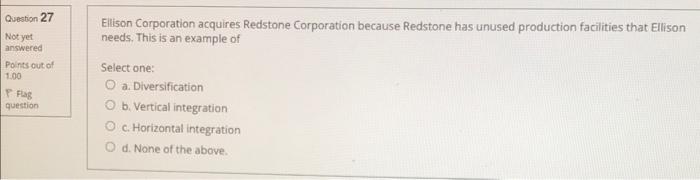

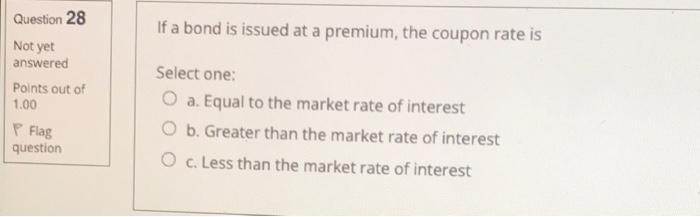

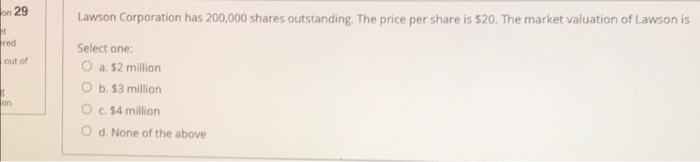

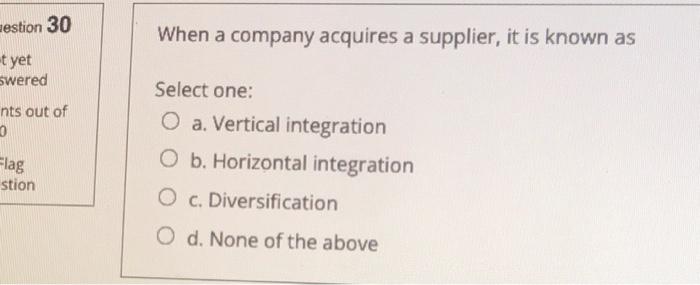

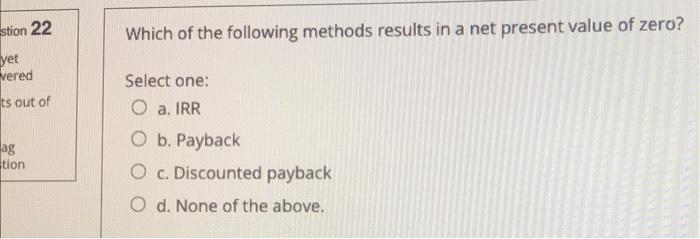

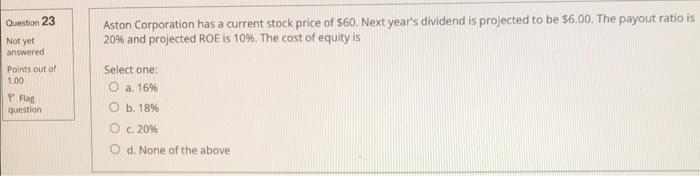

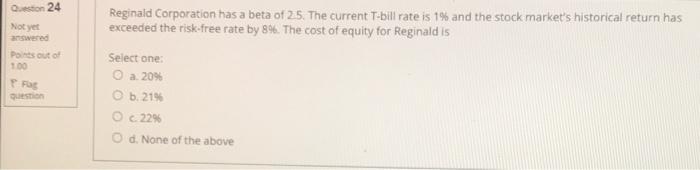

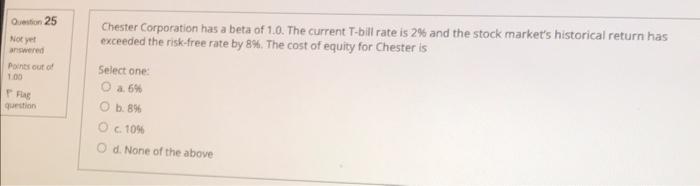

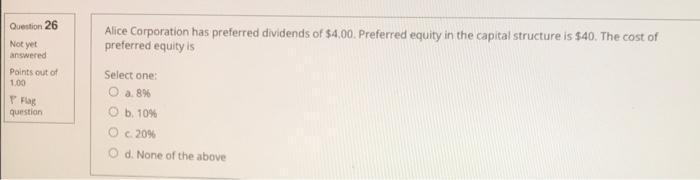

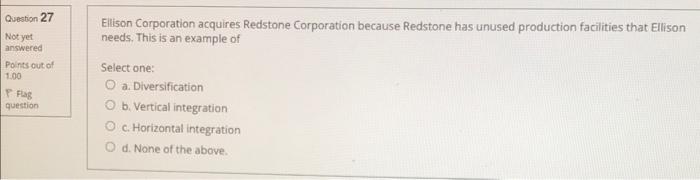

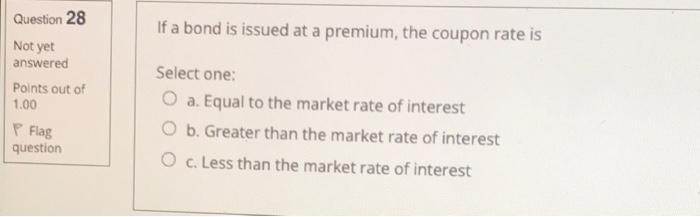

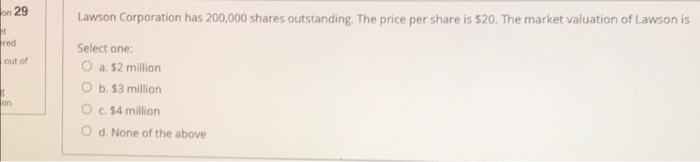

Which of the following elements is needed to calculate payback? Select one: a. Investment b. Annual cash inflows c. Both A and B d. Neither A nor B Which of the following methods results in a net present value of zero? Select one: a. IRR b. Payback c. Discounted payback d. None of the above. Aston Corporation has a current stock price of $60. Next year's dividend is projected to be $6.00. The payout ratio is 20% and projected ROE is 10%. The cost of equity is Select one: a. 16% b. 18% C. 20% d. None of the above Reginald Corporation has a beta of 25 . The current T-bill rate is 1% and the stock market's historical return has exceeded the risk-free rate by 8%. The cost of equity for Reginald is Select one: a. 20% b. 2196 c. 2226 d. None of the above Chester Corporation has a beta of 1.0. The current T-bill rate is 2% and the stock market's historical return has exceeded the risk-free rate by 8%. The cost of equity for Chester is Select one: a. 6% b. 8% c. 10% d. None of the above Alice Corporation has preferred dividends of $4.00. Preferred equity in the capital structure is $40. The cost of preferred equity is Select one: a. 8% b. 10% c. 20%6 d. None of the above Elison Corporation acquires Redstone Corporation because Redstone has unused production facilities that Ellison needs, This is an example of Select one: a. Diversification b. Vertical integration C. Horizontal integration d. None of the above. If a bond is issued at a premium, the coupon rate is Select one: a. Equal to the market rate of interest b. Greater than the market rate of interest c. Less than the market rate of interest Lawson Corporation has 200,000 shares outstanding. The price per share is $20. The market valuation of Lawson is Select one: a. $2 miltion b. $3 million c. $4 milion d. None of the above When a company acquires a supplier, it is known as Select one: a. Vertical integration b. Horizontal integration c. Diversification d. None of the above

2.

3.

4.

5.

6.

7.

8.

9.

10.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started