Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) 2) 3) 4) 5) Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of

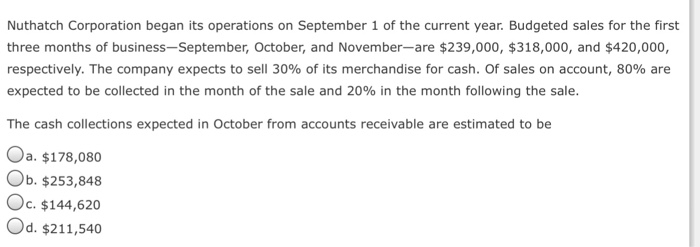

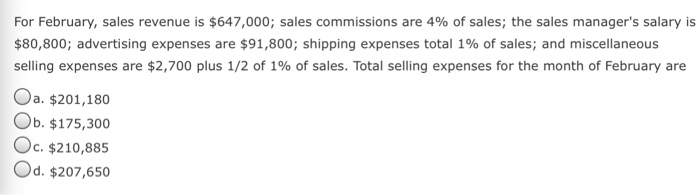

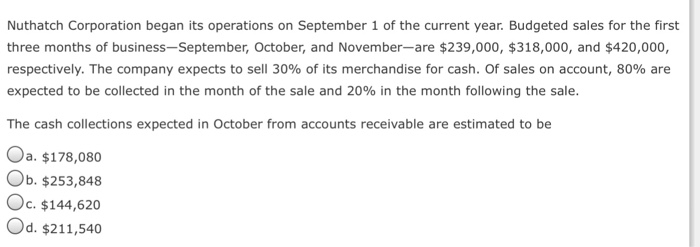

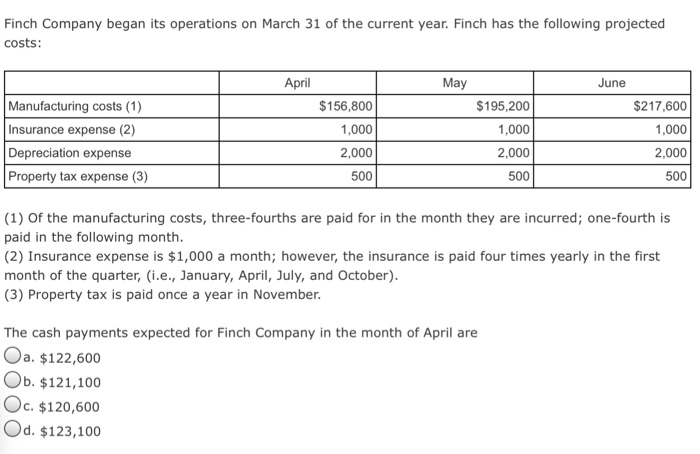

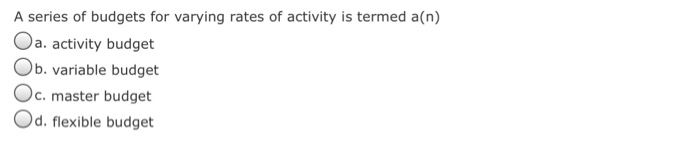

1)

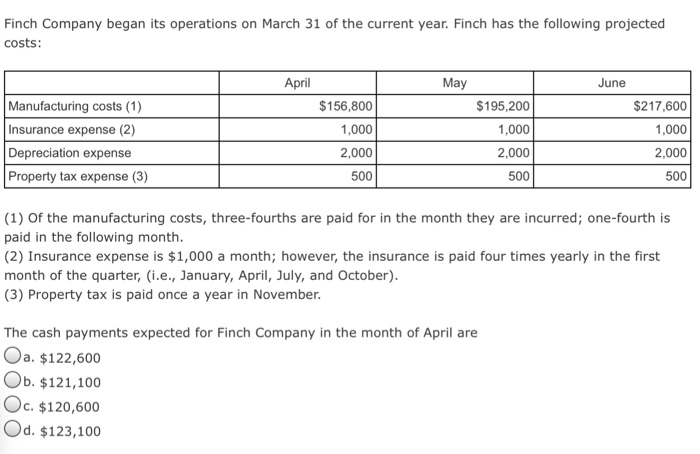

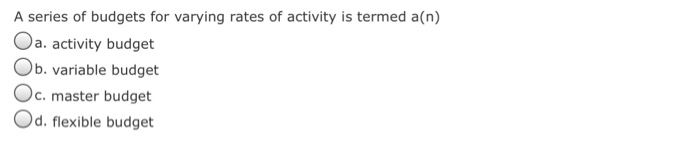

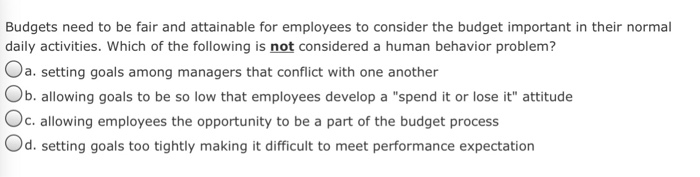

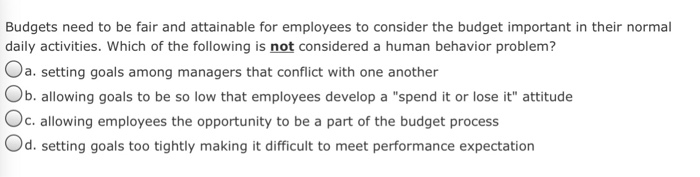

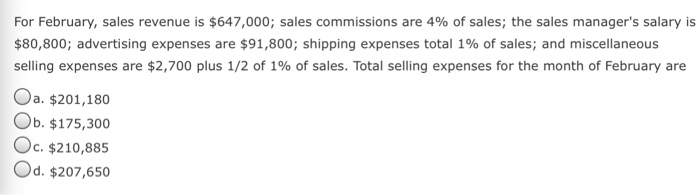

Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business-September, October, and November-are $239,000, $318,000, and $420,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. The cash collections expected in October from accounts receivable are estimated to be Oa, $178,080 Ob. $253,848 Oc. $144,620 Od. $211,540 Finch Company began its operations on March 31 of the current year. Finch has the following projected costs April May June Manufacturing costs (1) Insurance expense (2) Depreciation expense Property tax expense (3) $156,800 1,000 2,000 500 $195,200 1,000 2,000 500 $217,600 1,000 2,000 500 (1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month (2) Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the quarter, (i.e., January, April, July, and October) (3) Property tax is paid once a year in November The cash payments expected for Finch Company in the month of April are Oa. $122,600 Ob. $121,100 Oc. $120,600 Od. $123,100 A series of budgets for varying rates of activity is termed a (n) Oa. activity budget Ob. variable budget Oc. master budget Od. flexible budget Budgets need to be fair and attainable for employees to consider the budget important in their normal daily activities. Which of the following is not considered a human behavior problem? a. setting goals among managers that conflict with one another Ob. allowing goals to be so low that employees develop a "spend it or lose it" attitude Oc.allowing employees the opportunity to be a part of the budget process Od. setting goals too tightly making it difficult to meet performance expectation For February, sales revenue is $647,000; sales commissions are 4% of sales, the sales manager's salary is $80,800; advertising expenses are $91,800; shipping expenses total 1% of sales, and miscellaneous selling expenses are $2,700 plus l/2 of 1% of sales. Total selling expenses for the month of February are Oa. $201,180 Ob. $175,300 Oc. $210,885 Od. $207,650

2)

3)

4)

5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started