1)

2)

3)

4)

5)

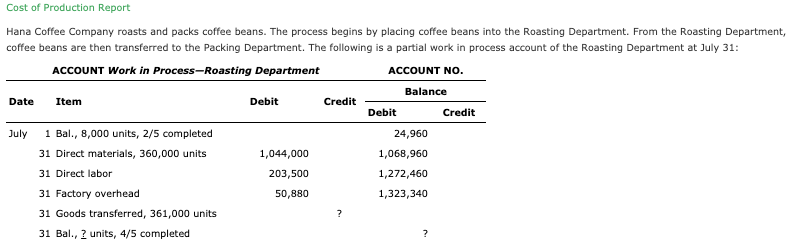

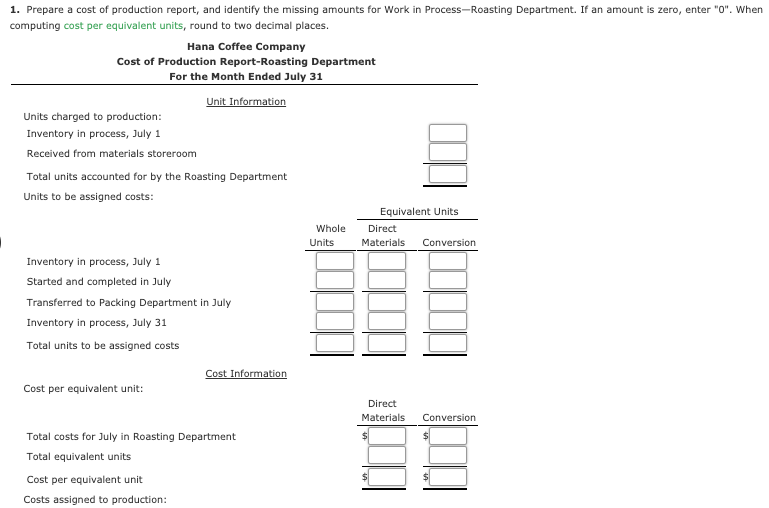

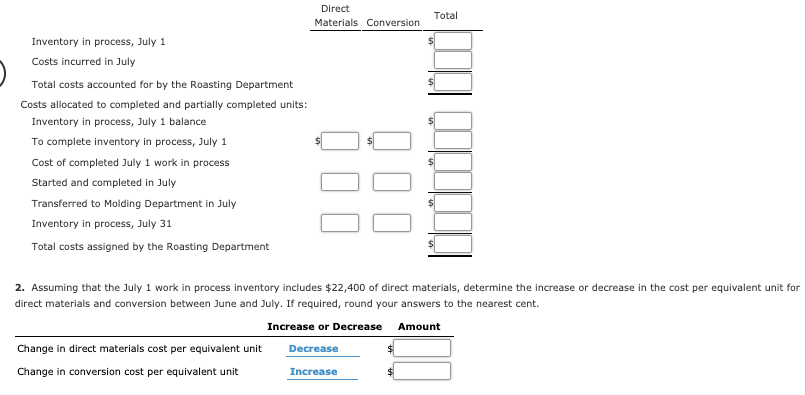

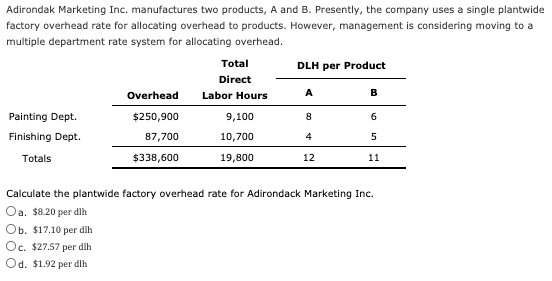

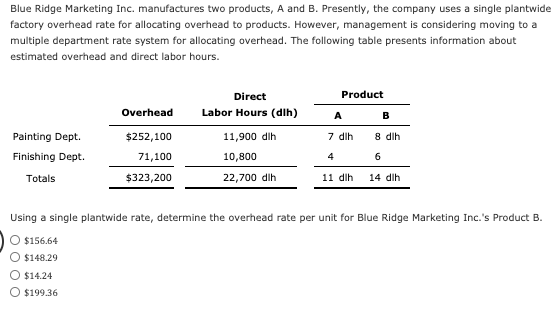

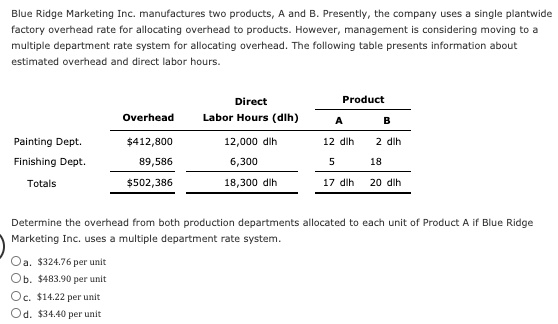

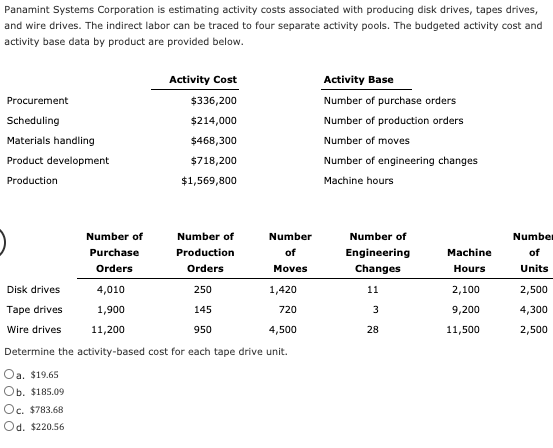

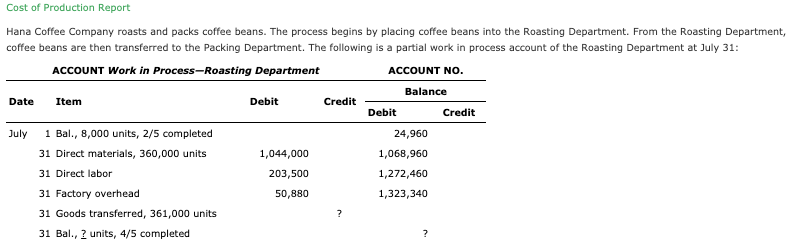

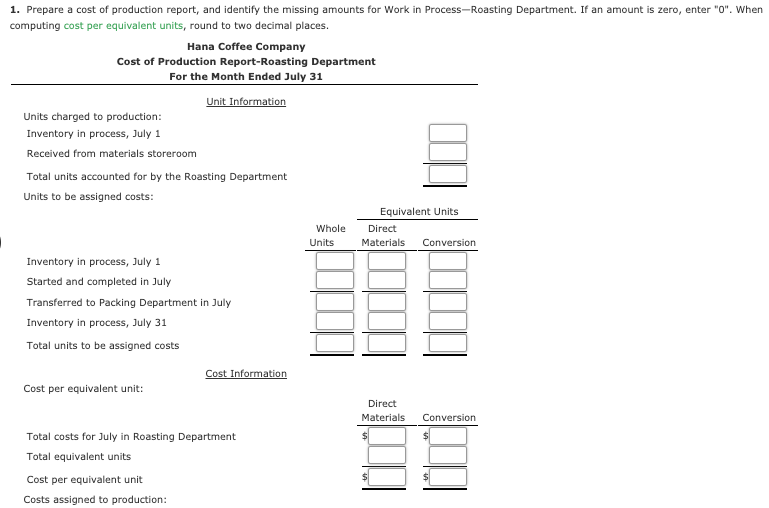

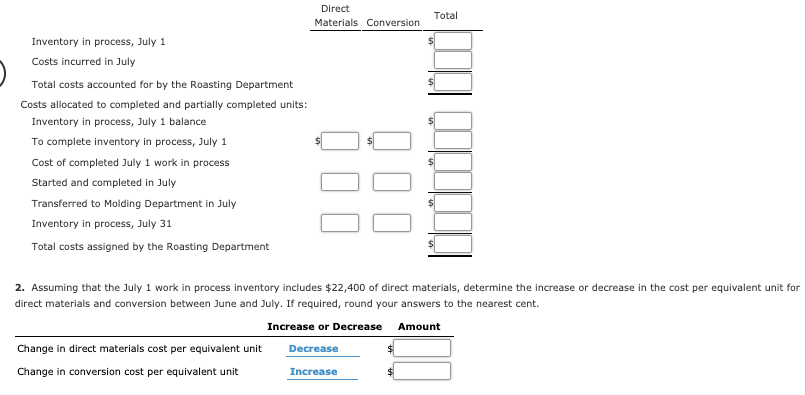

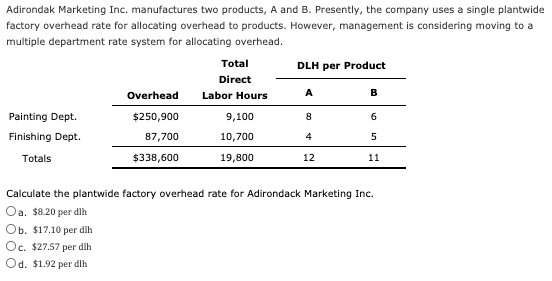

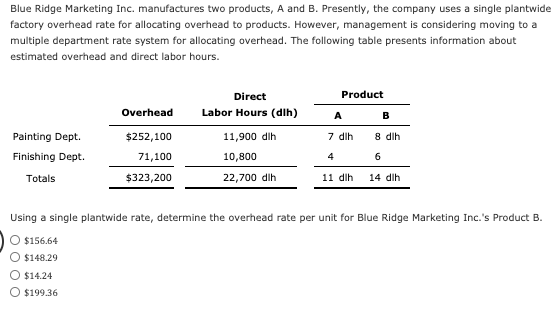

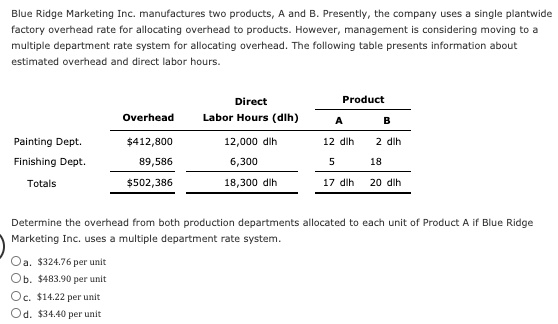

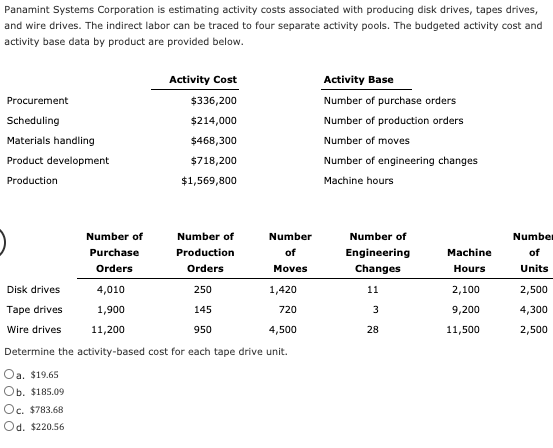

Cost of Production Report Hana Coffee Company roasts and packs coffee beans. The process begins by placing coffee beans into the Roasting Department. From the Roasting Department, coffee beans are then transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at July 31: ACCOUNT Work in Process Roasting Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit July 1 Bal., 8,000 units, 2/5 completed 24,960 31 Direct materials, 360,000 units 1,044,000 1,068,960 31 Direct labor 203,500 1,272,460 31 Factory overhead 50,880 1,323,340 31 Goods transferred, 361,000 units 31 Bal., 2 units, 4/5 completed ? ? 1. Prepare a cost of production report, and identify the missing amounts for Work in Process-Roasting Department. If an amount is zero, enter "O". When computing cost per equivalent units, round to two decimal places. Hana Coffee Company Cost of Production Report-Roasting Department For the Month Ended July 31 Unit Information Units charged to production: Inventory in process, July 1 Received from materials storeroom Total units accounted for by the Roasting Department Units to be assigned costs: Equivalent Units Whole Direct Units Materials Conversion Inventory in process, July 1 Started and completed in July Transferred to Packing Department in July Inventory in process, July 31 Total units to be assigned costs Cost Information Cost per equivalent unit: Direct Materials Conversion Total costs for July in Roasting Department Total equivalent units Cost per equivalent unit Costs assigned to production: Adirondak Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. Total DLH per Product Direct Overhead Labor Hours B Painting Dept. $250,900 9,100 6 Finishing Dept. 87,700 10,700 4 5 Totals $338,600 19,800 12 8 11 Calculate the plantwide factory overhead rate for Adirondack Marketing Inc. Oa. $8.20 per dih Ob. $17.10 per dlh Oc. $27.57 per dih Od. $1.92 per dlh Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Product Overhead 7 dih Direct Labor Hours (dih) 11,900 dih 10,800 22,700 din Painting Dept. Finishing Dept. Totals 8 dih $252,100 71,100 4 6 $323,200 11 din 14 dih Using a single plantwide rate, determine the overhead rate per unit for Blue Ridge Marketing Inc.'s Product B. O $156.64 $148.29 O $14.24 O $199.36 Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Product Direct Labor Hours (dih) Overhead B $412,800 12,000 dih 12 dih 2 dih Painting Dept. Finishing Dept. Totals 89,586 5 18 6,300 18,300 din $502,386 17 dih 20 din Determine the overhead from both production departments allocated to each unit of Product A if Blue Ridge Marketing Inc. uses a multiple department rate system. Oa. $324.76 per unit Ob. $483.90 per unit Oc. $14.22 per unit Od. $34.40 per unit Panamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below. Procurement Scheduling Materials handling Product development Production Activity Cost $336,200 $214,000 $468,300 $718,200 $1,569,800 Activity Base Number of purchase orders Number of production orders Number of moves Number of engineering changes Machine hours 2 Number of Engineering Changes Machine Hours Number of Units 11 2,100 3 Number of Number of Number Purchase Production of Orders Orders Moves Disk drives 4,010 250 1,420 Tape drives 1,900 145 720 Wire drives 11,200 950 4,500 Determine the activity-based cost for each tape drive unit. Oa. $19.65 Ob. $185.09 Oc. $783.68 Od. $220.56 9,200 11,500 2,500 4,300 2,500 28