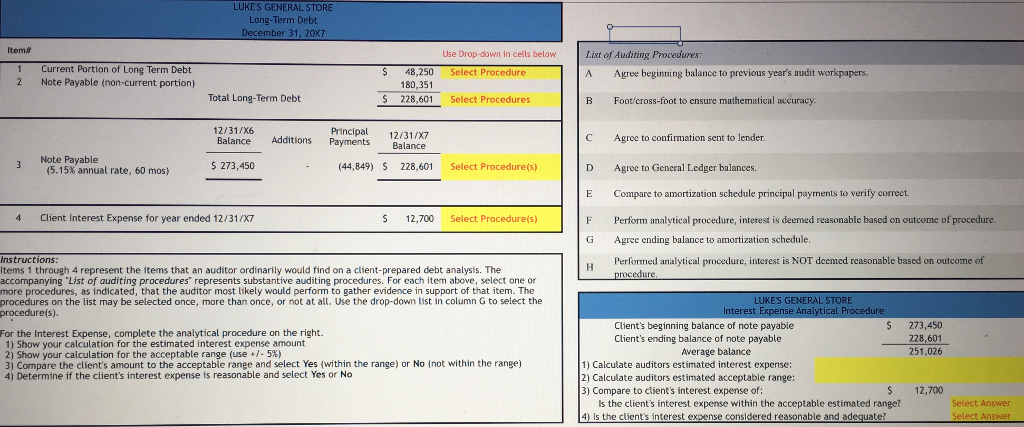

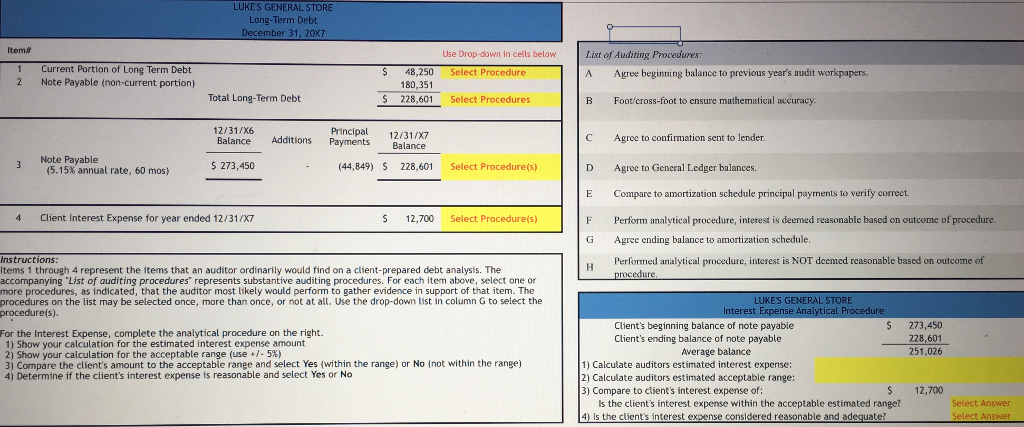

| 1 | 2 | 3 | 4 |

| Select Procedure | Select Procedures | Select Procedure(s) | Select Procedure(s) |

| A | A,B,C,D | A,B,C,D,E,F | A,F |

| B | A,C,D,G | A,B,C,D,E,G | B,E |

| C | B,C,D,G | A,B,C,D,E,H | C,H |

| D | B,C,D,E | A,C,D,E,F,G | D,F |

| E | C,D,E,G | B,C,D,E,G,H | D,H |

| F | | | |

| G | | | |

| H | | | |

LUKES GENERAL STORE Long-Term Debt December 31, 20X7 Item# Use Drop-down in cells belaw List of Auditing Procedures 1 2 Current Portion of Long Term Debt Note Payable (non-current portion) S 48,250 Select Procedure A Agree beginning balance to previous year's audit workpapers 180,351 Total Long-Term Debt $ 228,601 Select Procedures B Foot/cross-foot to ensure mathematical uccuracy. 12/31x Balance Additions Principal 12/31/X7 Payments Balance C Agree to confirmation sent to lender Agree to General Ledger balances. Compare to amortization schedule principal payments to verify correct. Perform analytical procedure, interest is deemed reasonable based on outcome of procedure. Agree ending balance to amortization schedule Performed analytical procedure, interest is NOT deemed reasonable based on outcome of 3 Note Payable 273,450 (44,849) S 228,601 Select Procedure(s) D E F G (5.15% annual rate, 60 mos) 4 Client Interest Expense for year ended 12/31/x7 S 12,700 Select Procedure(s) Instructions Items 1 through 4 represent the items that an auditor ordinarily would find on a client-prepared debt analysis. The accompanying "List of auditing procedures, represents substantive auditing procedures. For each item above, select one or more procedures, as indicated, that the auditor most likely would perfom to gather evidence in support of that item. The procedures on the list may be selected once, more than once, or not at all. Use the drop-down list in column G to select the procedure(s). LUKES GENERAL STORE Client's beginning balance of note payable Client's ending balance of note payable $ 273,450 228,601 251,026 For the Interest Expense, complete the analytical procedure on the right 1) Show your calculation for the estimated interest expense amount 2) Show your calculation for the acceptable range (use +/-5%) 3) Compare the client's amount to the acceptable range and select Yes (within the range) or No (not within the range) 4) Determine if the client's interest expense is reasonable and select Yes or No Average balance 1) Calculate auditors estimated interest expense: 2) Calculate auditors estimated acceptable range: 3) Compare to clients interest expense of $ 12,700 Is the client's interest expense within the acceptable estimated range? 4) Is the clients interest expense considered reasonable and adequate? Select