1.

2

2 3

3 4

4 5

5 6

6 7

7

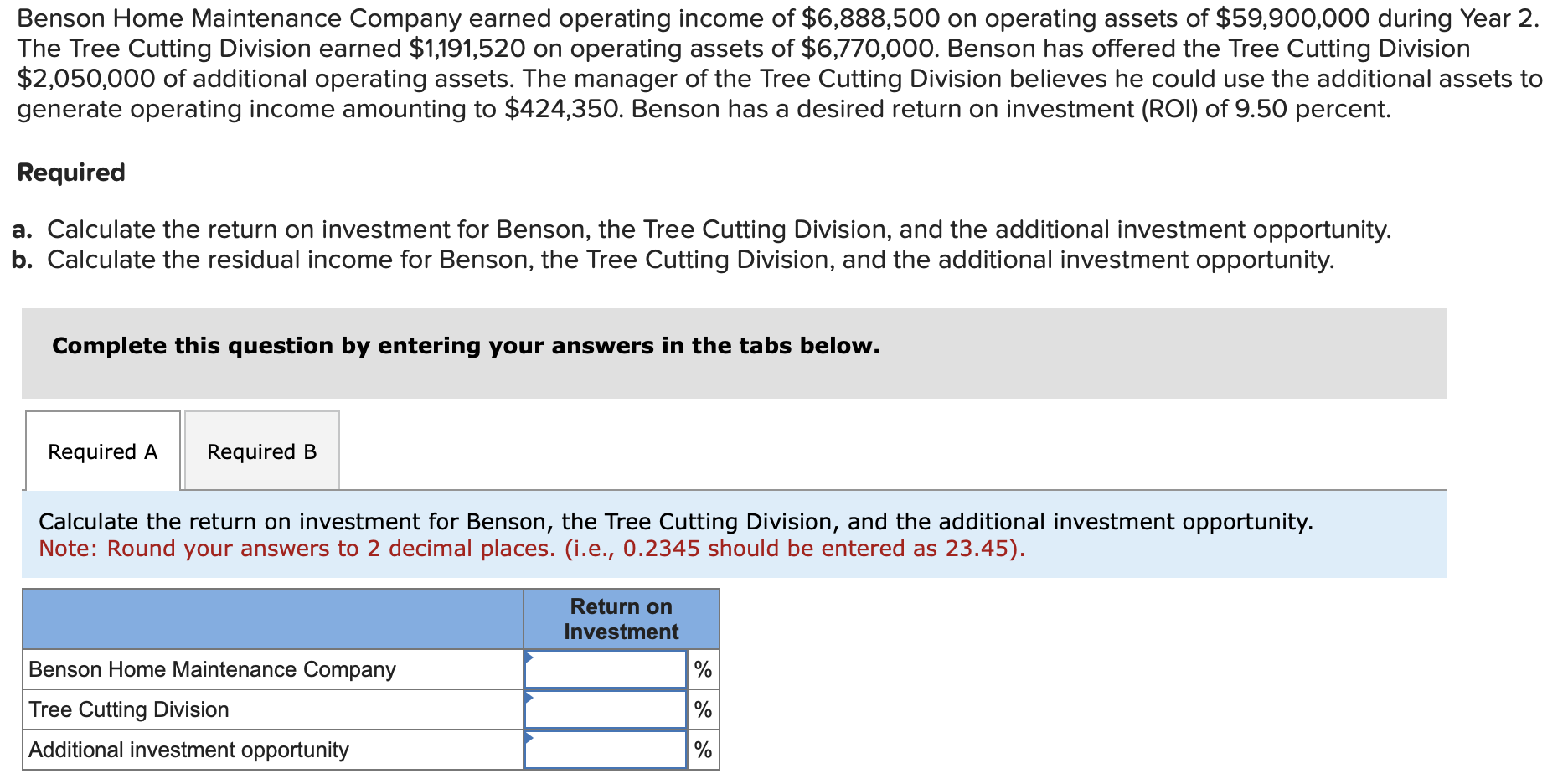

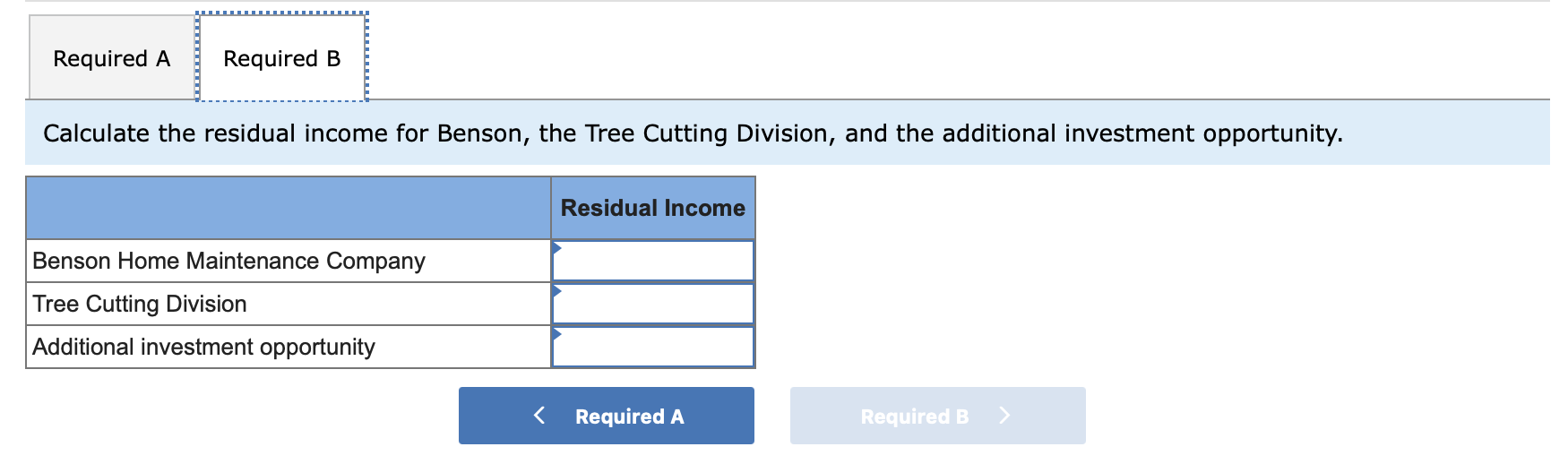

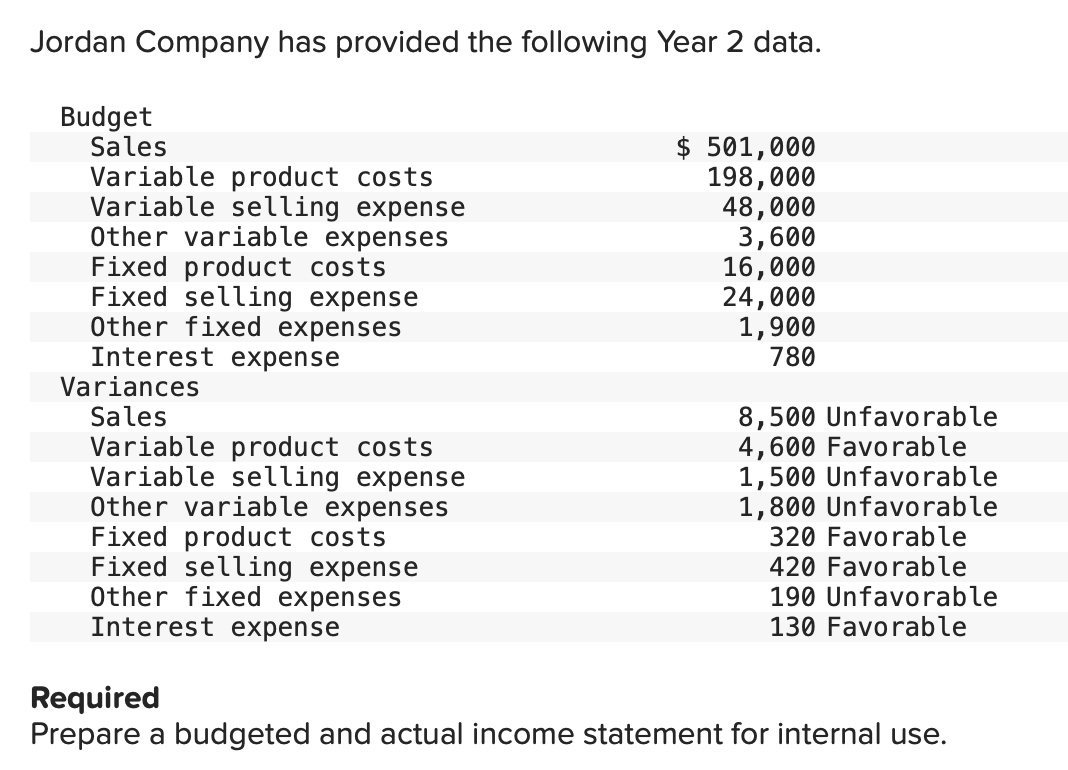

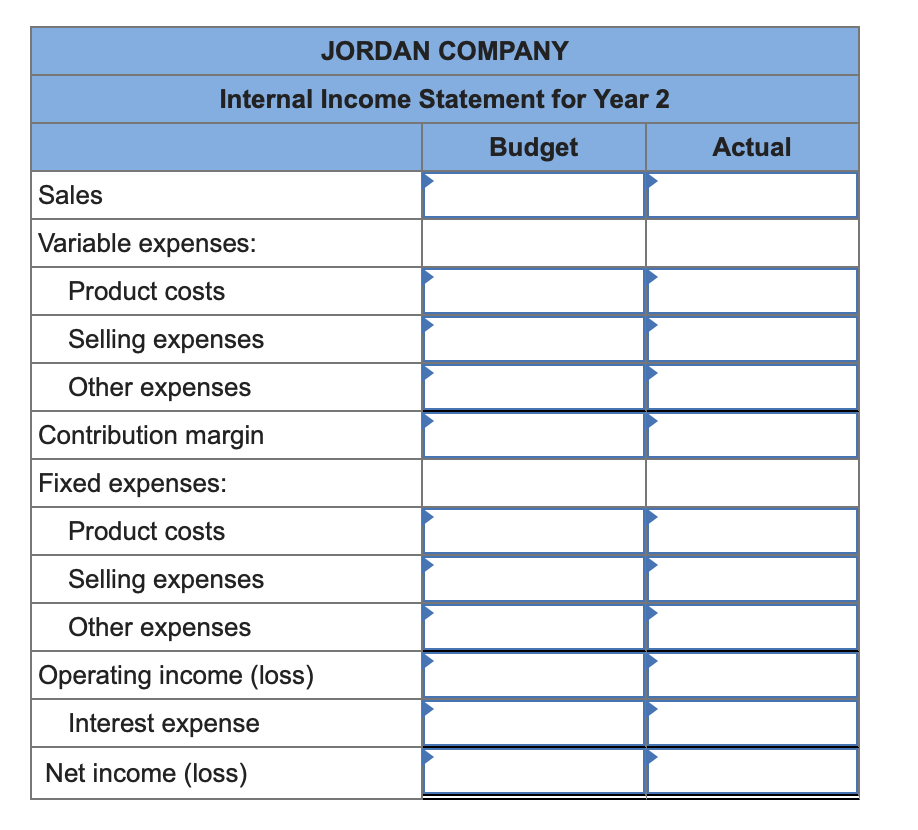

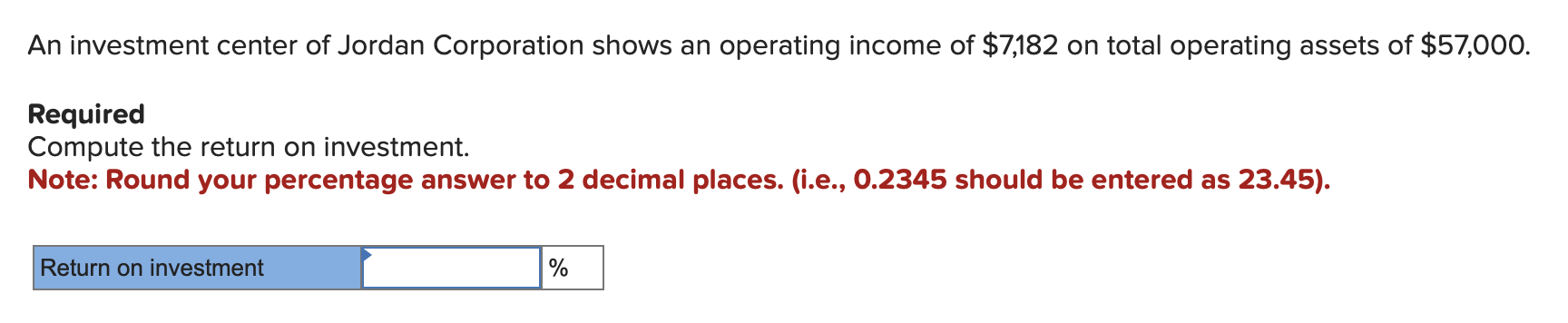

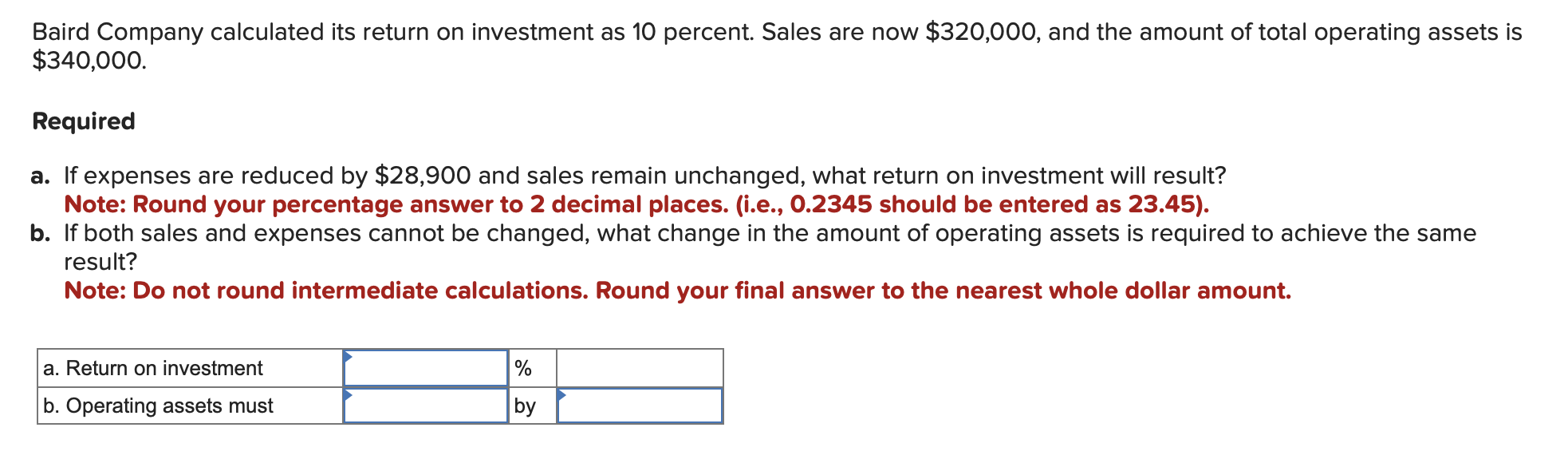

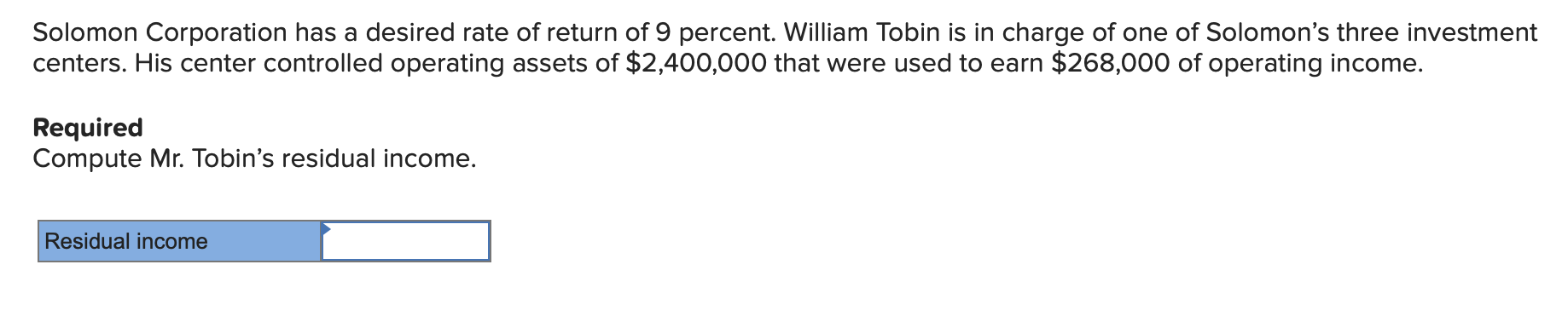

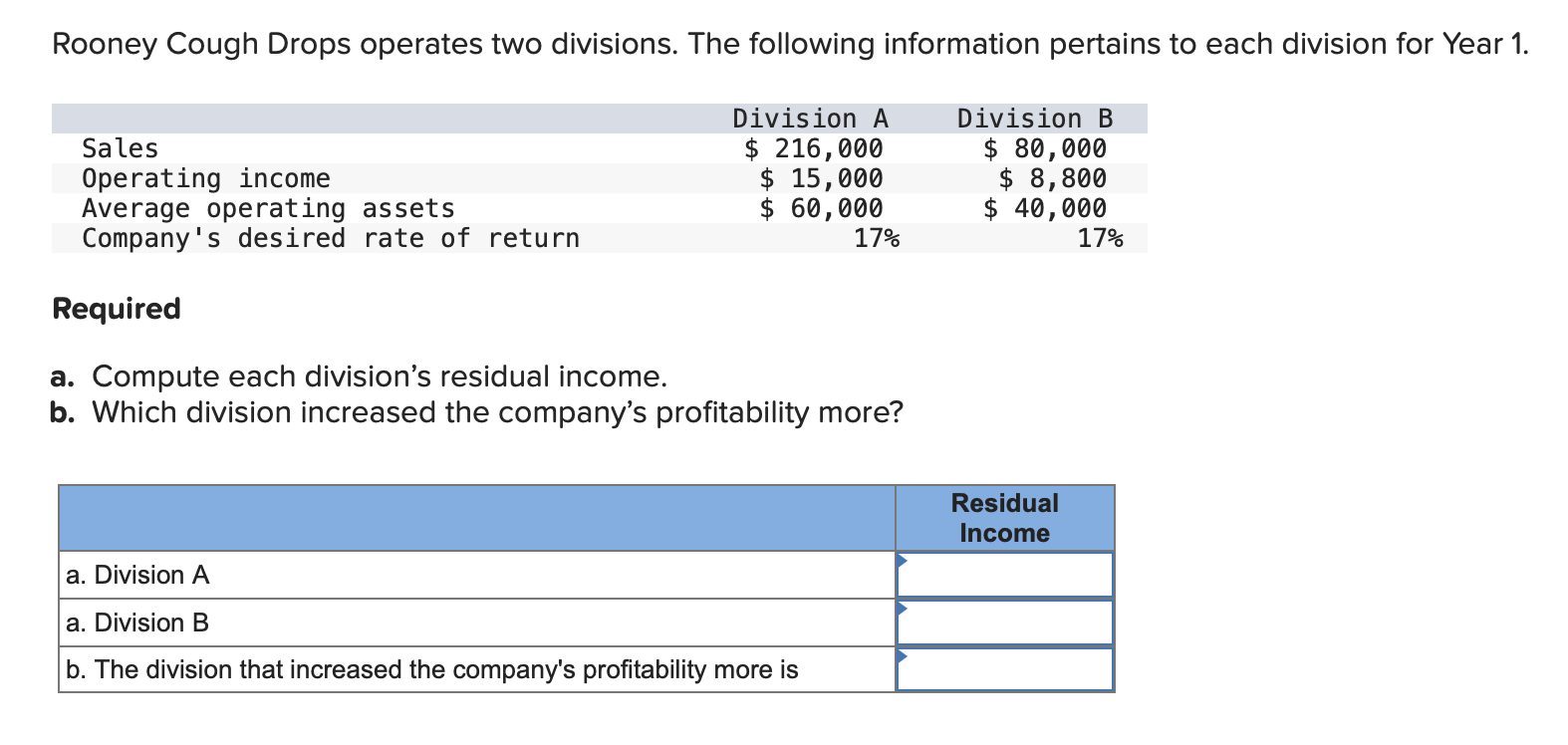

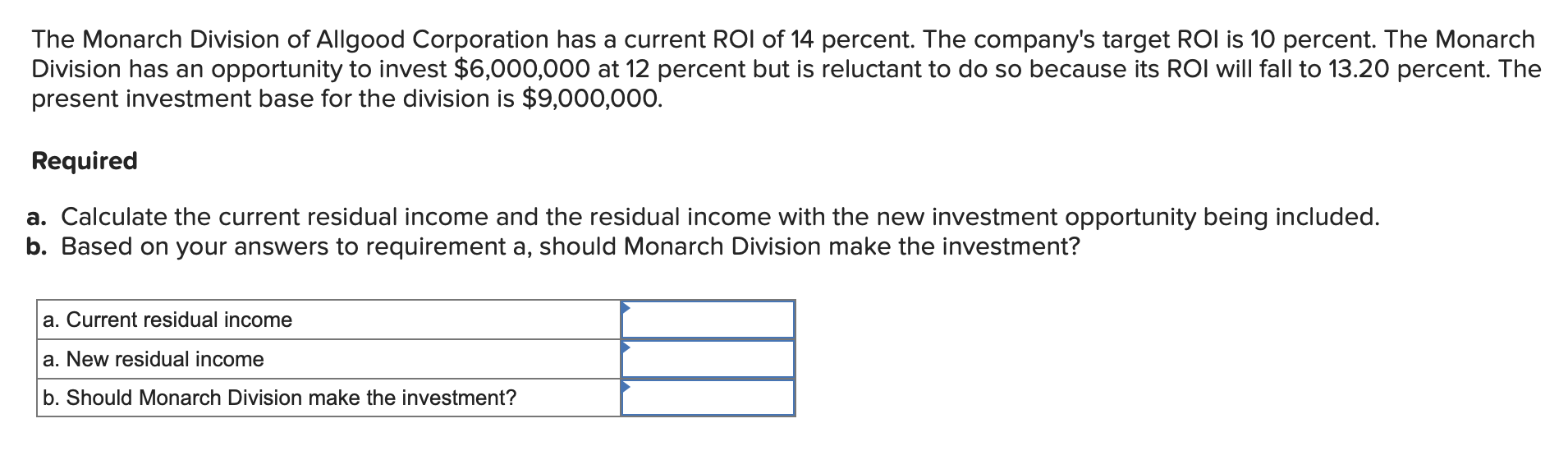

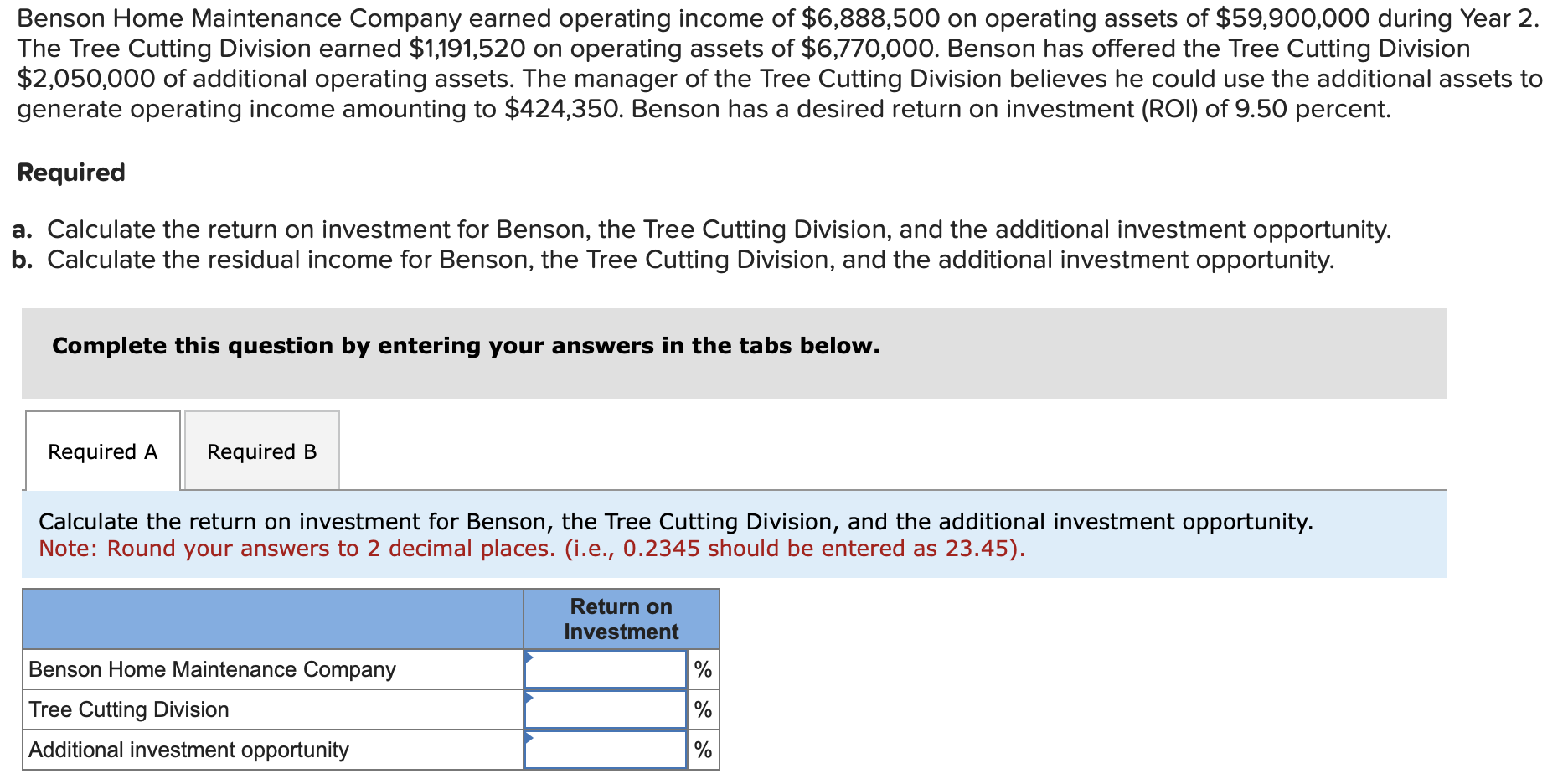

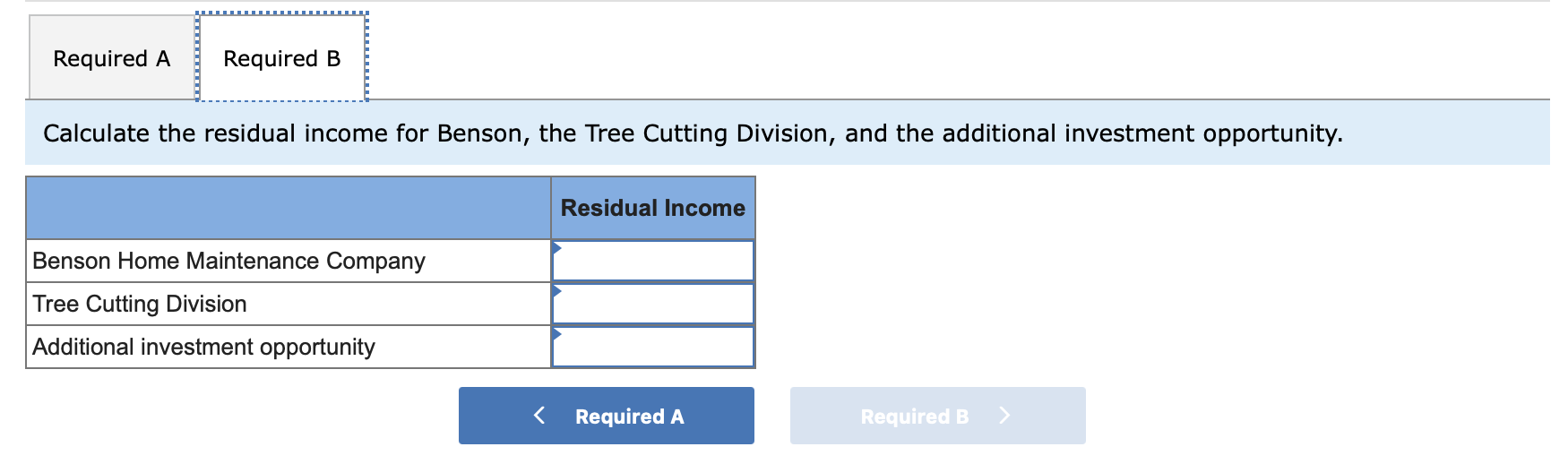

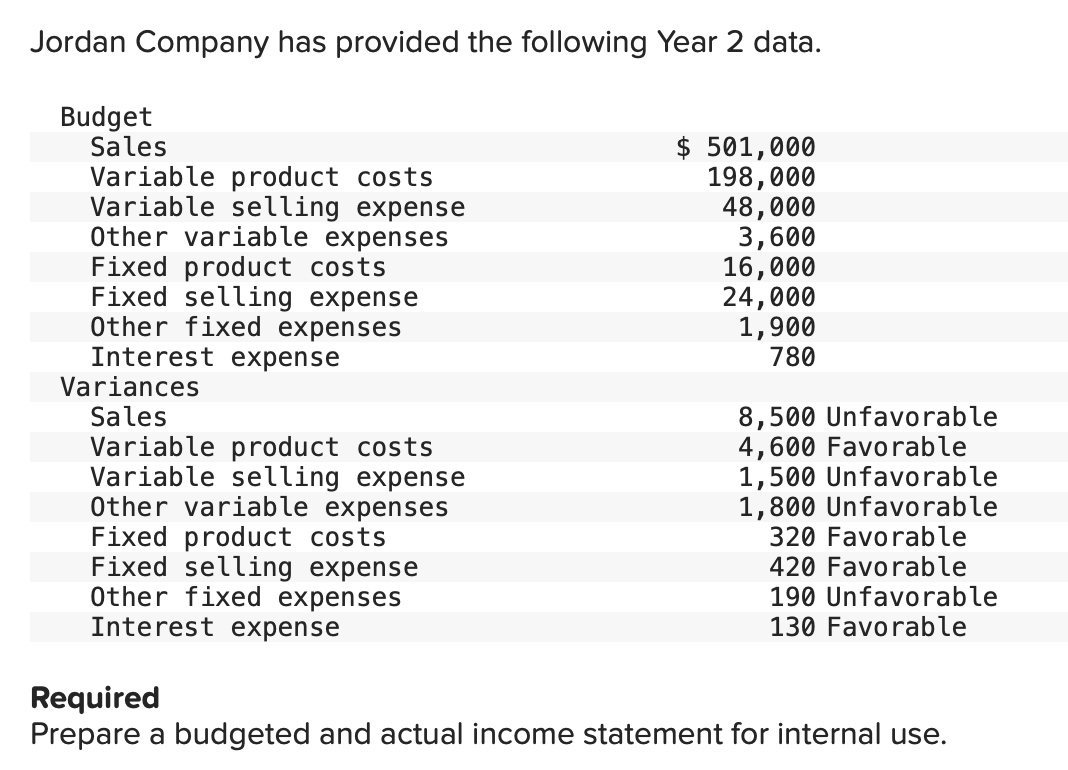

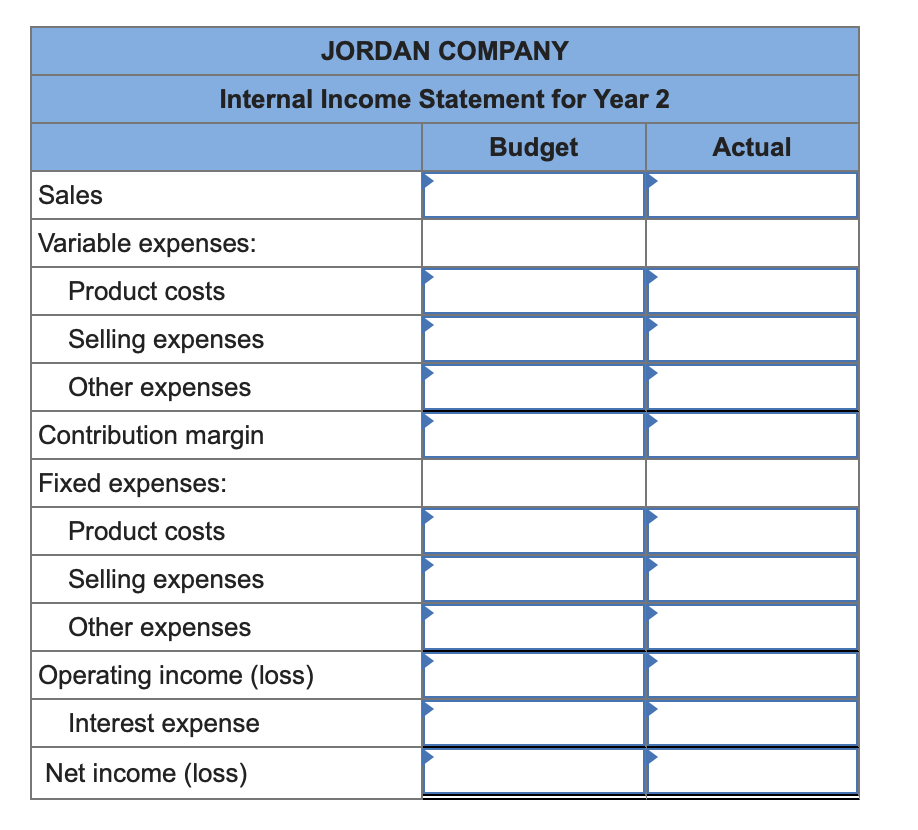

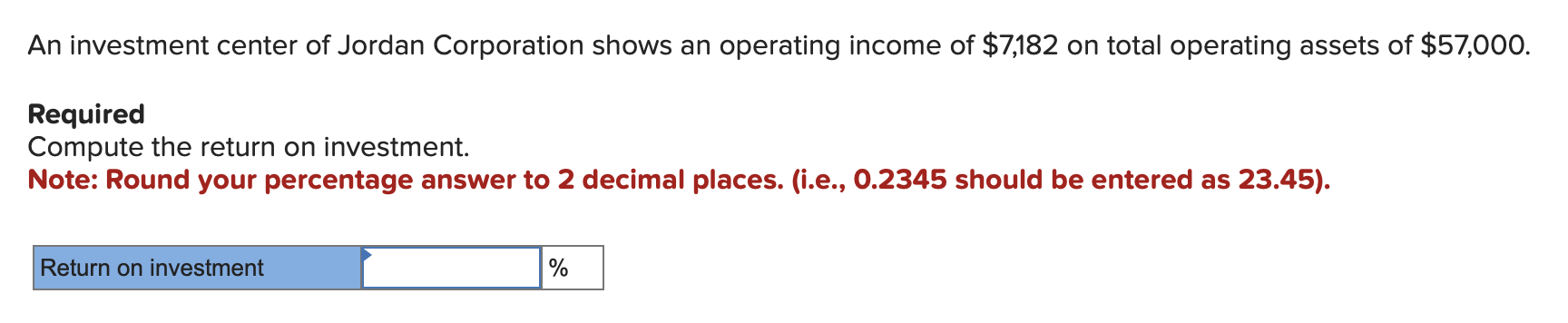

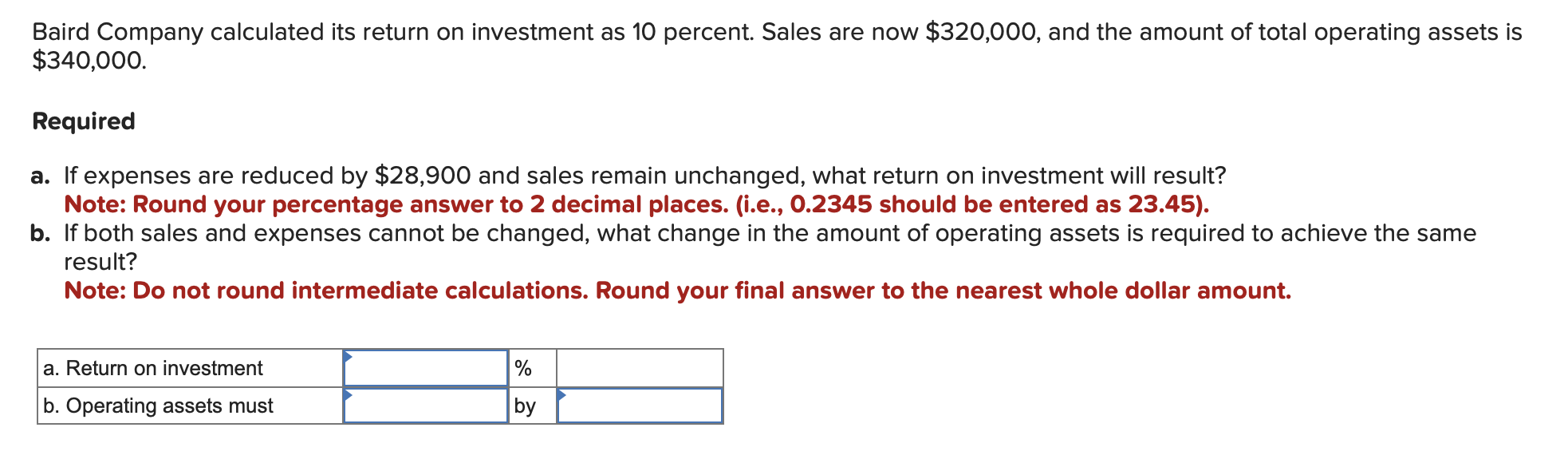

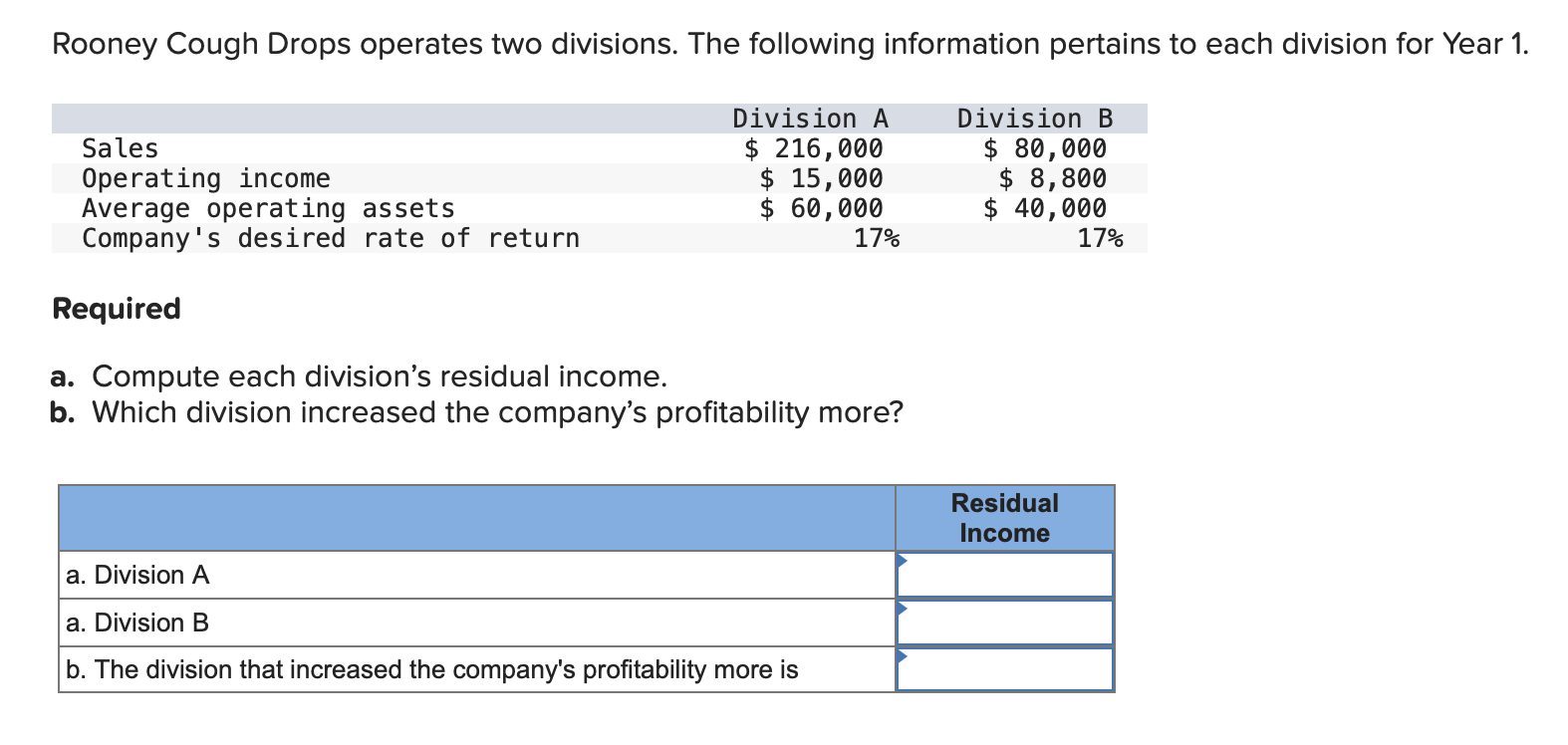

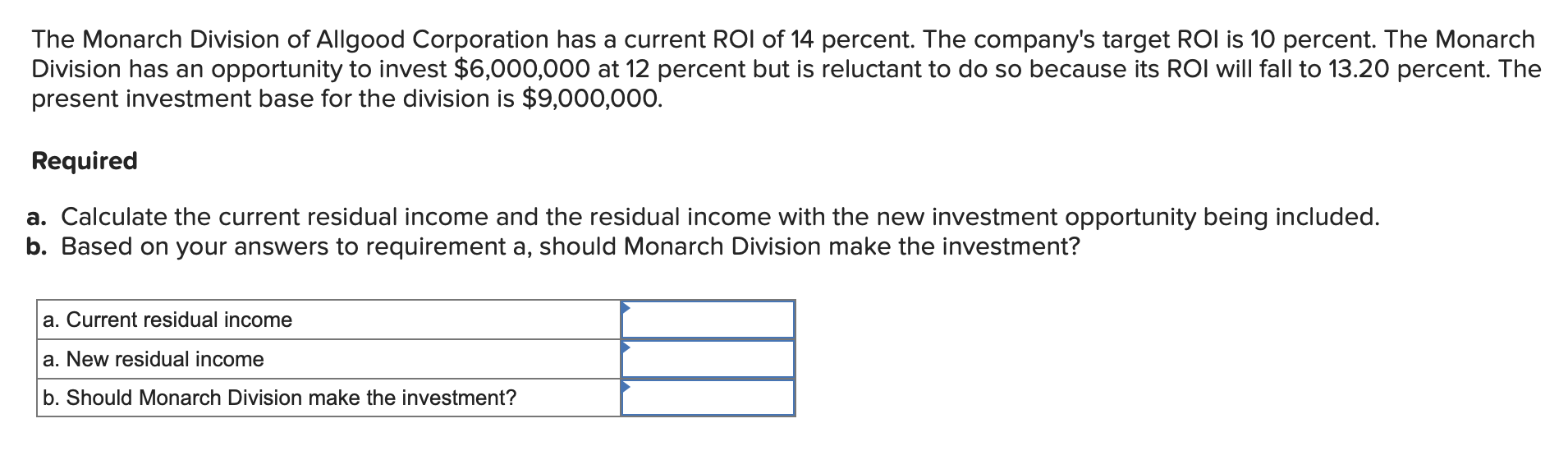

Jordan Company has provided the following Year 2 data. Required Prepare a budgeted and actual income statement for internal use. JORDAN COMPANY Internal Income Statement for Year 2 An investment center of Jordan Corporation shows an operating income of $7,182 on total operating assets of $57,000. Required Compute the return on investment. Note: Round your percentage answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45). Baird Company calculated its return on investment as 10 percent. Sales are now $320,000, and the amount of total operating assets is $340,000. Required a. If expenses are reduced by $28,900 and sales remain unchanged, what return on investment will result? Note: Round your percentage answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45). b. If both sales and expenses cannot be changed, what change in the amount of operating assets is required to achieve the same result? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. Solomon Corporation has a desired rate of return of 9 percent. William Tobin is in charge of one of Solomon's three investment centers. His center controlled operating assets of $2,400,000 that were used to earn $268,000 of operating income. Required Compute Mr. Tobin's residual income. Rooney Cough Drops operates two divisions. The following information pertains to each division for Year 1. Required a. Compute each division's residual income. b. Which division increased the company's profitability more? The Monarch Division of Allgood Corporation has a current ROI of 14 percent. The company's target ROI is 10 percent. The Monarch Division has an opportunity to invest $6,000,000 at 12 percent but is reluctant to do so because its ROI will fall to 13.20 percent. The present investment base for the division is $9,000,000. Required a. Calculate the current residual income and the residual income with the new investment opportunity being included. b. Based on your answers to requirement a, should Monarch Division make the investment? Benson Home Maintenance Company earned operating income of $6,888,500 on operating assets of $59,900,000 during Year The Tree Cutting Division earned $1,191,520 on operating assets of $6,770,000. Benson has offered the Tree Cutting Division $2,050,000 of additional operating assets. The manager of the Tree Cutting Division believes he could use the additional assets generate operating income amounting to $424,350. Benson has a desired return on investment (ROI) of 9.50 percent. Required a. Calculate the return on investment for Benson, the Tree Cutting Division, and the additional investment opportunity. b. Calculate the residual income for Benson, the Tree Cutting Division, and the additional investment opportunity. Complete this question by entering your answers in the tabs below. Calculate the return on investment for Benson, the Tree Cutting Division, and the additional investment opportunity. Note: Round your answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45). Calculate the residual income for Benson, the Tree Cutting Division, and the additional investment opportunity

2

2 3

3 4

4 5

5 6

6 7

7