1:

2:

3:

4:

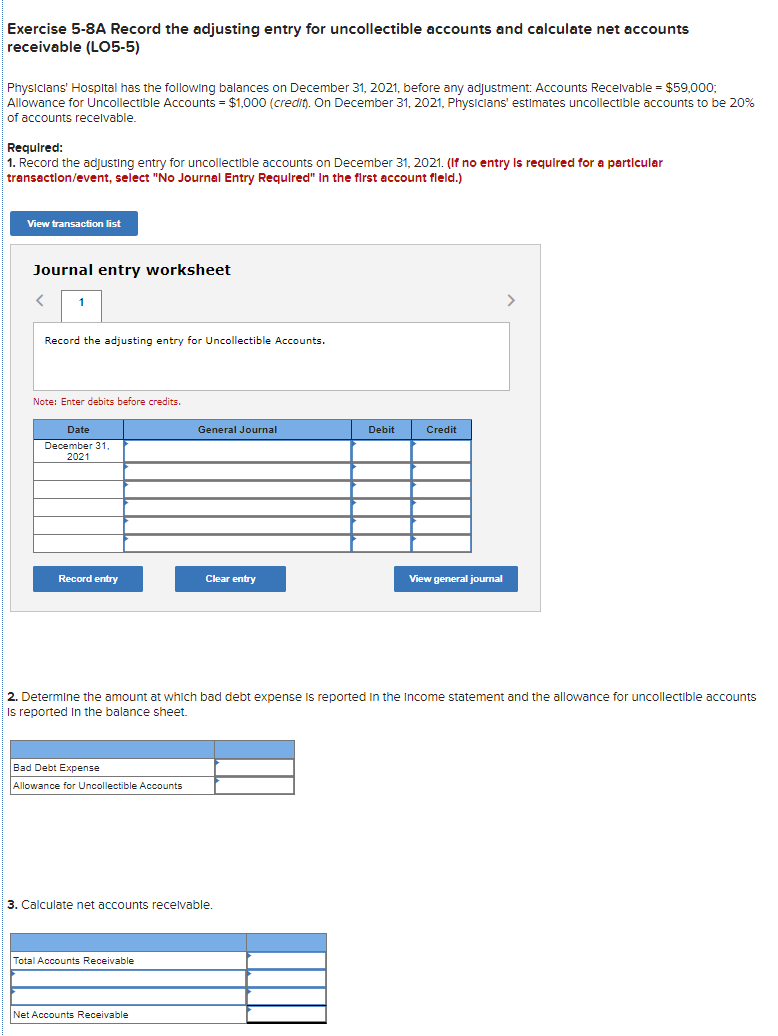

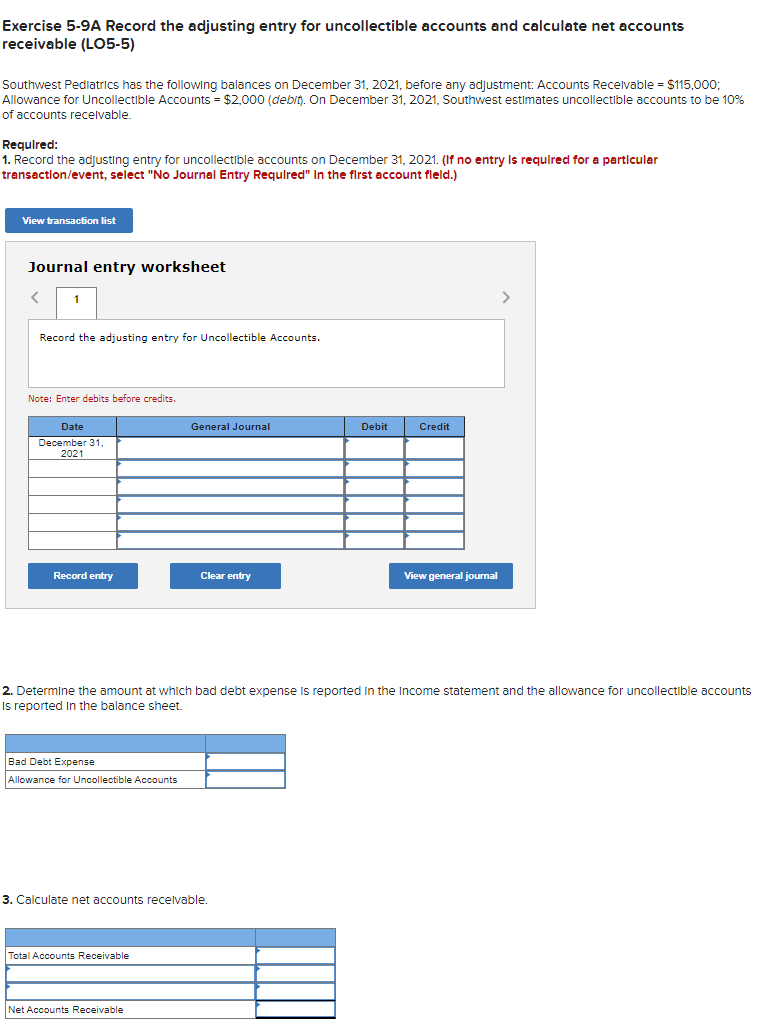

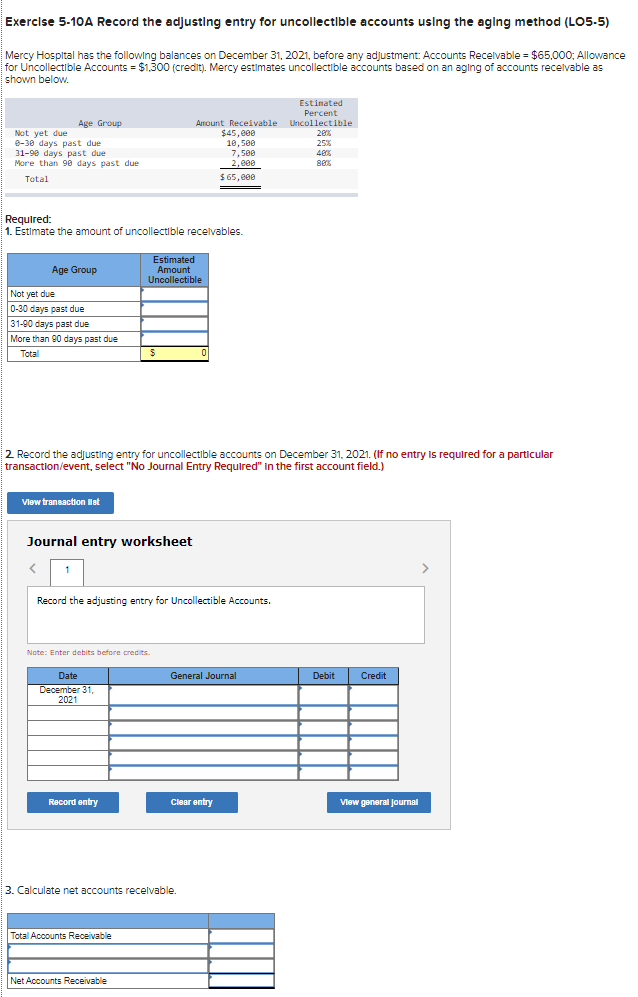

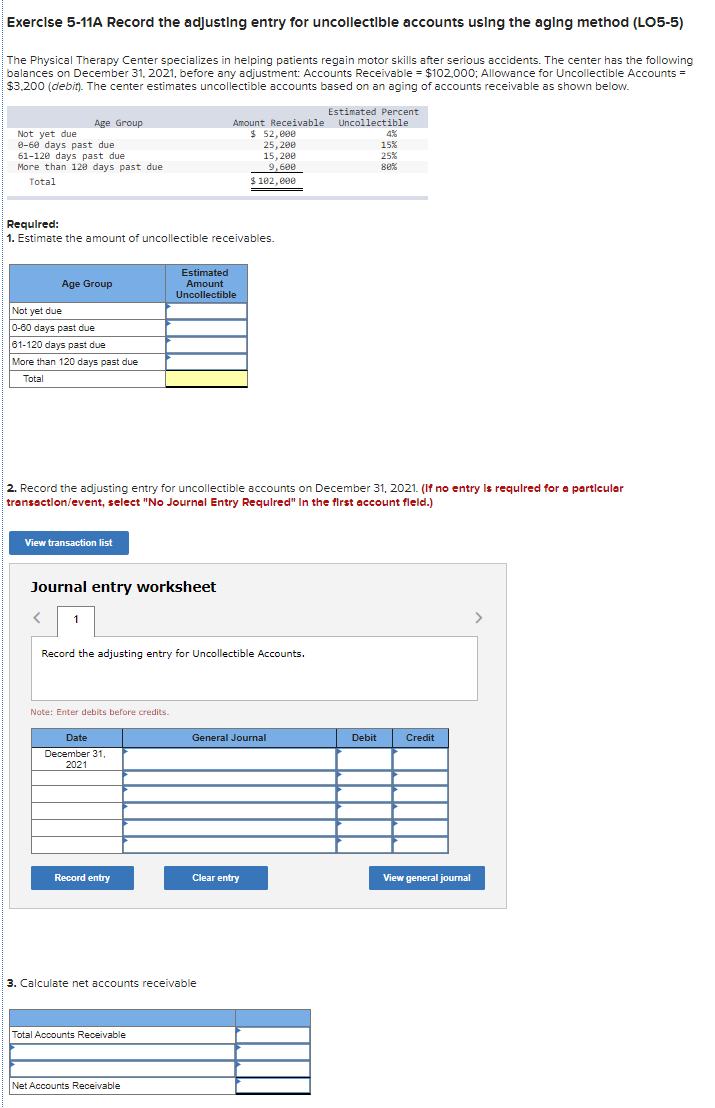

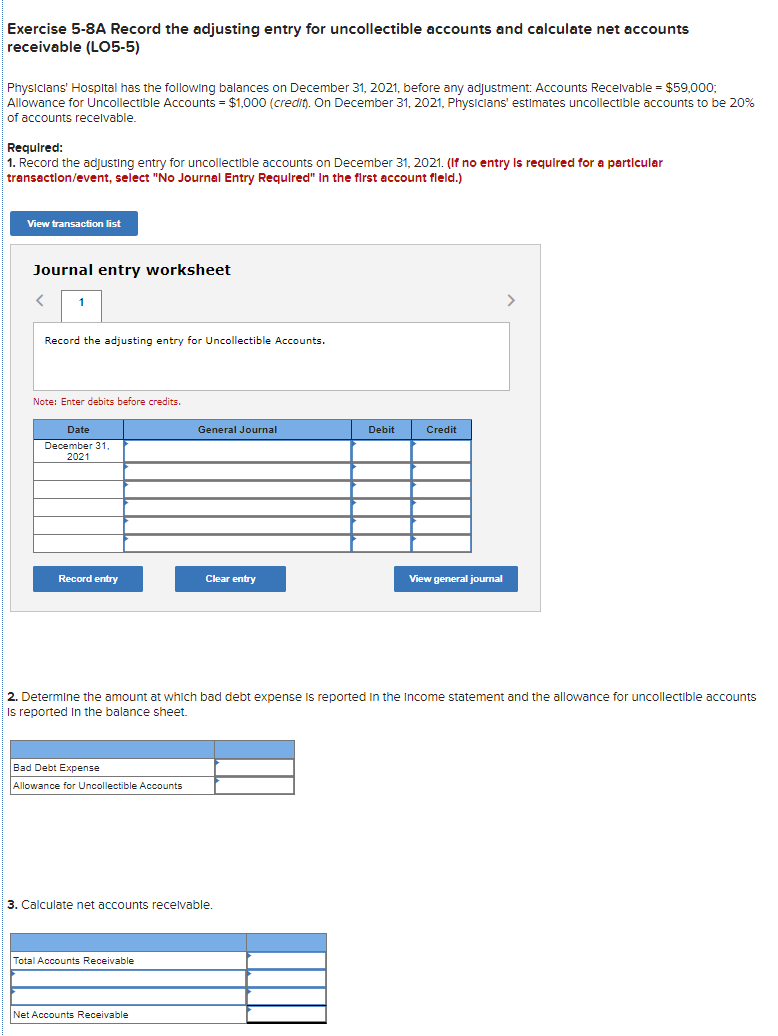

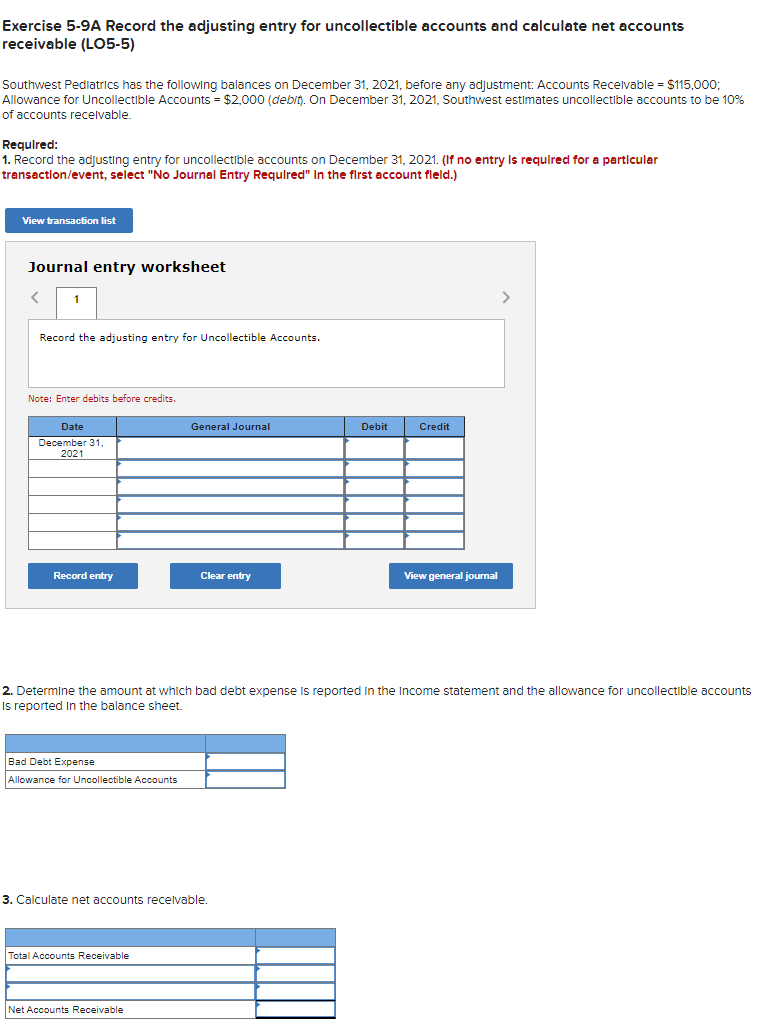

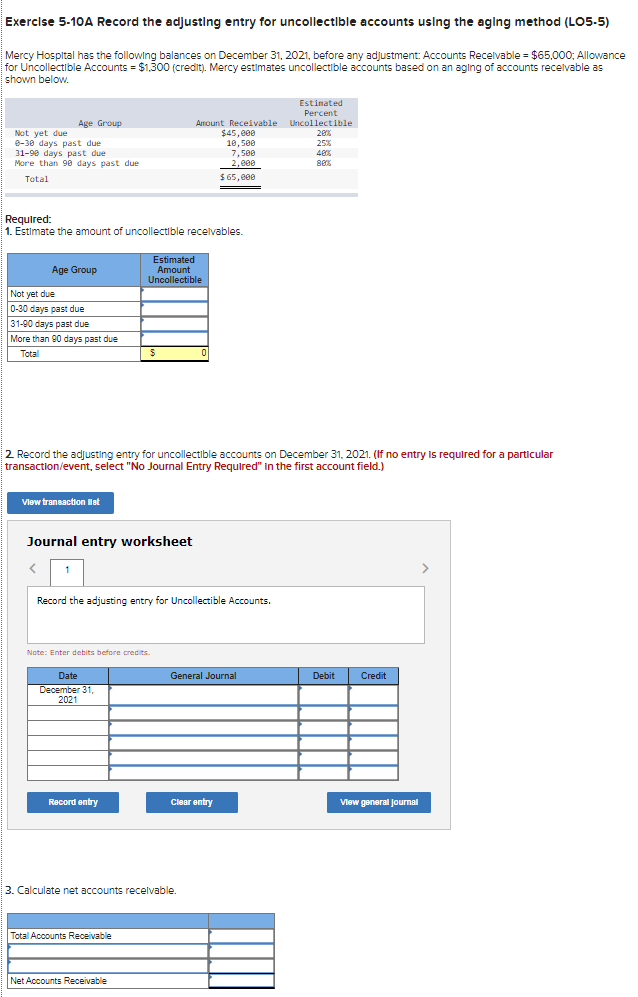

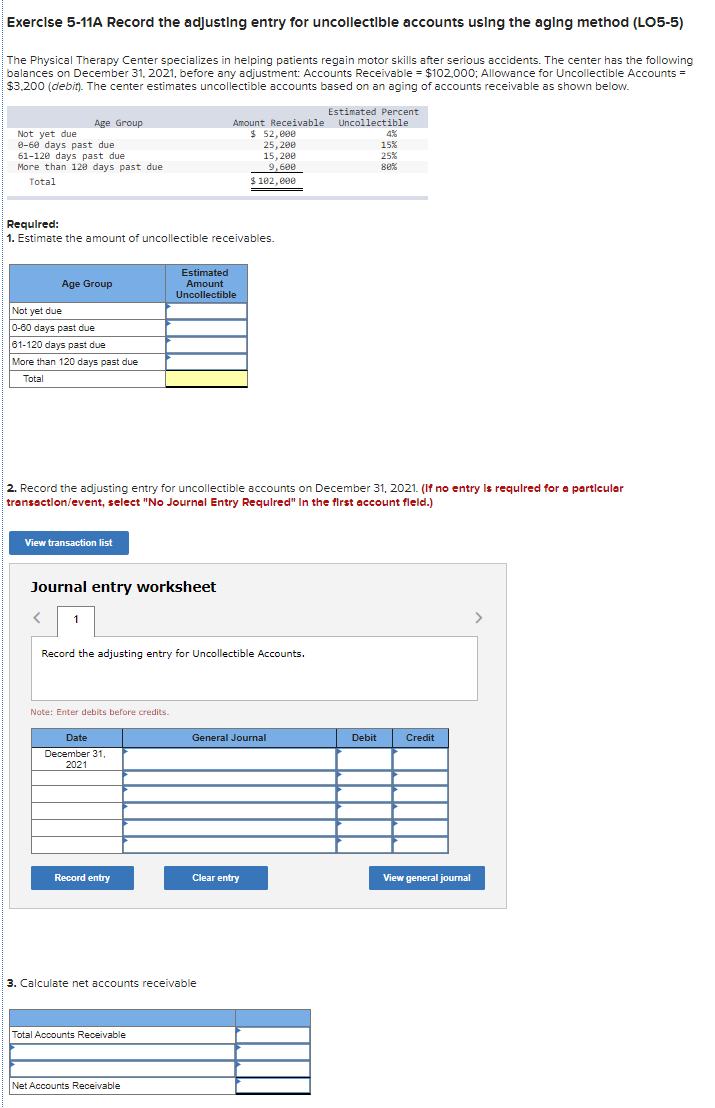

Exercise 5-8A Record the adjusting entry for uncollectible accounts and calculate net accounts receivable (LO5-5) Physicians' Hospital has the following balances on December 31, 2021, before any adjustment: Accounts Recelvable = $59,000; Allowance for Uncollectible Accounts = $1,000 (credit). On December 31, 2021, Physicians' estimates uncollectible accounts to be 20% of accounts receivable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet 1 > Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. General Journal Debit Credit Date December 31 2021 Record entry Clear entry View general journal 2. Determine the amount at which bad debt expense is reported in the Income statement and the allowance for uncollectible accounts is reported in the balance sheet. Bad Debt Expense Allowance for Uncollectible Accounts 3. Calculate net accounts receivable. Total Accounts Receivable Net Accounts Receivable Exercise 5-9A Record the adjusting entry for uncollectible accounts and calculate net accounts receivable (LO5-5) Southwest Pediatrics has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $115,000; Allowance for Uncollectible Accounts = $2,000 (debt). On December 31, 2021, Southwest estimates uncollectible accounts to be 10% of accounts receivable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits. General Journal Debit Credit Date December 31 2021 Record entry Clear entry View general journal 2. Determine the amount at which bad debt expense is reported in the income statement and the allowance for uncollectible accounts Is reported in the balance sheet. Bad Debt Expense Allowance for Uncollectible Accounts 3. Calculate net accounts recevable. Total Accounts Receivable Net Accounts Receivable Exercise 5-10A Record the adjusting entry for uncollectible accounts using the aging method (LO5-5) Mercy Hospital has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $65,000: Allowance for Uncollectible Accounts = $1,300 (credit). Mercy estimates uncollectible accounts based on an aging of accounts receivable as shown below. Age Group Not yet due 2-30 days past due 31-99 days past due More than 90 days past due Total Estimated Percent Amount Receivable Uncollectible $45,000 286 10,500 25% 7. See 48 2.ee 893 $ 65,eee Required: 1. Estimate the amount of uncollectible receivables. Age Group Estimated Amount Uncollectible Not yet due 0-30 days past due 31-90 days past due More than 90 days past due Total 5 2 Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction lit Journal entry worksheet Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits General Journal Debit Credit Date December 31 2021 Record entry Clear entry View general Journal 3. Calculate net accounts receivable. Total Accounts Receivable Net Accounts Receivable Exercise 5-11A Record the adjusting entry for uncollectible accounts using the aging method (L05-5) The Physical Therapy Center specializes in helping patients regain motor skills after serious accidents. The center has the following balances on December 31, 2021, before any adjustment: Accounts Receivable = $102.000: Allowance for Uncollectible Accounts = $3.200 (debit). The center estimates uncollectible accounts based on an aging of accounts receivable as shown below. Age Group Not yet due 0-60 days past due 61-120 days past due More than 120 days past due Total Estimated Percent Amount Receivable Uncollectible $ 52,eee 4% 25,200 15% 15,200 25% 9,600 80% $ 102,000 Required: 1. Estimate the amount of uncollectible receivables. Age Group Estimated Amount Uncollectible Not yet due 0-60 days past due 61-120 days past due More than 120 days past due Total 2. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet > Record the adjusting entry for Uncollectible Accounts. Note: Enter debits before credits Date General Journal Debit Credit December 31, 2021 Record entry Clear entry View general journal 3. Calculate net accounts receivable Total Accounts Receivable Net Accounts Receivable