Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. 4. 5. 6. Pompeii Pizza Club owns three identical restaurants popular for their specialty pizzas. Each restaurant has a debt equity ratio

1.

2.

3.

4.

5.

6.

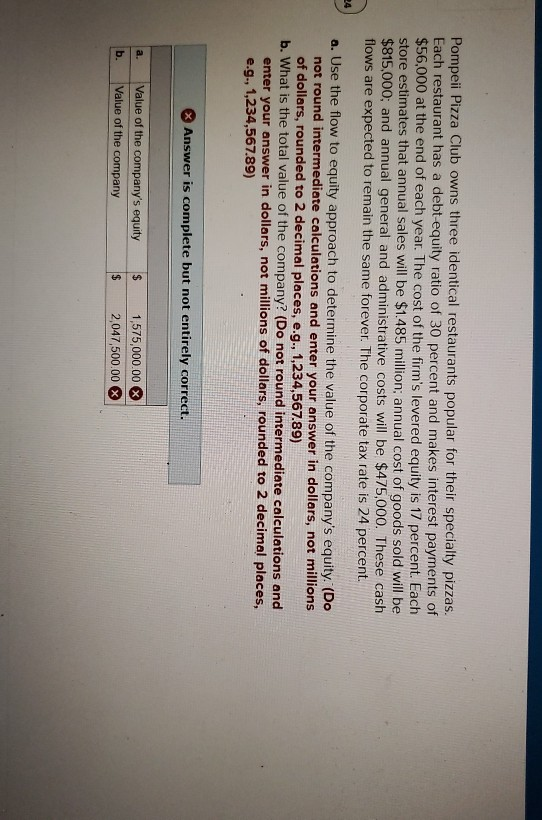

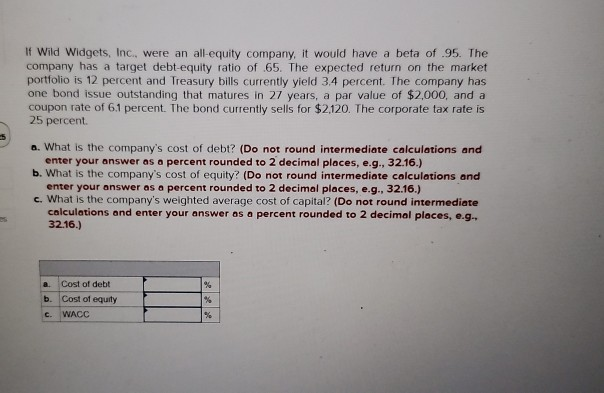

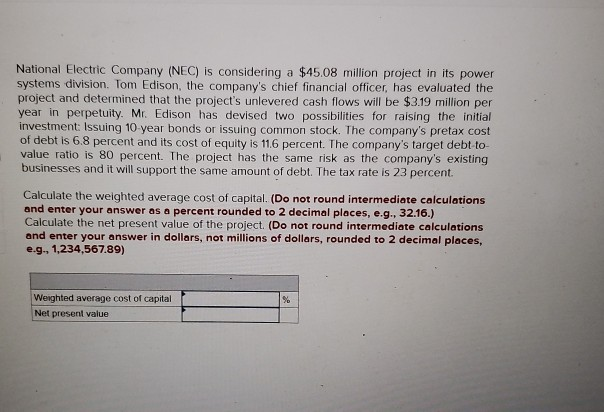

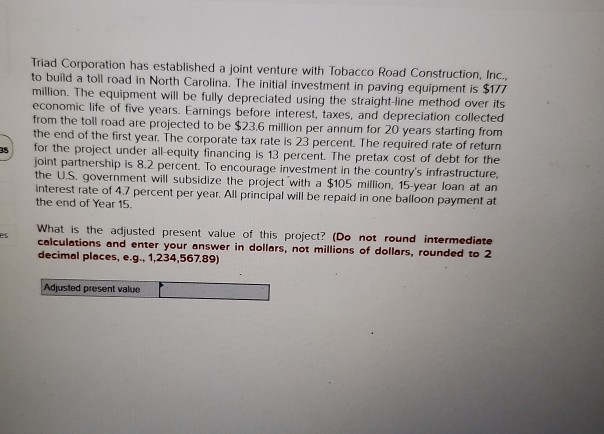

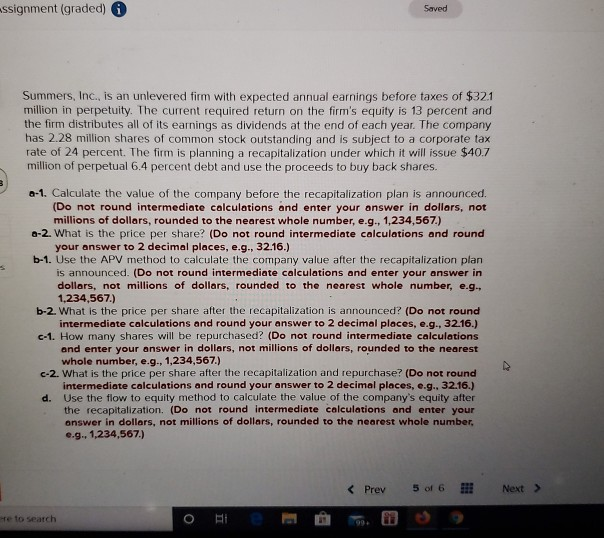

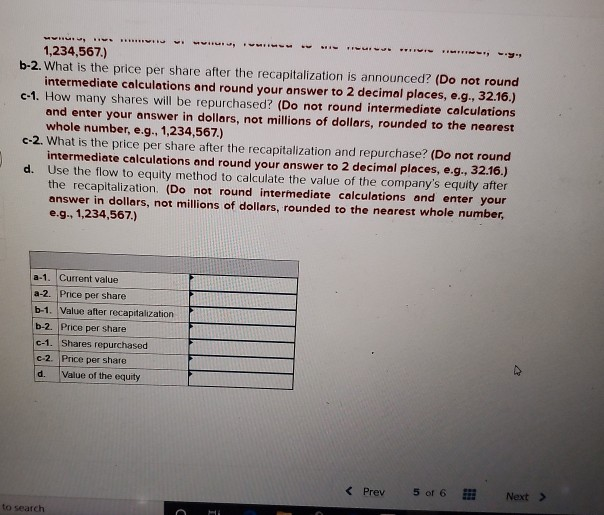

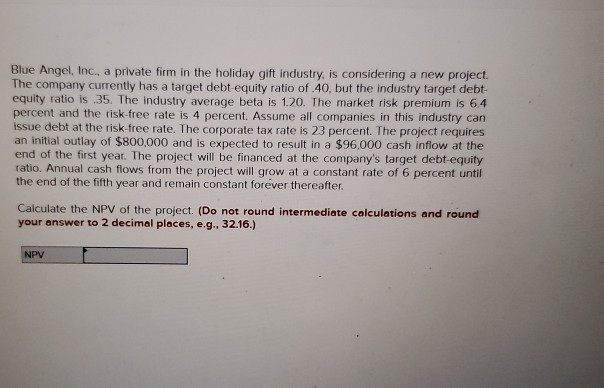

Pompeii Pizza Club owns three identical restaurants popular for their specialty pizzas. Each restaurant has a debt equity ratio of 30 percent and makes interest payments of $56,000 at the end of each year. The cost of the firm's levered equity is 17 percent. Each store estimates that annual sales will be $1.485 million; annual cost of goods sold will be $815,000, and annual general and administrative costs will be $475,000. These cash flows are expected to remain the same forever. The corporate tax rate is 24 percent. a. Use the flow to equity approach to determine the value of the company's equity. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) b. What is the total value of the company? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) Answer is complete but not entirely correct. Value of the company's equity Value of the company b. $ $ 1,575,000.00 2,047,500.00 If Wild Widgets, Inc., were an all-equity company, it would have a beta of.95. The target debt-equity ratio of 65. The expected return on the market portfolio is 12 percent and Treasury bills currently yield 3.4 percent. The company has one bond issue outstanding that matures in 27 years, a par value of $2,000, and a coupon rate of 6.1 percent. The bond currently sells for $2.120. The corporate tax rate is 25 percent. Q. What is the company's cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the company's cost of equity? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the company's weighted average cost of capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e... 32.16.) a Cost of debt b. Cost of equity c. WACC National Electric Company (NEC) is considering a $45.08 million project in its power systems division. Tom Edison, the company's chief financial officer, has evaluated the project and determined that the project's unlevered cash flows will be $3.19 million per year in perpetuity. Mr. Edison has devised two possibilities for raising the initial investment: Issuing 10 year bonds or issuing common stock. The company's pretax cost of debt is 6.8 percent and its cost of equity is 11.6 percent. The company's target debt-to value ratio is 80 percent. The project has the same risk as the company's existing businesses and it will support the same amount of debt. The tax rate is 23 percent. Calculate the weighted average cost of capital. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Calculate the net present value of the project. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) Weighted average cost of capital Net present value Triad Corporation has established a joint venture with Tobacco Road Construction, Inc., to build a toll road in North Carolina. The initial investment in paving equipment is $177 million. The equipment will be fully depreciated using the straight-line method over its economic life of five years. Earnings before interest, taxes, and depreciation collected from the toll road are projected to be $23.6 million per annum for 20 years starting from the end of the first year. The corporate tax rate is 23 percent. The required rate of return for the project under all-equity financing is 13 percent. The pretax cost of debt for the joint partnership is 8.2 percent. To encourage investment in the country's infrastructure, the US government will subsidize the project with a $105 million, 15 year loan at an Interest rate of 4.7 percent per year. All principal will be repaid in one balloon payment at the end of Year 15. What is the adjusted present value of this project? (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89) Adjusted present value assignment (graded) Saved Summers, Inc., is an unlevered firm with expected annual earnings before taxes of $32.1 million in perpetuity. The current required return on the firm's equity is 13 percent and the firm distributes all of its earnings as dividends at the end of each year. The company has 2.28 million shares of common stock outstanding and is subject to a corporate tax rate of 24 percent. The firm is planning a recapitalization under which it will issue $40.7 million of perpetual 6.4 percent debt and use the proceeds to buy back shares. 0-1. Calculate the value of the company before the recapitalization plan is announced. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) 0-2. What is the price per share? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-1. Use the APV method to calculate the company value after the recapitalization plan is announced. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g.. 1,234,567.) b-2. What is the price per share after the recapitalization is announced? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c-1. How many shares will be repurchased? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) c-2. What is the price per share after the recapitalization and repurchase? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) d. Use the flow to equity method to calculate the value of the company's equity after the recapitalization. (Do not round Intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e... 1,234,567.) e to search WHI 1,234,567.) b-2. What is the price per share after the recapitalization is announced? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c.1. How many shares will be repurchased? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) c-2. What is the price per share after the recapitalization and repurchase? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. Use the flow to equity method to calculate the value of the company's equity after the recapitalization. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, e.g. 1,234,567.) a-1. Current value a-2. Price per share b-1. Value after recapitalization b-2 Price per share C-1. Shares repurchased c-2. Price per share d. Value of the equity Blue Angel, Inc., a private firm in the holiday gift industry, is considering a new project. The company currently has a target debt equity ratio of 40, but the industry target debt equity ratio is 35. The industry average beta is 1.20. The market risk premium is 6.4 percent and the risk-free rate is 4 percent. Assume all companies in this industry can issue debt at the risk-free rate. The corporate tax rate is 23 percent. The project requires an initial outlay of $800,000 and is expected to result in a $96,000 cash inflow at the end of the first year. The project will be financed at the company's target debt-equity ratio. Annual cash flows from the project will grow at a constant rate of 6 percent until the end of the fifth year and remain constant forever thereafter Calculate the NPV of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started