Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. a) b) Cooperton Mining just announced it will cut its dividend from $4.02 to $2.59 per share and use the extra funds

1.

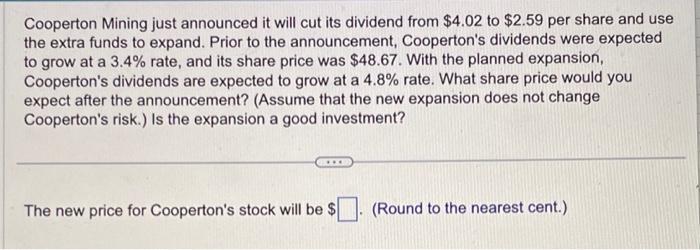

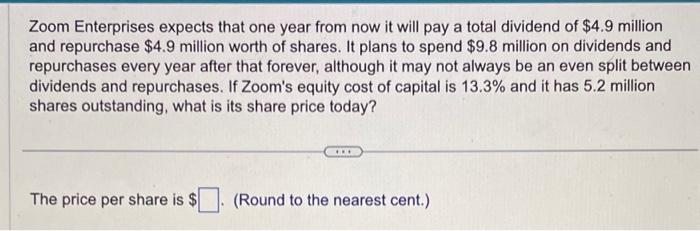

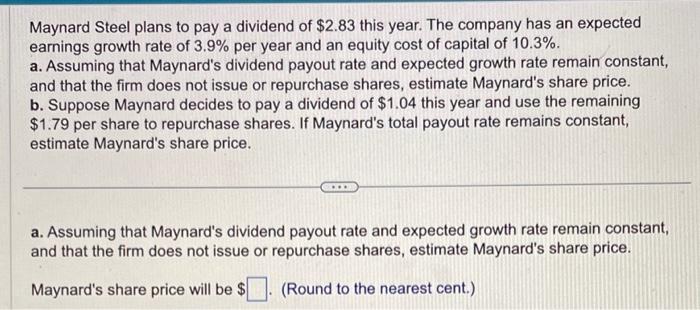

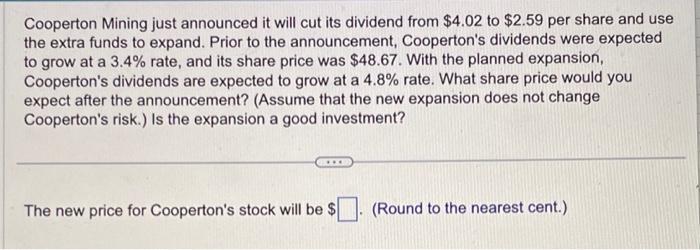

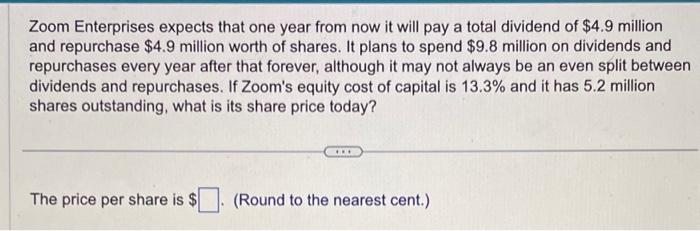

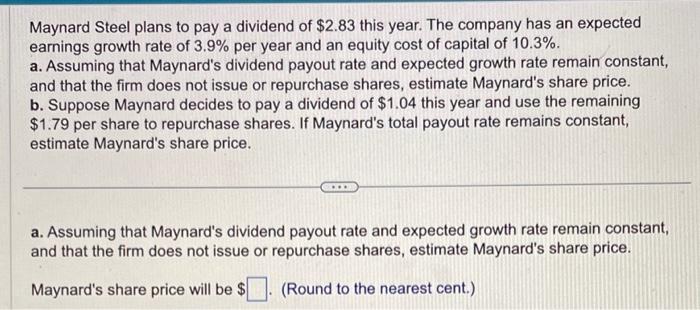

Cooperton Mining just announced it will cut its dividend from $4.02 to $2.59 per share and use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 3.4% rate, and its share price was $48.67. With the planned expansion, Cooperton's dividends are expected to grow at a 4.8% rate. What share price would you expect after the announcement? (Assume that the new expansion does not change Cooperton's risk.) Is the expansion a good investment? The new price for Cooperton's stock will be $. (Round to the nearest cent.) Zoom Enterprises expects that one year from now it will pay a total dividend of $4.9 million and repurchase $4.9 million worth of shares. It plans to spend $9.8 million on dividends and repurchases every year after that forever, although it may not always be an even split between dividends and repurchases. If Zoom's equity cost of capital is 13.3% and it has 5.2 million shares outstanding, what is its share price today? The price per share is $ (Round to the nearest cent.) Maynard Steel plans to pay a dividend of $2.83 this year. The company has an expected earnings growth rate of 3.9% per year and an equity cost of capital of 10.3%. a. Assuming that Maynard's dividend payout rate and expected growth rate remain constant, and that the firm does not issue or repurchase shares, estimate Maynard's share price. b. Suppose Maynard decides to pay a dividend of $1.04 this year and use the remaining $1.79 per share to repurchase shares. If Maynard's total payout rate remains constant, estimate Maynard's share price. a. Assuming that Maynard's dividend payout rate and expected growth rate remain constant, and that the firm does not issue or repurchase shares, estimate Maynard's share price. Maynard's share price will be $ (Round to the nearest cent.)

2.

3.

a)

b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started