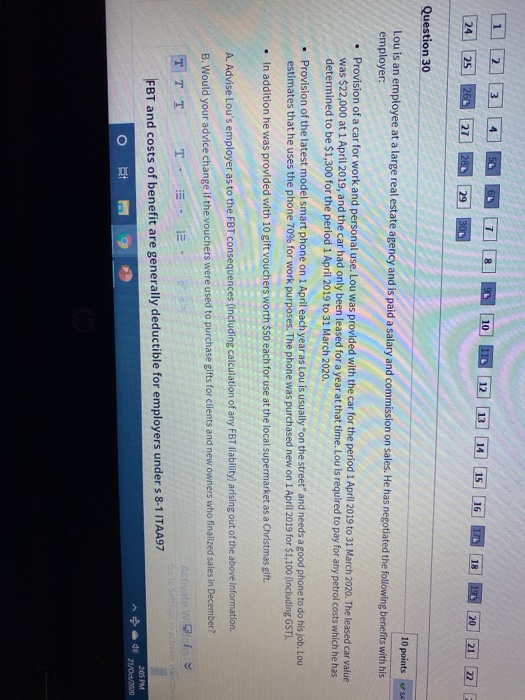

1 2 3 4 7 8 10 11 12 13 14 15 16 170 IR 24 19 20 25 260 27 21 280 29 Question 30 10 points SA Lou is an employee at a large real estate agency and is paid a salary and commission on sales. He has negotiated the following benefits with his employer: Provision of a car for work and personal use. Lou was provided with the car for the period 1 April 2019 to 31 March 2020. The leased car value was $22,000 at 1 April 2019, and the car had only been leased for a year at that time. Lou is required to pay for any petrol costs which he has determined to be $1,300 for the period 1 April 2019 to 31 March 2020. Provision of the latest model smart phone on 1 April each year as Lou is usually on the street" and needs a good phone to do his job. Lou estimates that he uses the phone 70% for work purposes. The phone was purchased new on 1 April 2019 for $1,100 (including GST). . In addition he was provided with 10 gift vouchers worth $50 each for use at the local supermarket as a Christmas gift. A. Advise Lou's employer as to the FBT consequences (including calculation of any FBT liability) arising out of the above information. B. Would your advice change if the vouchers were used to purchase gifts for clients and new owners who finalized sales in December? T. e Activate w Boy FBT and costs of benefit are generally deductible for employers under s 8-1 ITAA97 do 205 PM 21/Oct/2000 et 1 2 3 4 7 8 10 11 12 13 14 15 16 170 IR 24 19 20 25 260 27 21 280 29 Question 30 10 points SA Lou is an employee at a large real estate agency and is paid a salary and commission on sales. He has negotiated the following benefits with his employer: Provision of a car for work and personal use. Lou was provided with the car for the period 1 April 2019 to 31 March 2020. The leased car value was $22,000 at 1 April 2019, and the car had only been leased for a year at that time. Lou is required to pay for any petrol costs which he has determined to be $1,300 for the period 1 April 2019 to 31 March 2020. Provision of the latest model smart phone on 1 April each year as Lou is usually on the street" and needs a good phone to do his job. Lou estimates that he uses the phone 70% for work purposes. The phone was purchased new on 1 April 2019 for $1,100 (including GST). . In addition he was provided with 10 gift vouchers worth $50 each for use at the local supermarket as a Christmas gift. A. Advise Lou's employer as to the FBT consequences (including calculation of any FBT liability) arising out of the above information. B. Would your advice change if the vouchers were used to purchase gifts for clients and new owners who finalized sales in December? T. e Activate w Boy FBT and costs of benefit are generally deductible for employers under s 8-1 ITAA97 do 205 PM 21/Oct/2000 et