1

2

3

4

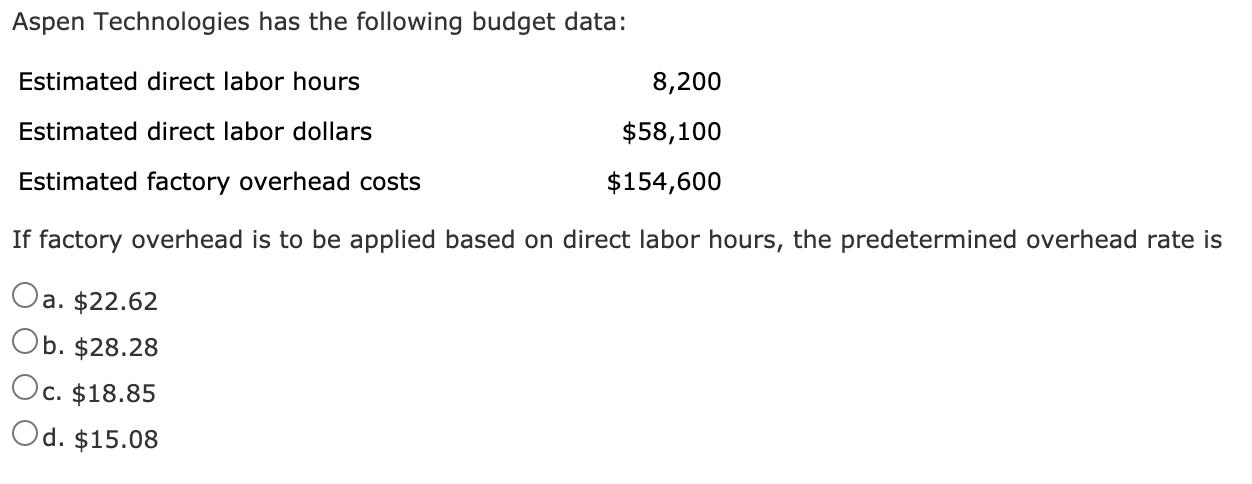

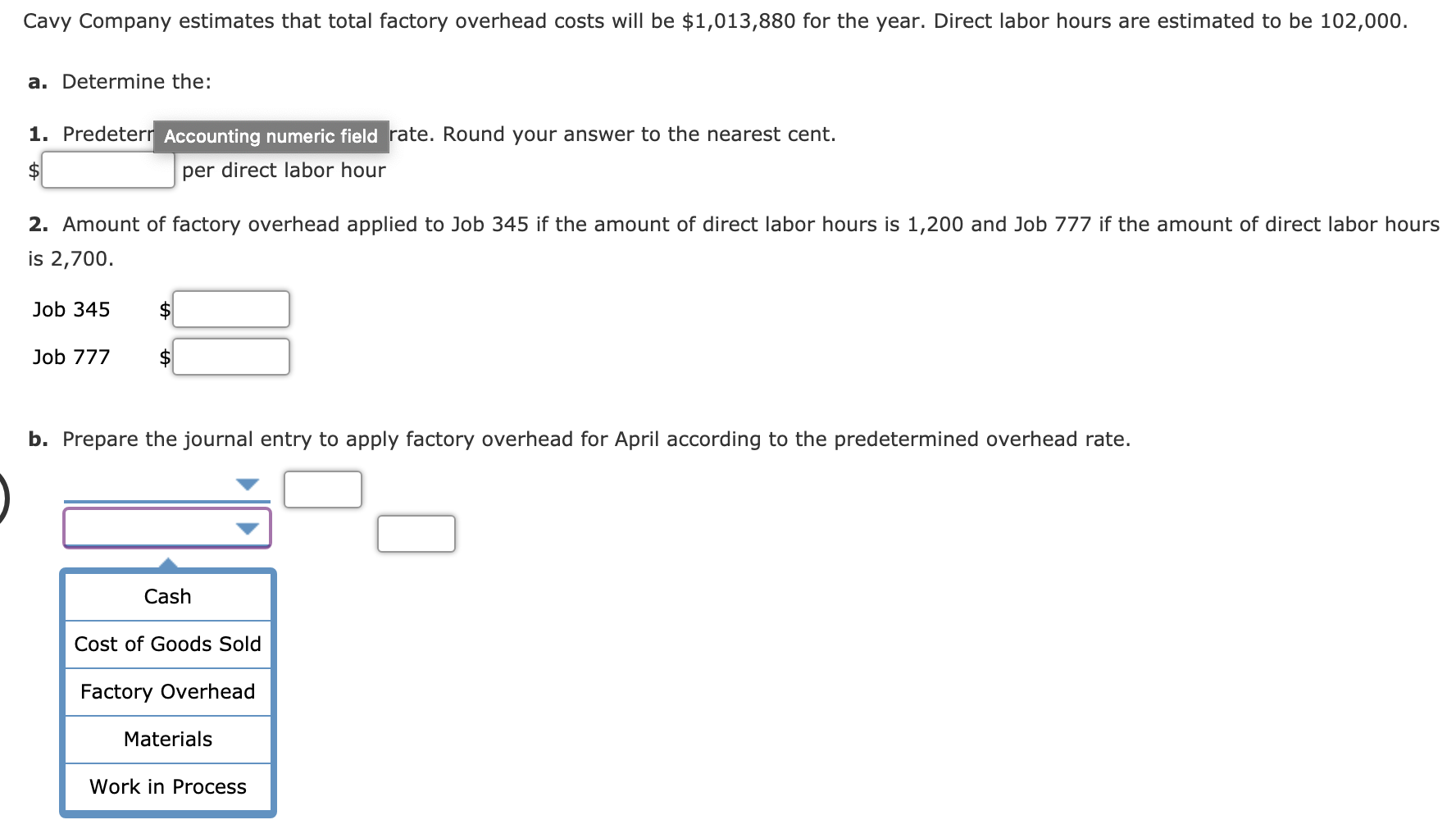

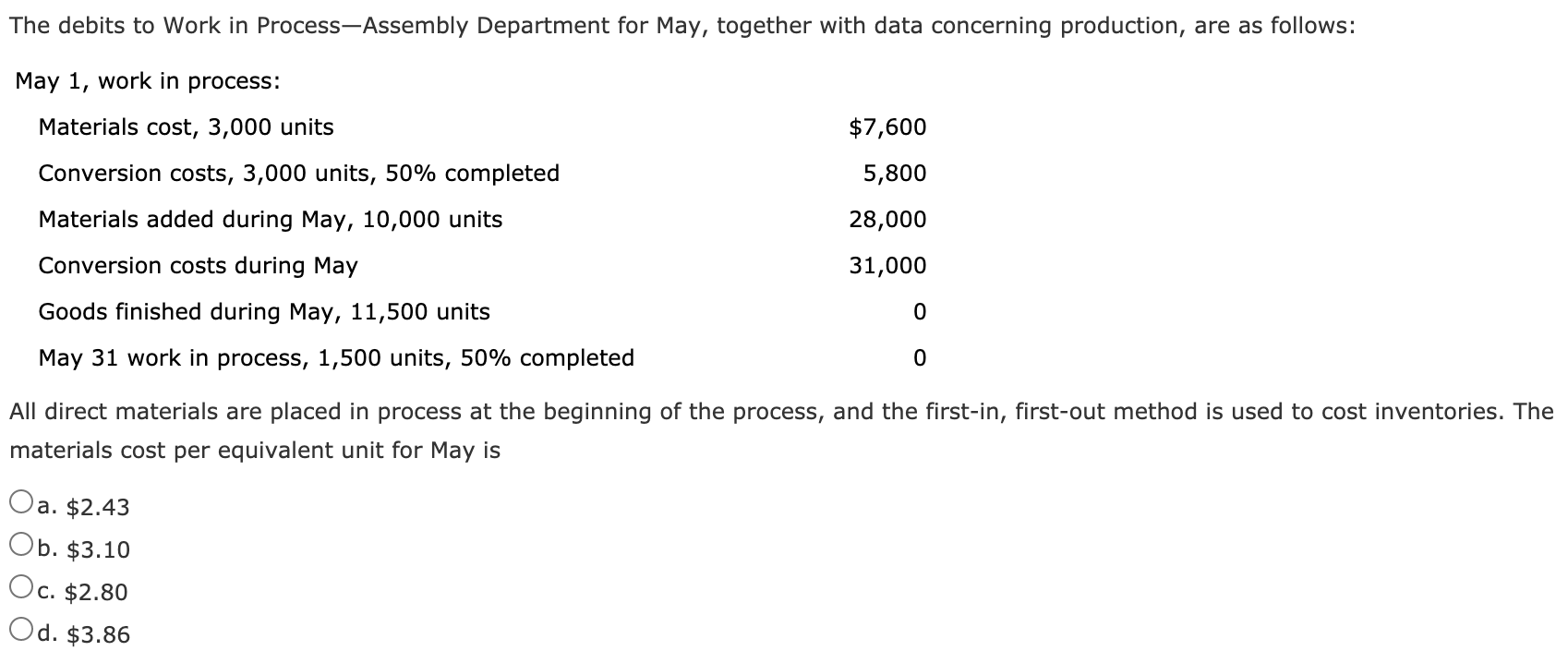

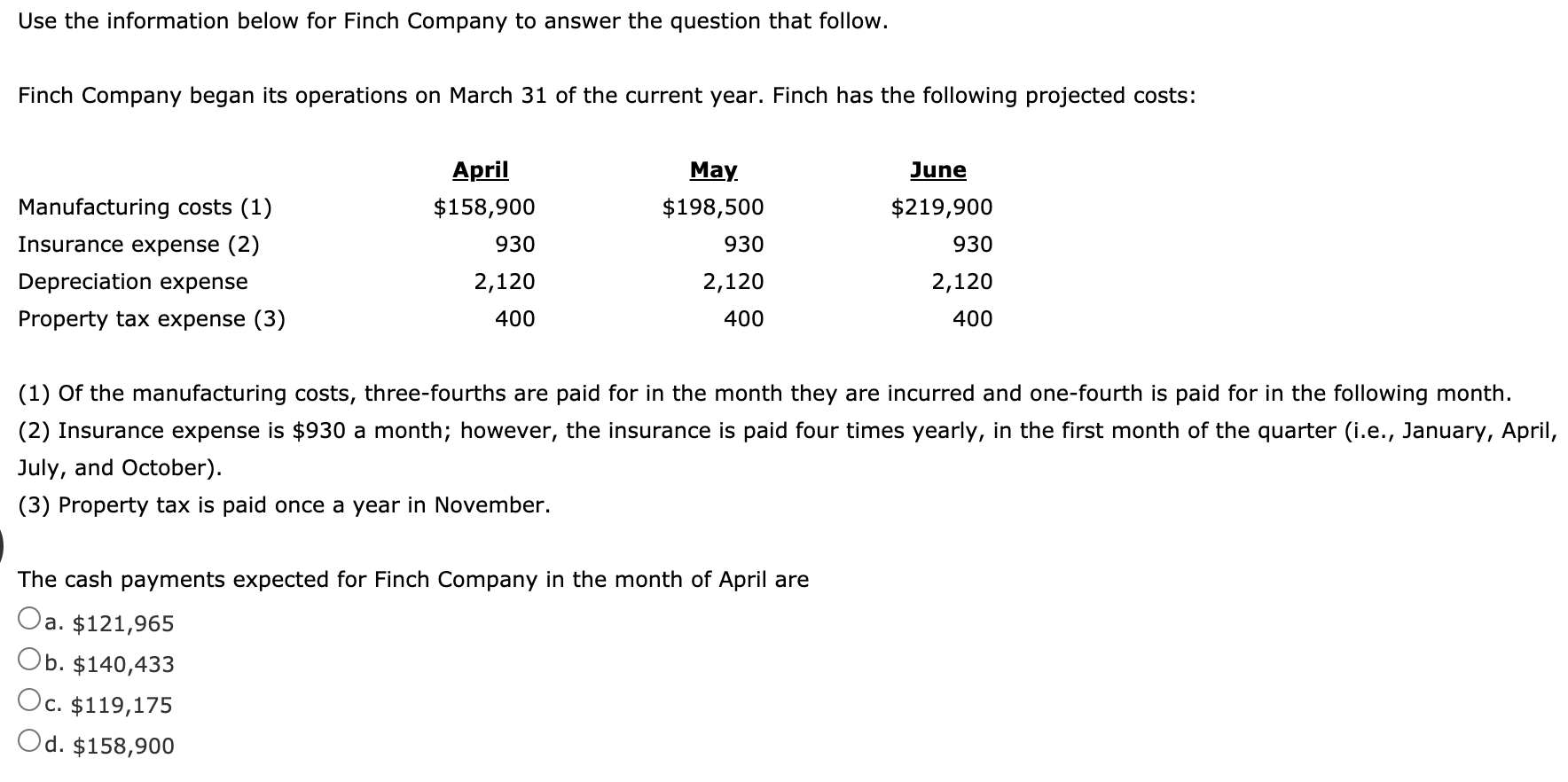

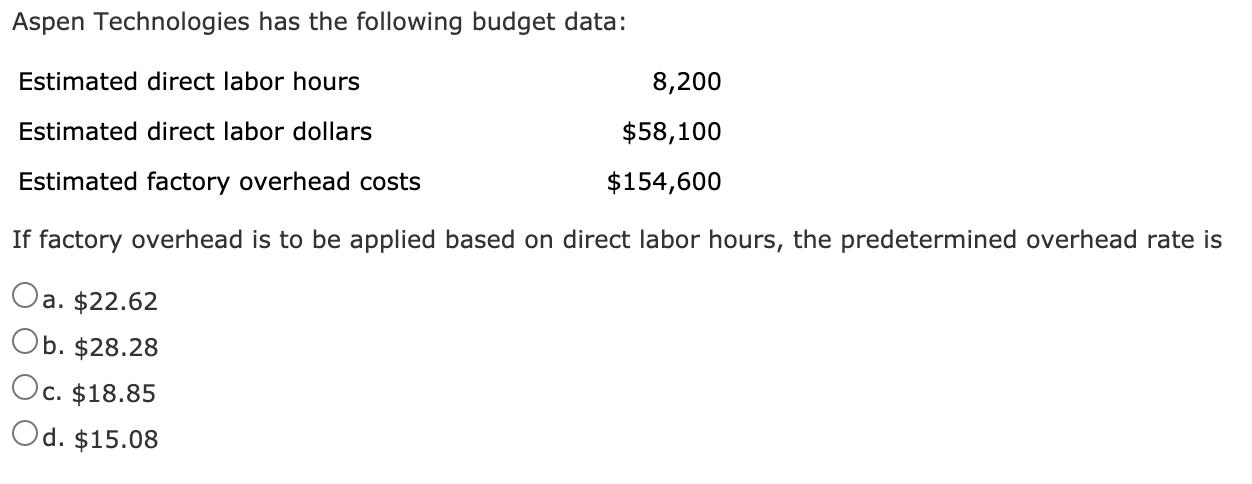

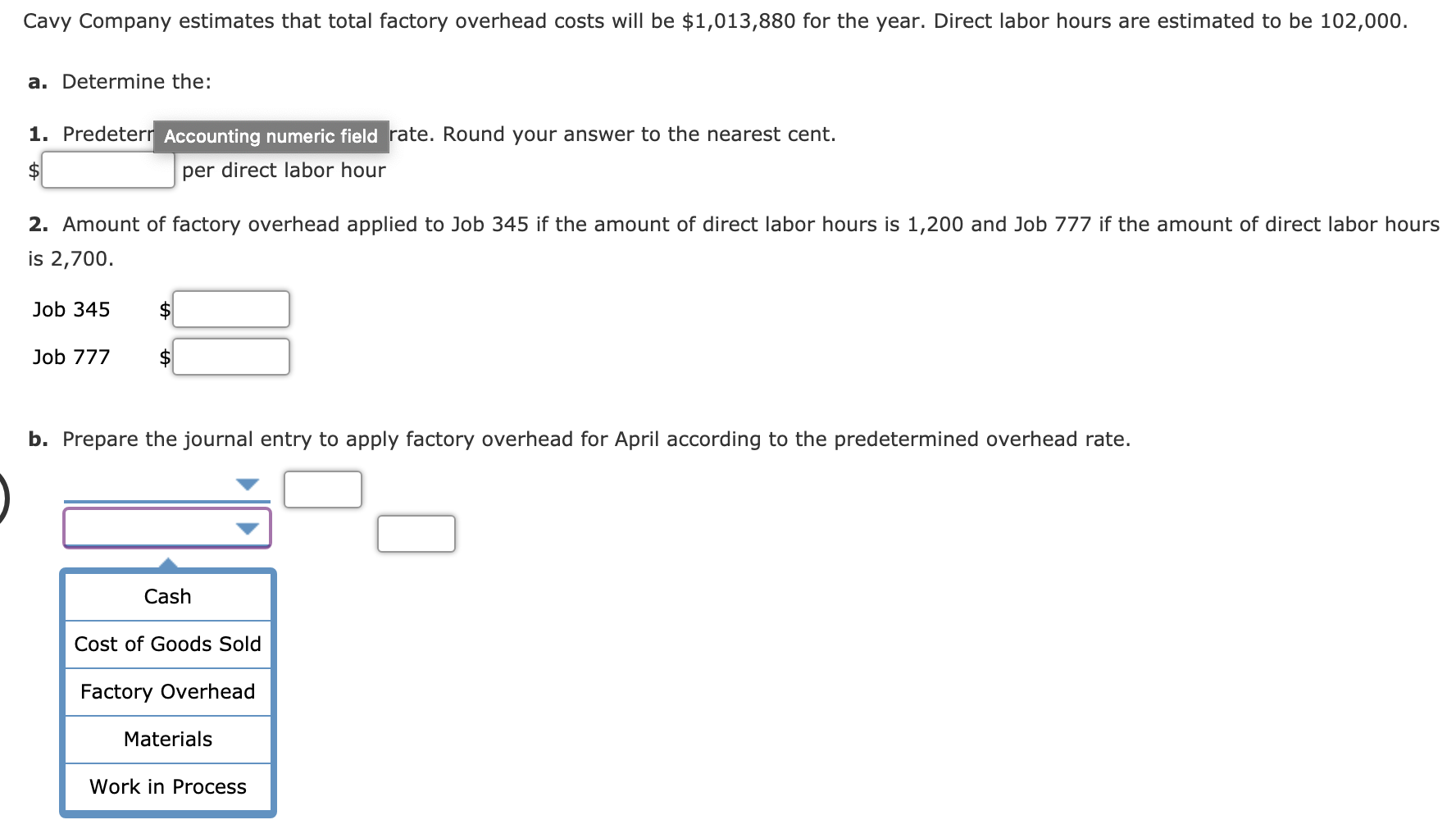

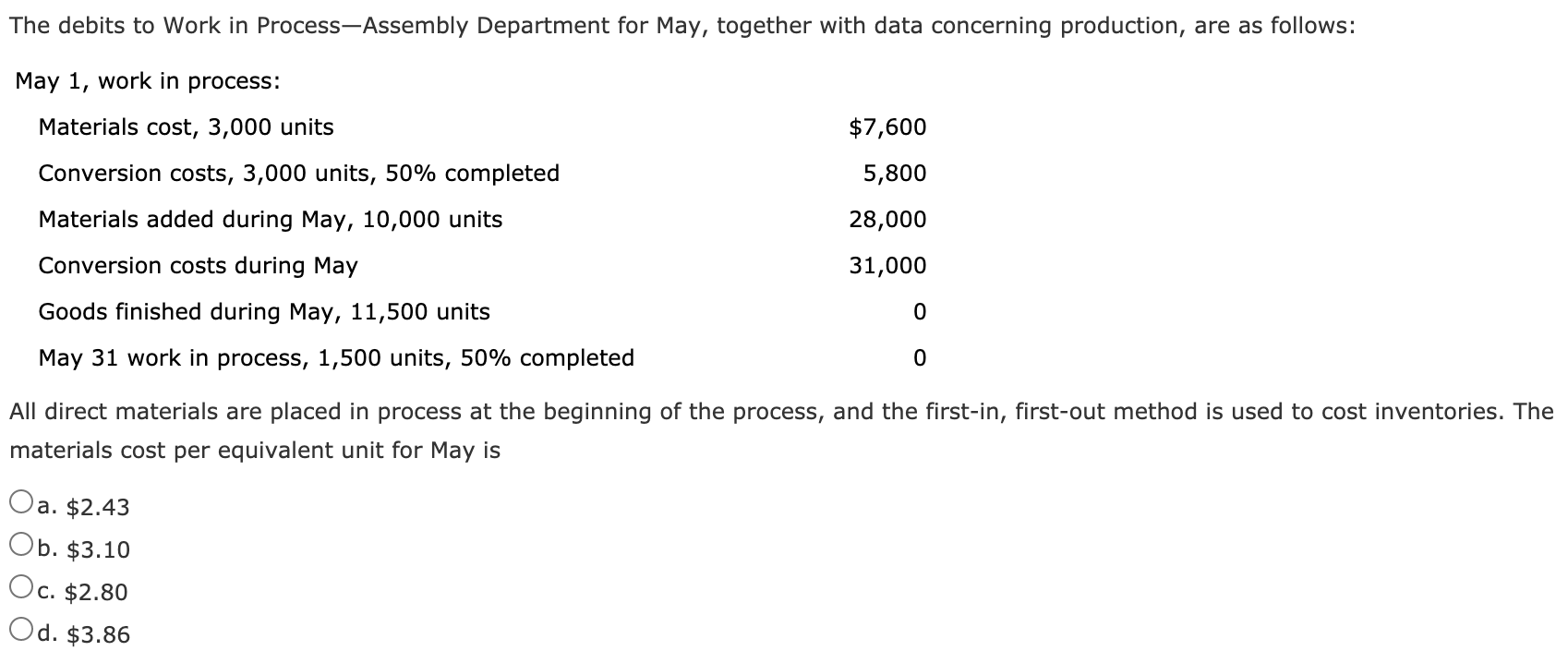

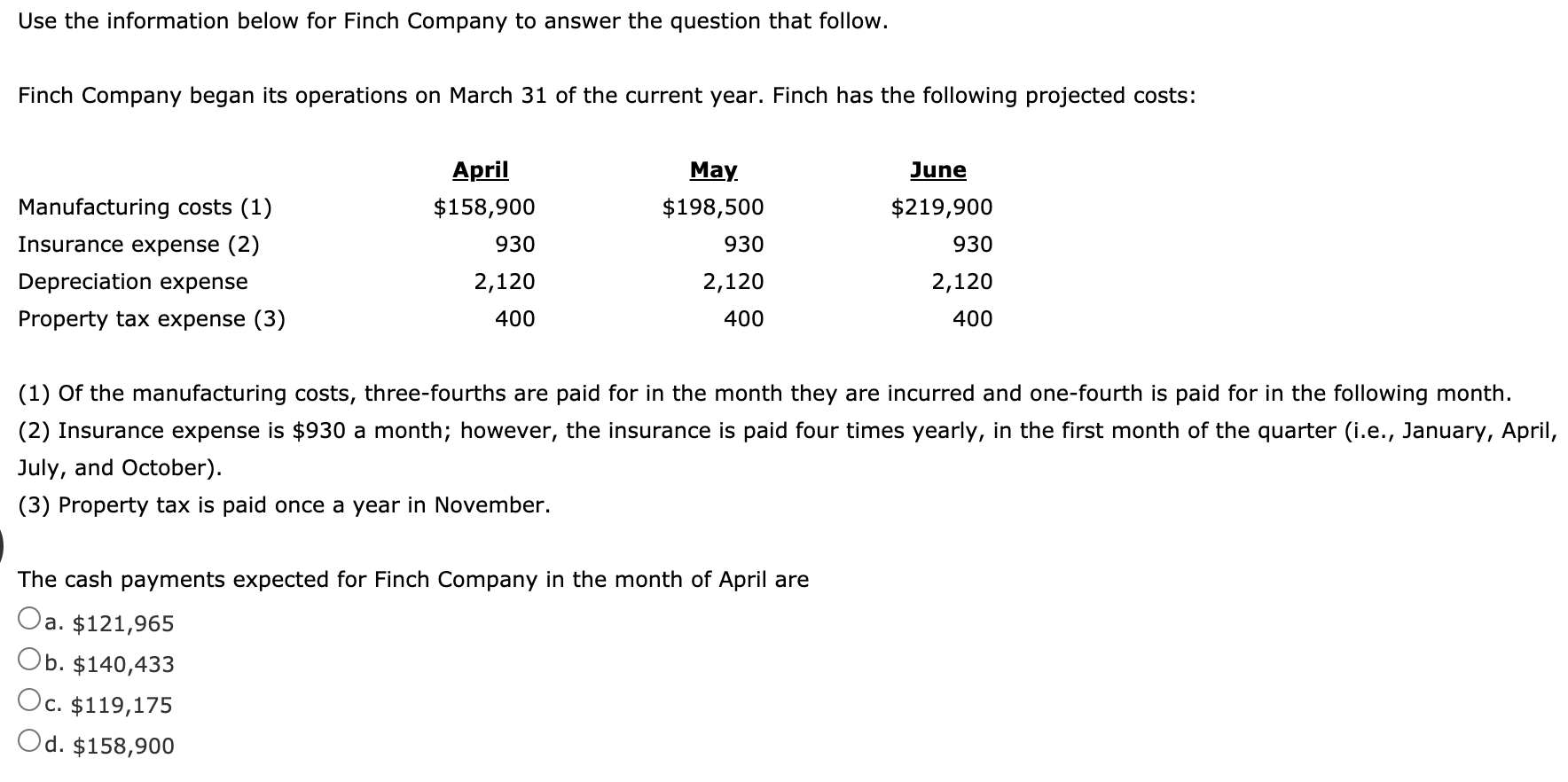

Aspen Technologies has the following budget data: Estimated direct labor hours 8,200 Estimated direct labor dollars $58,100 Estimated factory overhead costs $154,600 If factory overhead is to be applied based on direct labor hours, the predetermined overhead rate is Oa. $22.62 Ob. $28.28 Oc. Od. $15.08 c. $18.85 Cavy Company estimates that total factory overhead costs will be $1,013,880 for the year. Direct labor hours are estimated to be 102,000. a. Determine the: 1. Predeterr Accounting numeric field rate. Round your answer to the nearest cent. per direct labor hour 2. Amount of factory overhead applied to Job 345 if the amount of direct labor hours is 1,200 and Job 777 if the amount of direct labor hours is 2,700. Job 345 Job 777 b. Prepare the journal entry to apply factory overhead for April according to the predetermined overhead rate. Cash Cost of Goods Sold Factory Overhead Materials Work in Process The debits to Work in Process-Assembly Department for May, together with data concerning production, are as follows: May 1, work in process: $7,600 Materials cost, 3,000 units Conversion costs, 3,000 units, 50% completed 5,800 Materials added during May, 10,000 units 28,000 Conversion costs during May 31,000 0 Goods finished during May, 11,500 units May 31 work in process, 1,500 units, 50% completed 0 All direct materials are placed in process at the beginning of the process, and the first-in, first-out method is used to cost inventories. The materials cost per equivalent unit for May is O a. $2.43 Ob. $3.10 Oc. $2.80 Od. $3.86 Use the information below for Finch Company to answer the question that follow. Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: April $158,900 930 May. $198,500 June $219,900 930 930 Manufacturing costs (1) Insurance expense (2) Depreciation expense Property tax expense (3) 2,120 2,120 2,120 400 400 400 (1) of the manufacturing costs, three-fourths are paid for in the month they are incurred and one-fourth is paid for in the following month. (2) Insurance expense is $930 a month; however, the insurance is paid four times yearly, in the first month of the quarter (i.e., January, April, July, and October). (3) Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of April are Oa. $121,965 $140,433 Oc. $119,175 Od. $158,900 Ob