1) 2)

2)

3)

4)

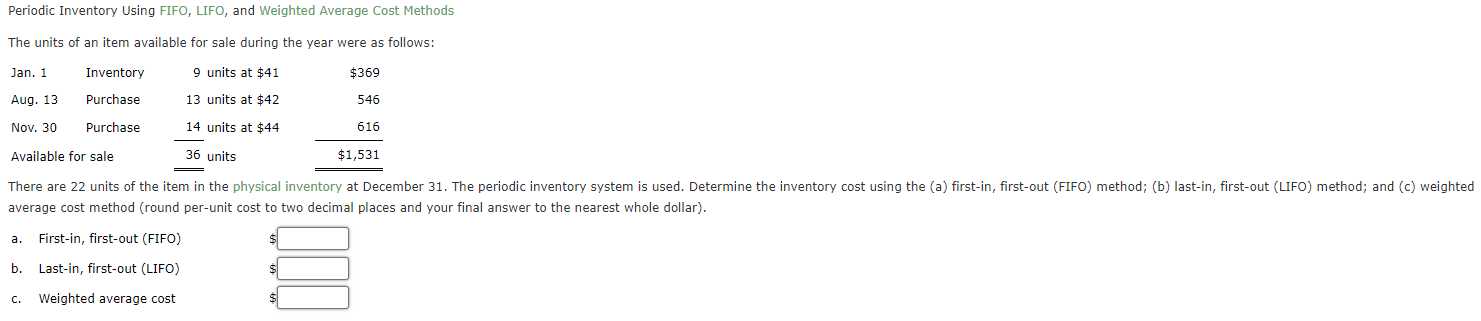

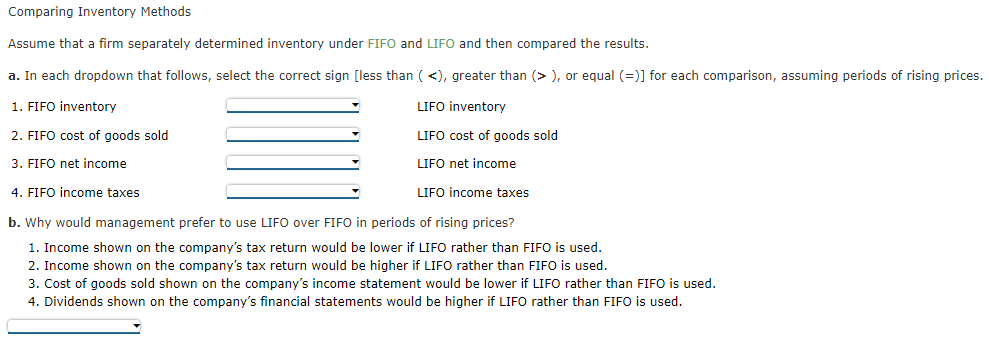

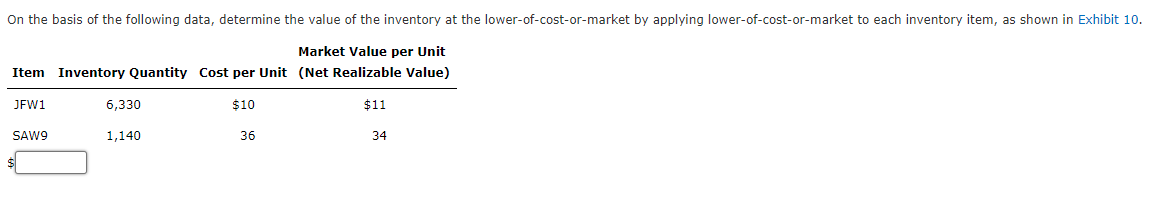

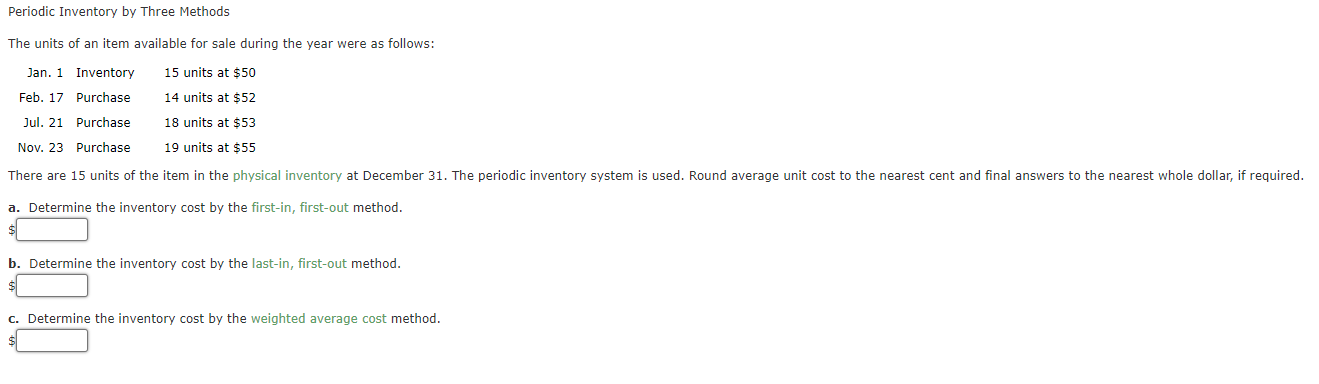

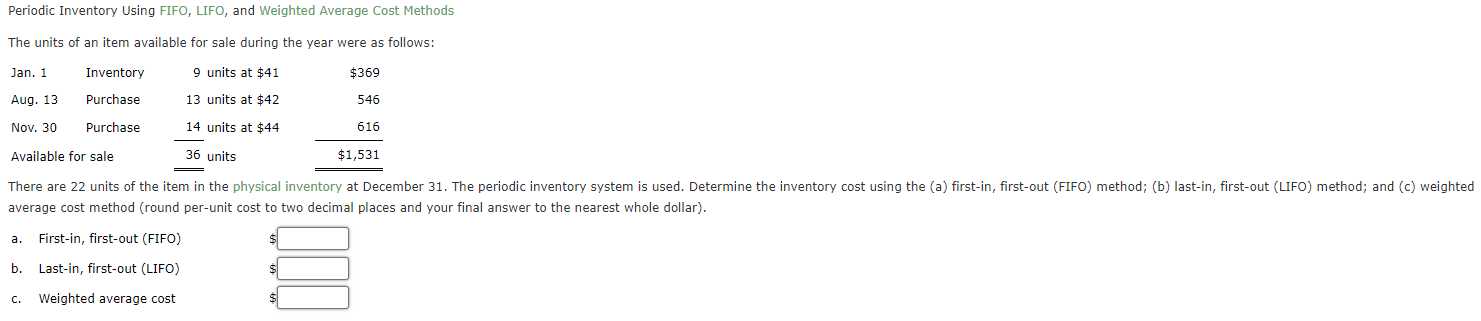

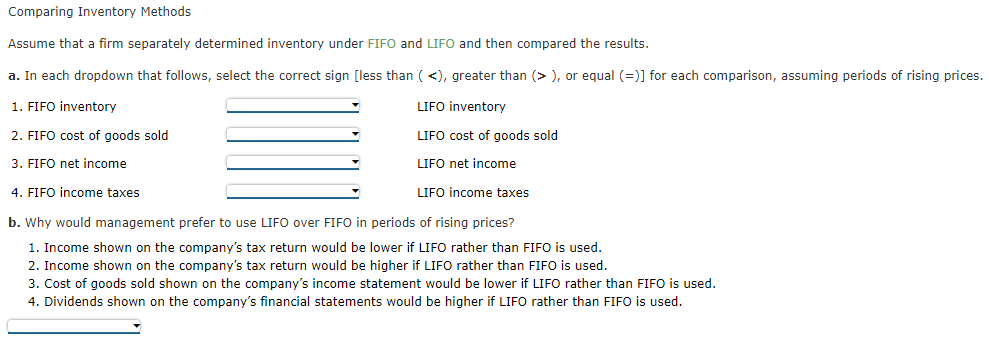

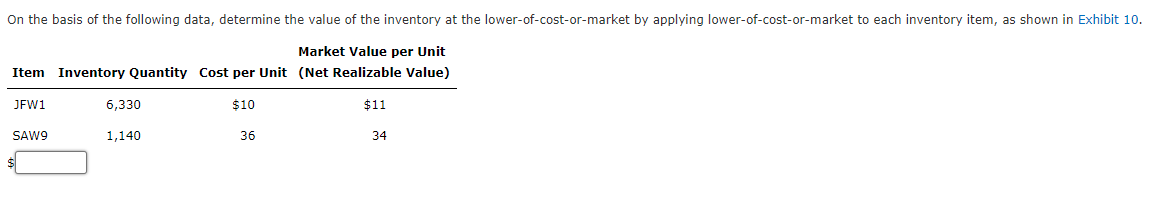

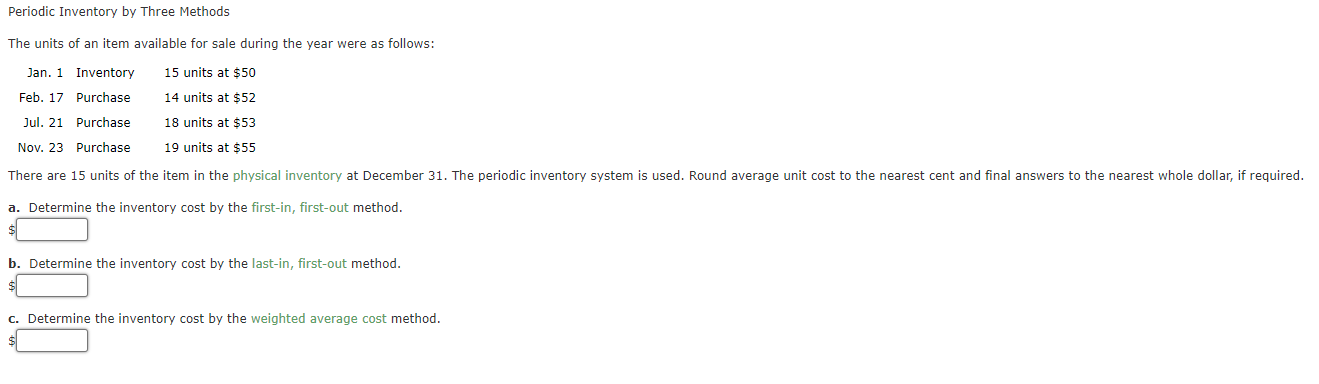

Periodic Inventory by Three Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory Feb. 17 Purchase 15 units at $50 14 units at $52 Jul. 21 Purchase 18 units at $53 Nov. 23 Purchase 19 units at $55 There are 15 units of the item in the physical inventory at December 31. The periodic inventory system is used. Round average unit cost to the nearest cent and final answers to the nearest whole dollar, if required. a. Determine the inventory cost by the first-in, first-out method. $ b. Determine the inventory cost by the last-in, first-out method. c. Determine the inventory cost by the weighted average cost method. Periodic Inventory Using FIFO, LIFO, and weighted Average Cost Methods The units of an item available for sale during the year were as follows: Jan. 1 Inventory 9 units at $41 $369 Aug. 13 Purchase 13 units at $42 546 Nov. 30 Purchase 14 units at $44 616 Available for sale 36 units $1,531 There are 22 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using the (a) first-in, first-out (FIFO) method; (b) last-in, first-out (LIFO) method; and (c) weighted average cost method (round per-unit cost to two decimal places and your final answer to the nearest whole dollar). a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) C. Weighted average cost Comparing Inventory Methods Assume that a firm separately determined inventory under FIFO and LIFO and then compared the results. a. In each dropdown that follows, select the correct sign [less than (), or equal (=)] for each comparison, assuming periods of rising prices. 1. FIFO inventory LIFO inventory 2. FIFO cost of goods sold LIFO cost of goods sold 3. FIFO net income LIFO net income 4. FIFO income taxes LIFO income taxes b. Why would management prefer to use LIFO over FIFO in periods of rising prices? 1. Income shown on the company's tax return would be lower if LIFO rather than FIFO is used. 2. Income shown on the company's tax return would be higher if LIFO rather than FIFO is used. 3. Cost of goods sold shown on the company's income statement would be lower if LIFO rather than FIFO is used. 4. Dividends shown on the company's financial statements would be higher if LIFO rather than FIFO is used. On the basis of the following data, determine the value of the inventory at the lower-of-cost-or-market by applying lower-of-cost-or-market to each inventory item, as shown in Exhibit 10. Market Value per Unit Item Inventory Quantity Cost per Unit (Net Realizable Value) JFW1 6,330 $10 $11 SAW9 1,140 36 34

2)

2)