Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. 7 5. 7. 8. 9. 10. Name the two services that are part of the System Manager. List and describe each

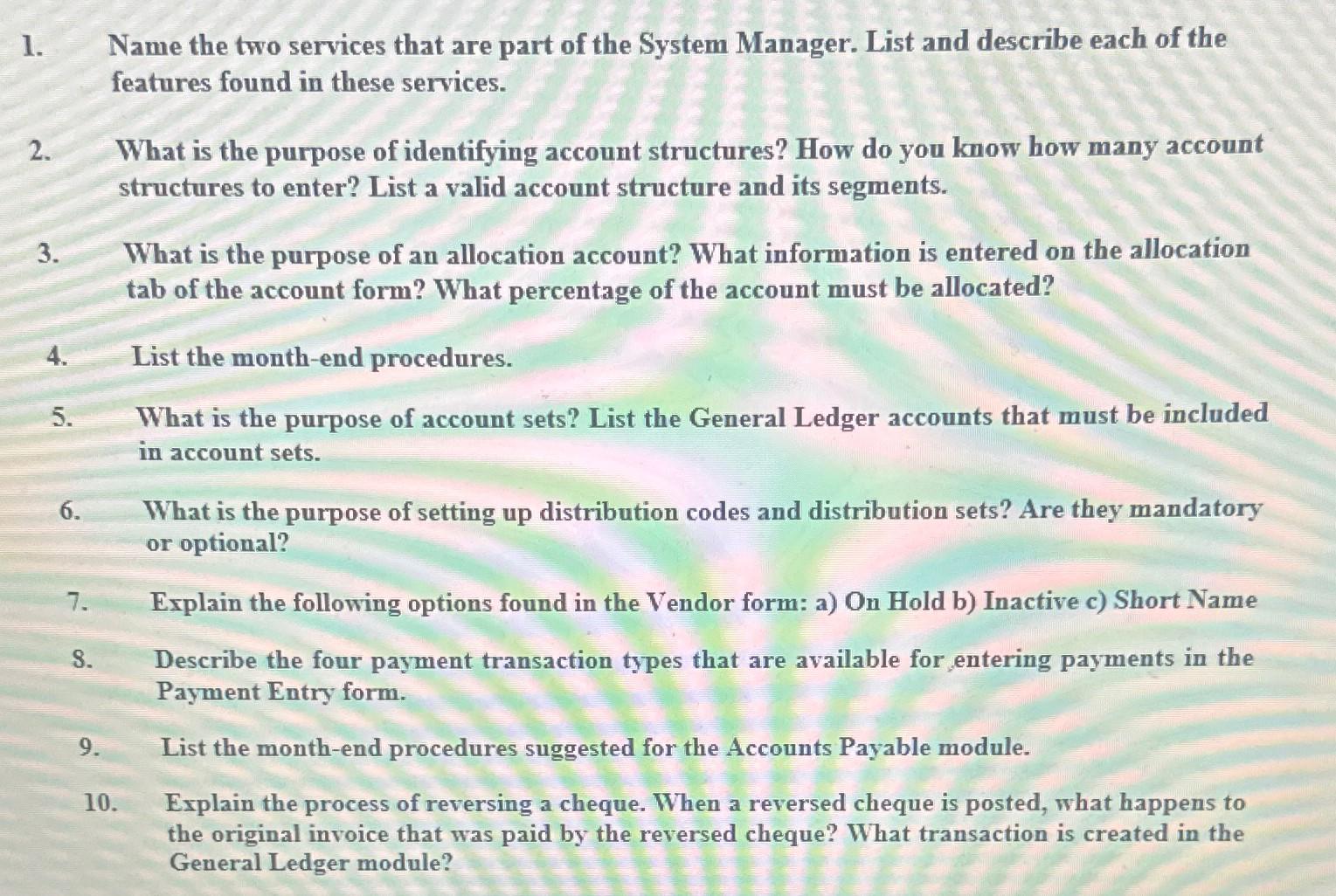

1. 2. 3. 7 5. 7. 8. 9. 10. Name the two services that are part of the System Manager. List and describe each of the features found in these services. What is the purpose of identifying account structures? How do you know how many account structures to enter? List a valid account structure and its segments. What is the purpose of an allocation account? What information is entered on the allocation tab of the account form? What percentage of the account must be allocated? List the month-end procedures. What is the purpose of account sets? List the General Ledger accounts that must be included in account sets. What is the purpose of setting up distribution codes and distribution sets? Are they mandatory or optional? Explain the following options found in the Vendor form: a) On Hold b) Inactive c) Short Name Describe the four payment transaction types that are available for entering payments in the Payment Entry form. List the month-end procedures suggested for the Accounts Payable module. Explain the process of reversing a cheque. When a reversed cheque is posted, what happens to the original invoice that was paid by the reversed cheque? What transaction is created in the General Ledger module?

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The two services that are part of the System Manager are a Security Service This service manages user access to the system including setting up user profiles defining security roles and assig...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started