Answered step by step

Verified Expert Solution

Question

1 Approved Answer

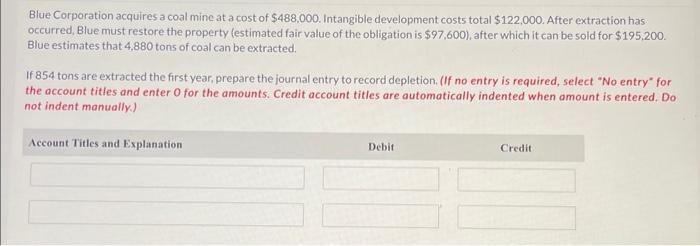

1. 2. 3. Blue Corporation acquires a coal mine at a cost of $488,000. Intangible development costs total $122,000. After extraction has. occurred, Blue must

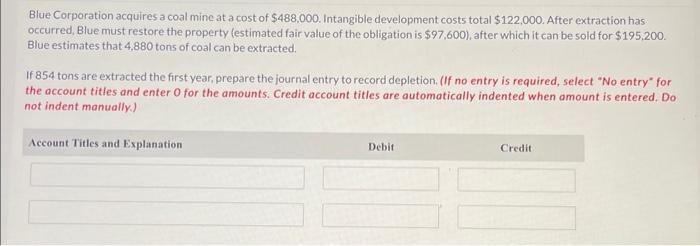

1.

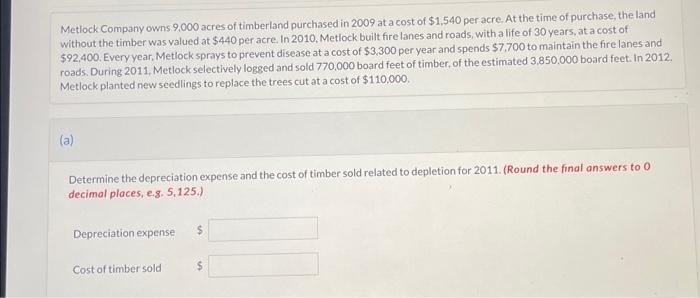

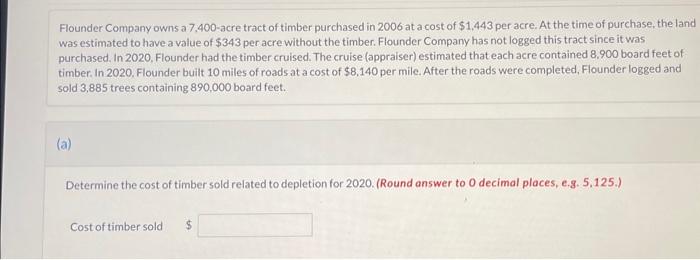

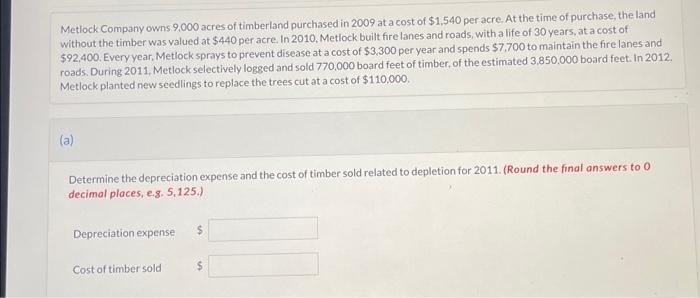

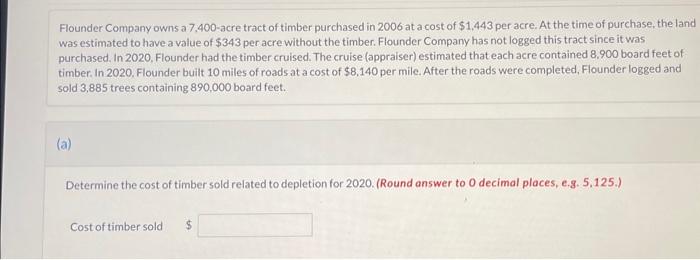

Blue Corporation acquires a coal mine at a cost of $488,000. Intangible development costs total $122,000. After extraction has. occurred, Blue must restore the property (estimated fair value of the obligation is $97,600 ), after which it can be sold for $195,200. Blue estimates that 4,880 tons of coal can be extracted. If 854 tons are extracted the first year, prepare the journal entry to record depletion, (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Metlock Company owns 9,000 acres of timberland purchased in 2009 at a cost of $1,540 per acre. At the time of purchase, the land without the timber was valued at $440 per acre. In 2010, Metlock built fire lanes and roads, with a life of 30 years, at a cost of $92,400. Every year, Metlock sprays to prevent disease at a cost of $3,300 per year and spends $7,700 to maintain the fire lanes and roads. During 2011, Metlock selectively logged and sold 770,000 board feet of timber, of the estimated 3,850,000 board feet. In 2012 . Metlock planted new seedlings to replace the trees cut at a cost of $110,000. (a) Determine the depreciation expense and the cost of timber sold related to depletion for 2011. (Round the final answers to 0 decimal places, e.g. 5,125.) Depreciation expense $ Cost of timber sold Flounder Company owns a 7.400-acre tract of timber purchased in 2006 at a cost of $1,443 per acre. At the time of purchase, the land was estimated to have a value of $343 per acre without the timber. Flounder Company has not logged this tract since it was purchased. In 2020. Flounder had the timber cruised. The cruise (appraiser) estimated that each acre contained 8.900 board feet of timber. In 2020. Flounder built 10 miles of roads at a cost of $8,140 per mile. After the roads were completed, Flounder logged and sold 3,885 trees containing 890,000 board feet. (a) Determine the cost of timber sold related to depletion for 2020. (Round answer to 0 decimal places, e.g. 5.125.) Cost of timber sold $

2.

3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started