1

2

3

4

4

5

5

6

6

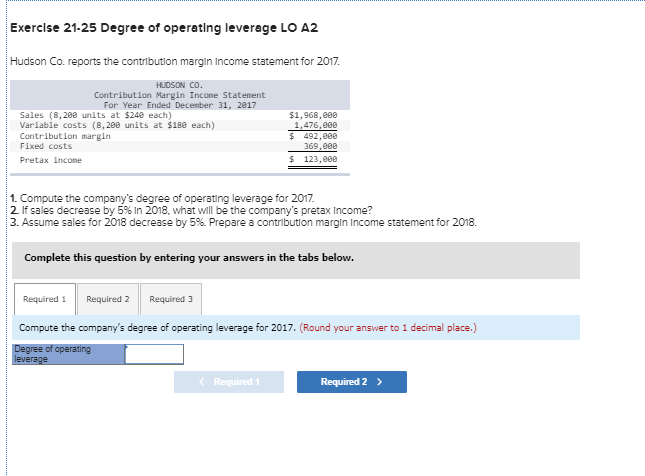

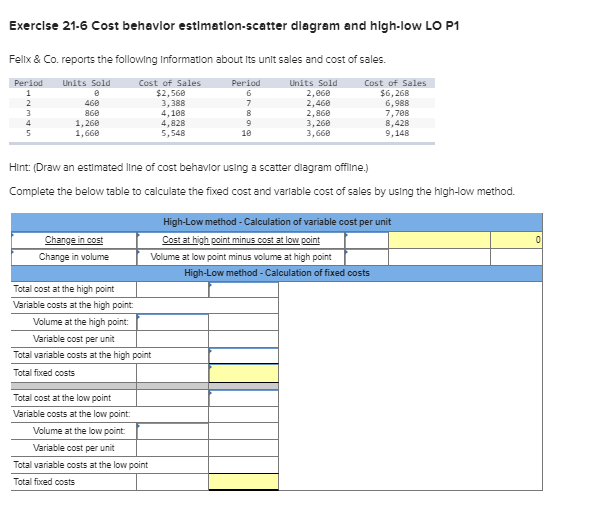

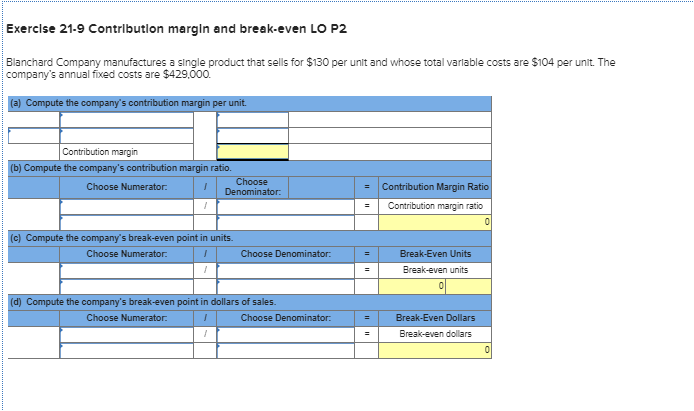

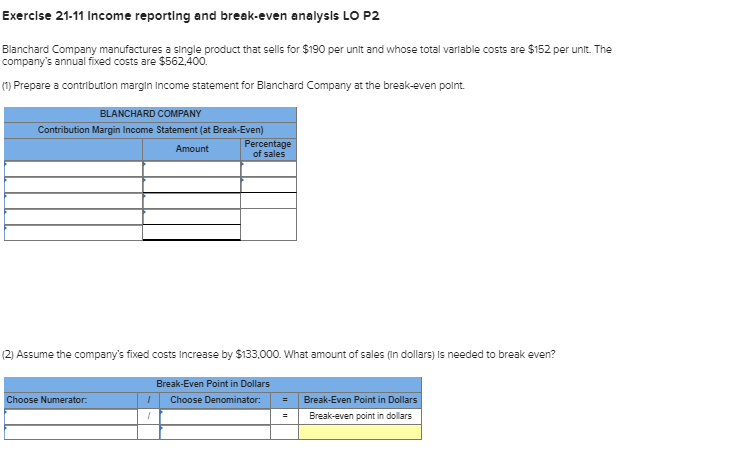

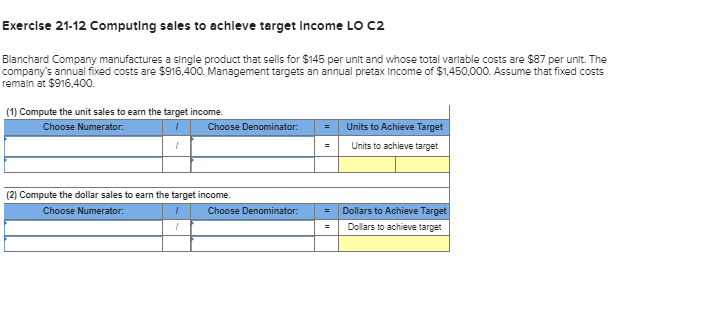

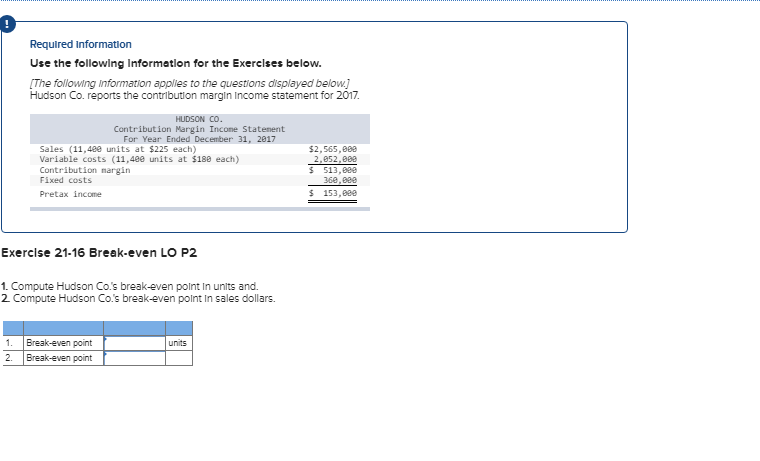

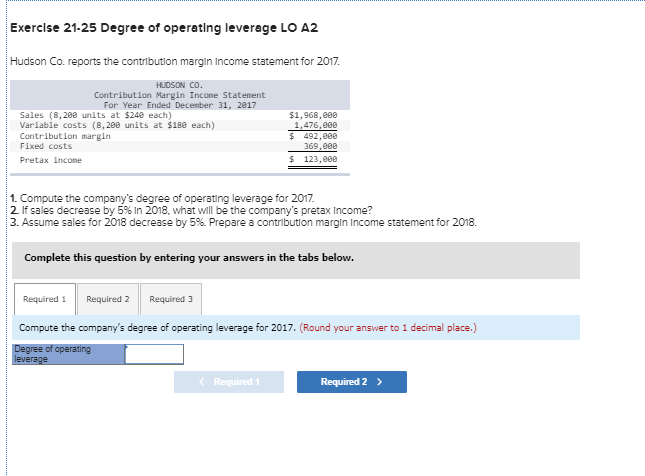

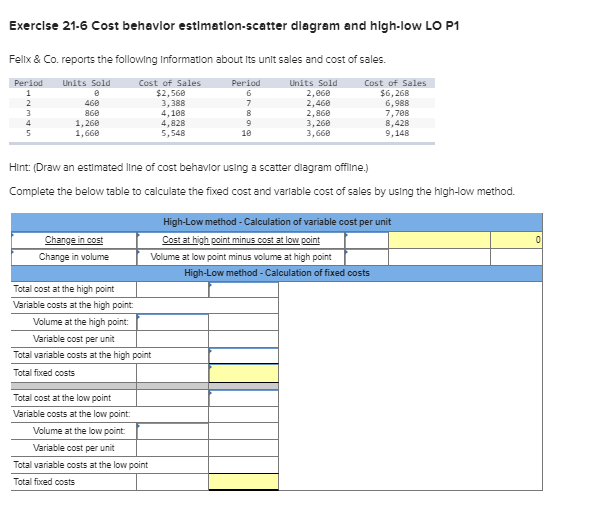

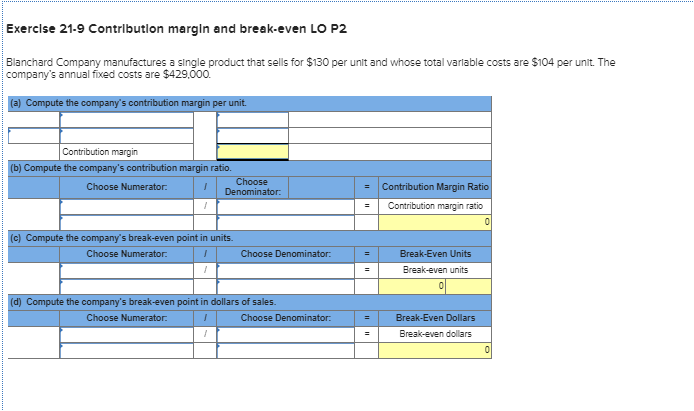

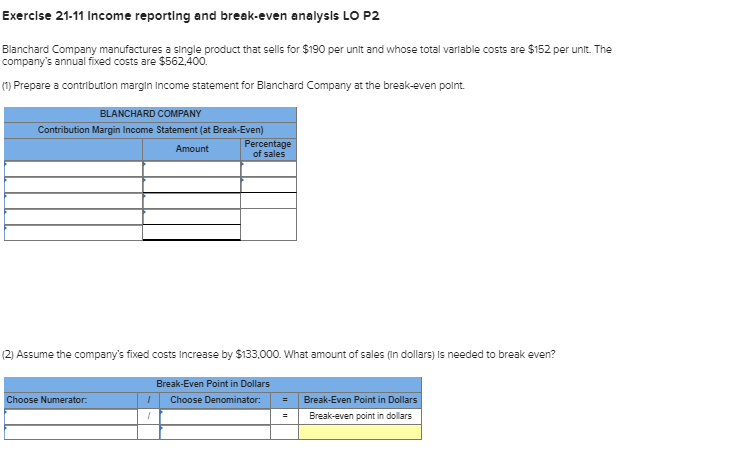

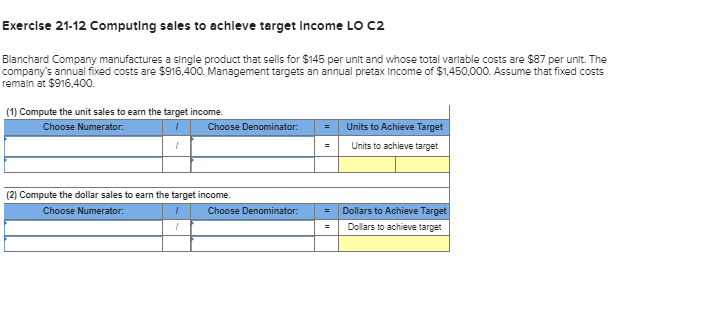

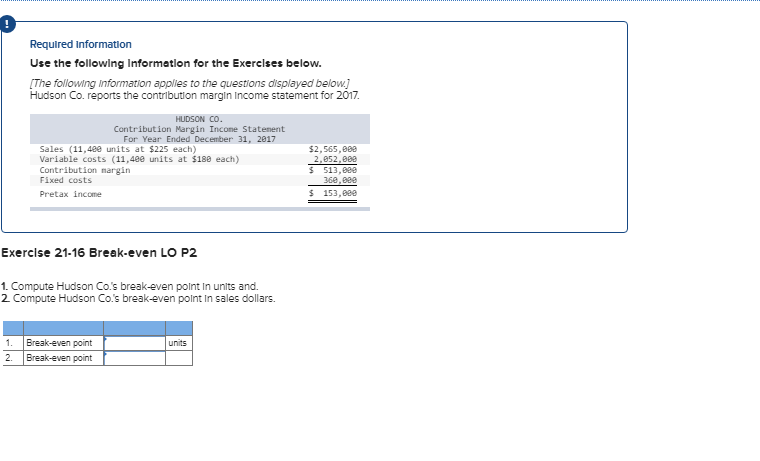

Exercise 21-6 Cost behavior estimation-scatter diagram and high-low LO P1 Fellx & Co. reports the following Information about Its unit sales and cost of sales. Period Units Sold Cost of Sales Period Units Sold Cost of Sales $6,268 6,988 7,788 8,428 9,148 $2,560 3,388 2,068 2,460 2,868 3,260 3,660 2 460 7 860 3. 4.108 8 1,260 1,660 4,828 5,548 10 5 Hint: (Draw an estimated line of cost behavlor using a scatter diagram offline.) Complete the below table to calculate the fixed cost and varlable cost of sales by usinq the highlow method. High-Low method - Calculation of variable cost per unit Change in cost Cost at high point minus cost at low point Change in volume Volume at low point minus volume at high point High-Low method - Calculation of fixed costs Total cost at the high point Variable costs at the high point Volume at the high point Variable cost per unit Total variable costs at the high point Total fixed costs Total cost at the low point Variable costs at the low point Volume at the low point Variable cost per unit Total variable costs at the low point Total fixed costs Exercise 21-9 Contribution margin and break-even LO P2 Blanchard Company manufactures a single product that sells for $130 per unit and whose total varlable costs are $104 per unit. The company's annual fixed costs are $429,000. (a) Compute the company's contribution margin per unit. Contribution margin (b) Compute the company's contribution margin ratio. Choose Denominator Choose Numerator Contribution Margin Ratio Contribution margin ratio 0 (c) Compute the company's break-even point in units. Choose Numerator: Choose Denominator: Break-Even Units Break-even units 0 (d) Compute the company's break-even point in dollars of sales. Choose Denominator: Choose Numerator Break-Even Dollars Break-even dollars 0 Exercise 21-11 Income reporting and break-even analysis LO P2 Blanchard Company manufactures a single product that sells for $190 per unit and whose total varlable costs are $152 per unit. The company's annual fixed costs are $562,400 (1) Prepare a contributlon margln Income statement for Blanchard Company at the break-even point BLANCHARD COMPANY Contribution Margin Income Statement (at Break-Even) Percentage of sales Amount (2) Assume the company's fixed costs Increase by $133,000. What amount of sales (in dollars) Is needed to break even? Break-Even Point in Dollars Choose Denominator: Choose Numerator Break-Even Point in Dollars Break-even point in dollars - Exercise 21-12 Computing sales to achieve target Income LO C2 Blanchard Company manufactures a single product that sells for $145 per unlt and whose total varlable costs are $87 per unit. The company's annual fixed costs are $916.400. Management targets an annual pretax income otf $1.450,000. Assume that fixed costs remaln at $916,400. (1) Compute the unit sales to eam the target income. Units to Achieve Target Choose Numerator: Choose Denominator: Units to achieve target (2) Compute the dollar sales to earn the target income. Dollars to Achieve Target Choose Numerator: Choose Denominator: Dollars to achieve target Required Information Use the following Information for the Exerclses below. The following Information applies to the questions displayed below.] Hudson Co. reports the contributlon margin Income statement for 2017 HUDSON CO. Contribution Margin Incone Statenent For Year Ended December 31, 2817 Sales (11,480 units at $225 each) Variable costs (11,480 units at $180 each) Contribution nargin Fixed costs $2,565,088 2.052.000 513,000 360,00e 153,000 Pretax income Exercise 21-16 Break-even LO P2 1. Compute Hudson Co.s break-even point in units and. 2 Compute Hudson Co.s break-even polnt In sales dollars. 1. Break-even point units 2. Break-even point Exercise 21-25 Degree of operating leverage LO A2 Hudson Co. reports the contributlon margin Income statement for 2017 HUDSON CO Contribution Margin Incone Statement For Year Ended December 31, 2817 Sales (8,280 units at $240 each) Variable costs (8,200 units at $18e each) Contribution margin $1,968,e08 1.476.000 492,000 Fixed costs 369,e0e 123,e00 Pretax incone 1. Compute the company's degree of operating leverage for 2017 2 If sales decrease by 5% In 2018, what will be the company's pretax Income? 3. Assume sales for 2018 decrease by 5 % Prepare a contribution margin Income statement for 2018. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the company's degree of operating leverage for 2017. (Round your answer to 1 decimal place.) Degree of operating leverage

4

4 5

5 6

6