Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) 2) 3) 4) 5) The management of River Corporation is considering the purchase of a new machine costing $380,000 The company's desired rate of

1)  2)

2)  3)

3)  4)

4)  5)

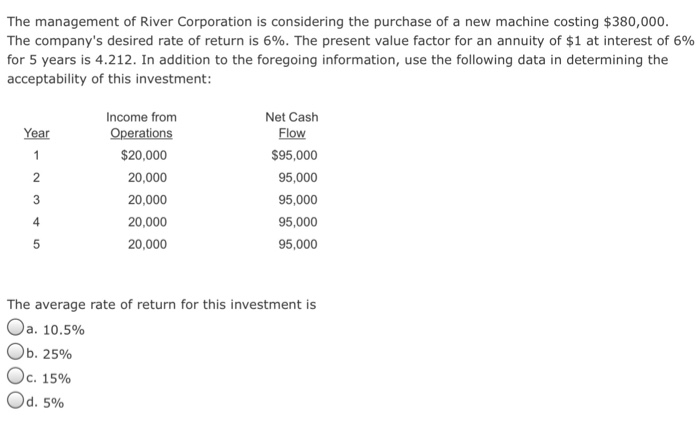

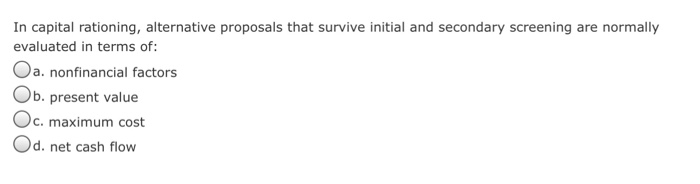

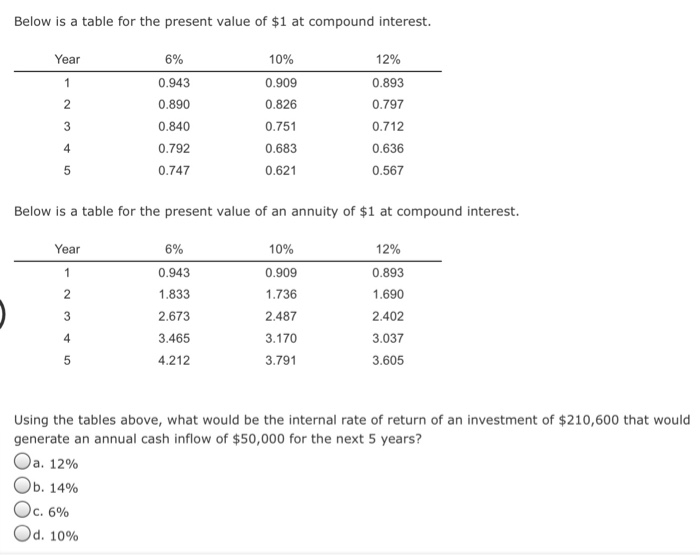

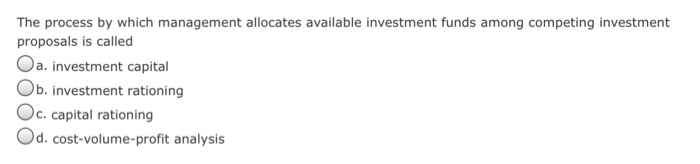

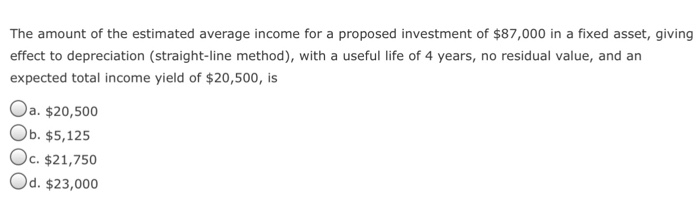

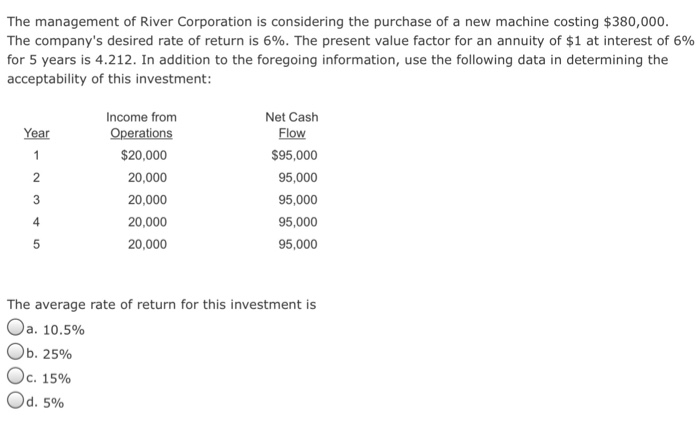

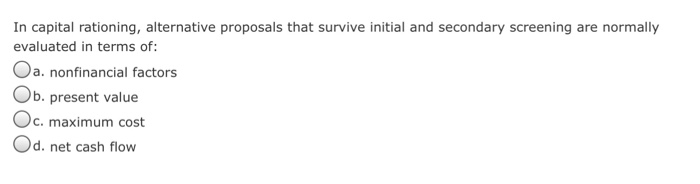

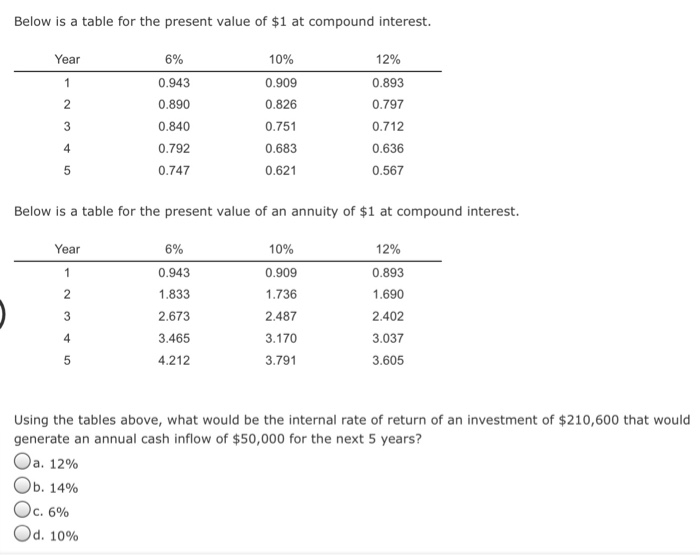

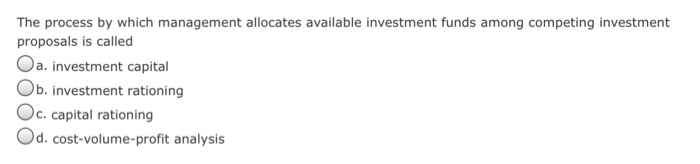

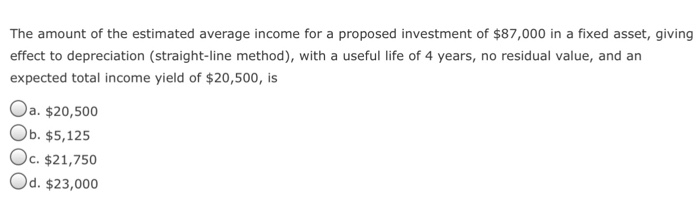

5)  The management of River Corporation is considering the purchase of a new machine costing $380,000 The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment: ncome from Net Cash Year Flow $20,000 20,000 20,000 20,000 20,000 $95,000 95,000 95,000 95,000 95,000 4 The average rate of return for this investment is Ja, 10.5% Ob. 25% oc. 15% od, 5% In capital rationing, alternative proposals that survive initial and secondary screening are normally evaluated in terms of: Oa. nonfinancial factors b. present value Oc. maximum cost d. net cash flow Below is a table for the present value of $1 at compound interest 6% 0.943 0.890 0.840 0.792 0.747 10% 0.909 0.826 0.751 0.683 0.621 12% 0.893 0.797 0.712 0.636 0.567 Year 2 4 Below is a table for the present value of an annuity of $1 at compound interest 6% 0.943 1.833 2.673 3.465 4.212 10% 0.909 1.736 2.487 3.170 3.791 12% 0.893 1.690 2.402 3.037 3.605 Year 4 Using the tables above, what would be the internal rate of return of an investment of $210,600 that would generate an annual cash inflow of $50,000 for the next 5 years? . 12% Ob. 14% . 6% Od. 10% The process by which management allocates available investment funds among competing investment proposals is called Oa. investment capital Ob. investment rationing Oc. capital rationing Od.cost-volume-profit analysis The amount of the estimated average income for a proposed investment of $87,000 in a fixed asset, giving effect to depreciation (straight-line method), with a useful life of 4 years, no residual value, and an expected total income yield of $20,500, is a. $20,500 Ob. $5,125 Oc. $21,750 Od. $23,000

The management of River Corporation is considering the purchase of a new machine costing $380,000 The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment: ncome from Net Cash Year Flow $20,000 20,000 20,000 20,000 20,000 $95,000 95,000 95,000 95,000 95,000 4 The average rate of return for this investment is Ja, 10.5% Ob. 25% oc. 15% od, 5% In capital rationing, alternative proposals that survive initial and secondary screening are normally evaluated in terms of: Oa. nonfinancial factors b. present value Oc. maximum cost d. net cash flow Below is a table for the present value of $1 at compound interest 6% 0.943 0.890 0.840 0.792 0.747 10% 0.909 0.826 0.751 0.683 0.621 12% 0.893 0.797 0.712 0.636 0.567 Year 2 4 Below is a table for the present value of an annuity of $1 at compound interest 6% 0.943 1.833 2.673 3.465 4.212 10% 0.909 1.736 2.487 3.170 3.791 12% 0.893 1.690 2.402 3.037 3.605 Year 4 Using the tables above, what would be the internal rate of return of an investment of $210,600 that would generate an annual cash inflow of $50,000 for the next 5 years? . 12% Ob. 14% . 6% Od. 10% The process by which management allocates available investment funds among competing investment proposals is called Oa. investment capital Ob. investment rationing Oc. capital rationing Od.cost-volume-profit analysis The amount of the estimated average income for a proposed investment of $87,000 in a fixed asset, giving effect to depreciation (straight-line method), with a useful life of 4 years, no residual value, and an expected total income yield of $20,500, is a. $20,500 Ob. $5,125 Oc. $21,750 Od. $23,000

2)

3)

4)

5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started