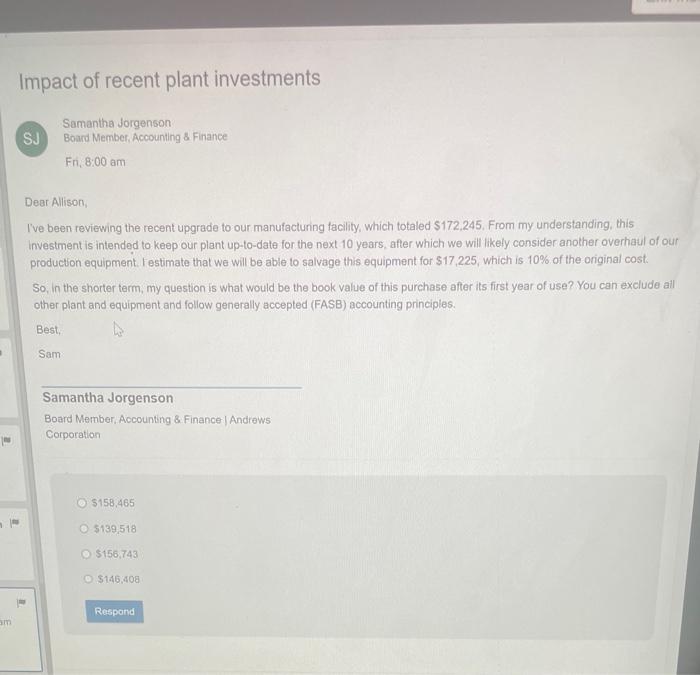

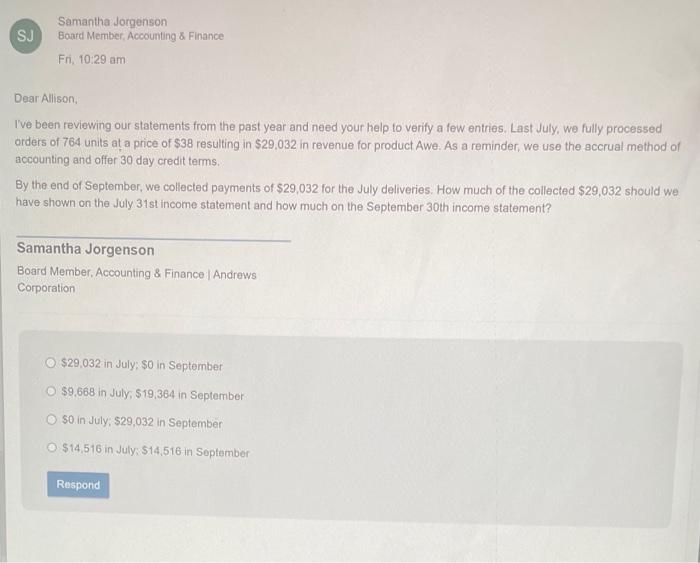

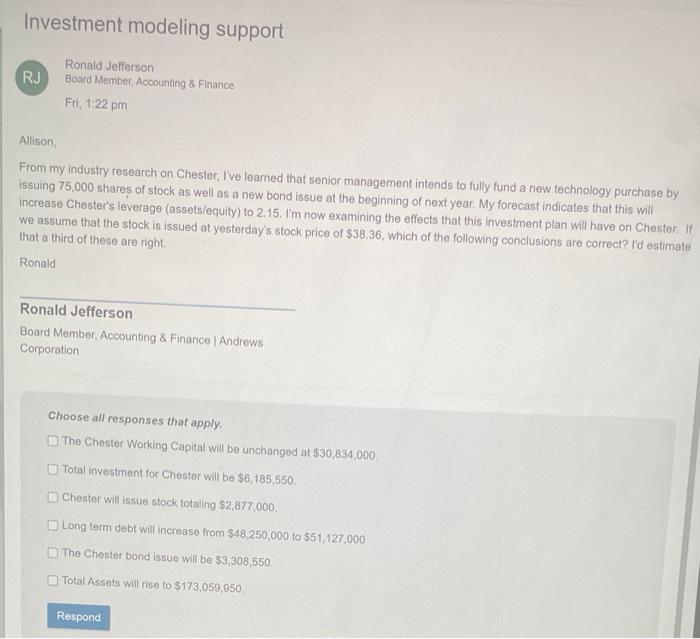

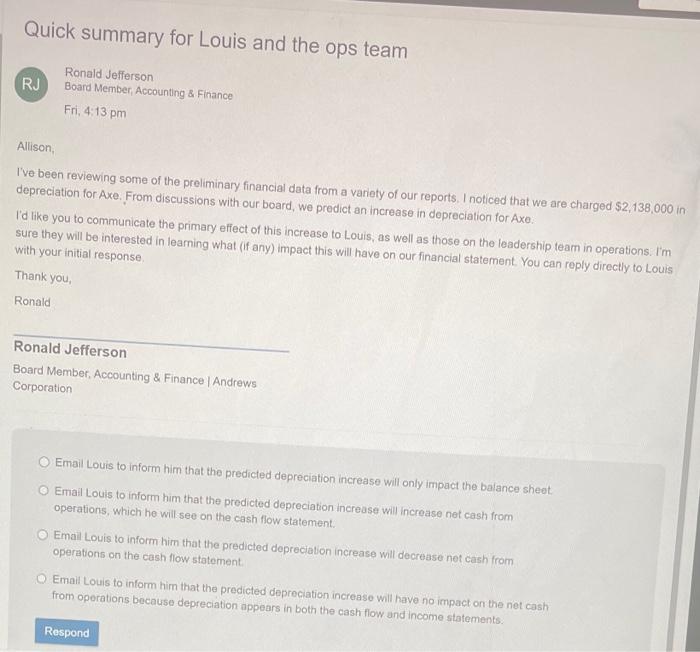

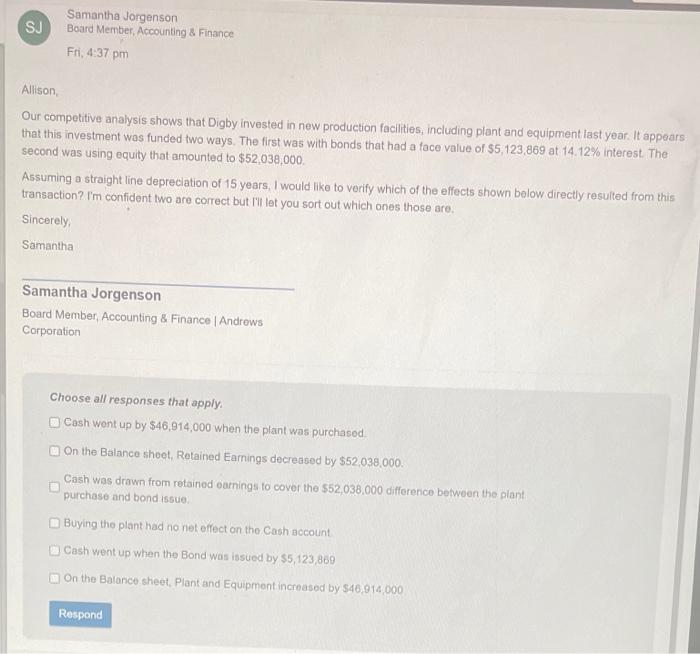

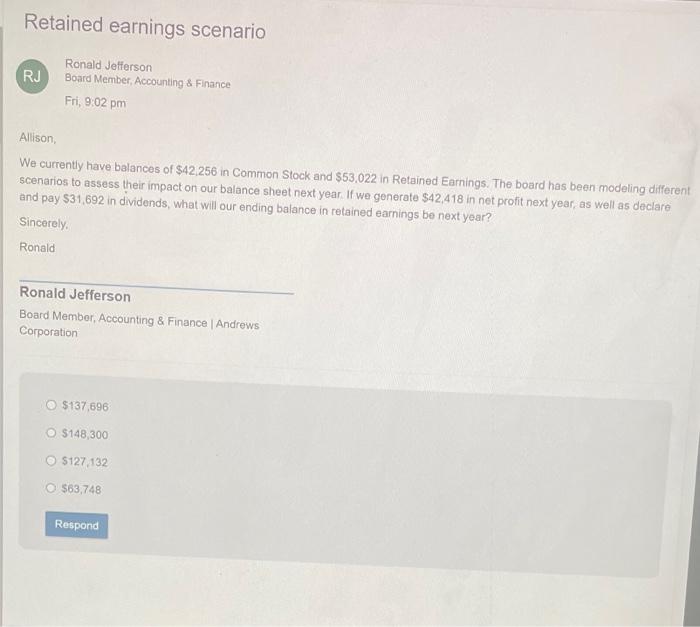

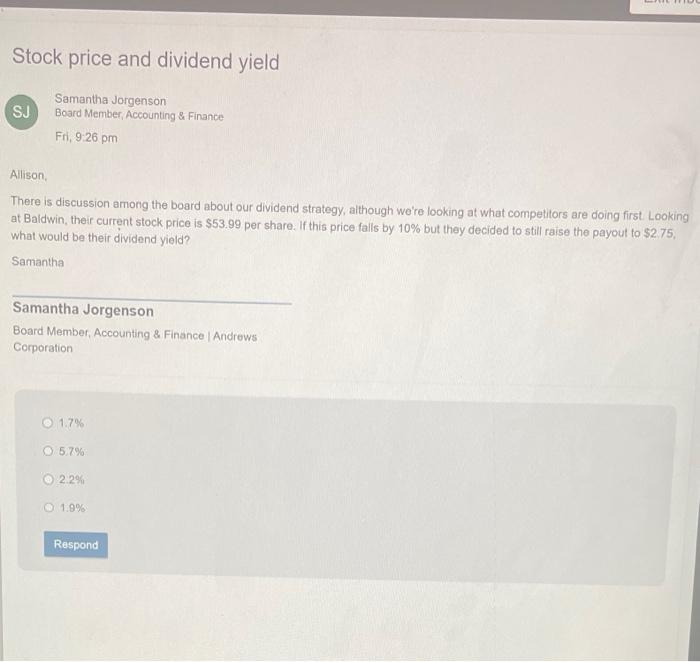

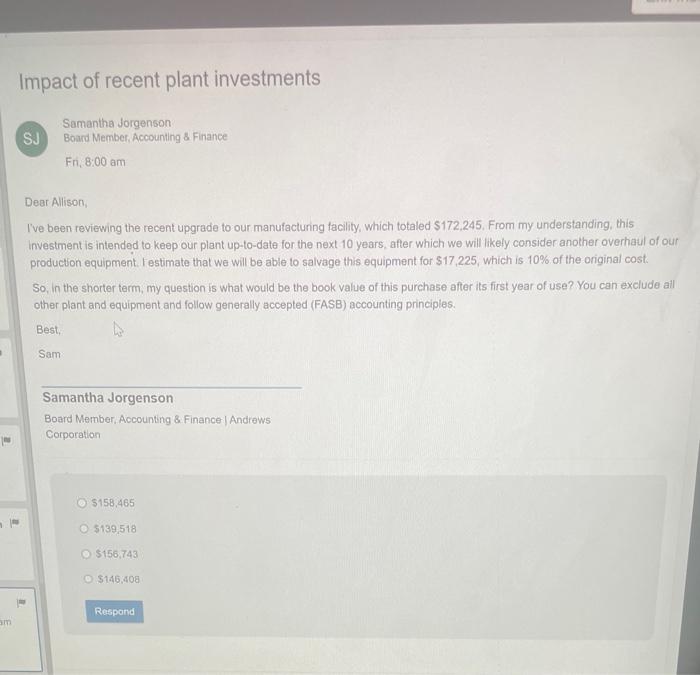

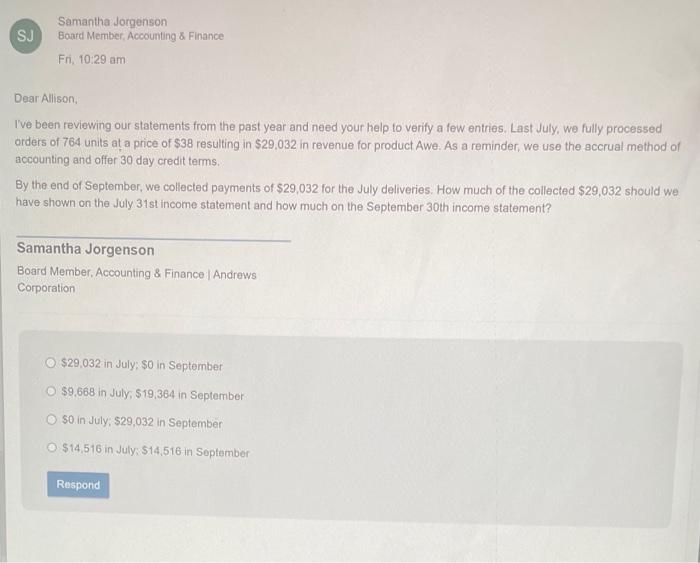

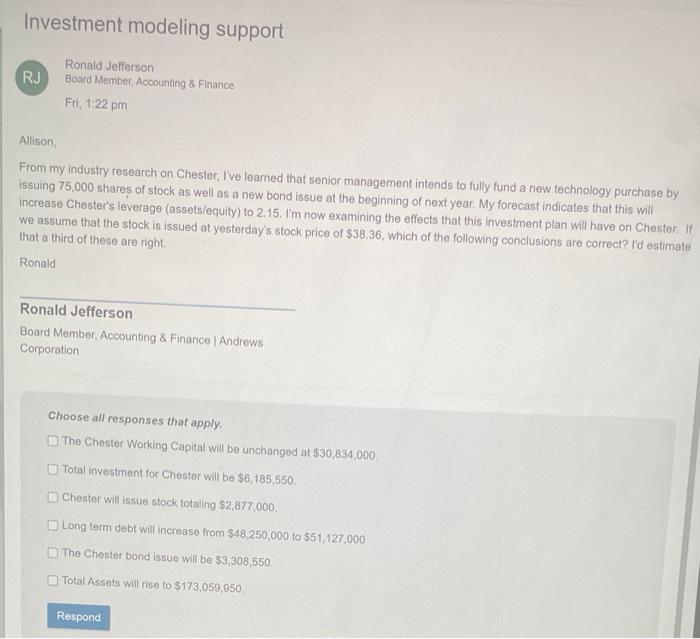

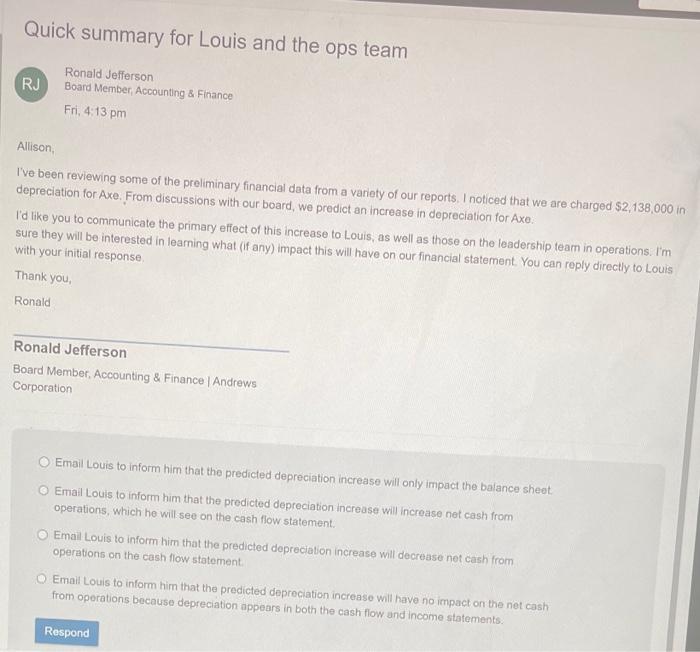

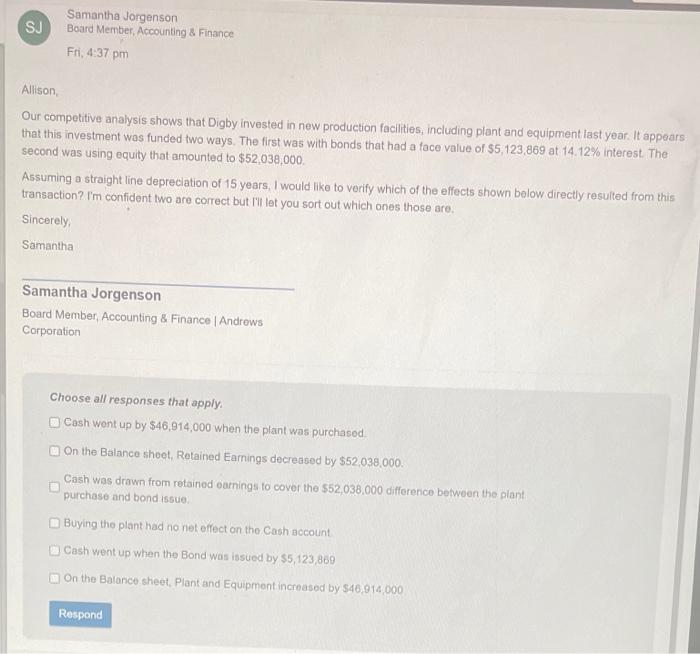

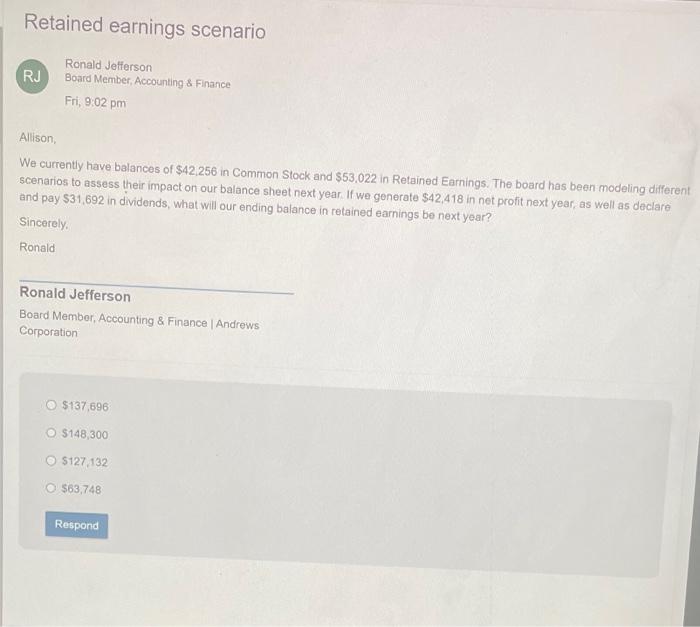

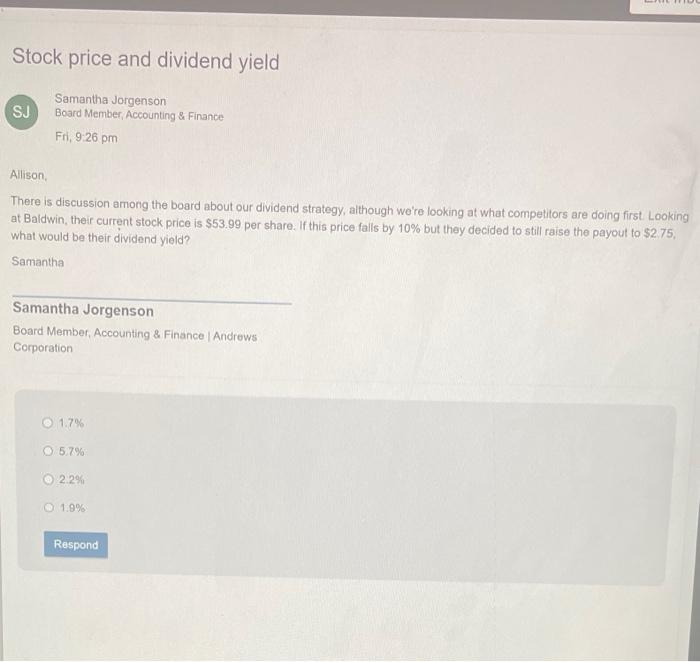

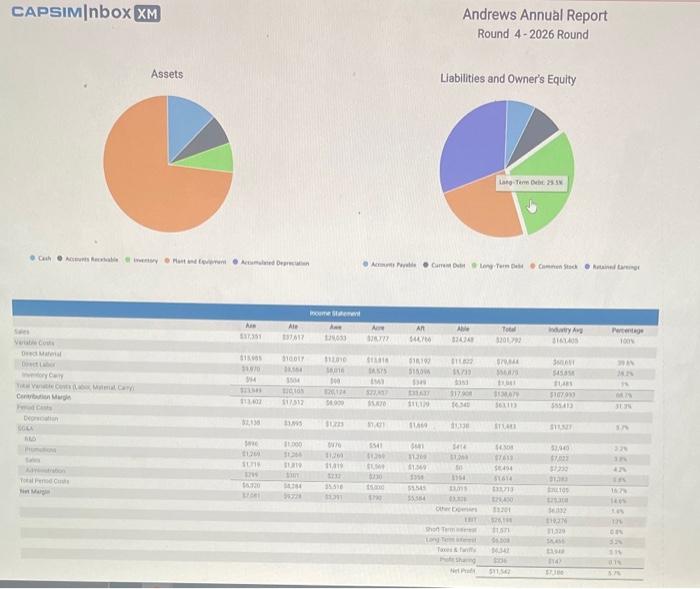

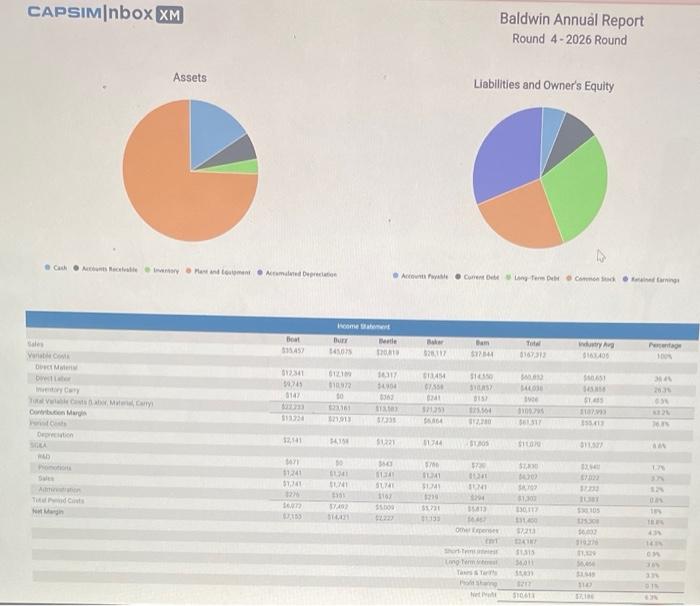

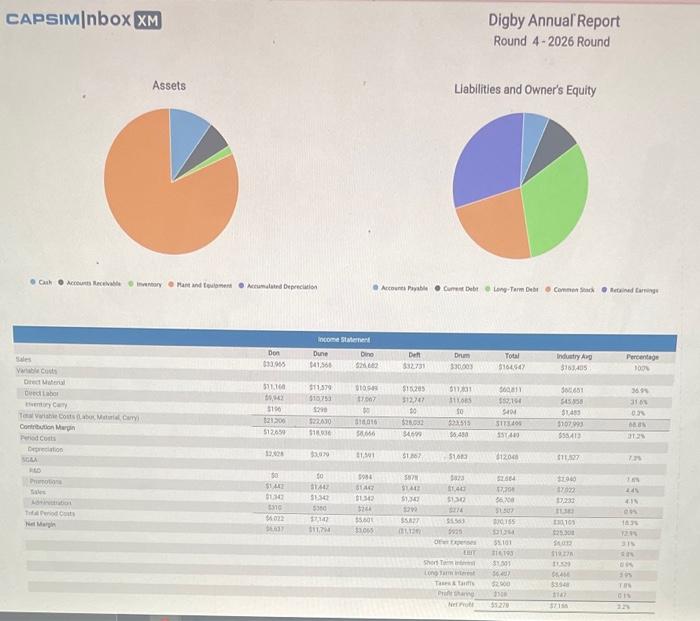

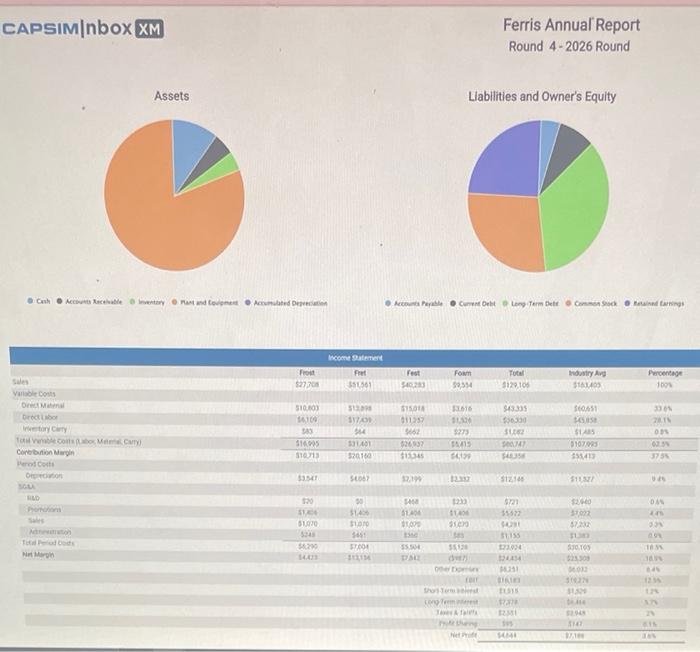

Impact of recent plant investments Samantha Jorgenson Board Member, Accounting \& Finance Fri, 8:00 am Dear Allison, I've been reviewing the recent upgrade to our manufacturing facility, which totaled $172,245. From my understanding, this investment is intended to keep our plant up-to-date for the next 10 years, after which we will likely consider another overhaul of our production equipment. I estimate that we will be able to salvage this equipment for $17,225, which is 10% of the original cost. So, In the shorter term, my question is what would be the book value of this purchase after its first year of use? You can exclude ail other plant and equipment and follow generally accepted (FASB) accounting principles. Best, Sam Samantha Jorgenson Board Member, Accounting \& Finance| Andrews Corporation $158,465 $139,518 $156,743 $146.408 Samantha Jorgenson Board Member, Accounting 8 Finance Fri, 10:29 am Dear Allison, I've been reviewing our statements from the past year and need your help to verify a few entries. Last July, we fully processed orders of 764 units at a price of $38 resulting in $29.032 in revenue for product Awe. As a reminder, we use the accrual method of accounting and offer 30 day credit terms. By the end of September, we collected payments of $29,032 for the July deliveries. How much of the collected $29,032 should we have shown on the July 31 st income statement and how much on the September 30th income statement? Samantha Jorgenson Board Member, Accounting \& Finance|Andrews Corporation $29,032 in July; $0 in September $9.668 in July, $19,364 in September \$0. in July; $29,032 in September $14,516 in July: $14,516 in September Investment modeling support Ronald Jefferson Board Member, Accounting \& Flaance Fri, 1:22 pm Allison, From my industry research on Chester, I've learned that senior management intends to fully fund a new technology purchase by issuing 75,000 shares of stock as well as a new bond issue at the beginning of next year. My forecast indicates that this will increase Chester's leverage (assetslequity) to 2.15. I'm now examining the effects that this investment plan will have on Chester. If we assume that the stock is issued at yesterday's stock price of $38,36, which of the following conclusions are correct? I'd estimate that a third of these are right: Ronaid Ronald Jefferson Board Member, Accounting \& Finance | Andrews Corporation Choose all responses that apply. The Chester Working Capital will be unchanged at $30,834,000. Total investment for Chester will be $6,185,550, Chester will issue stock totaling $2,877,000. Long term debt will increase from $48,250,000 to $51,127,000 The Chester bond issue will be $3,308,550. Total Assets will rise to $173,059,850. Quick summary for Louis and the ops team Ronald Jefferson Board Member, Accounting \& Finance Fri, 4:13 pm Allison, I've been reviewing some of the preliminary financial data from a variety of our reports. I noticed that we are charged $2,138,000 in depreciation for Axe. From discussions with our board, we predict an increase in depreciation for Axe. I'd like you to communicate the primary effect of this increase to Louis, as well as those on the leadership team in operations. I'm sure they will be interested in leaming what (if any) impact this will have on our financial statement. You can reply directly to Louis with your in Thank you, Ronald Ronald Jefferson Board Member, Accounting \& Finance I Andrews Corporation Email Louis to inform him that the predicted depreciation increase will only impact the balance sheet. Email Louis to inform him that the predicted depreciation increase will increase net cash from operations, which he will see on the cash flow statement. Email Louis to inform him that the predicted depreciation increase will decrease net cash from operations on the cash flow statement. Email Louis to inform him that the predicted depreciation increase will have no impact on the net cash from operations because depreciation appears in both the cash flow and income statements. SJ Board Member, Accounting \& Finance Fri, 4:37 pm Allison, Our competitive analysis shows that Digby invested in new production facilities, including plant and equipment last year. It appears that this investment was funded two ways. The first was with bonds that had a face value of $5,123.869 at 14.12% interest. The second was using equity that amounted to $52,038,000. Assuming a straight line depreclation of 15 years, I would like to verify which of the effects shown below directly resulted from this transaction? I'm confident two are correct but IIl let you sort out which ones those are. Sincerely, Samantha Samantha Jorgenson Board Member, Accounting \& Finance |Andrews Corporation Choose all responses that apply. Cash went up by $46,914,000 when the plant was purchased On the Balance sheet, Relained Earnings decreased by $52,038,000. Cash was drawn from retained earnings to cover the $52,038,000 difference between the plant. purchase and bond issue. Buying the plant had no net effect on the Cash account Cash went up when the Bond was issued by $5,123,869 On the Balance sheet, Plant and Equipment increased by $46,914,000 Ronald Jefferson Board Member, Accounting \& Finance Fri, 9.02pm Allison, We currently have balances of $42,256 in Common Stock and $53.022 in Retained Earnings. The board has been modeling different scenarios to assess their impact on our balance sheet next year. If we generate $42,418 in net profit next year, as well as declare and pay $31,692 in dividends, what will our ending balance in retained earnings be next year? Sincerely. Ronald $137,696 5148,300 $127,132 $63,748 Stock price and dividend yield Samantha Jorgenson Board Member, Accounting \& Finance Fir, 9:26 pm Allison, There is discussion among the board about our dividend strategy, although we're looking at what competitors are doing first. Looking at Baldwin, their current stock price is $53.99 per share. If this price falls by 10% but they decided to still raise the payout to $2.75, what would be their dividend yield? Samantha Samantha Jorgenson Board Member, Accounting \& Finance|Andrews Corporation 1.7% 5.7% 2.2% 1.9% Llabilities and Owner's Equity 8 Eath Acrears terwalle Annwit Porelle Liabilities and Owner's Equity B Cank Medand Mecolestion Nramulivel Depereiatie Assets Liabilities and Owner's Equity Llabilities and Owner's Equity Natumaluind Depectation Liabilities and Owner's Equity APSIM|nbox XM Ferris Annual Report Round 4-2026 Round Llabilities and Owner's Equity