1-

2-

3-

4-

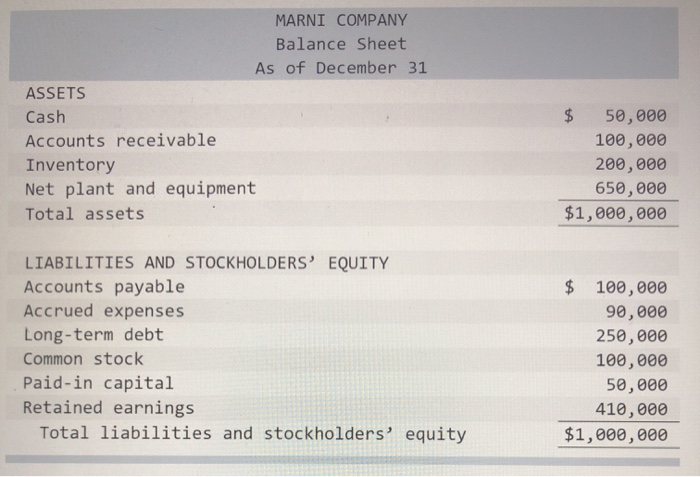

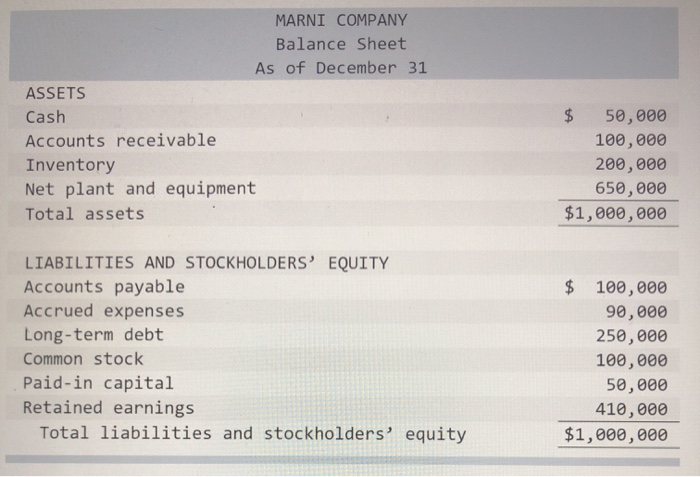

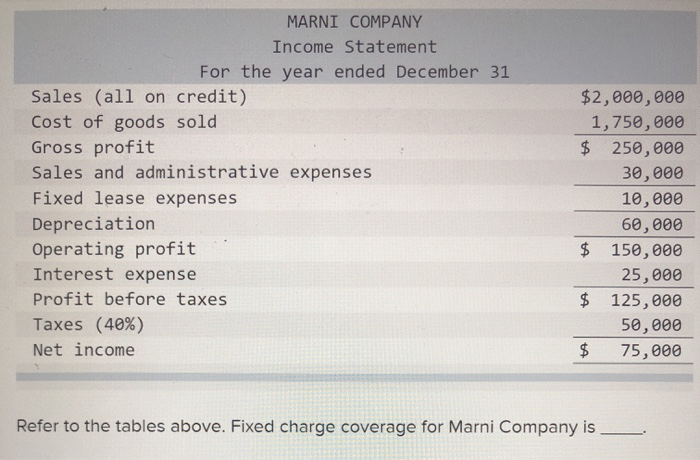

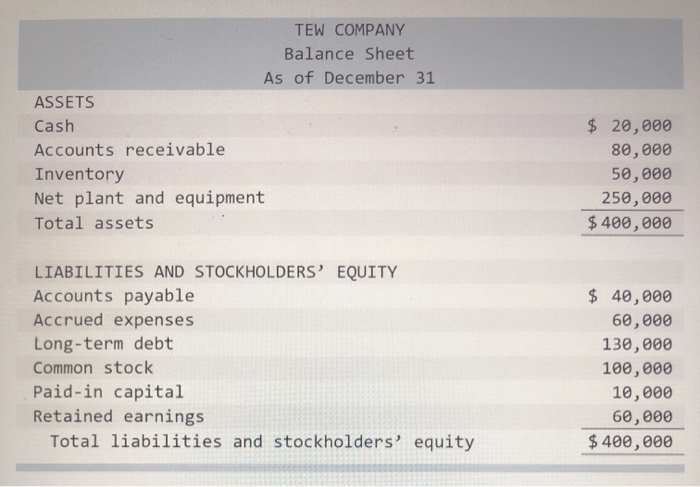

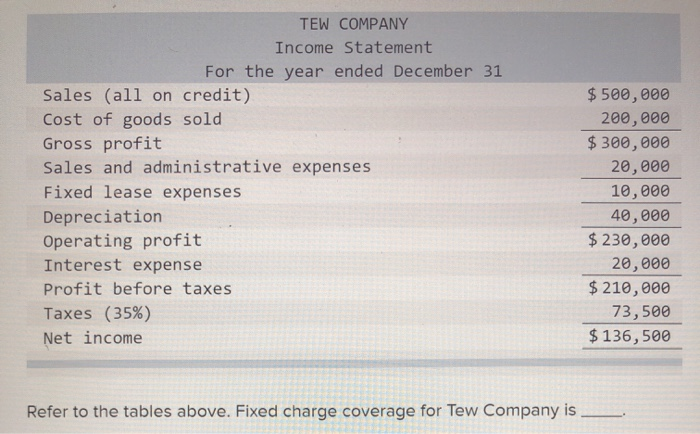

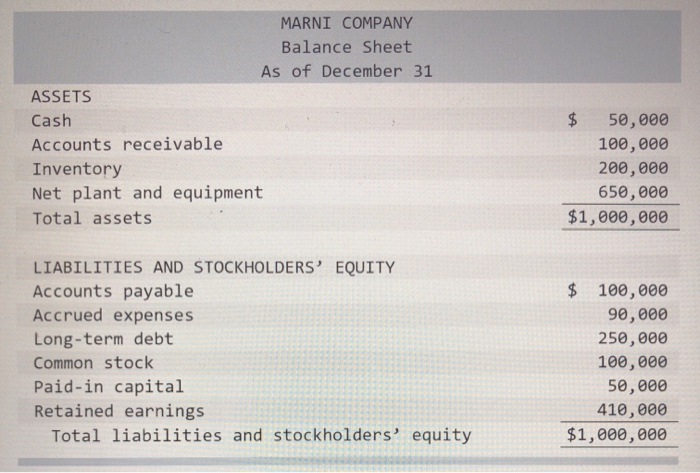

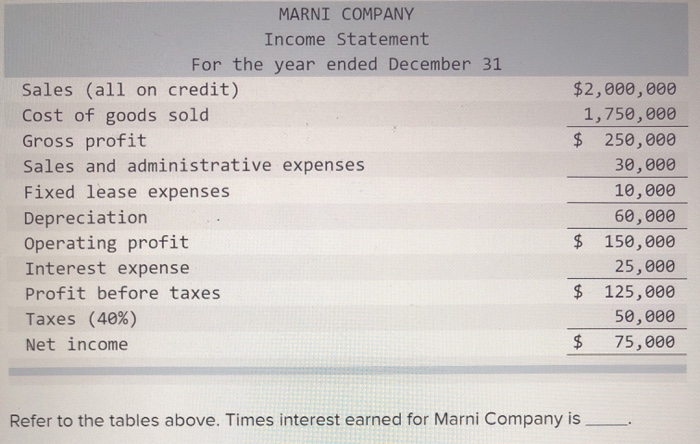

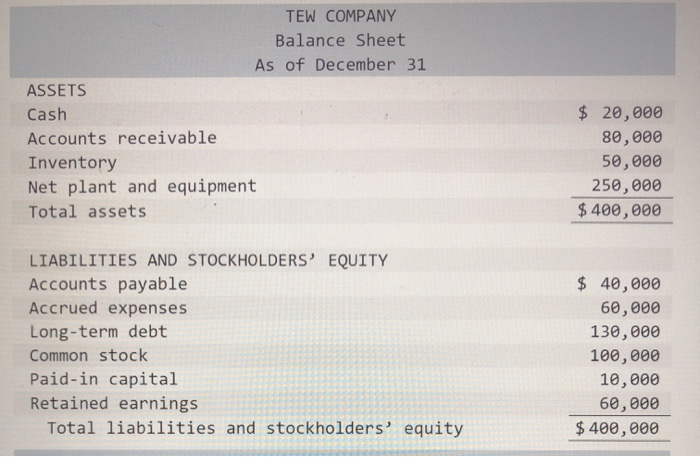

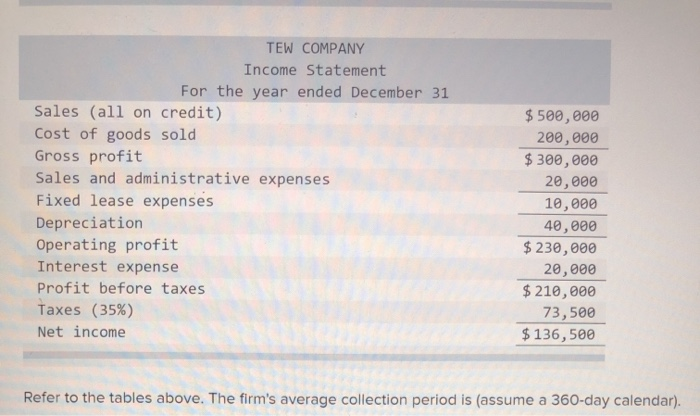

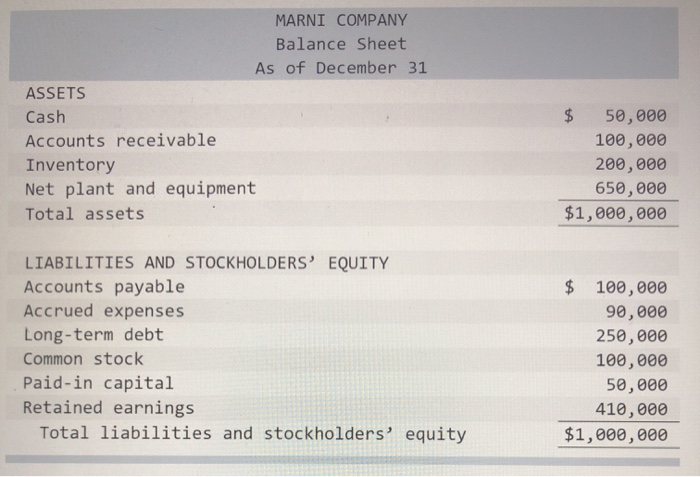

MARNI COMPANY Balance Sheet As of December 31 ASSETS $ 50,000 Cash Accounts receivable 100,000 200,000 650,000 $1,000,000 Inventory Net plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt $ 100,000 90,000 250,000 Common stock 100,000 Paid-in capital Retained earnings 50,000 410,000 Total liabilities and stockholders' equity $1,000,000 MARNI COMPANY Income Statement For the year ended December 31 $2,000, 000 Sales (all on credit) Cost of goods sold Gross profit Sales and administrative expenses 1,750,000 $ 250,000 30,000 Fixed lease expenses 10,000 Depreciation Operating profit 60,000 $ 150,000 Interest expense 25,000 Profit before taxes $ 125,000 50,000 $ Taxes (40%) Net income 75,000 Refer to the tables above. Fixed charge coverage for Marni Company is TEW COMPANY Balance Sheet As of December 31 ASSETS $ 20,000 Cash Accounts receivable 80,000 Inventory 50,000 Net plant and equipment 250,000 $ 400,000 Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt $40,000 60,000 130,e00 100,000 Common stock Paid-in capital Retained earnings Total liabilities and stockholders' equity 10,000 60,000 $400,000 TEW COMPANY Income Statement For the year ended December 31 Sales (all on credit) Cost of goods sold Gross profit $500,000 200,000 $300,000 Sales and administrative expenses 20,000 10,000 Fixed lease expenses Depreciation Operating profit 40,000 $230,000 20,000 Interest expense $210,000 Profit before taxes Taxes (35%) 73,500 $136,500 Net income Refer to the tables above. Fixed charge coverage for Tew Company is MARNI COMPANY Balance Sheet As of December 31 ASSETS $ 50,000 Cash Accounts receivable 100,000 Inventory 200,000 650,000 $1,000,000 Net plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt 100,000 90,000 250, 000 100,000 50,000 410,000 $1,000,000 Common stock Paid-in capital Retained earnings Total liabilities and stockholders' equity MARNI COMPANY Income Statement For the year ended December 31 $2,000,000 Sales (all on credit) Cost of goods sold 1,750,000 $ 250,000 Gross profit Sales and administrative expenses 30,000 10,000 Fixed lease expenses 60,000 Depreciation $ 150,000 Operating profit 25,000 Interest expense $ 125,000 Profit before taxes 50,000 Taxes (40%) $ 75,000 Net income Refer to the tables above. Times interest earned for Marni Company is TEW COMPANY Balance Sheet As of December 31 ASSETS 20,000 0,000 50,000 Cash Accounts receivable Inventory Net plant and equipment 250,000 $400,000 Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses 40,000 60,000 130,000 Long-term debt Common stock 100,000 Paid-in capital Retained earnings 10,000 60,000 Total liabilities and stockholders' equity $400,000 TEW COMPANY Income Statement For the year ended December 31 Sales (all on credit) $500,000 Cost of goods sold Gross profit Sales and administrative expenses 200,000 $300,000 20,000 Fixed lease expenses 10,000 Depreciation Operating profit Interest expense 40,000 $230,000 20,000 Profit before taxes $210,000 Taxes (35%) 73,500 Net income $136,500 Refer to the tables above. The firm's average collection period is (assume a 360-day calendar)